In an era where seamless connectivity is paramount, imagine downloading a 4K movie in seconds or enjoying lag-free multiplayer gaming across multiple devices, all while navigating complex industrial networks in real time. WiFi 7 (IEEE 802.11be) is not just an upgrade; it’s a leap into the future of wireless technology. Officially finalized in January 2024, WiFi 7 promises extremely high throughput (EHT) and unprecedented low-latency communication, designed to meet the growing demand for faster, more reliable wireless networks.

What makes WiFi 7 truly transformative isn’t just its capabilities—it’s the wave of patent innovation driving it. Leading the charge in WiFi 7 development are industry giants like Qualcomm, Huawei, Intel, LG, and MediaTek, who are shaping the future of wireless connectivity. These companies are not only advancing the IEEE 802.11be standard but are also strategically positioning themselves by securing Standard Essential Patents (SEPs), which will determine their influence and revenue potential in the growing WiFi 7 market.

For instance, Qualcomm’s FastConnect 7800 platform and Huawei’s Multi-Link Operation (MLO) are two innovations that are setting new benchmarks in wireless connectivity—and both are backed by a robust portfolio of patents. As these companies race to secure WiFi 7 patents, the strategic value of their intellectual property will play a pivotal role in defining their dominance in the market.

With the global WiFi 7 market projected to reach USD 31.87 billion by 2033, growing at a CAGR of 38.60% from 2025 to 2033, the rapid growth is driven not only by the increasing demand for high-speed, low-latency wireless networks but also by the critical role that patents will play in enabling next-gen applications like AR, VR, and cloud gaming. As the demand for high-performance network solutions intensifies, the companies with the most strategic patent portfolios will lead the way.

As WiFi 7 paves the way for the next-generation connectivity, explore how it stacks up against WiFi 6, the innovative research universities are spearheading, and the groundbreaking advancements that will shape the future of wireless technology, each insight adding a crucial piece to understanding WiFi 7’s full potential

In this article, we’ll explore how WiFi 7 is more than a technological advance—it’s an ecosystem in motion, driven by patents and innovations that will shape the future of wireless communications.

Unlock The Full Wi-Fi 7 Essentiality Report

Read The ReportWho are the leaders in WiFi 7 Innovation?

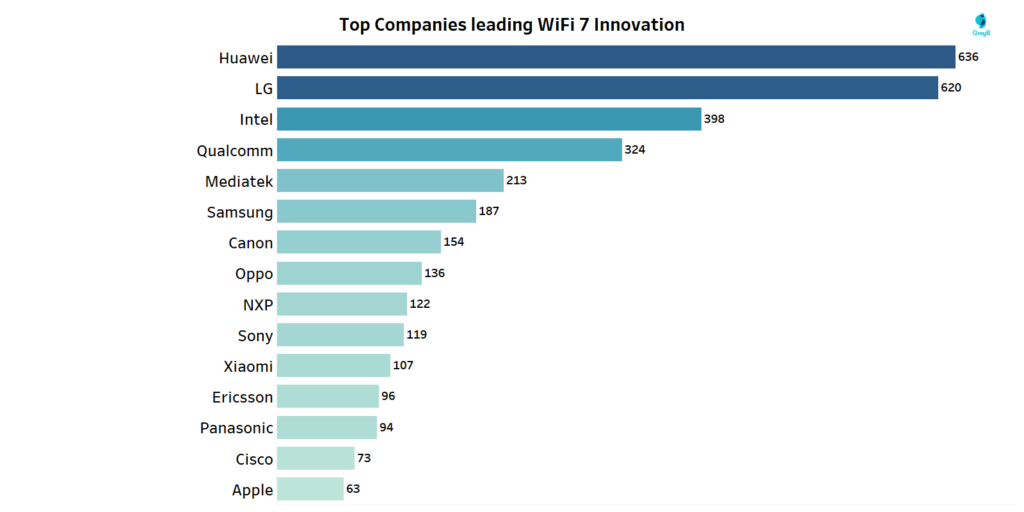

This chart ranks the leading companies in WiFi 7 innovation based on their patent count. The data highlights the number of patent families each company holds, reflecting their contributions to the development of the IEEE 802.11be standard.

