In the next five years, the US insurance industry won’t just be about policies and claims—it will be shaped by prediction, automation, and real-time decision-making. Insurers in the US are shifting from assessing risk to preventing it, leveraging AI-powered fraud detection, predictive analytics and embedded insurance models to stay ahead. This transformation isn’t just about technology adoption—it’s about who owns these innovations and how they are protected within the US market.

US Insurance Companies like State Farm and Progressive Corporation are using AI and machine learning to build predictive models that don’t just analyze risk—they anticipate it. Meanwhile, Lemonade Inc is rewriting the rulebook with blockchain-driven parametric insurance, ensuring instant payouts based on real-time events rather than tedious damage assessments. And then there’s Stand Insurance, a recent entrant, stepping into uncharted territory by leveraging advanced simulation software to provide coverage in high-risk disaster zones—places where traditional insurers have retreated.

Our analysis of US insurance patents from 2018 to 2025, reveals a surge in patent filings, with State Farm and Allstate leading the race. Notably, tech giants like IBM and Sony have also secured a foothold in the US insurance patent landscape, signalling a broader industry shift where fintech and technology firms are playing an increasing role.

Patent litigation in the US insurance market is shaping the competitive landscape, with Amadora Systems LLC initiating 32 lawsuits and financial institutions like Truist Bank and Texas National Bank of Jacksonville among the most targeted defendants. Data processing, payment architectures, and claims automation aren’t just the most frequently patented technologies—they are also the most contested in US courts.

This analysis was conducted to map out who is leading the transformation of the US insurance industry and which technologies will dictate the next era of insurance.

How has Insurance Innovation in the US Market Evolved?

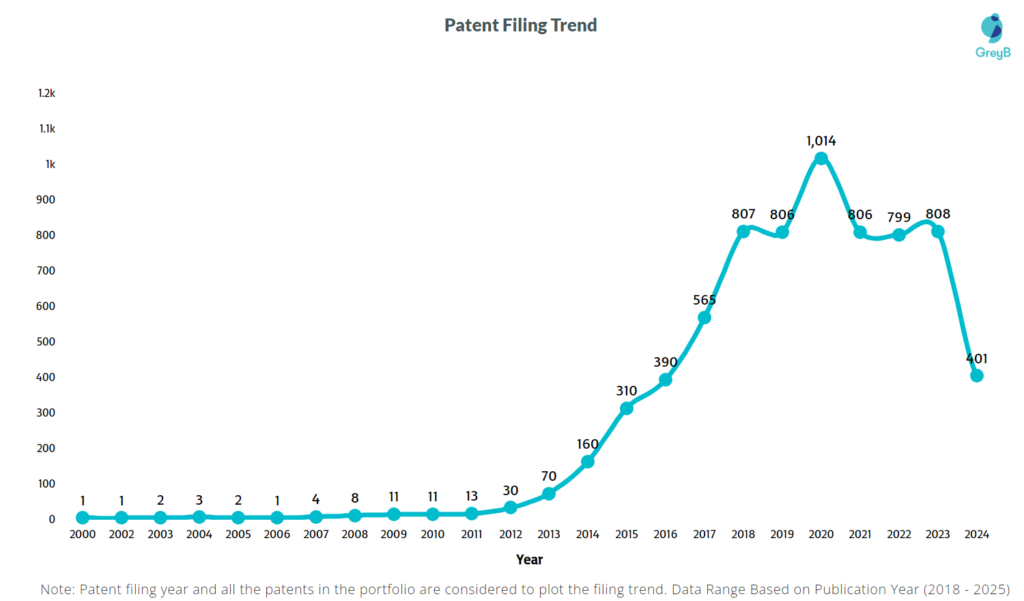

For years, US insurance companies have been on an innovation spree, filing patents at an unprecedented rate. This chart showcases the fluctuations in patents over the past two decades, reflecting the industry’s shifting priorities and competitive landscape. But what does this trend tell us?

Between 2013 and 2020, the US insurance industry saw an explosive rise in patent filings, peaking at 1,014 applications in 2020—a testament to the industry’s aggressive push for technological breakthroughs. AI-driven underwriting, blockchain-powered claims processing, and data-driven risk modeling all fueled this patent frenzy.

