The integration of Artificial Intelligence (AI) and Machine Learning (ML) into 5G technology is redefining the boundaries of telecommunications. These technologies are pivotal in transforming 5G networks from static data channels into dynamic systems capable of self-optimization and predictive responses. AI and ML facilitate significant advancements in network efficiency, reliability and security enabling networks to adapt to user needs and varying conditions seamlessly.

Recent advancements in AI and ML are significantly shaping the landscape of 5G technology. AI-driven network slicing optimizes resource allocation dynamically, enhancing service delivery across various network segments. Meanwhile, ML-based anomaly detection plays a critical role in bolstering network security, rapidly identifying and mitigating potential threats to maintain robust network integrity. These technological strides underscore a shift towards more autonomous and efficient 5G networks, pointing to a future where network efficiency and security are significantly enhanced.

Beyond AI-driven advancements, the 5G patent space continues to expand. Explore the latest insights on ETSI-declared 5G patents.

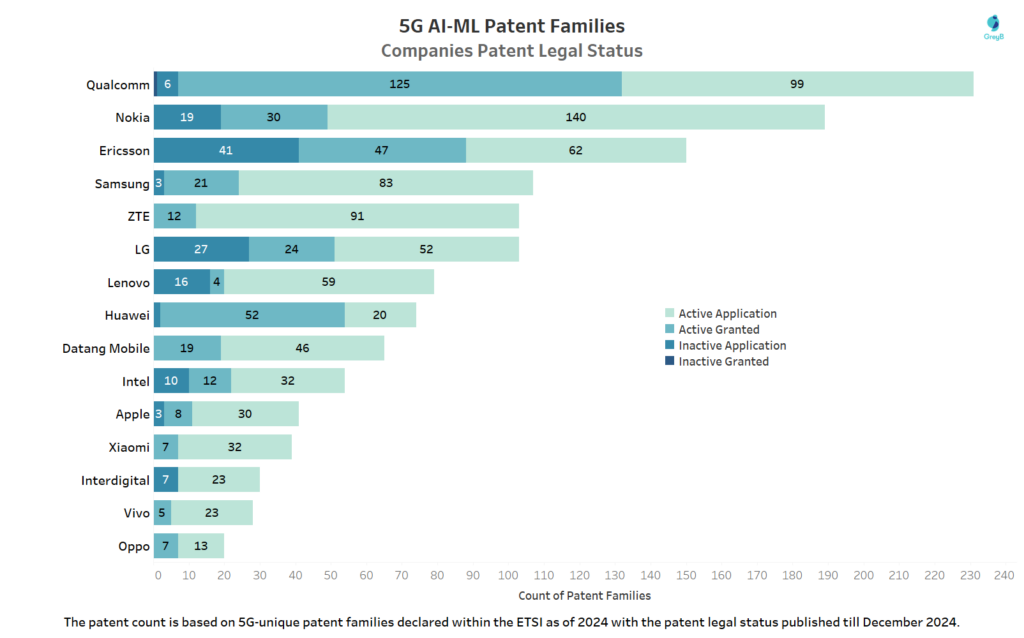

Which Companies Hold the Most 5G AI/ML Patents and Their Legal Status Breakdown?

Key Insights & Takeaways:

Market Leadership and Patent Portfolio Strength

- Qualcomm leads with 230 patent families (6 inactive application, 125 active granted, 99 active applications).

- Nokia follows with 189 patent families, with 140 Active Application indicating strong R&D investment

- Ericsson ranks third with 150 patent families and shows a higher number of inactive patents compared to other players.

