The future of automotive is taking shape through continuous innovation, as evidenced by 184,240 patents filed in the US between 2003 and 2018. Our analysis of this patent data set identified three key areas driving advancements: Ancillary Vehicle Systems, Battery Electric Vehicles (BEVs), and Internal Combustion Engines (ICEs).

Also, the United States of America emerged as the leading contributor in research and development, while top companies included Toyota, Ford Motors and General Motors. Additionally, the analysis revealed key inventors like Atsushi Tabata (Toyota), Shinji Ichikawa (Toyota) and Tooru Matsubara (Toyota) as significant players in shaping the future of automobiles.

Want to know which automotive companies are leading in innovation? Check out our list of the top automotive companies ranked by their patent count here

Join us on a thrilling expedition through a mountain of data – the secret world of automotive patents. Insights;Gate cracked the code, revealing hidden insights into the technology and trends shaping this game-changing industry.

This analysis is based on published US patent data from 2007-2018. Interested in the updated analysis?

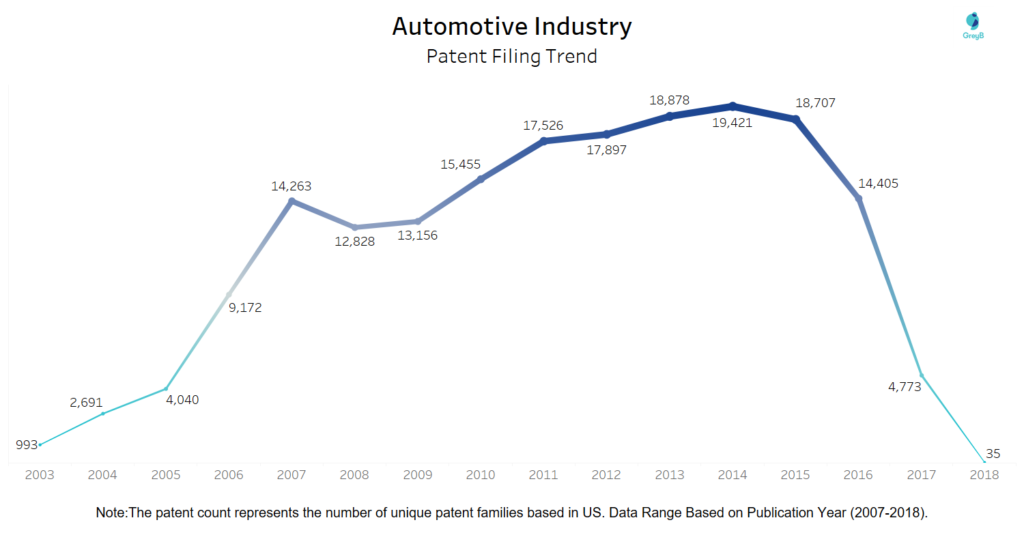

What is the patent filing trend in Automotive Industry?

The chart below represents the patent filing trend in US within the Automotive Industry from the year 2007 to 2018.

The table below provides the number of applications filed and the number of patents granted from the year 2010 to 2018.

| Year | Applications Filed in Automotive Industry | Patents Granted in Automotive Industry |