However, the past few years tell a different story. Patent filings have gradually declined, dropping to 401 in 2024—the lowest since 2016. Could this indicate a saturation of ideas, shifting business strategies, or a more selective approach to innovation? Or is it simply the natural cycle of patent lifespans, where older filings are now reaching expiration?

Now, here’s the real question: Of all these patents filed, how many are still active and how many have become inactive?

How Many Insurance Patents in the US Are Still Active?

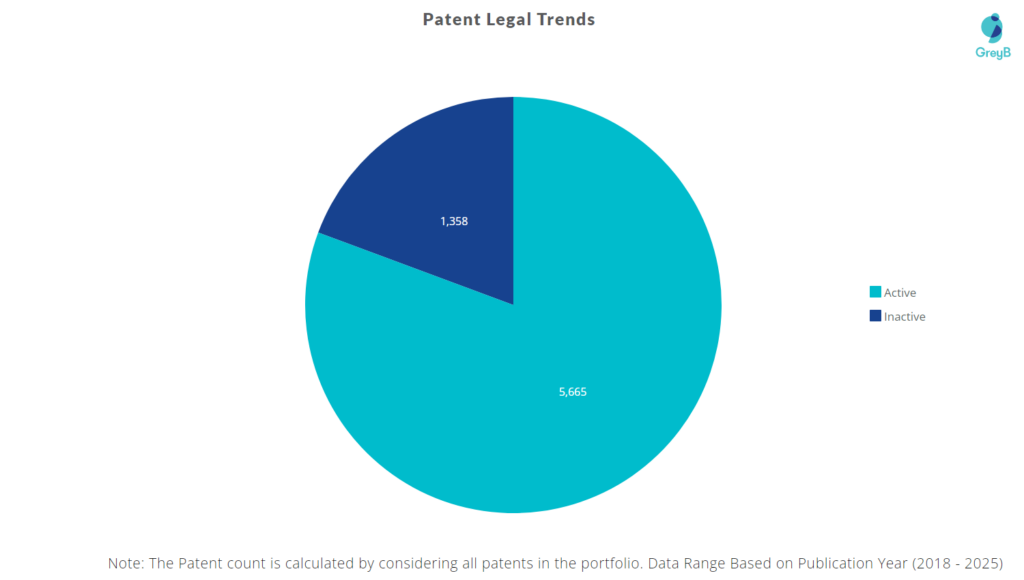

This chart provides a legal status breakdown of patents filed by insurance companies in the United States of America (USA), categorizing them into active and inactive patents.

A staggering 81% of patents filed by US insurance companies remain active while 19% of these patents have become inactive.

With thousands of patents still active, a key question emerges—who owns the largest share of these innovations?

Which US Insurance Companies Are Leading the Innovation Race?