The chart reveals a concentrated patent landscape in WiFi 7, with Huawei, Qualcomm, LG, MediaTek and Intel collectively holding 50% of all WiFi 7 patent families. Huawei leads with the highest number of filings, underscoring its aggressive strategy to secure essential intellectual property in this emerging technology. Notably, Qualcomm and Intel, traditionally known for their semiconductor prowess, have significantly increased their patent portfolios in WiFi 7, indicating a strategic pivot towards wireless connectivity solutions. This trend mirrors the broader industry shift where companies are expanding their IP portfolios to encompass next-generation wireless technologies, ensuring they remain competitive in the evolving market.

The table below lists the top 30 companies dominating the WiFi 7 innovation.

| Company | Patent Families |

| Huawei | 636 |

| LG | 620 |

| Intel | 398 |

| Qualcomm | 324 |

| Mediatek | 213 |

| Samsung | 187 |

| Canon | 154 |

| Oppo | 136 |

| NXP | 122 |

| Sony | 119 |

| Xiaomi | 107 |

| Ericsson | 96 |

| Panasonic | 94 |

| Cisco | 73 |

| Apple | 63 |

| Interdigital | 57 |

| Hyundai Motor | 43 |

| Sharp | 43 |

| Xgimi Technology | 42 |

| Newracom | 41 |

| Nippon Telegraph & Telephone | 41 |

| Ofinno | 41 |

| Spreadtrum | 40 |

| Kia | 32 |

| G Electronics | 28 |

| ZTE | 28 |

| Nokia | 25 |

| Marvell | 20 |

| Maxlinear Inc | 17 |

| Meta | 17 |

As these companies secure their positions through patent filings, the next critical question arises: Who are the individual inventors driving these innovations? Understanding the key contributors at the inventor level provides deeper insights into the technological advancements propelling WiFi 7 forward.

Who Are the Key Inventors Driving WiFi 7 Innovation?

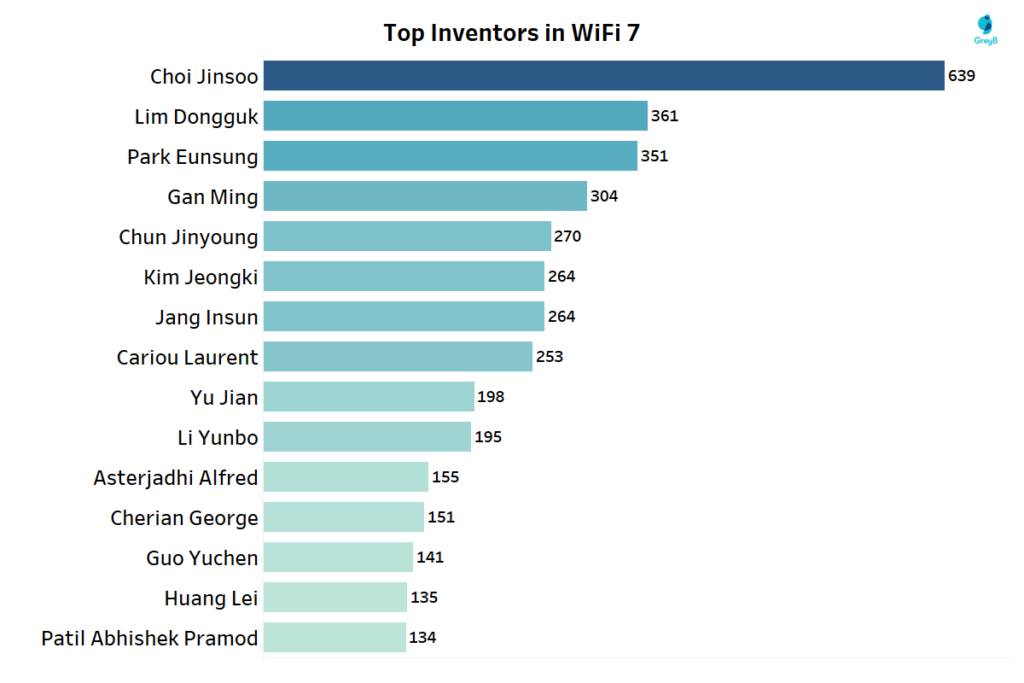

This chart displays the top inventors in WiFi 7 technology, ranked by the number of patents attributed to them. The chart highlights the significant contributions of individuals driving innovation in the domain.

