In May 2025, a federal jury in Texas ordered Samsung to pay nearly $112 million for infringing three networking and information‑processing patents held by Maxell, an award that came after years of back‑and‑forth over licensing and portfolio strategy. While headlines emphasize the dollars, the deeper signal is this: the machinery of patent litigation is humming again.

While Samsung’s case drew headlines, it’s just one of several high-stakes patent lawsuits that defined 2025. Here’s a look at the other landmark cases that shaped the IP landscape this year.

This resurgence didn’t erupt overnight. Between 2020 and 2025, patent litigation in US district courts quietly evolved. After a period of plateau and retrenchment, plaintiffs, both non‑practicing entities and operating companies, began refining how they assert. They filed fewer sprawling suits; instead, they picked narrower claims, deployed staggered campaigns and rethought venue strategies. Defendants, meanwhile, sharpened defenses, pushing early motions, navigating parallel review paths and contesting damage theory more aggressively.

Consider another case: in 2025, AT&T and Nokia convinced an appellate court to vacate a $166 million jury verdict. The Federal Circuit found the underlying expert testimony unsupported and reversed the infringement ruling entirely. That move underscores a tension at the core of modern litigation: verdicts matter, but reversals sometimes matter more.

Beyond the high‑stakes suits, doctrinal and procedural shifts have subtly rebalanced risk. The Supreme Court’s decision in Amgen v. Sanofi (2023) constraining how broadly a patent must be enabled forced patentees to tighten disclosures at the outset. Meanwhile, recent Federal Circuit rulings have reshaped issue preclusion in IPRs and altered how damage awards are reviewed.

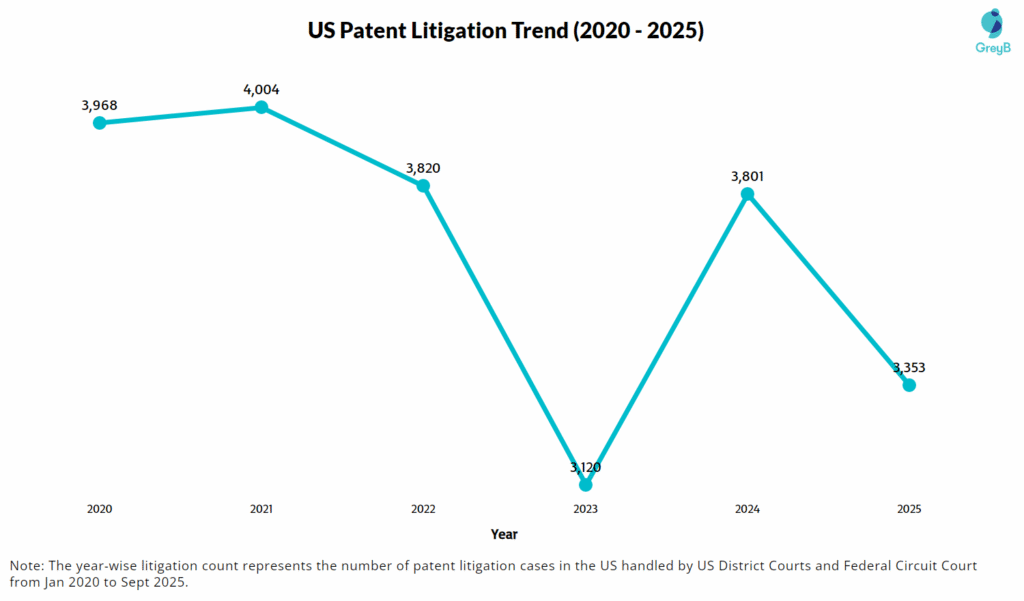

Against that evolving backdrop patent strategies and litigation roadmaps can no longer rely on patterns from a decade ago. This article examines that transformation through the lens of litigation activity spanning January 1, 2020 to September 26, 2025, focusing exclusively on cases filed in US District Courts and the Federal Circuit, while excluding PTAB and ITC proceedings. This five-year window includes 26,129 cases—of which 20,990 have been terminated and 5,139 remain active. The dataset encompasses litigation initiated by both Non-Practicing Entities (NPEs) and operating companies, offering a comprehensive view of the enforcement landscape as it stands today.