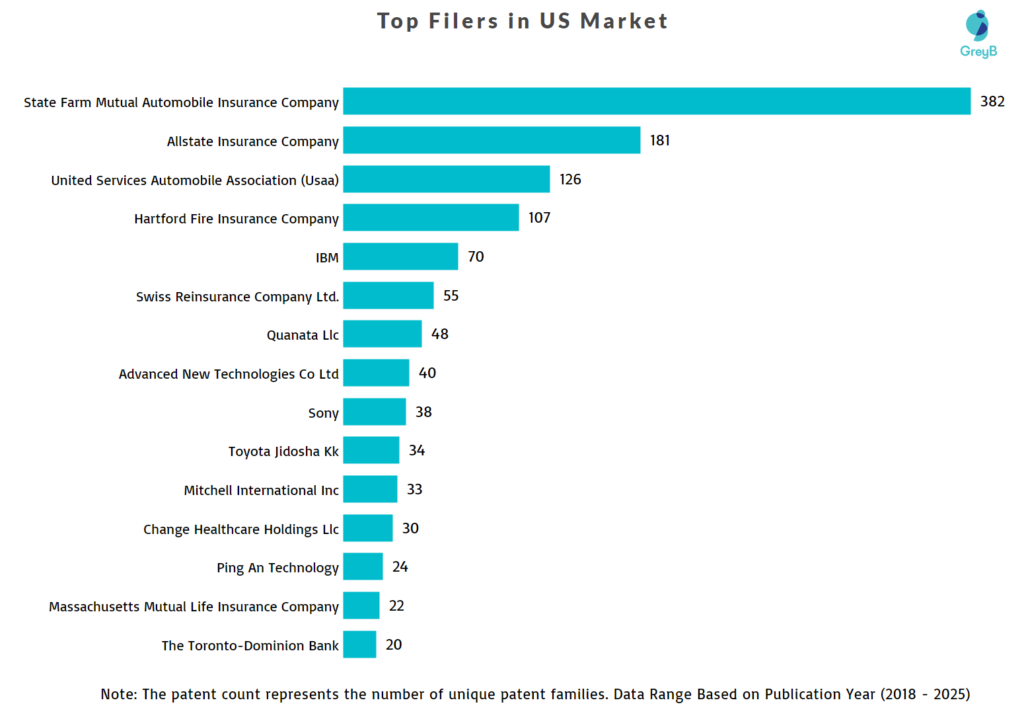

Patents offer a unique lens into which companies are shaping the future of the US insurance industry. This chart highlights the top insurance companies in the United States, revealing which players are dominating the technology-driven innovation.

The innovation race in insurance isn’t just about who provides the best policies—it’s about who owns the technology powering them.

The chart makes one thing clear: State Farm (382 patents) and Allstate (181 patents) are leading the charge, with significantly more patents than others. These long-established giants, with nearly a century of history, continue to strengthen their foothold through intellectual property.

However, the list also reveals unexpected players. Technology-focused companies like IBM and Sony have also made their mark in insurance innovation, signalling the industry’s growing reliance on AI, automation, and digital transformation.

Interestingly, newer players like Quanata Llc and Change Healthcare are emerging as active patent filers. This raises a critical question—are these companies filing patents to challenge the dominance of traditional insurers, or are they carving out niche areas of innovation?

With so many patents in play, it’s essential to understand what these companies are focusing on. The next insight takes us deeper into the technologies defining the future of insurance.

Which are the Key Technology Areas in US Insurance Industry?

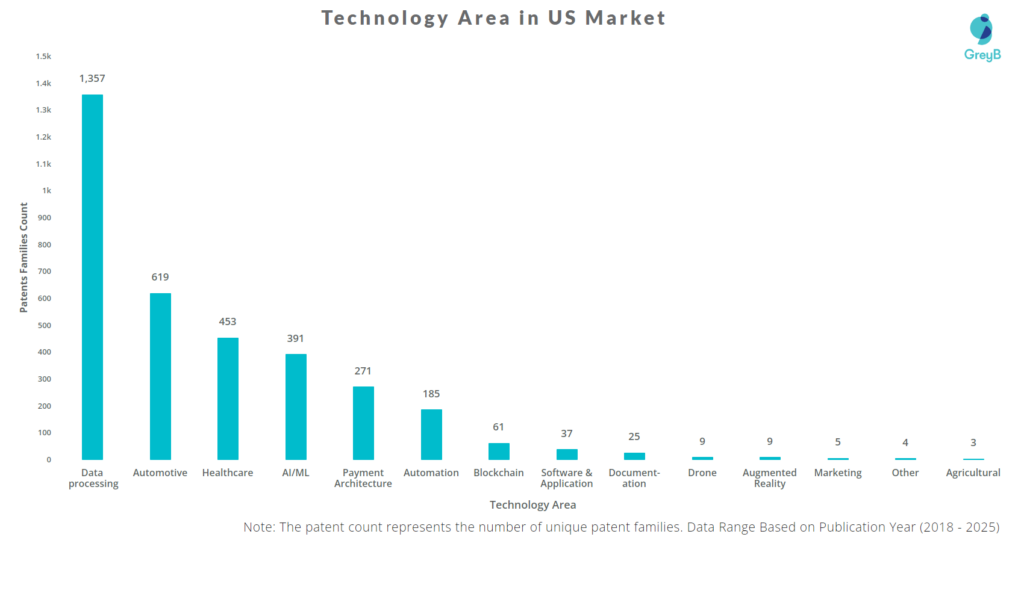

Patents don’t just reveal who is innovating, but also where innovation is happening. This chart breaks down the key technology areas where US insurance companies are filing patents, offering insights into the industry’s focus areas.