The chart reveals that Choi Jinsoo leads with an impressive 639 patents, signaling his pivotal role in shaping WiFi 7 technologies. Close behind, Lim Dongguk and Park Eunsung represent a growing trend where individual inventors are at the forefront of wireless technology development. These inventors contribute to foundational advancements like 4096-QAM and MLO, cementing their influence over WiFi 7’s evolution. The concentration of patents with these top inventors from companies like LG, Qualcomm and Huawei reflects a competitive landscape, where securing IP rights is integral to controlling the future of WiFi 7. This trend also underscores the importance of patent ownership in shaping the commercial success of WiFi 7 technologies.

The table below showcases the top 15 inventors driving innovation in WiFi 7.

| Inventor | Associated Company | Patent Count |

| Choi Jinsoo | LG | 639 |

| Lim Dongguk | LG | 361 |

| Park Eunsung | LG | 351 |

| Gan Ming | Huawei | 304 |

| Chun Jinyoung | LG | 270 |

| Kim Jeongki | LG | 264 |

| Jang Insun | LG | 264 |

| Cariou Laurent | Intel | 253 |

| Yu Jian | Huawei | 198 |

| Li Yunbo | Huawei | 195 |

| Asterjadhi Alfred | Qualcomm | 155 |

| Cherian George | Qualcomm | 151 |

| Guo Yuchen | Huawei | 141 |

| Huang Lei | Oppo | 135 |

| Patil Abhishek Pramod | Qualcomm | 134 |

As these inventors secure their patents, it’s crucial to examine how these innovations are legally protected. What is the legal status of the patents owned by the top companies, and how does it affect the overall market dynamics?

What is the Patent Legal Status of Key Players in WiFi 7 Patents?

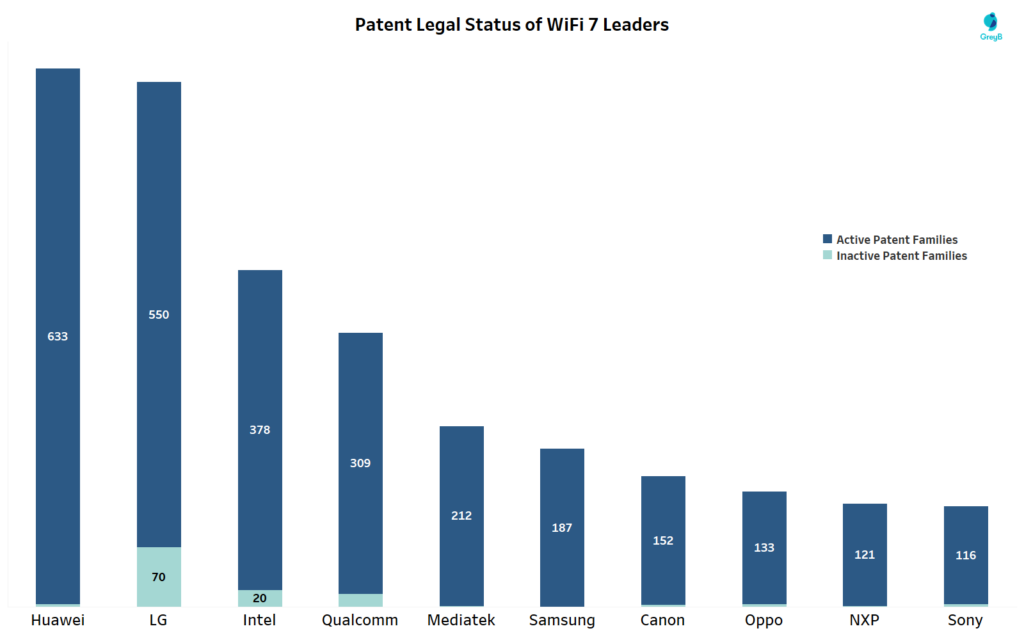

This chart shows the number of active and inactive patent families held by the top 10 companies in WiFi 7 innovation. This reveals the proportion of active and inactive patents owned by the key players.

The chart highlights an interesting pattern among the top WiFi 7 patent holders. Huawei stands out with the highest total filings, and nearly all of its patents are active, underscoring the company’s strong position in the WiFi 7 space and its ongoing commitment to innovation. Similarly, LG maintains a large active portfolio, though a small percentage of their patents are inactive, possibly reflecting older innovations or patents that no longer contribute directly to their strategy.

On the other hand, Intel and Qualcomm show a significant number of inactive patents—a strategic shift that may indicate these companies are focusing on newer technologies or licensing older patents out to generate revenue. This trend aligns with the broader WiFi 7 patent landscape, where companies with large active patent families hold a competitive advantage, driving licensing agreements and market control in the evolving wireless connectivity market.