- Companies like Qualcomm and Nokia focus on both current protection (granted patents) and future innovations (applications)

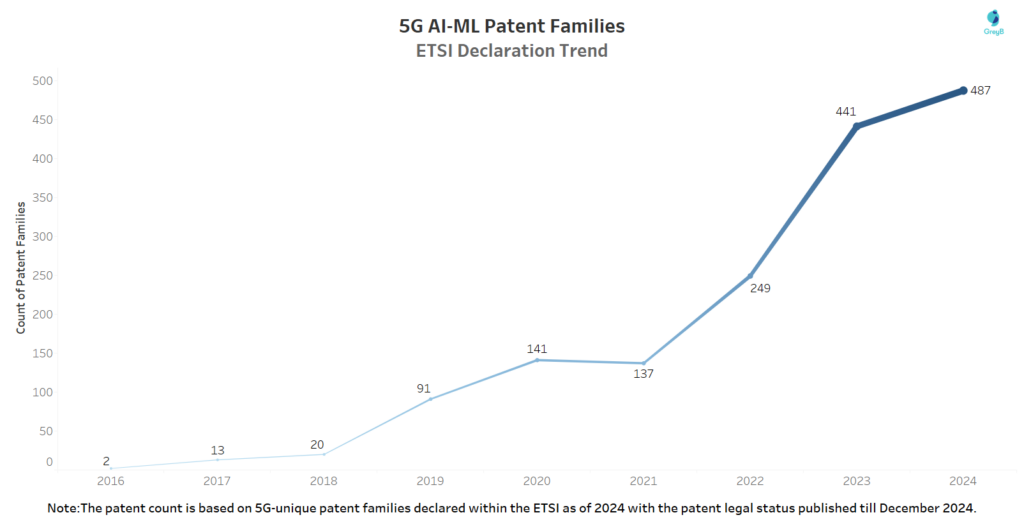

How Have 5G AI/ML Patent Family Declarations in ETSI Evolved Over the Years?

This chart illustrates the yearly trends in 5G AI/ML SEPs submitted to ETSI, highlighting the progression of AI/ML-related advancements in the 5G ecosystem.

Which 3GPP Specifications Have the Most 5G AI/ML Patent Families Declared by ETSI?

The 3GPP specification numbers (TGPP Number) serve as vital identifiers within the technical standards developed by the 3rd Generation Partnership Project (3GPP), enabling the seamless integration of mobile network technologies, including 5G. These numbers correspond to specific features or technologies, such as AI/ML technology, and play a pivotal role in mapping patents declared as 5G-related in the ETSI dataset. By linking patents to their relevant 3GPP specifications, this dataset provides valuable insights into the focus areas of innovation within AI/ML technology.

| TGPP Number | 5G AI/ML Patent Families | 3GPP Specification |

| 38.214 | 80 | NR; Physical layer procedures for data |

| 38.331 | 77 | NR; Radio Resource Control (RRC); Protocol specification |

| 38.213 | 54 | NR; Physical layer procedures for control |

| 38.211 | 43 | NR; Physical channels and modulation |

| 38.212 | 35 | NR; Multiplexing and channel coding |

| 23.501 | 35 | System architecture for the 5G System (5GS) |

| 37.355 | 31 | LTE Positioning Protocol (LPP) |

| 38.321 | 25 | NR; Medium Access Control (MAC) protocol specification |

| 23.288 | 23 | Architecture enhancements for 5G System (5GS) to support network data analytics services |

| 23.502 | 22 | Procedures for the 5G System (5GS) |

| 38.306 | 17 | NR; User Equipment (UE) radio access capabilities |

| 38.3 | 15 | NR; NR and NG-RAN Overall description; Stage-2 |

| 38.305 | 14 | NG Radio Access Network (NG-RAN); Stage 2 functional specification of User Equipment (UE) positioning in NG-RAN |

| 38.423 | 12 | NG-RAN; Xn Application Protocol (XnAP) |

| 38.101 | 9 | NR; User Equipment (UE) radio transmission and reception; Part 1: Range 1 Standalone |