The dominance of data processing patents (1,357 patents) is no surprise—insurance thrives on data. From risk modelling to fraud detection, insurers are relying on big data and AI to make faster, smarter decisions. But what stands out is the rising role of automation (185 patents) and Blockchain (61 patents), signalling a push toward self-executing claims processing and decentralized security solutions.

Interestingly, the chart also reveals a growing convergence of industries. With 619 patents in automotive technology and 453 in healthcare, insurers are expanding their innovation footprint beyond traditional financial services. This reflects the rise of embedded insurance—where coverage is seamlessly integrated into products like smart cars and connected health devices.

While some areas are booming, others remain experimental. Drones (9 patents), Marketing Technologies (5 patents) and Agricultural (3 patents), are still emerging fields, but they signal what the future of insurance could look like.

Yet, behind every patent, there’s an inventor—a mind shaping the future of insurance. The real question is: Who are the key innovators driving this change?

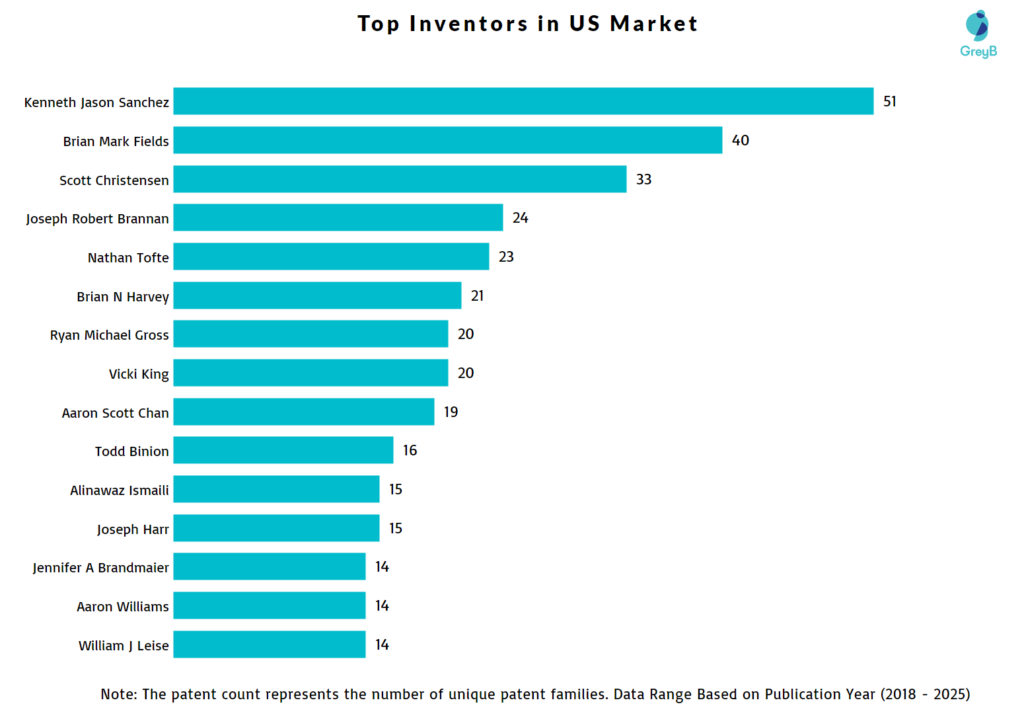

Who are the Top Inventors behind the US Insurance Patents?

Behind every ingenious patent, there is an inventor pushing the boundaries of insurance technology. This chart highlights the top inventors in the US insurance market based on the number of patents they have contributed to, offering a glimpse into the individuals shaping the future of the industry.

The sheer number of patents these inventors have contributed to highlights their influence—but which of these innovations are truly shaping the industry? To understand their impact, we turn to the patents that are cited the most across the insurance sector.

Which are the Top 10 Insurance Patents based on Citation Count?