With companies positioning themselves through their patent portfolios, the next key question is: Which countries are leading in WiFi 7 innovation, and how do their patent filings shape the global competitive landscape?

Which Countries Are Dominating WiFi 7 Innovation?

This map illustrates the leading countries in WiFi 7 innovation based on patent filings. It showcases the top 10 countries with the highest number of patents in WiFi 7 technologies, providing a geographical view of where the most significant innovations are taking place.

The chart underscores the global nature of WiFi 7 innovation, with the United States and China leading the way, each holding thousands of patents. The US, driven by key innovators like Qualcomm and Intel, holds a commanding lead with 3,832 patents, reflecting its historical dominance in wireless technology. China, with its strong focus on wireless advancements, particularly from Huawei, follows closely with 2,898 patents.

The presence of South Korea, Japan and Taiwan in the top 10 highlights the Asia-Pacific region’s growing influence in WiFi 7 development, driven by companies like Samsung, LG and MediaTek. These countries are not just adopting WiFi 7 technologies—they are defining the landscape, filing significant patents that will shape the future of wireless connectivity. The widespread geographic distribution shows that WiFi 7 is not only being developed by traditional leaders but is increasingly a global race, with China and the United States emerging as powerful competitors.

As we examine the geographical distribution of WiFi 7 patents, it’s crucial to understand the relative share each country holds in the global patent landscape. What percentage of WiFi 7 patents do the top 5 countries own, and what does that mean for the competitive landscape?

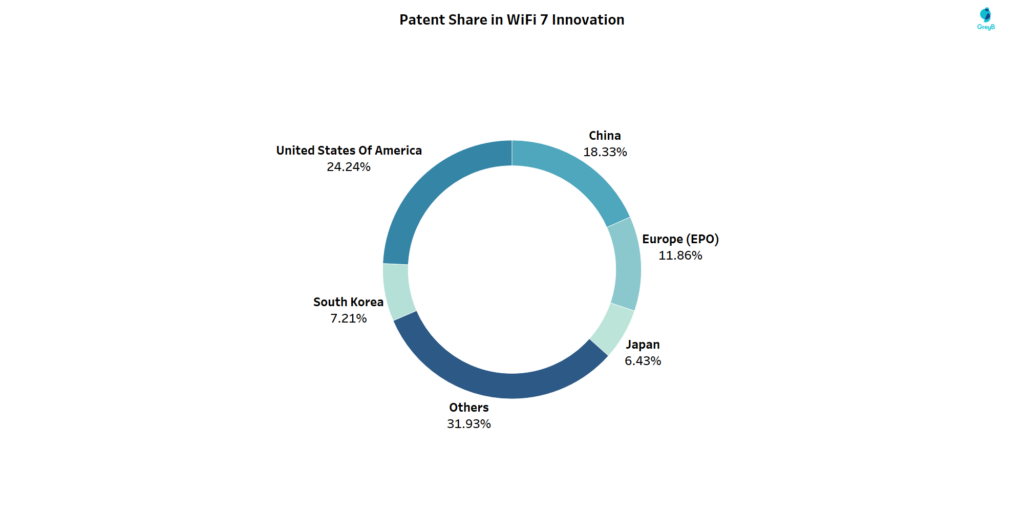

What Is the Patent Share Distribution Among the Leading Countries in WiFi 7?

This chart illustrates the share of WiFi 7 patents held by the top 5 countries—United States, China, Europe (EPO), South Korea and Japan—compared to the rest of the world. The top 5 countries hold a significant share of the total patents, with Others representing the remaining global contributions.

The chart highlights the dominance of the United States and China in the WiFi 7 patent race, collectively holding over 40% of global patents. The “Others” category, comprising regions like India, Brazil and Australia, accounts for 28.36% of global WiFi 7 patents, signaling the global expansion of WiFi 7 innovation. This data reveals a concentrated patent landscape dominated by a few major players, while also showing the growing contributions from emerging markets.