Note: While every effort has been made to ensure data completeness and accuracy, readers should note that slight variances may exist due to ongoing updates in court dockets and the dynamic nature of litigation records.

How has US Patent Litigation Evolved in the last 5 years?

This chart tracks the annual number of new patent litigation cases filed from 2020 to 2025.

Between 2020 and 2025, patent litigation cases in US have followed a non-linear trajectory, reflecting broader industry and legal shifts. After a relatively stable period from 2020 to 2022,cases dipped sharply in 2023marking the lowest annual figure in this five-year span.

Legal analysts attributed the 2023 decline to several converging factors: the residual slowdown from pandemic-era court backlogs, increasing early settlements due to adverse Alice §101 rulings, and uncertainty around venue preferences following Federal Circuit scrutiny of Judge Albright’s Western District of Texas docket dominance.

Additionally, reforms proposed in 2024, including the USPTO’s revised guidelines for AI-related patent eligibility, may have instilled confidence in both NPEs and operating companies regarding enforceability of cutting-edge IP.

For a deeper understanding of the specific patents at the center of these litigations, our article on the Most Asserted Patents provides valuable insights into the patents that were most frequently asserted from 2021 to 2024.

But as litigation volumes rise, what kinds of patents are actually being enforced? Are utility patents still dominant or are we seeing a strategic shift toward asserting design and plant patents?

Let’s explore the breakdown by patent type.

Which Types of Patents Are Most Litigated in the US?

This table breaks down total litigation cases based on the patent types over the last 5 years.

| Patent Type | Number of Litigation Cases |

| Utility Patents | 22832 |

| Design Patents | 2046 |

| Reissue Patents | 803 |

| Plant Patents | 6 |

Across the total of 26,129-cases in the US from 2020 to 2025, utility patents account for ~87.3%, dwarfing all others. This reflects their role in protecting core technological innovations.

Design patents show up in ~7.8% cases. While historically a smaller share, design patent litigation has gained attention recently, especially in sectors like consumer electronics, wearables and user-interface design. In 2024, the Federal Circuit agreed to review LKQ v. GM, the first en banc review of a design patent issue since 2018 to assess the proper standard of obviousness in design contexts.

The growing relevance of design patent cases hints at shifting strategies. See how litigation trends have evolved in 2024.

Reissue patents surface in ~3.1% cases. Reissues often arise from attempts to correct errors in original claims or expand claim scope in light of marketplace developments. On the other hand, plant patents are virtually absent. Their limited relevance is consistent with the restricted use cases (primarily in horticultural or agronomic inventions) and narrower commercial ecosystems.

Strategic Implications

- For operating companies and NPEs alike, asserting utility patents remains the most viable path to leverage R&D investments into litigation risk.

- Design litigation, though smaller in volume, may offer higher tactical value in fast-moving consumer sectors or where utility claims face validity challenges.

- Reissue patent enforcement seems peripheral, possibly deployed as a supplemental claim strategy rather than a principal litigation front.

Now that we understand which patent types dominate litigation, it’s crucial to look beyond what was asserted and into what courts decided. How many cases resulted in determinations? The next section will explore case determinations.

What Were the Judicial Determinations in US Patent Litigation?

This table classifies litigation cases during 2020–2025 by their judicial determinations.

| Determination | Definition | Number of Litigation Cases |

| Not Invalid | The patent is legally valid and enforceable | 1346 |

| Infringed | Another party is found to have used the patented invention without permission | 1243 |

| Invalid | The patent is legally flawed (e.g., not new or obvious) and cannot be enforced | 637 |

| Not Infringed | The accused product or process does not violate the patent | 357 |

| Not Unenforceable | The patent remains enforceable; claims of misconduct (like fraud) did not succeed | 349 |

| Unenforceable | The patent cannot be enforced, often due to misconduct during the patent process | 14 |

| Add/Change Inventor | The court orders a correction to the listed inventors on the patent | 1 |

The distribution of determinations offers a window into judicial rigor, plaintiff risk and defense strategies in patent enforcement.

- Plaintiffs can gain confidence from the prevalence of Not invalid + Infringed outcomes, but should remain cautious: a vigorous defendant can drag the case into Invalid or Not infringed territory.

