Innovation is shaping the future and Europe is playing a big part in that story. In just the last five years, more than 14,000 startups have launched across the region, creating solutions that make life simpler, healthier, and more connected.

The latest figures show the UK at the top with over 3,300 new startups, followed by Germany with nearly 2,000 and Spain with 1,300+. IT Consulting & Services and Software Development lead the way with 1,500+ companies each, while Fintech and Healthcare remain hotbeds of activity with more than 1,200 new players each.

Do read about some interesting highlights of the US Startups & Acquisition, US AI Startups, and Recent US Startup Acquisitions:

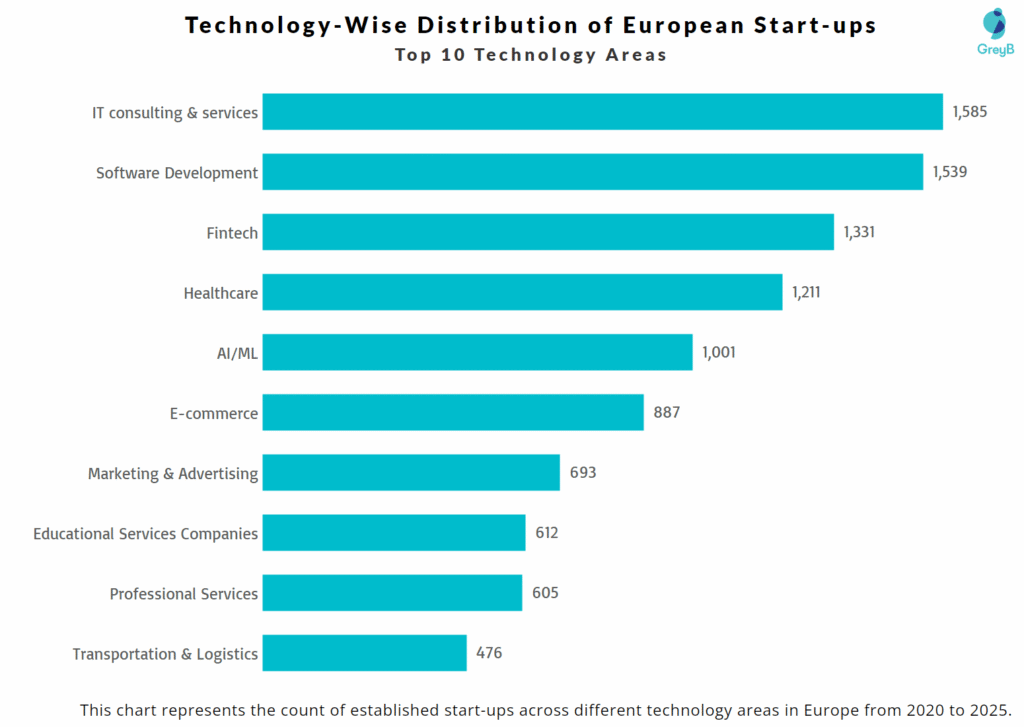

Where European Startups are focused

This chart shows that from 2020 to 2025, European startups are primarily focused on IT services, software development, and fintech, highlighting a strong push toward digital transformation. Sectors like healthcare and AI/ML also see significant traction, reflecting growing demand for innovation in health tech and intelligent systems. The distribution points to a tech-driven, service-oriented start-up ecosystem across Europe.

Why these sector are on top, let’s break it down –

IT Consulting & Services:-

Digital Transformation Push: Across Europe, businesses (including SMEs and government agencies) are under pressure to modernize operations, adopt cloud solutions, and implement cybersecurity measures. Startups are filling the gap by offering specialized consulting services that established players often cannot provide quickly or affordably.

Remote Work & Post-Pandemic Demand: The pandemic accelerated digital adoption. Companies needed rapid solutions for IT infrastructure, cloud migration, and collaboration tools, creating fertile ground for new IT consulting ventures.

Lower Entry Barriers: Consulting businesses have relatively low startup costs (often service-based, no heavy infrastructure required), making them an attractive first step for tech entrepreneurs.

Software Development & Applications:-

Boom in SaaS & Custom Solutions: Businesses demand niche, tailored solutions CRM, HR tools, workflow automation driving startups to build specialized software products.

Rise of Low-Code/No-Code Platforms: Lower development barriers allow more founders (even non-technical ones) to launch software startups, accelerating growth in this sector.

Government & EU Support: European Union initiatives like the Digital Europe Programme provide funding for innovation in AI, data, and digital infrastructure, encouraging entrepreneurs to build software solutions locally.

Fintech:-

Strong Regulatory Support: Regulations like PSD2 (open banking) created opportunities for startups to innovate in payments, lending, and financial data aggregation.