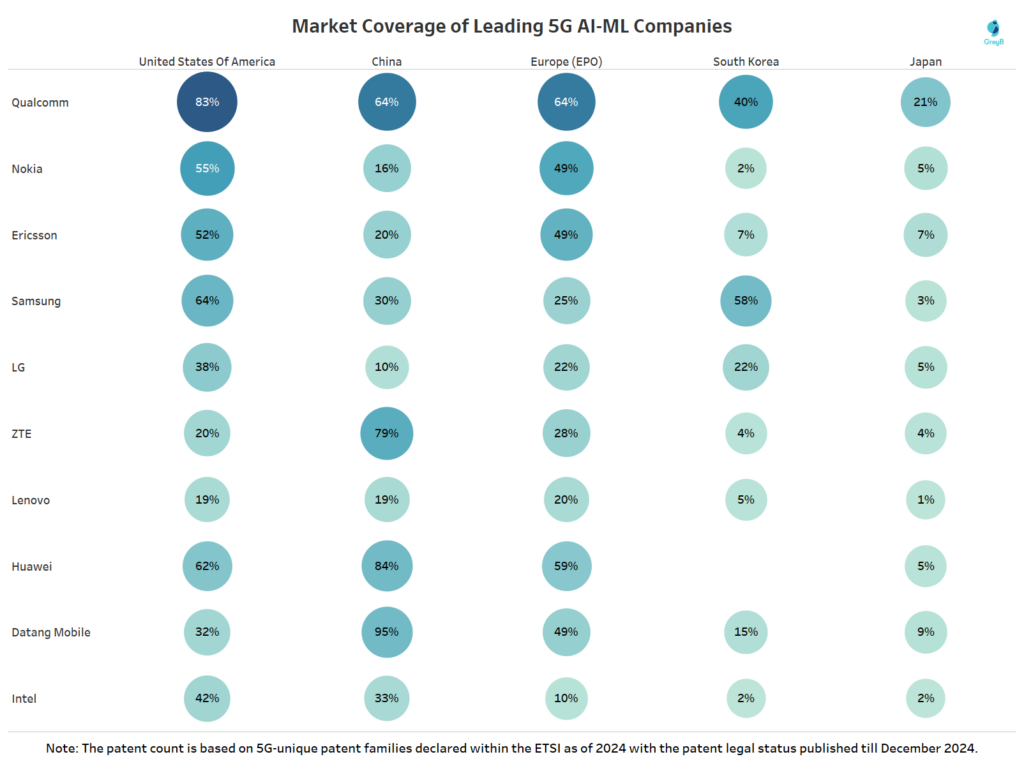

Market Coverage of Key Companies in 5G AI/ML Domain

A Cross-Market Analysis of 5G AI/ML Industry Leaders

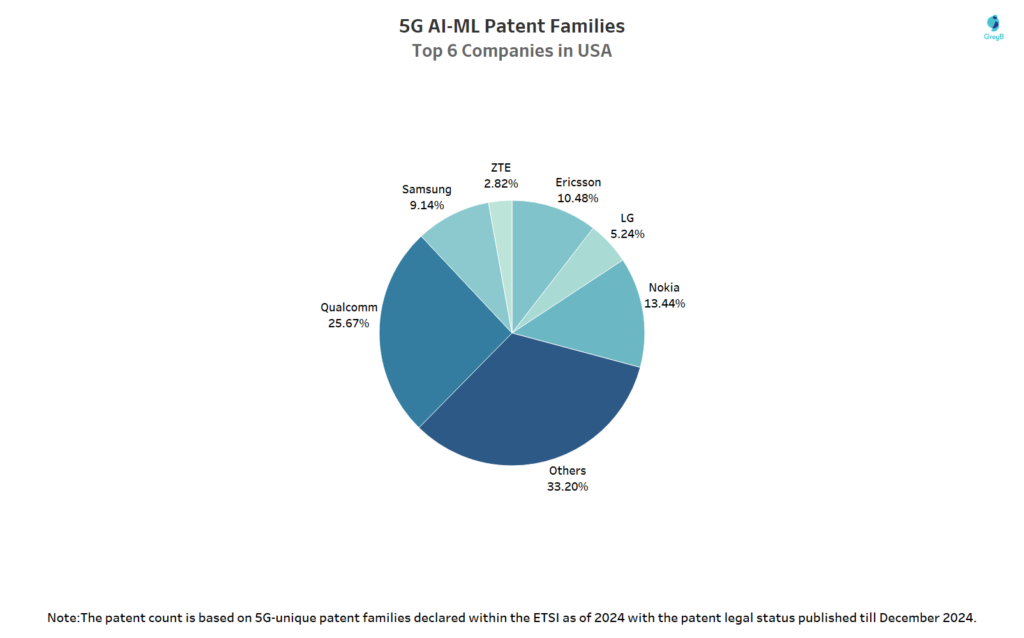

Key Players in the US’s 5G AI/ML Patent Families Share

This chart highlights the leading companies in 5G AI/ML patent families within the United States, showcasing their market share in declared 5G-essential patents.

Key Insights & Takeaways:

- Qualcomm dominates with 25.67% of 5G AI/ML patent families, making it the largest contributor.