The table below highlights the patent share in WiFi 7 Innovation owned by the top 25 countries.

| Country | Patent Share |

| United States Of America | 24.24% |

| China | 18.33% |

| Europe (EPO) | 11.84% |

| South Korea | 7.21% |

| Japan | 6.43% |

| Taiwan | 3.57% |

| Australia | 1.68% |

| Brazil | 1.59% |

| Canada | 1.11% |

| Mexico | 1.09% |

| Germany | 0.63% |

| Spain | 0.58% |

| United Kingdom | 0.38% |

| India | 0.36% |

| Singapore | 0.34% |

| Philippines | 0.20% |

| Poland | 0.16% |

| Hungary | 0.15% |

| Russia | 0.14% |

| Indonesia | 0.11% |

| South Africa | 0.09% |

| Denmark | 0.06% |

| Israel | 0.06% |

| Colombia | 0.06% |

As these countries secure their patent shares, it’s crucial to examine the market coverage of leading WiFi 7 companies. How do the patent filings of these companies compare across different geographies, and what does it mean for their global market strategies?

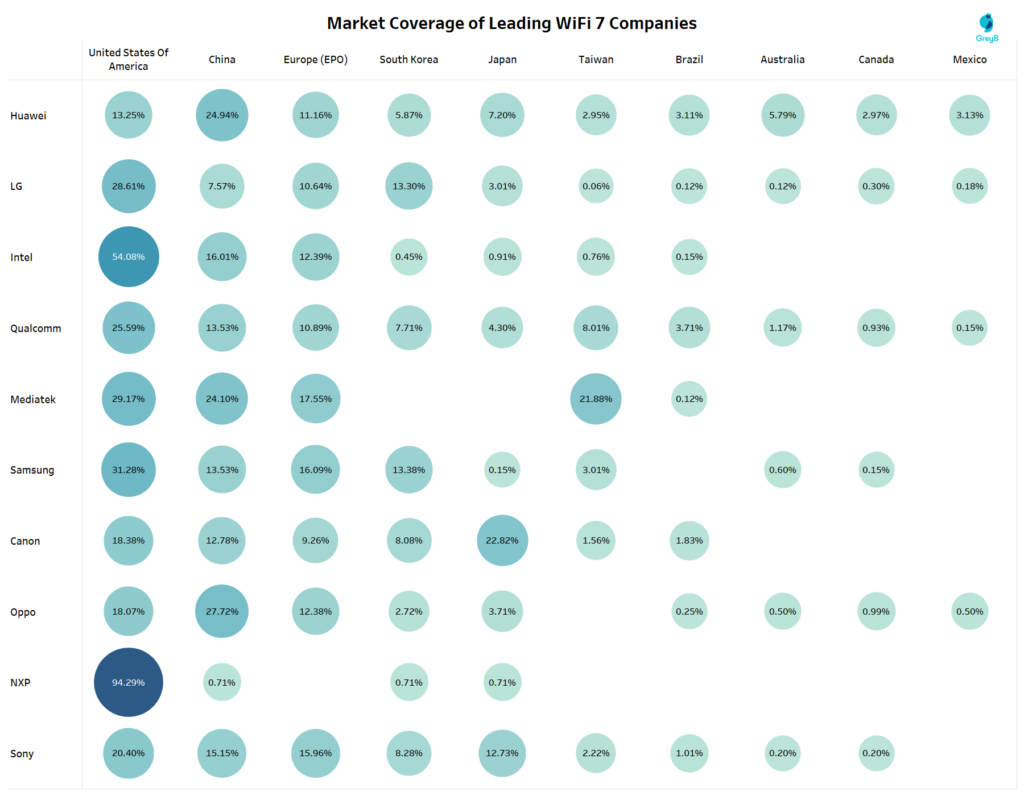

How Do Leading WiFi 7 Companies’ Patents Distribute Across Different Markets?

This chart illustrates the geographic distribution of WiFi 7 patents owned by the leading companies in the industry. The chart breaks down the number of patents each company holds in different countries, highlighting the global reach of WiFi 7 innovation and the strategic positioning of these key players.

The chart highlights that Intel has the largest share of patents in the United States, with 54.08% of its WiFi 7 patents held in the country, reflecting its strong market focus on the US. Qualcomm and Huawei also show significant coverage in the United States and China, respectively, emphasizing their key markets. NXP, however, stands out with an extraordinary 94.29% of its patents in the United States, indicating its deep integration into the US market, particularly in automotive and industrial applications.

Countries like China, South Korea and Europe (EPO) emerge as critical regions for WiFi 7 patent filings, with companies like Huawei, Qualcomm and Samsung maintaining a high number of patents in these countries. The distribution of patents across countries is a clear indicator of the global strategic importance these companies place on specific markets, especially those with robust tech infrastructure and growth potential for WiFi 7 technologies.

As companies align their patent portfolios with key markets, the next focus is on the key technologies driving WiFi 7 innovation. Which technologies are the most significant, and how are they shaping the future of wireless connectivity?