- Enforceability defenses are seldom successful but when pressed can carry outsized leverage in settlement negotiations.

- Defendants may increasingly lean early validity challenges (e.g. motions to dismiss or summary judgment) to avoid protracted infringement battles.

A deeper dive into 2025’s court rulings reveals fascinating shifts in damage theory and reversal trends. See which cases made the biggest waves in 2025.

This snapshot of determinations offers a static portrait of how courts resolve core issues. But the next question is more dynamic: Of those cases, how many reach final outcomes and what form do those outcomes take? Let’s now examine case outcomes to understand resolution paths and plaintiff success rates.

How Patent Litigation Cases Were Resolved in US Courts?

This table presents resolution outcomes for patent disputes filed in the US district courts and the Federal Circuit between 2020 and 2025.

| Case Outcome | Definition | Number of Litigation Cases |

| Settled / Voluntarily Dismissed | The parties agreed to end the case before a court decision. | 14236 |

| Patentee Won | The patent owner won the case. | 821 |

| Transferred | The case was moved to another court. | 813 |

| Patent Challenger Won | The party challenging the patent won the case. | 734 |

| Non-Merits Dismissal | The case was dismissed for reasons unrelated to the patent’s validity or infringement. | 471 |

| Pending | The case is still ongoing. | 220 |

| Mixed | Both sides won on some issues but lost on others. | 111 |

| Administrative Closure | The court closed the case for procedural reasons but not on the merits. | 4 |

| Severed | A case was split into separate cases. | 2 |

A striking 54.5% of total cases end by settlement or voluntary dismissal. This confirms that in contemporary patent enforcement, litigation is often a negotiation tool, not a path exclusively to trial.

In 821 cases, patentees won via adjudication (bench or jury). That’s roughly 3.1% of all filings suggesting that while trial victories are relatively rare, they are still material and strategic. Importantly, a patentee win likely implies both validity and infringement determinations shading in their favor.

Patent challengers prevail in ~2.8% of cases. These outcomes often reflect strong defences, e.g. invalidity, noninfringement, or enforceability arguments. In sum, while plaintiff-side convictions dominate the narrative, defense victories are not negligible.

Strategic Implications

- Plaintiffs rely heavily on the threat of litigation and settlement leverage rather than high trial conversion rates.

- For defendants, strong early motions (e.g. invalidity, §101 challenges, venue dismissal) are critical, given the small window to win fully post-discovery.

- The precedent that most cases settle limits the accumulation of judicial rulings on novel doctrines, making each court decision more impactful.

Are You Keeping Track of the Latest US Patent Litigation Cases?

The stakes are higher than ever in patent litigation this year. In first quarter, Fundamental Innovation Systems International LLC is battling Anker Innovations Ltd over key consumer electronics patents—$27.27 million at risk. But that’s just the beginning. In second quarter, VLSI Technology LLC is taking Intel Corporation to court over semiconductor patents, with an eye-popping $948.76 million at stake!

Want to see the same detailed insights for the US patent litigation cases in 2025? We’ve tracked each case, and the data could drastically shift your IP strategy. Don’t miss out on critical information that could shape your legal moves.

Fill out the form below to get access to exclusive information and stay ahead of the game!

Resolution is only part of the story. What happens after a determination or settlement? The next insight will dig into remedies awarded, such as damages, injunctive relief, royalties or licensing terms, to understand how courts translate wins into enforceable outcomes.

Which Remedies Do US Courts Award in Patent Litigation?

This table categorizes the remedies granted or sought across litigation outcomes from January 2020 through September 2025.

| Remedy | Definition | Number of Litigation Cases |

| Permanent Injunction | A permanent ban on using the patented invention. | 1358 |

| Preliminary Injunction | A temporary stop until the case is resolved. | 703 |

| Damages | Monetary compensation awarded for patent infringement. | 696 |

| TRO (Temporary Restraining Order) | A short-term emergency order stopping use of the patent until a hearing. | 601 |

| Costs | Litigation-related expenses awarded to one party. | 166 |

| Damages (Non-Patent) | Monetary awards for claims not directly tied to patents (e.g., contracts, torts). | 140 |

| Attorney Fees | Legal fees ordered to be paid by one side to the other. | 109 |

| Sanctions | Penalties imposed for misconduct in litigation. | 69 |

| Enhanced Damages | Extra damages (up to 3x) for intentional infringement. | 59 |

| Pre-judgment Interest | Interest on damages calculated from before the judgment. | 48 |

| Post-judgment Interest | Interest added to damages until payment is made after judgment. | 33 |

| Ongoing Royalty | Court-ordered payments for continued use of the patent after the case. | 9 |