| 2018 | 35 | 7224 |

| 2017 | 4773 | 7882 |

| 2016 | 14405 | 6658 |

| 2015 | 18707 | 6471 |

| 2014 | 19421 | 5527 |

| 2013 | 18878 | 4946 |

| 2012 | 17897 | 4109 |

| 2011 | 17526 | 3381 |

| 2010 | 15455 | 3019 |

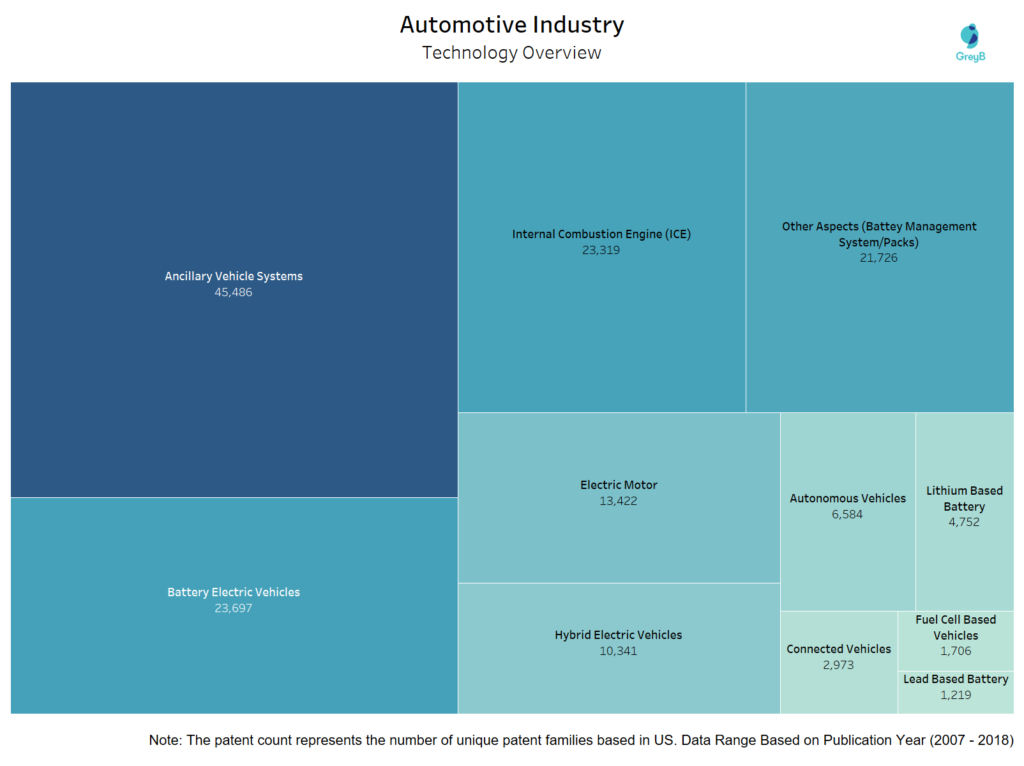

Technology Overview of Automotive Patents

The technology analysis of patents related to automotive industry explores the diverse and evolving nature of innovations within the sector.

The patents have been classified into distinct technological categories such as Ancillary Vehicle System, Battery Electric Vehicles and Connected Vehicles with each representing key areas of innovation while serving as blueprints for technological progress in the domain.

This classification aids in creating a roadmap for understanding technological developments in the sector as well as assists in efficient analysis, trend identification and improved understanding of dynamic nature of the automotive industry.

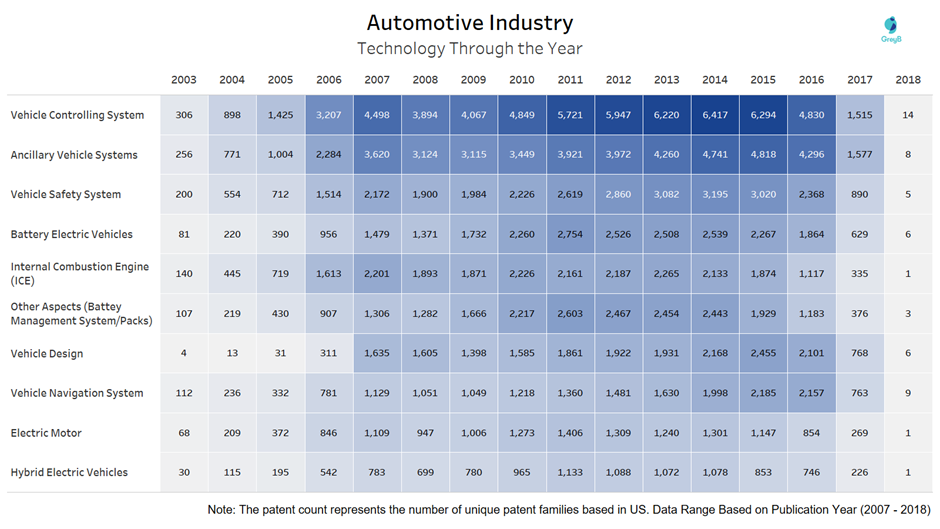

Evolution of Automotive Technology: 2003-2018

The chart below showcases the technology through the years 2003 to 2018 for the Automotive Industry