Demand for Financial Inclusion: Consumers and SMEs want cheaper, faster, more transparent financial services, leading to growth in neobanks, payment gateways, and digital lending platforms.

Global Investment Interest: Europe’s fintech hubs (London, Berlin, Amsterdam) attract significant VC funding, allowing more fintech startups to emerge and scale quickly.

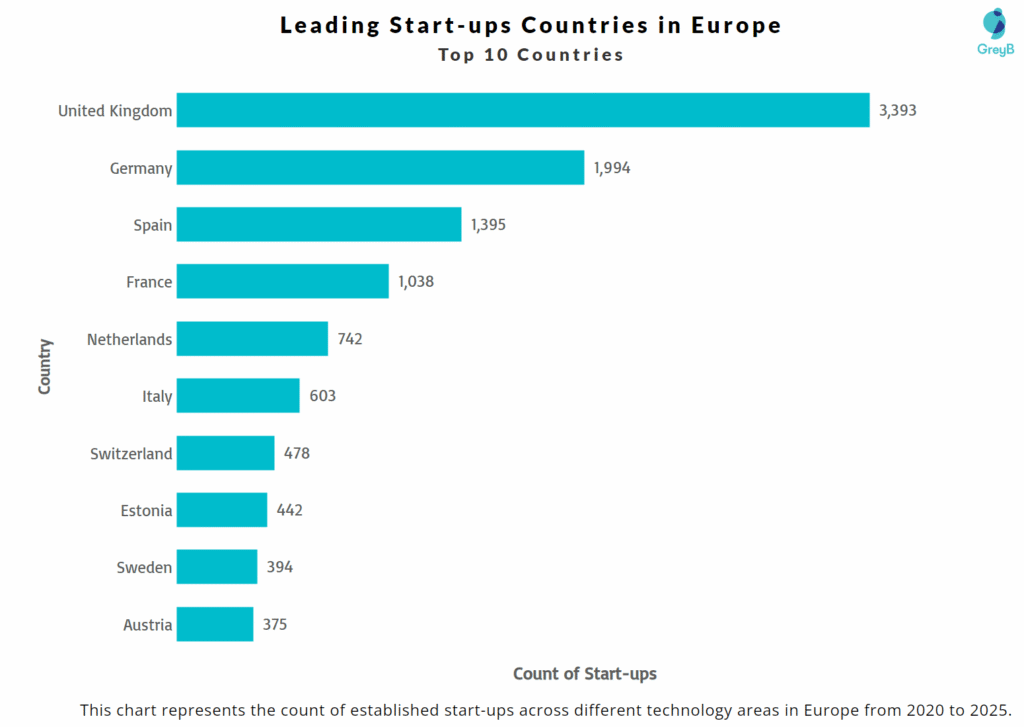

Leading Startups Countries in Europe –

Between 2020 and 2025, the United Kingdom leads Europe’s start-up scene with 3,393 companies, nearly 70% more than Germany (1,994), the second-highest. Spain and France follow with 1,395 and 1,038 startups respectively, showing strong southern European activity. The Netherlands, Italy, and Switzerland round out the mid-tier, while Estonia, Sweden, and Austria represent emerging hubs.

This distribution highlights the UK as Europe’s dominant innovation hub, while also signaling a rise in decentralized entrepreneurship across both Western and Northern Europe.

Explore the list of Leading Startups Countries in Europe

| Country | Startups |

| United Kingdom | 3393 |

| Germany | 1994 |

| Spain | 1395 |

| France | 1038 |

| Netherlands | 742 |

| Italy | 603 |

| Switzerland | 478 |

| Estonia | 442 |

| Sweden | 394 |

| Austria | 375 |

| Poland | 348 |

| Belgium | 342 |

| Denmark | 320 |

| Ireland | 304 |

| Portugal | 262 |

| Finland | 228 |

| Romania | 211 |

| Cyprus | 196 |

| Norway | 160 |

| Bulgaria | 159 |

| Lithuania | 147 |

| Greece | 144 |

| Czechia | 141 |

| Latvia | 130 |

| Croatia | 113 |

| Luxembourg | 102 |

| Hungary | 101 |

| Slovakia | 77 |

| Malta | 72 |

| Slovenia | 61 |

Out of 14,000+ startups founded in Europe from 2020 onwards, only a fraction are truly shaping the future with patents, research breakthroughs, and market-ready innovations.

Get a custom deep-dive report on:

- Which startups are filing patents (and in what fields)

- Who’s leading R&D efforts in your industry

- Key innovation hotspots for potential partnerships or acquisitions

Request Your Customized Analysis and make data-driven decisions for your next big move.