Introduction: Strategic Acquisitions, Sector Shifts, and Innovation Predictions

In 2024, US patent assignment activity revealed sharp strategic moves across industries, with a surge in acquisitions underscoring the competitive importance of innovation ownership. This analysis uncovers the top patent acquirers and assignors, highlights technology verticals driving IP consolidation, and offers predictive insights into future innovation trajectories.

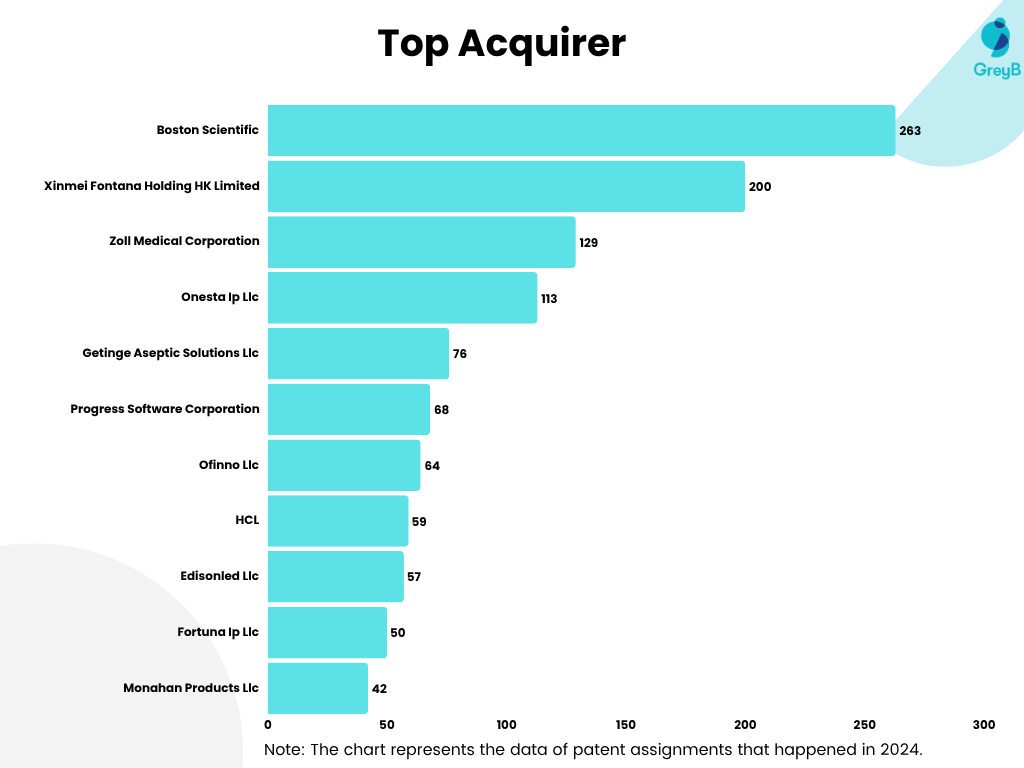

Boston Scientific emerged as the top acquirer with 263 patents, targeting domains like medical devices, therapies, and diagnostic technologies, indicating a continued push into cardiovascular and digital health solutions. Close behind, firms such as Xinmei Fontana, Zoll Medical, and Onesta IP actively built IP portfolios, particularly in healthcare and electronics.