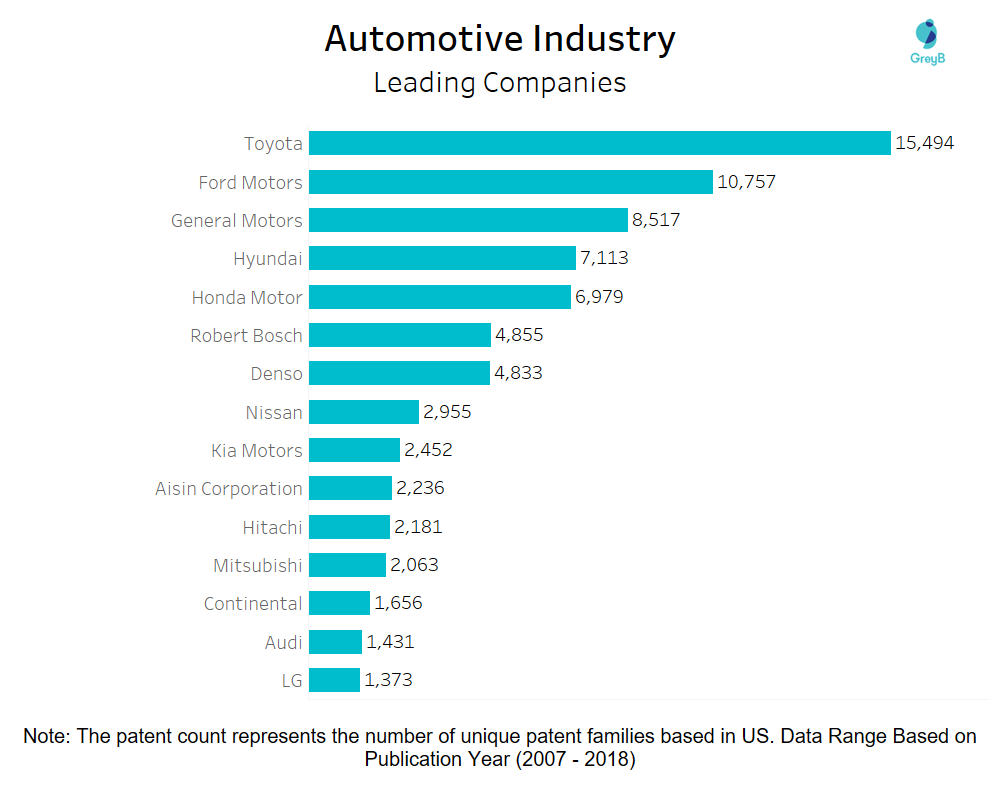

Key companies filing patents in Automotives

The chart below showcases the leading 15 companies actively involved in research and development in automotive industry.