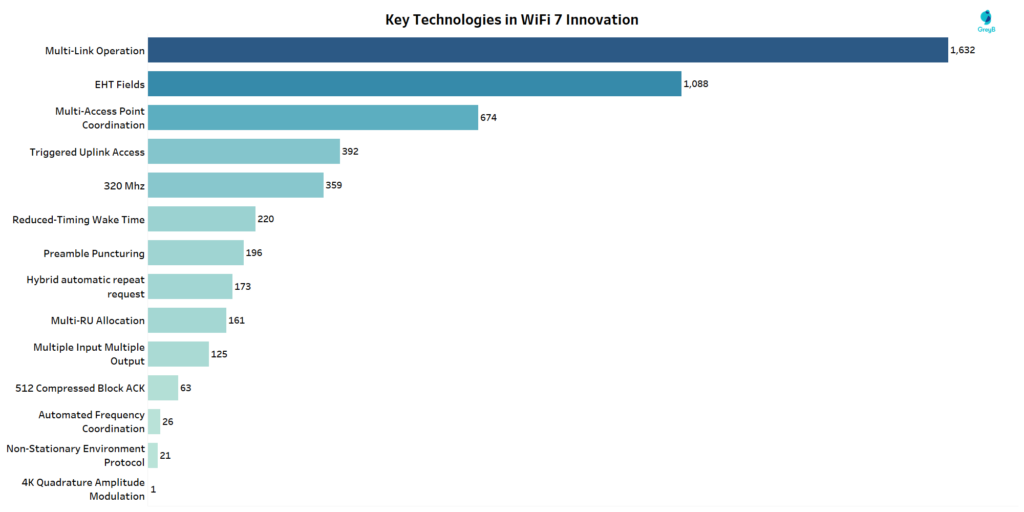

What Are the Key Technologies Shaping WiFi 7 Innovation?

This chart highlights the most significant WiFi 7 technologies driving innovation. Multi-Link Operation (MLO) leads with the highest number of patents, followed by technologies such as DFT Fields, Multi-Access Point Coordination and Triggered Uplink Access. These technologies are central to enhancing WiFi 7’s capabilities, including higher throughput, improved reliability and low-latency communication.

The chart shows that Multi-Link Operation (MLO) is by far the most innovative and sought-after technology in WiFi 7, with the highest number of patents filed (1,632). This underscores MLO’s role in enabling simultaneous multi-band operation, drastically improving network performance and device connectivity. Other significant technologies include EHT Fields and Multi-Access Point Coordination, each contributing to WiFi 7’s improved efficiency and coverage.

Technologies like Triggered Uplink Access, 320 MHz bandwidth, and Hybrid Automatic Repeat Request (HARQ) play key roles in enhancing data throughput and ensuring real-time communication, which is crucial for next-gen applications such as smart cities, autonomous vehicles and cloud gaming.

The dominance of MLO reflects the growing demand for high-performance networks capable of supporting the increasing number of connected devices, offering more stable connections and faster speeds. These technologies are key to WiFi 7’s success, ensuring its ability to handle the future demands of both consumer and industrial applications.

As these technologies continue to evolve, the next key focus is: How are these technologies distributed across the patent portfolios of leading WiFi 7 companies? Let’s explore the patents owned by the companies in these critical technology areas.