This table showcases the most influential patents—those that have been cited the most across the industry.

| Publication Number | Citation Count |

| US11620702B2 | 475 |

| US10156848B1 | 332 |

| US10042359B1 | 314 |

| US9972054B1 | 255 |

| US9870649B1 | 242 |

| US9946531B1 | 235 |

| US9858621B1 | 225 |

| US10198879B2 | 220 |

| US10324463B1 | 219 |

| US10086782B1 | 217 |

Citations indicate a patent’s importance in the industry, but litigation tells us which technologies companies are fighting to control. When patents become valuable assets, disputes are inevitable. Let’s explore which tech areas are facing the most legal battles in the US insurance sector.

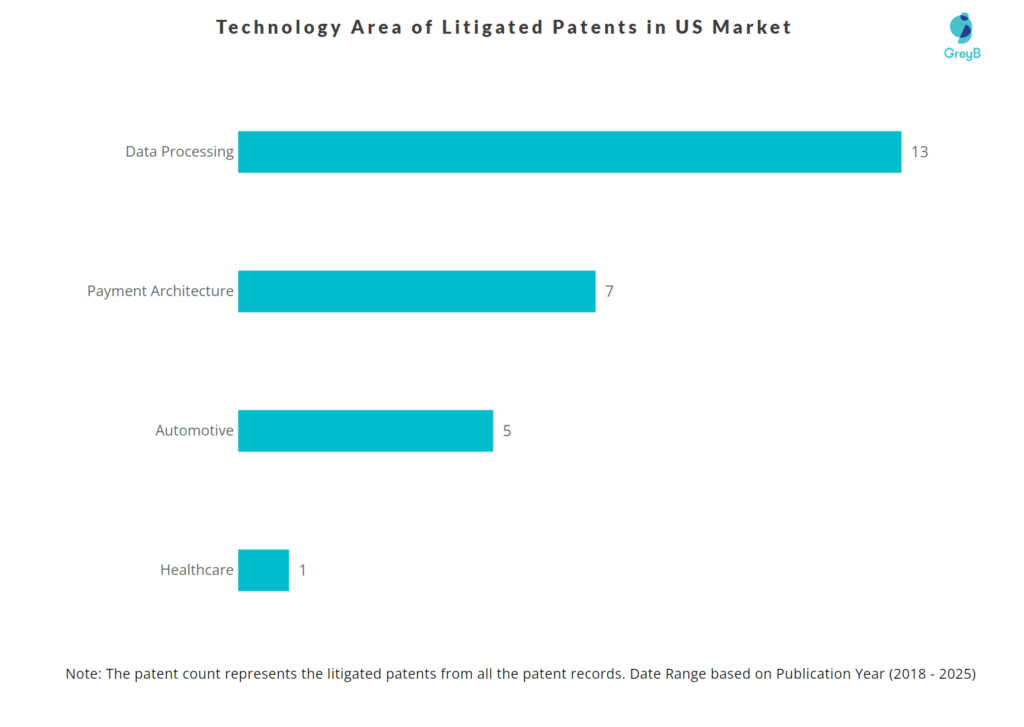

Which Key Technologies in US Insurance Industry Are Facing the Most Legal Battles?

This chart highlights the tech areas most frequently involved in litigation within the US insurance market, offering a deeper look into where competition is leading to legal disputes.

Looking at the broader US Insurance patent landscape, data processing was already the most dominant tech area in insurance innovation, with 1,357 patents filed. The fact that it also leads in litigation (13 cases) suggests something crucial—companies aren’t just innovating in this space, they are fiercely protecting their advancements.

Payment architecture (271 patents) has the second-highest litigation count (7 cases), reinforcing that fintech-driven insurance innovations are becoming hotly contested. However, other highly patented areas like AI/ML (391 patents) and automation (185 patents) don’t appear in the litigation records. This raises a key question—are companies in these spaces more focused on innovation rather than legal disputes, or is litigation in these areas yet to emerge?

Interestingly, automotive and healthcare, which had strong patent activity (619 and 453 patents, respectively), have relatively low litigation numbers.

While data processing and payment architecture have emerged as the most litigated areas, the real battle isn’t just about the technology itself—it’s about who is being targeted in these disputes.