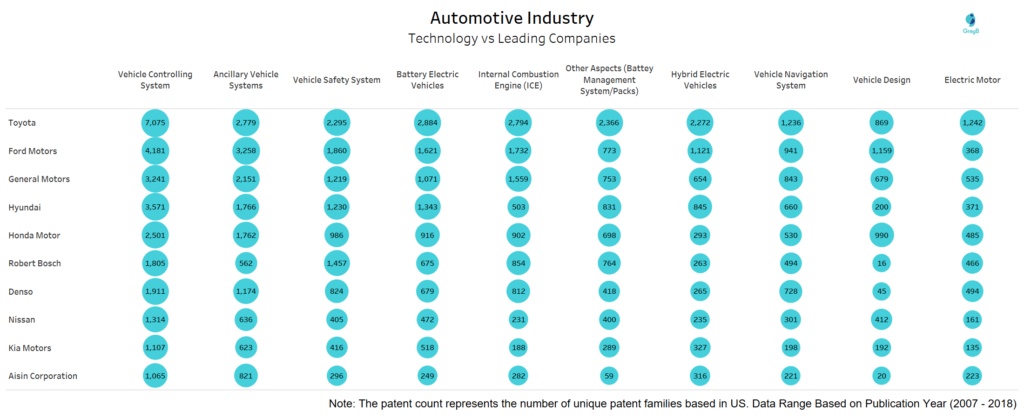

Technology Overview of Key Companies in Automotive Industry

This analysis provides an insight into areas of focus and innovations of companies thereby offering comprehensive snapshot of their contributions to the dynamic landscape of automotive sector.

The technology overview reveals a focus on diverse areas such as Vehicle Controlling System, Hybrid Electric Vehicles and Vehicle Navigation System.

The table below shows the number of patents assigned to the leading 25 companies involved in the automotive industry.

| Leading Companies | Patents |

| Toyota | 15494 |

| Ford Motors | 10757 |

| General Motors | 8517 |

| Hyundai | 7113 |

| Honda Motor | 6979 |

| Robert Bosch | 4855 |

| Denso | 4833 |

| Nissan | 2955 |

| Kia Motors | 2452 |

| Aisin Corporation | 2236 |

| Hitachi | 2181 |

| Mitsubishi | 2063 |

| Continental | 1656 |

| BMW | 1546 |

| Audi | 1431 |

| LG | 1373 |

| Porsche | 1364 |

| Mercedes-Benz | 1307 |

| Samsung | 1294 |

| ZF Friedrichshafen | 1243 |

| Panasonic | 1231 |

| Goodyear Tire & Rubber Company | 1030 |

| JTEKT | 934 |

| Volkswagen | 824 |

| Deere & Company | 812 |

Who are the leading innovators in the Automotives?

The table below shows the number of patents assigned to the top 25 inventors involved in innovations and technological advancements in the automotive industry.