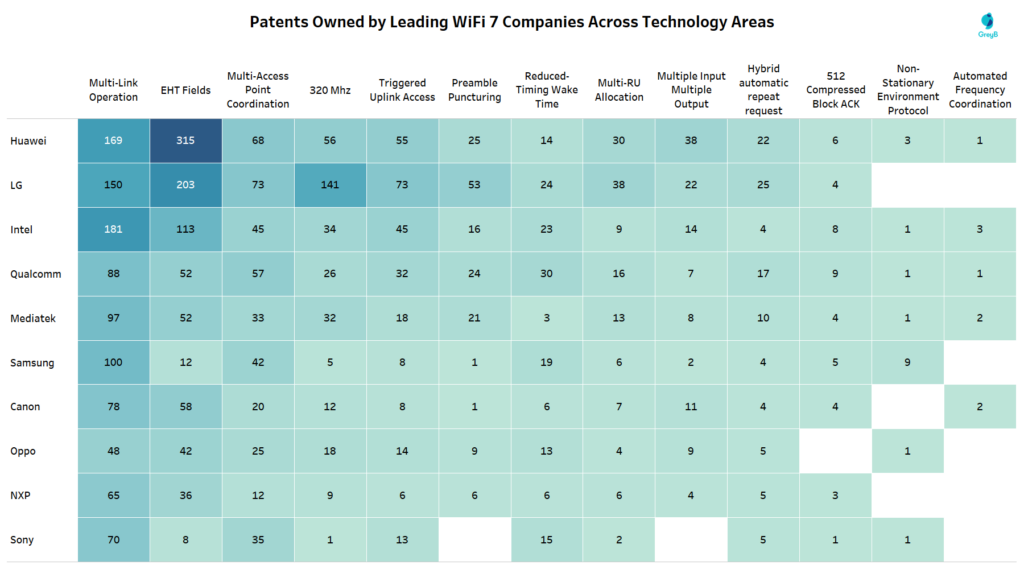

How Are WiFi 7 Patents Distributed Across Technology Areas by Leading Companies?

This chart presents the number of WiFi 7 patents held by leading companies in various technology areas. It highlights the innovation focus of each company in different aspects of WiFi 7 technology.

The chart reveals that Huawei leads in EHT Fields and Multi-Link Operation, reflecting its strong focus on enhancing network efficiency and multi-band connectivity. LG also holds a significant number of patents in EHT Fields and 320 MHz, indicating its leadership in driving high-speed, low-latency communication for WiFi 7.

This patent distribution showcases the diverse innovation strategies of the leading companies, each positioning themselves as key players in different aspects of WiFi 7 technology. The wide spread of patents across various areas underscores the competitive nature of the WiFi 7 development process, with each company securing its IP in the most strategic areas for future growth.

As these companies drive WiFi 7 innovation in specific technology areas, the next crucial question is: How are these patents distributed across different countries? Let’s take a look at the geographical spread of WiFi 7 patents across technology areas and analyze the global impact.

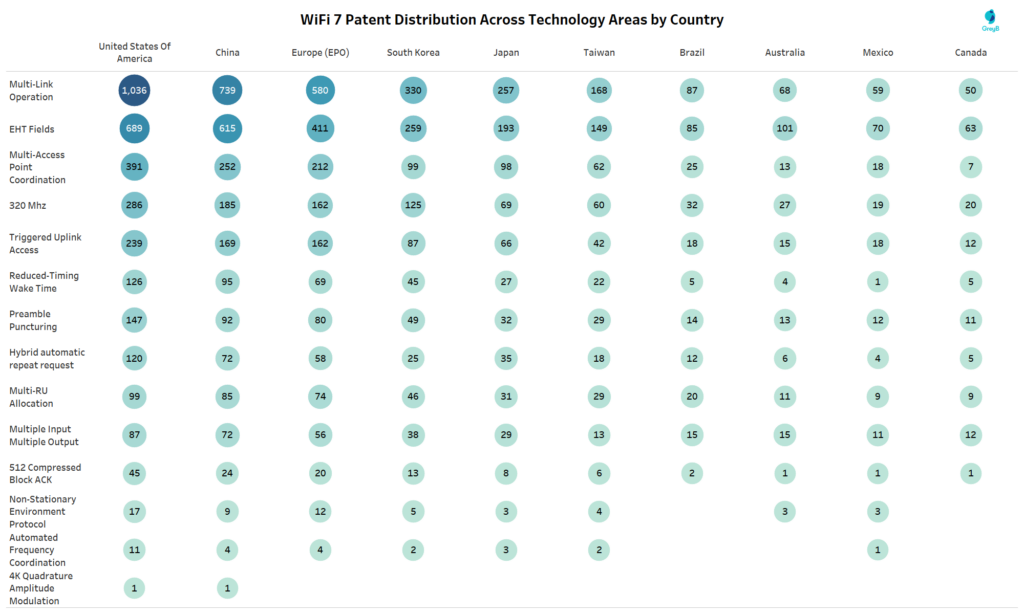

How Are WiFi 7 Patents Distributed Across Technology Areas in Different Countries?

This chart illustrates the distribution of WiFi 7 patents across various technology areas in different countries. It highlights how each country contributes to WiFi 7 innovation.

The chart clearly shows that the United States and China dominate in WiFi 7 patent filings, with the US leading in Multi-Link Operation (1,036 patents) and EHT Fields (689 patents). China follows closely, with 739 and 615 patents in Multi-Link Operation and EHT Fields, respectively, reflecting its strategic focus on enhancing network capacity and coverage.