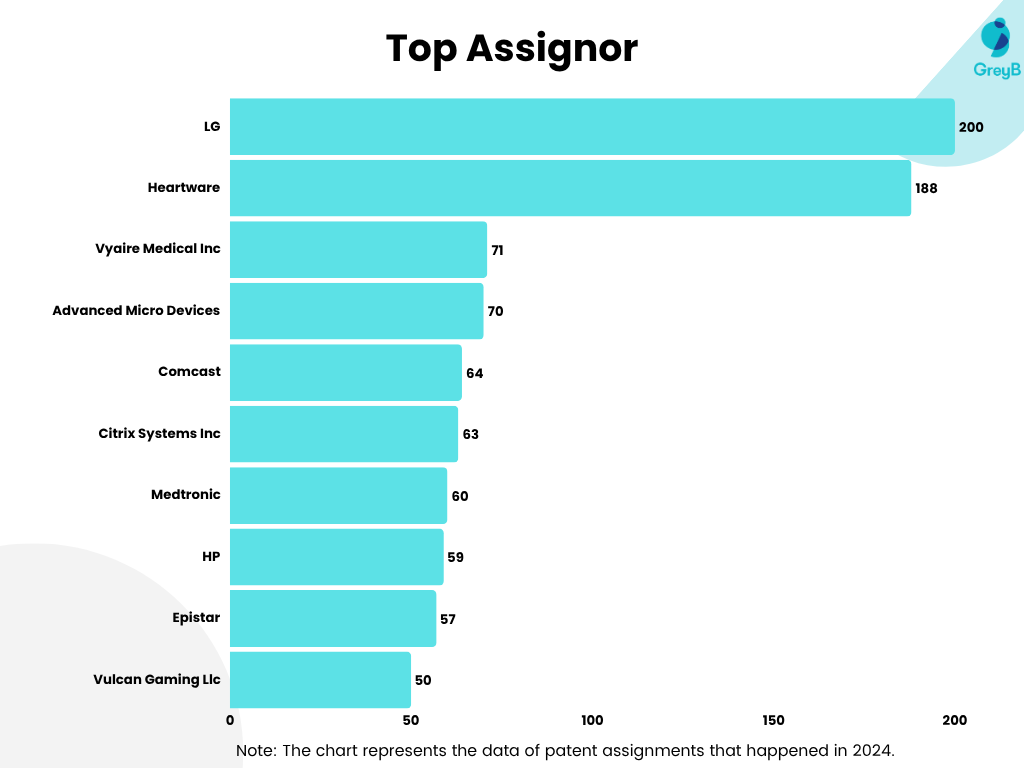

On the assignor side, LG Electronics and Heartware Inc. led the list, transferring significant portfolios 200 and 188 patents respectively pointing to strategic IP divestitures and potential partnerships. This realignment reflects evolving priorities, monetization strategies, and shifts in market positioning.