Who are the Top Defendants in Patent Litigation in US Insurance Market?

This table highlights the top defendants in litigated insurance patents, showcasing the number of litigation cases they’ve been involved in and the number of patents at stake.

| Defendants | Litigation Case Count | Patent Count |

| Social Auto Transport Inc | 7 | 4 |

| Truist Bank | 5 | 5 |

| Texas National Bank of Jacksonville | 5 | 5 |

| VeraBank Na | 5 | 5 |

| Texas Bank & Trust Company | 5 | 5 |

| United Service Automobile Association | 4 | 2 |

| Samsung | 4 | 1 |

| Peloton Interactive | 4 | 4 |

| Toyota | 4 | 1 |

| Motive Technologies | 3 | 1 |

Patent litigation in insurance isn’t limited to industry giants—companies from diverse sectors, including automotive, fintech and consumer tech, are being pulled into legal battles. Social Auto Transport Inc leads the list with 7 litigation cases, while financial institutions like Truist Bank, VeraBank and Texas National Bank of Jacksonville each face 5 cases, signalling increasing disputes over fintech-driven insurance solutions. Interestingly, companies like Samsung, Toyota and Peloton Interactive are also entangled in lawsuits, hinting at the expanding intersection between insurance and other industries.

But who’s driving these litigations? Behind every patent lawsuit, there’s a company actively enforcing its intellectual property.

Who are the Top Plaintiffs in Patent Litigation in US Insurance Market?

This table highlights the top plaintiffs in US insurance patent litigation, showcasing which companies are leading the charge in legal battles and how many patents are at the center of these disputes.

| Plaintiffs | Litigation Case Count | Patent Count |

| Amadora Systems Llc | 32 | 5 |

| Haley IP Llc | 7 | 1 |

| DRIVERDO Llc | 7 | 4 |

| Auto Telematics Ltd | 4 | 2 |

| Johnson Health Tech Co Ltd | 4 | 4 |

| PV LAW Llp | 4 | 1 |

| AutoConnect Holdings Llc | 3 | 1 |

| Bright Data Ltd | 3 | 1 |

| Eagle View Technologies Inc | 3 | 1 |

| Cardtek International Inc | 3 | 1 |

Patent enforcement in the US insurance market isn’t being driven by traditional insurers—but by entities actively protecting their intellectual property.

Amadora Systems Llc leads with 32 litigation cases involving just 5 patents, signaling an aggressive enforcement strategy. Many other plaintiffs, including Haley IP Llc, DRIVERDO Llc and Auto Telematics Ltd, focus on telematics, automation and data-driven solutions, reinforcing that technology-driven insurance innovations are at the center of legal disputes.

Interestingly, companies outside the traditional insurance space—such as Johnson Health Tech (fitness technology), Bright Data Ltd (web data solutions) and Cardtek International (payment technologies)—are also enforcing patents, reinforcing how innovations from different sectors are influencing insurance-related technologies.

With Amadora Systems LLC leading insurance patent litigation, a key question emerges—who are they targeting?

The following table highlights the key defendants facing multiple lawsuits from Amadora Systems Llc.

| Defendants | Litigation Case Count |

| Texas Bank & Trust Company | 5 |

| VeraBank Na | 5 |

| Texas National Bank of Jacksonville | 5 |

| Truist Bank | 5 |

| Bank Ozk | 2 |

| Bank Of Texas | 2 |

| Regions Financial Corporation | 2 |

| Frost Bank | 2 |

| Austin Bancorp | 2 |

| JPMorgan Chase Bank | 2 |

In the US insurance industry, innovation isn’t just about who creates the best technology—it’s about who controls it. Patents have become the ultimate competitive tool, securing market dominance and driving legal battles. With rising litigation over AI, automation and fintech-driven solutions, the fight for intellectual property is only intensifying. As financial institutions, tech firms and insurers collide in this high-stakes race, the future of insurance in the US won’t be shaped by invention alone—but by those who fiercely protect and enforce their innovations.

Innovation moves fast—are you keeping up? Gain exclusive access to the most up-to-date patent insights and discover what’s driving insurance innovation today. Sign up to get the latest insights!