This distribution shows that the global innovation in WiFi 7 is highly concentrated in a few regions, but each country’s contributions are strategic in different areas of wireless technology, shaping the future of WiFi 7 capabilities.

Now that we’ve explored the geographical spread of WiFi 7 patents, let’s shift focus to patent trends. How have the number of WiFi 7 patents evolved over the past decade? Let’s look at the filings from 2014 to 2024 to understand the trajectory of WiFi 7 innovation.

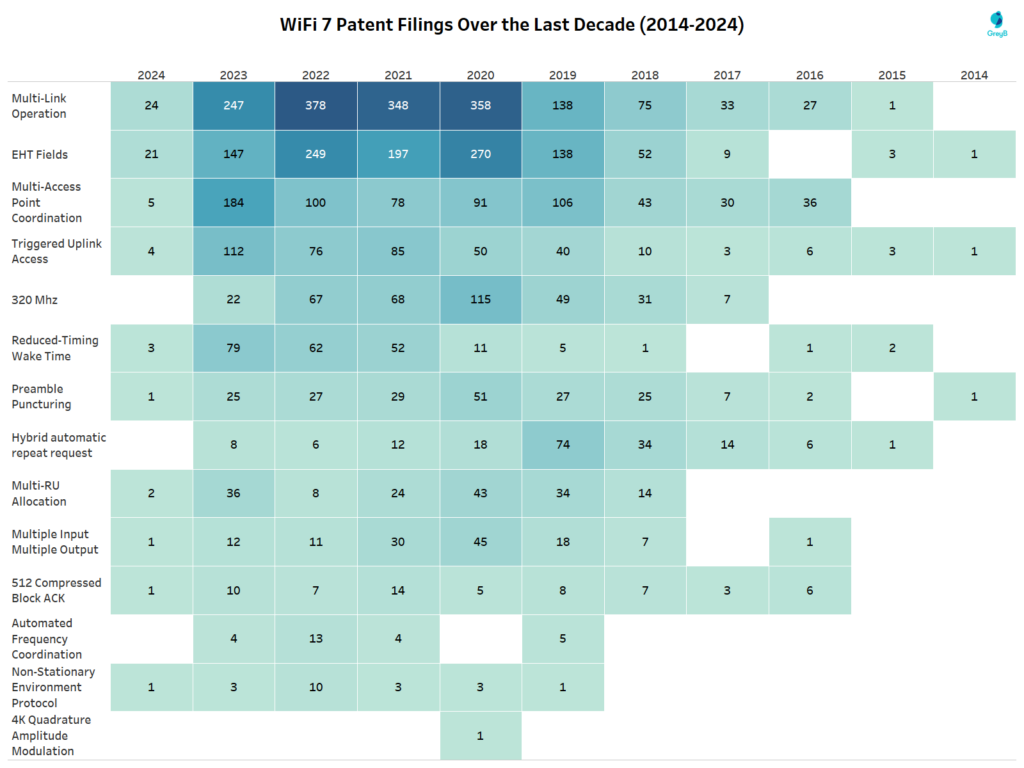

How Have WiFi 7 Patent Filings Evolved in the Last Decade?

This chart tracks WiFi 7 patent filings across various technology areas from 2014 to 2024, showcasing the annual number of patents filed in key WiFi 7 technologies such as Multi-Link Operation, DFT Fields and 320 MHz.

The chart reveals a significant increase in WiFi 7 patent filings from 2019 to 2024, with a notable spike in Multi-Link Operation (MLO), which led the way from 2020 to 2022. This surge aligns with the development of the IEEE 802.11be standard and reflects the growing focus on multi-band connectivity and network efficiency. Similarly, 320 MHz show increased filings in 2020, indicating the industry’s shift in focus to improve high-speed, low-latency communication capabilities.

In the earlier years (2014-2018), patent filings were comparatively sparse, suggesting that the WiFi 7 development phase was in its early stages, with fewer companies prioritizing these innovations. However, as the demand for next-gen wireless technologies increased, companies began to rapidly file patents, signaling a competitive race to secure intellectual property ahead of WiFi 7’s commercial deployment.

This increase in patent filings not only underscores the technical advancements in WiFi 7 but also highlights the rising market competition in key technologies that will define the next era of wireless connectivity.

Which companies hold the critical Standard Essential Patents (SEPs) for WiFi 7, and how will their control over the IEEE 802.11be standard shape the future of wireless connectivity?