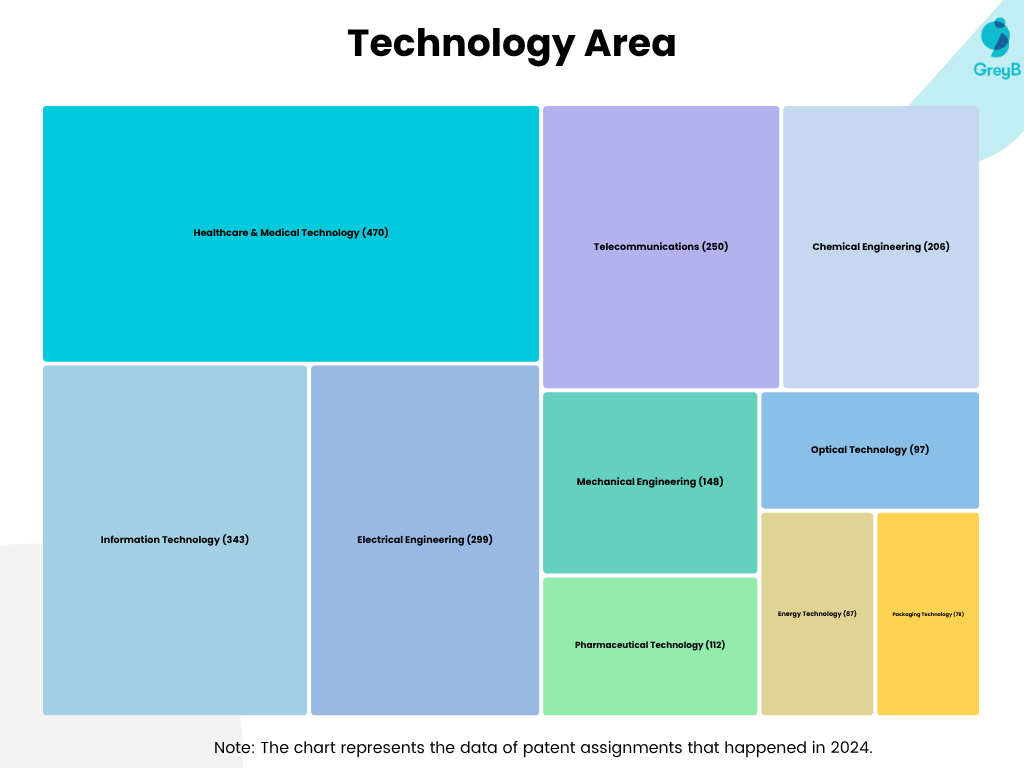

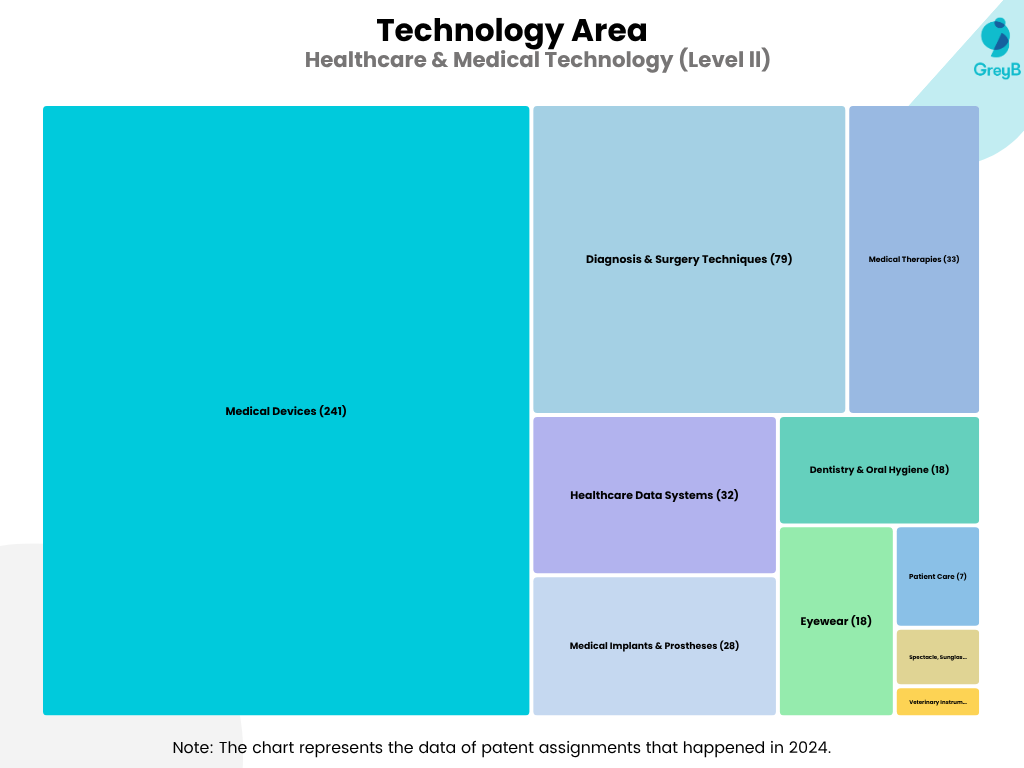

From a technical perspective, Healthcare & Medical Technology dominated acquisition trends with 470 patents, followed by Information Technology (343) and Electrical Engineering (299). Notably, within healthcare, segments like medical devices (241) and diagnosis & surgery techniques (79) saw heavy acquisition activity, suggesting industry bets on next-gen clinical solutions, data-driven diagnostics, and smart therapeutic platforms.