Once a court rules in favor of a patent holder, either through judgment or settlement, the next pivotal question becomes: What remedy(s) follow? The distribution of injunctive relief, monetary damages, and related awards reveals how courts balance enforcement with equity.

- For litigants, the prevalence of permanent injunctions over damages suggests that injunctive relief remains the primary value lever, especially for high-stakes, head-to-head competition.

- The relatively high counts of preliminary injunctions and TROs indicate that speed and motion practice are front-loaded in litigation strategy.

- Because enhanced damages, attorney fees and interest are less frequently awarded, plaintiffs must present well-documented evidence of willfulness, litigation costs or delay to unlock those layers.

- The dearth of ongoing royalty awards could reflect courts’ hesitance to supervise long-term remedy frameworks or the preference of parties to negotiate licensing outside court.

Settlements are becoming more common than ever, but the underlying strategies are evolving. Explore the litigation trends that defined patent litigation in 2024.

With a clear view of remedy frequency, the next step is to examine how much is awarded when financial remedies or injunctive relief are granted. The following insight will analyze yearly totals and medians of awards (damages, royalties, etc.) from 2020 through 2025 to reveal temporal trends in compensation levels.

How Have Remedies and Financial Awards Shifted Over Time?

This table shows the aggregate amounts awarded in patent litigation across three key remedy categories on the basis of the remedy dates of the cases from January 2020 to September 2025.

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| Damages (in millions) | $1133.71 | $1500 | $1500 | $481.29 | $583 | $315.72 |

| Sanctions (in millions) | $0.36 | $20.03 | $1.13 | $0.77 | $5.23 | $0.32 |

| Attorney Fees (in millions) | $13.51 | $6.09 | $3.91 | $20.65 | $9.50 | $2.60 |

Do monetary awards in patent litigation reflect a stable winning premium or do they swing dramatically with legal and market dynamics? The year‑by‑year shifts in damages, sanctions and fees tell a deeper story about enforcement pressure and legal strategy.

- Damages: This volatility signals that large verdicts are episodic and likely driven by particular blockbuster cases or industry waves, not consistent baseline enforcement.

- Sanctions: This show a dramatic spike in 2021 ($20.03 million), likely reflecting a handful of high‑impact decisions involving misconduct or discovery abuse.

- Attorney fees: The 2023 figure stands out: $20.65 million in attorney fees, the highest in the period.

Strategic Implication: Sanctions and attorney fees are vastly more variable and contingent on misconduct or tactical arguments, litigants must document and litigate cost-shifting carefully.

Now that we’ve examined the amounts of monetary remedies, the next logical step is to look at where those outcomes are concentrated, i.e. which courts are most active in handling patent litigation. Let’s next map the most active judicial venues over 2020–2025 to see how forum dynamics shape enforcement.