| Inventor Name | Patents |

| Tabata Atsushi | 367 |

| Ichikawa Shinji | 302 |

| Matsubara Tooru | 260 |

| Pursifull Ross Dykstra | 229 |

| Kuang Ming Lang | 229 |

| Chung Suny | 220 |

| Dudar Aed M | 206 |

| Wagener Gorden | 201 |

| Doering Jeffrey Allen | 201 |

| Surnilla Gopichandra | 187 |

| Salter Stuart C | 187 |

| Martin Douglas Raymond | 185 |

| Yamazaki Mark Steven | 177 |

| Heap Anthony H | 177 |

| Kook Jae Chang | 176 |

| Hwang Seong Wook | 175 |

| Zhao John | 171 |

| Miller Kenneth James | 169 |

| Bucher George | 160 |

| Nefcy Bernard D | 159 |

| Takami Norio | 158 |

| Kaltenbach Johannes | 157 |

| Futschik Hans-Dieter | 157 |

| Imamura Tatsuya | 156 |

| LAI Ching-Tsung | 155 |

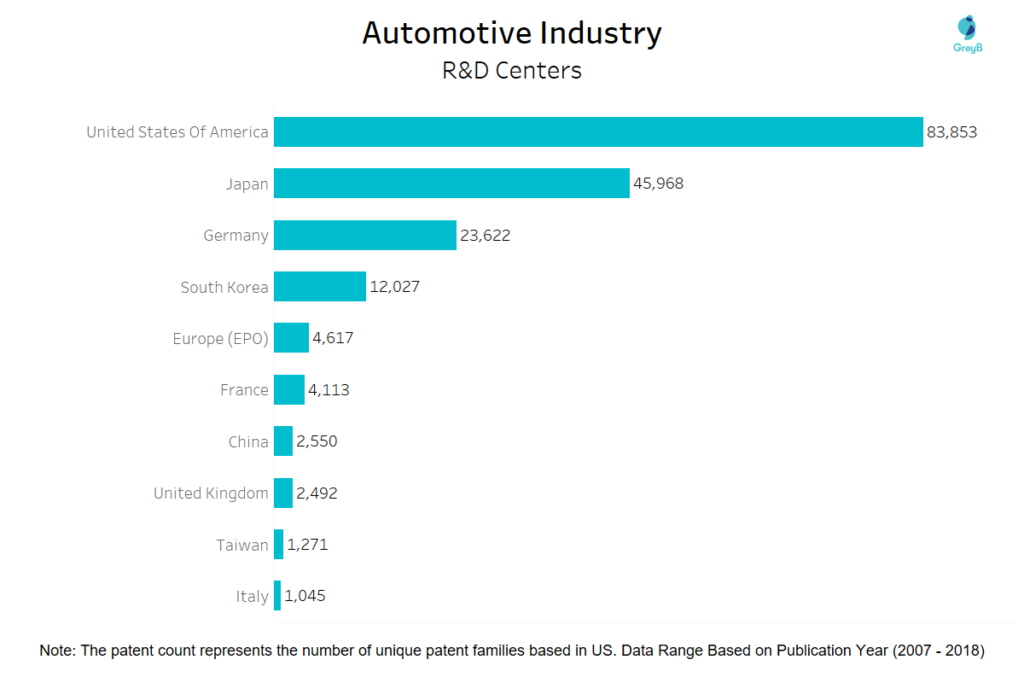

Where are the Research Centers of Automotive patents located?

The chart below represents the major research and development centers contributing towards innovations and technological advancements in the automotive industry.

Evidently, United States of America is leading in research and development with highest patent count of 83853 showcasing its significant role in driving innovation in automotive industry. Japan and Germany follow United States of America with patent count of 45968 and 23622 respectively.

Despite having a leading role in automotive research and development, the United States of America has just two representatives among the top 15 leading companies in the global automotive industry.

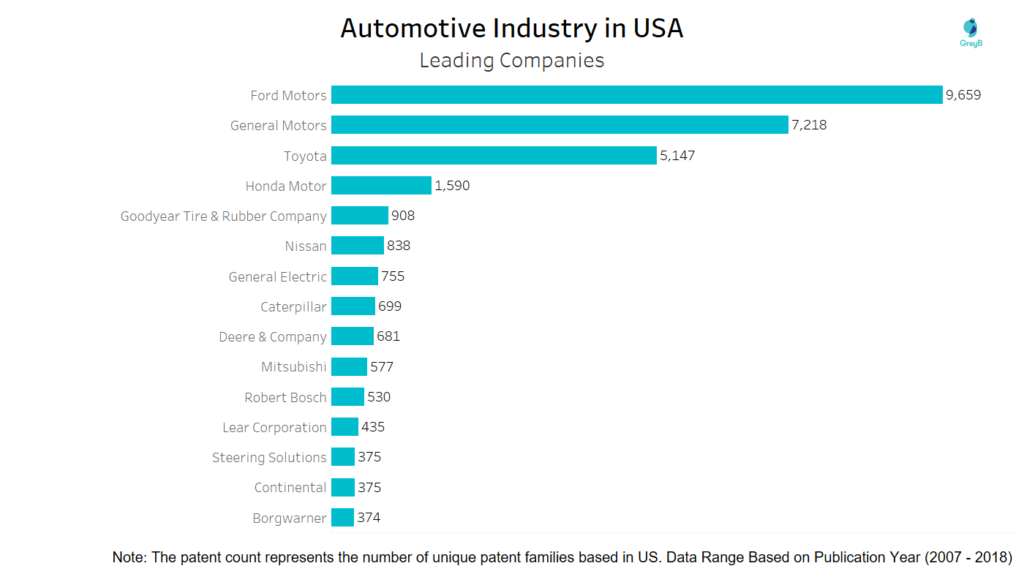

Leading companies in USA filing patents in Automotives

The chart below depicts the distribution of patents owned by the 15 leading companies within United States of America involved in the automotive industry.