Prediction: 2024’s patent assignments reveal a pivot toward integrated health-tech ecosystems, AI-enhanced care, and smart hardware convergence. Expect continued acceleration in acquisitions across data processing, robotic surgery, telehealth infrastructure, and wearable diagnostics areas where IP will become a defining asset in global competitiveness.

Top Patent Acquirers in 2024

Boston Scientific led with 263 patent acquisitions, followed by Xinmei Fontana Holding and Zoll Medical. The top 20 acquirers represent strategic investments in healthcare, IT, and electronics sectors, with a notable presence of IP-focused entities like Onesta IP and Fortuna IP.

Top Patent Assignors in 2024

LG Electronics and Heartware Inc. topped the assignor list, suggesting portfolio realignment. Companies like AMD, Comcast, and Medtronic reflect a cross-sector shift in IP holdings, indicating monetization, restructuring, or focus on core innovations.

Top Technology Areas for Patent Acquisition in 2024

Healthcare & Medical Technology (470 patents) dominated IP acquisitions, followed by Information Technology (343) and Electrical Engineering (299). The data indicates a clear shift toward life sciences, digital transformation, and core hardware innovations.

Healthcare & Medical Technology – Level 2 Categorization

Within healthcare, Medical Devices led with 241 patents, trailed by Diagnosis & Surgery Techniques (79). There’s a strong trend toward data-integrated devices and personalized care platforms.

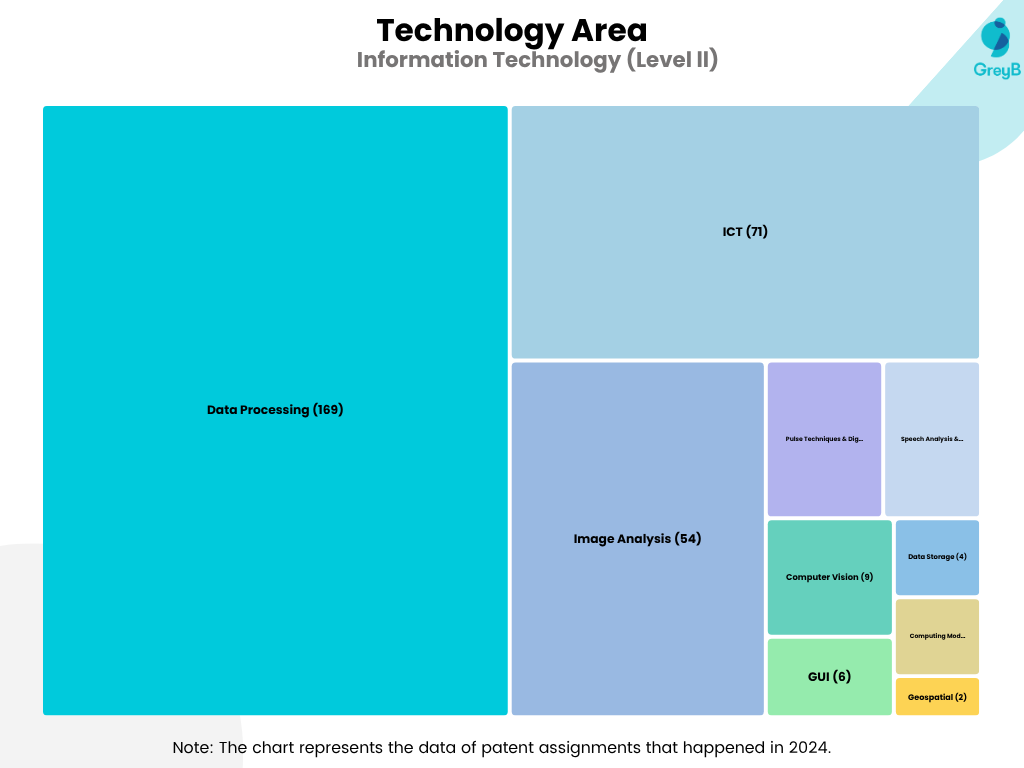

Information Technology – Level 2 Categorization

Data Processing (169) was the primary focus, highlighting AI, big data, and digital infrastructure growth. ICT and Image Analysis follow closely, showing advancements in smart systems and visual computing.