- Nokia (13.44%)and Ericsson (10.48%) hold significant shares, reinforcing their role in 5G infrastructure and AI-powered network solutions.

- ZTE holds just 2.82% of patent families, indicating a limited influence in the U.S. compared to its strong presence in China.

- The “Others” category (33.2%) shows a highly diverse and evolving 5G AI/ML market.

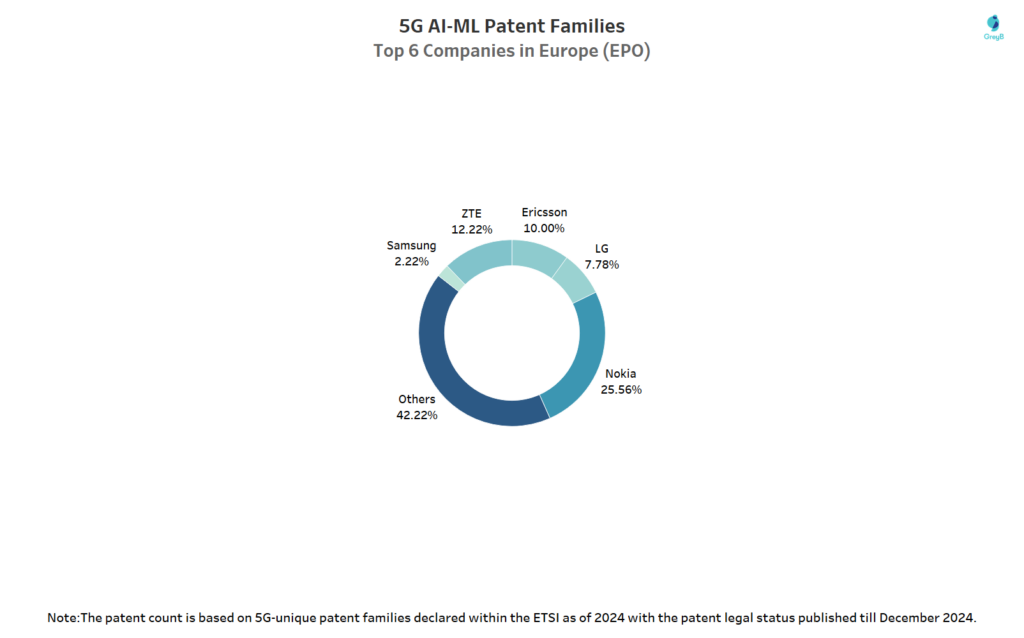

Key Players in EPO’s 5G AI/ML Patent Families Share

This chart highlights the leading companies in 5G AI/ML patent families within European Patent Office (EPO), showcasing their market share in declared 5G-essential patents.