Noticeably, Ford Motors is the prominent company in the competitive landscape of automotive industry with highest patent count of 9659 signifying its immense contribution in the industry. General Motors and Honda Motor follow Ford Motors in the patent count of 7218 and 1590 respectively.

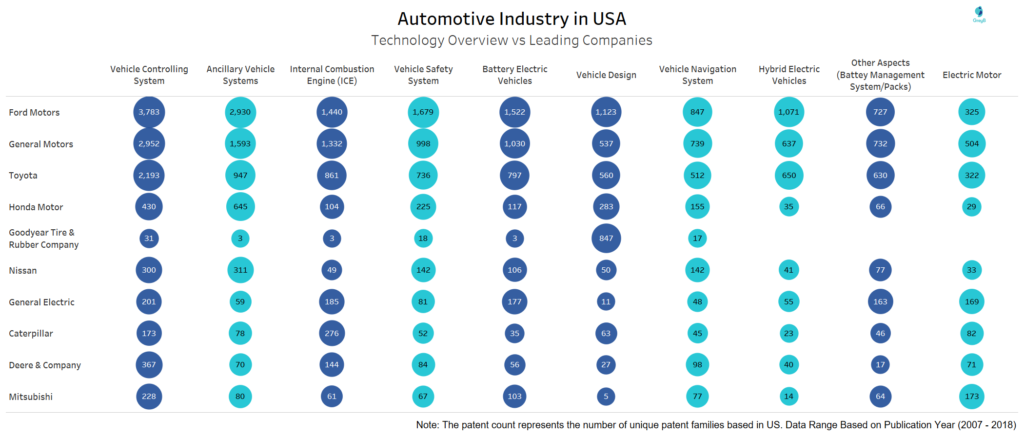

Technology Overview of Key Companies in USA

The technological categorization of patents ranging from Vehicle Controlling System, Vehicle Safety System and Vehicle Design offers a comprehensive overview of United States of America’s contributions towards the automotive sector.

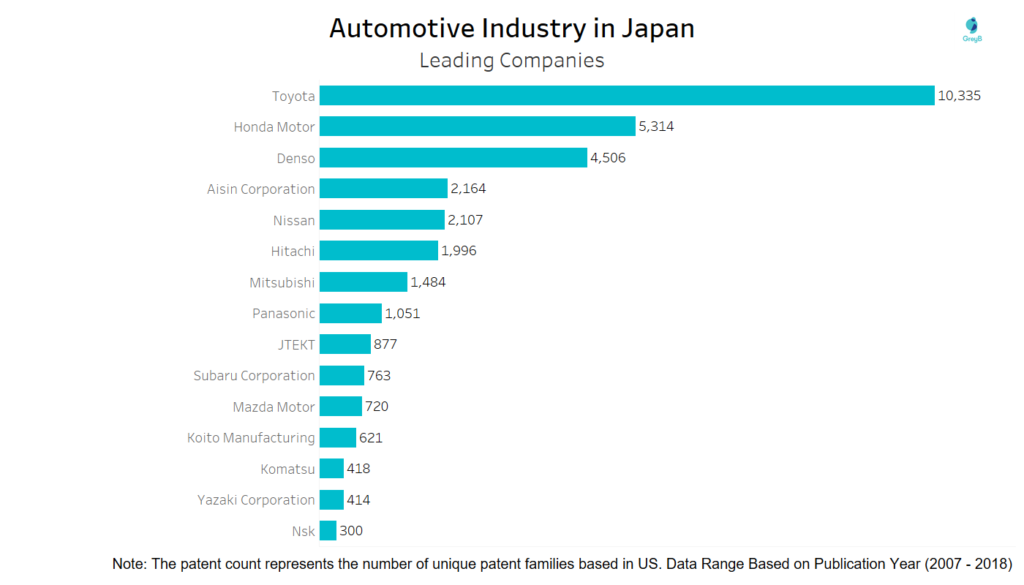

Leading companies in Japan filing patents in Automotives

The chart below depicts the distribution of patents owned by the 15 leading companies within Japan involved in the automotive industry.