Boston Scientific Patent Acquisition Analysis

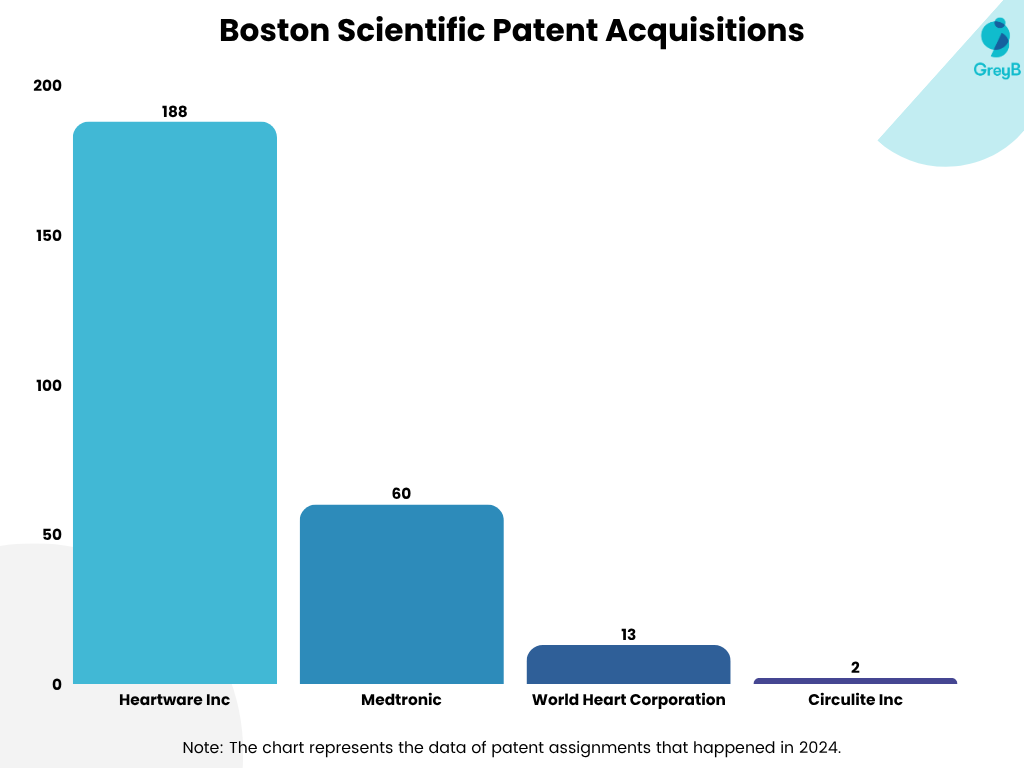

Boston Scientific’s 263 patents were sourced mainly from Heartware Inc. and Medtronic, underscoring a strategic emphasis on cardiac care and therapeutic technologies. Their focus aligns with expansion into high-growth clinical and surgical markets.

| Boston Scientific patent Acquisition | Acquired Patents |

| Heartware Inc | 188 |

| Medtronic | 60 |

| World Heart Corporation | 13 |

| Circulite Inc | 2 |

Boston Scientific – Technology Area Focus

Major acquisitions were in Medical Devices (143), Medical Therapies (33), and Diagnosis & Surgery Techniques (27), affirming Boston Scientific’s drive toward comprehensive clinical care solutions and integration of digital health components.