Key Insights & Takeaways:

- Nokia holds the largest share (25.56%), making it the dominant player in the European 5G AI/ML patent landscape.

- ZTE (12.22%) has a strong presence in Europe’s 5G AI/ML market, indicating its expansion beyond China.

- Ericsson (10.00%), a Swedish company, continues to be a key European player, leveraging AI/ML to enhance 5G infrastructure and network optimization.

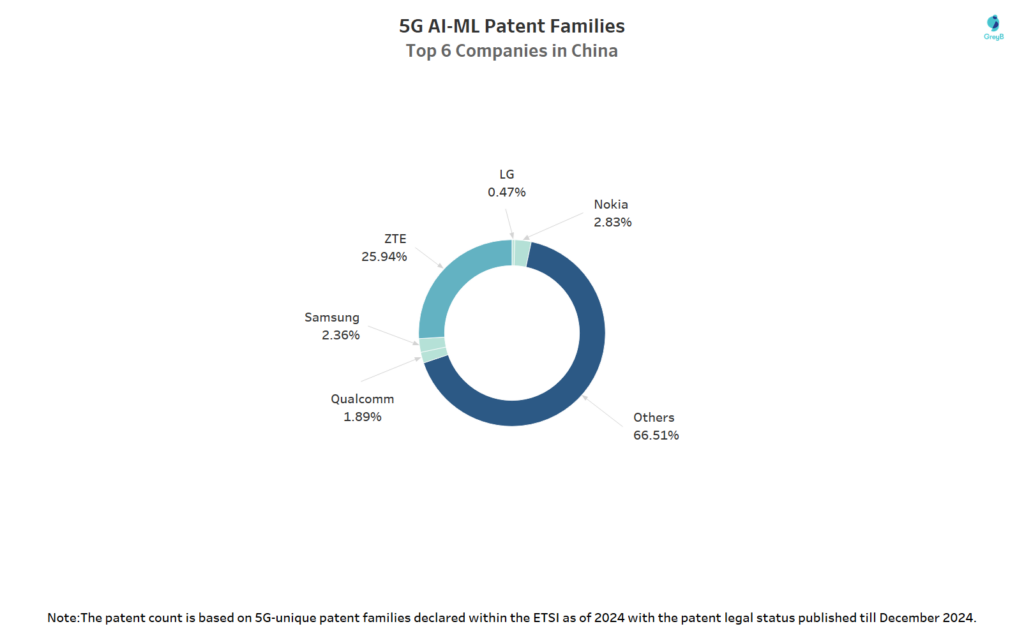

Key Players in China’s 5G AI/ML Patent Families Share

This chart highlights the leading companies in 5G AI/ML patent families within China, showcasing their market share in declared 5G-essential patents.

Key Insights & Takeaways:

- ZTE holds the largest share (25.94%), positioning itself as China’s leader in AI/ML-driven 5G technology.

- Nokia (2.83%), Samsung (2.36%), and Qualcomm (1.89%) have a relatively small presence in the Chinese 5G AI/ML patent space.

- LG (0.47%) has the lowest share among major patent holders, indicating a limited role in China’s 5G AI/ML patent landscape.

- Two-thirds (66.51%) of the patents belong to various other companies, suggesting a highly fragmented and competitive patent environment.

Methodology

This report is based on a detailed analysis of patents and applications declared essential to the 5G standard as of 2024, listed in the ETSI 5G Declaration List. It focuses exclusively on 5G-specific technologies identified through the 3GPP portal, consolidating 4,22,827 patent documents into 84,940 patent families for a clear view of the innovation landscape. For identifying AI/ML SEPs declared to ETSI, we have relied on search queries to capture the patent families related to AI/ML technology.

Exploring the AI/ML in 5G patent landscape? Get a detailed report on key AI/ML technology in 5G patents declared under the ETSI framework. Stay ahead with insights into essential filings, patent trends and competitive positioning. Fill out the form below to access expert-driven analysis.