Evidently, Toyota is the prominent company in the competitive landscape of automotive industry with highest patent count of 10335 signifying its immense contribution in the industry. Honda Motor and Denso follow Toyota in the patent count of 5314 and 4506 respectively.

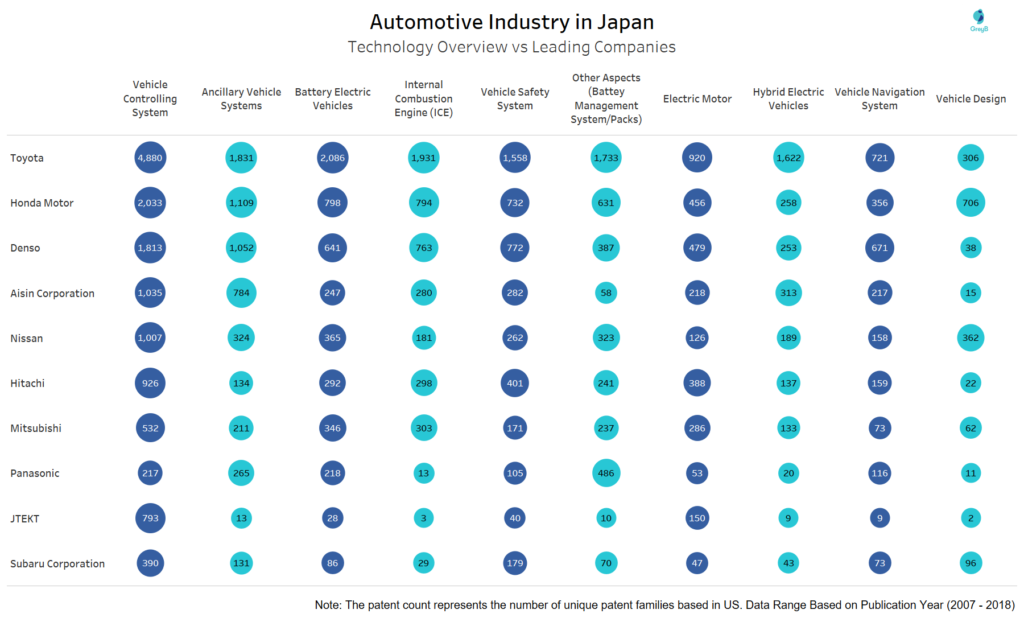

Technology Overview of Key Companies in Japan

The technological categorization of patents ranging from Ancillary Vehicle Systems, Battery Electric Vehicles and Electric Motor offers a comprehensive overview of Japan’s contributions towards the automotive sector.