| Boston Scientific Patent Acquisition in | Patents |

| Medical Devices | 143 |

| Medical Therapies | 33 |

| Diagnosis & Surgery Techniques | 27 |

| Fluid Machinery | 19 |

| Healthcare Data Systems | 14 |

| Non-Electric Control Systems | 4 |

| Electric Power Generation, Distribution & Storage | 3 |

| Data Processing | 3 |

| Medical Implants & Prostheses | 2 |

| Electrical Connectors | 2 |

| Audio Systems | 2 |

| Computing Models | 2 |

| Handheld controller | 1 |

| Electric Generators & Motors | 1 |

| Controller | 1 |

| Signal Transmission | 1 |

| Power Conversion Apparatus | 1 |

| Electronic & Magnetic Measurement Tools | 1 |

| Sterilization & Disinfection Apparatus | 1 |

| Material Analysis | 1 |

| Control panel | 1 |

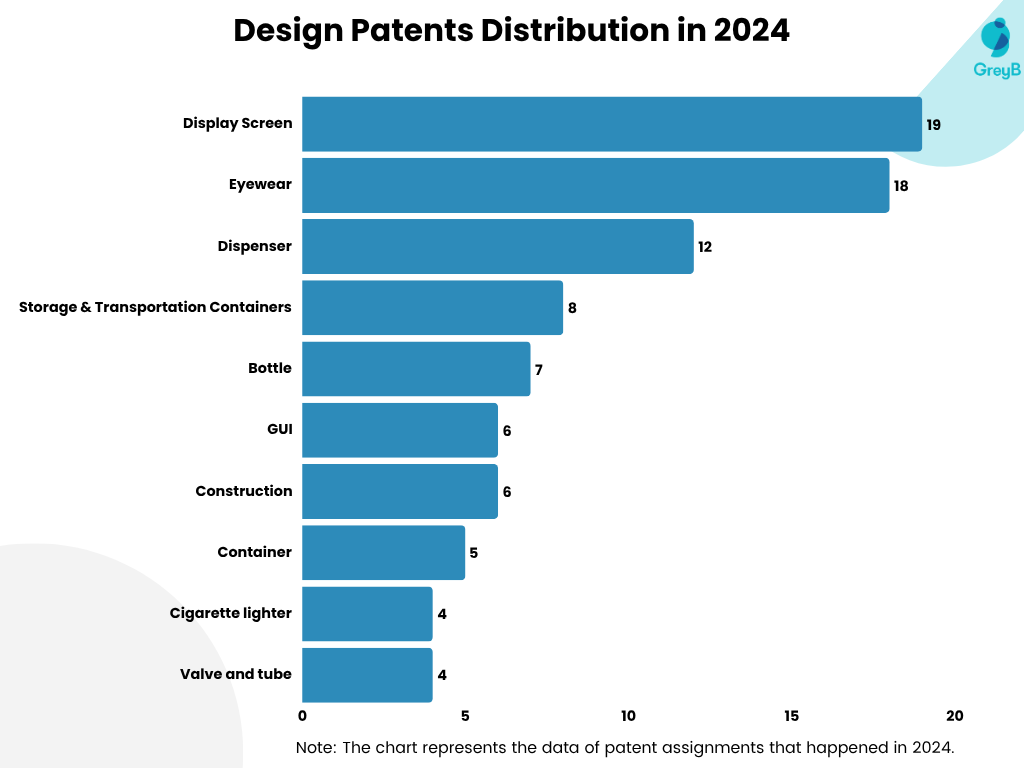

Design Patents Distribution in 2024

Over 130 design patents were acquired across diverse domains, with strong emphasis on Display Screens (19) and Eyewear (18). The trend signals user-centric innovation, especially in interfaces, wearables, and personalized devices.

Patent assignment activity in 2024 reflects deep consolidation in digital health, smart systems, and connected hardware. We anticipate continued M&A and licensing in AI-healthcare, secure data systems, and cross-disciplinary innovations. IP will be central to differentiation and long-term strategy across sectors.

Looking for detailed patent insights in a specific Patent Assignment?

Submit your interest, and our team will reach out to explore a customized report for you!