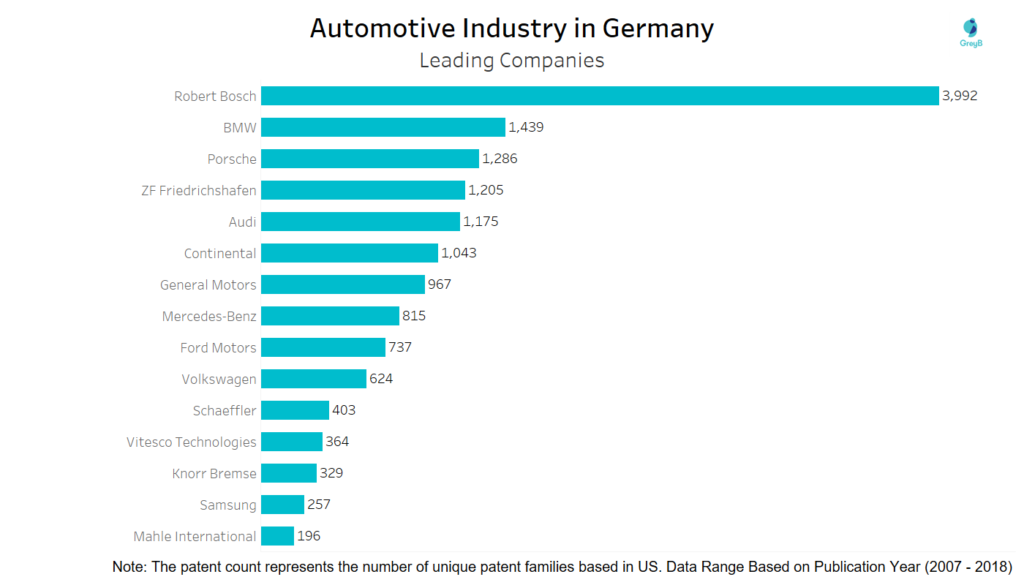

Leading companies in Germany filing patents in Automotives

The chart below depicts the distribution of patents owned by the 15 leading companies within Germany involved in the automotive industry.

Clearly, Robert Bosch is the prominent company in the competitive landscape of automotive industry with highest patent count of 3992 signifying its immense contribution in the industry. BMW and Porsche follow Robert Bosch in the patent count of 1439 and 1286 respectively.

Samsung, a major player in consumer electronics, also contributes significantly to the automotive industry, particularly in Germany. Their involvement likely lies in developing innovative solutions related to connectivity, autonomous driving and in-vehicle experiences which are transforming the automotive landscape.

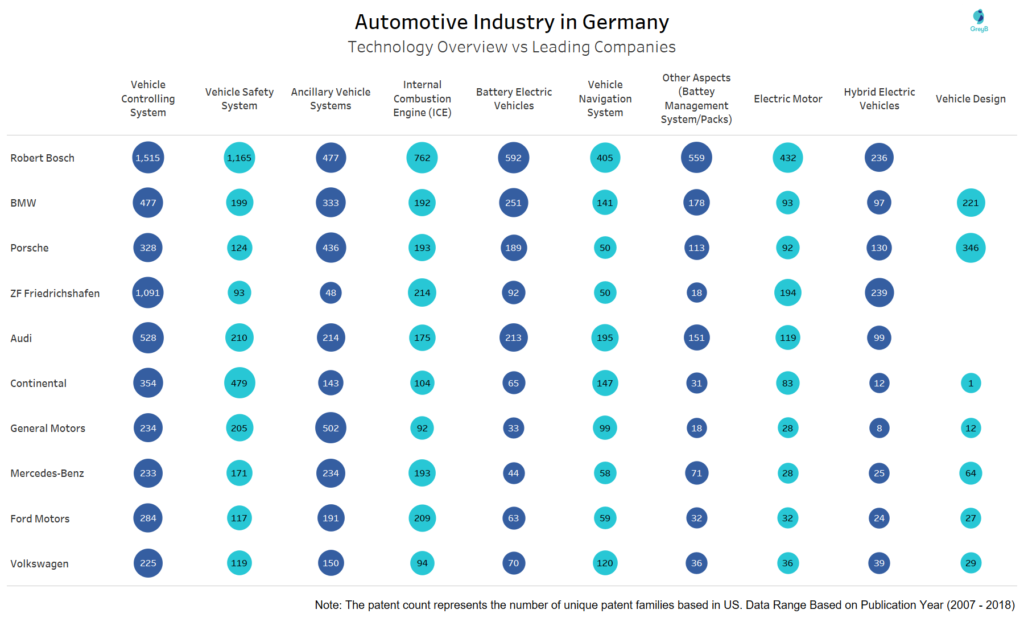

Technology Overview of Key Companies in Germany

The technological categorization of patents ranging from Vehicle Safety System, Vehicle Navigation System and Hybrid Electric Vehicles offers a comprehensive overview of Germany’s contributions towards the automotive sector.

Need to know anything else? We got you covered!