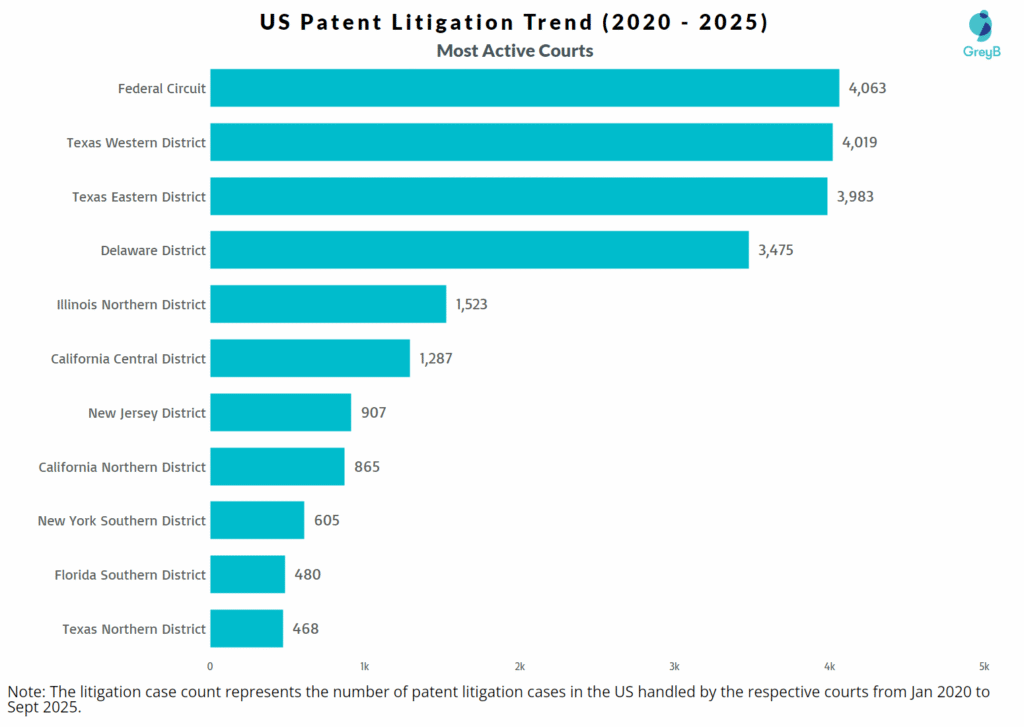

Which Are the Most Active Courts in US Patent Litigation?

This chart presents the top courts handling patent litigation cases in the US from 2020 to 2025.

The Federal Circuit unsurprisingly tops the list given its exclusive appellate jurisdiction over patent appeals. Its role is central in shaping claim construction, patent eligibility, damages law and more.

Texas Western District, Texas Eastern District and Delaware District Courts handle a large share of patent case flow, affirming how filing parties still cluster toward favorable or familiar jurisdictions despite pushback and reforms.

This concentration means judges in these venues accrue deep patent case experience, influencing doctrine development, claim construction norms, scheduling practices and local procedural preferences. Meanwhile, the rise of weighting in district choice may drive plaintiffs to experiment with less traditional venues, especially when seeking faster timelines or avoiding congested dockets.

Court volumes tell one side of the story but in patent litigation, which judge hears the case often matters more than the district name. With a few judges handling disproportionate volumes in top districts, they become power centers in the doctrinal ecosystem. Next, we will analyze the most active patent judges across US district courts and assess the concentration of influence in facing litigants.

Who are the Top Judges in Handling US Patent Litigation Cases?

This table lists the top 10 judges by number of patent cases handled between 2020 and 2025, along with their associated courts.

| Judge Name | Associated Court | Number of Cases Handled |

| Rodney Gilstrap | Texas Eastern District | 2994 |

| Alan D Albright | Texas Western District | 2877 |

| Roy S. Payne | Texas Eastern District | 1641 |

| Maryellen Noreika | Delaware District | 893 |

| Leonard P. Stark | Federal Circuit | 875 |

| Colm F. Connolly | Delaware District | 869 |

| Richard G. Andrews | Delaware District | 828 |

| Alan D. Lourie | Federal Circuit | 819 |

| Derek T. Gilliland | Texas Western District | 819 |

| Sharon Prost | Federal Circuit | 801 |

The concentration of case volume among a few judges amplifies their jurisprudential influence. Judge Rodney Gilstrap leads with 2,994 cases in the Eastern District of Texas, reinforcing the Eastern District’s status as a patent litigation stronghold. Gilstrap has long been viewed as the single busiest patent judge in the US.

Judge Alan D. Albright, with 2,877 cases in the Western District of Texas, is the second-most active judge. His docket growth in past years was driven in part by plaintiff preference for rapid schedules and favorable practices before him. Judge Roy S. Payne, also in the Eastern District, ranks third with 1,641 cases. Payne is well known for a high volume of Markman (claim construction) proceedings and for his integral role in Eastern Texas IP dockets.

The fact that nearly all these judges sit across Texas, Delaware or the Federal Circuit underscores the venue‑judge halo effect: filing in a favored district usually ensures exposure to an elite subset of judges with deep patent-law experience.

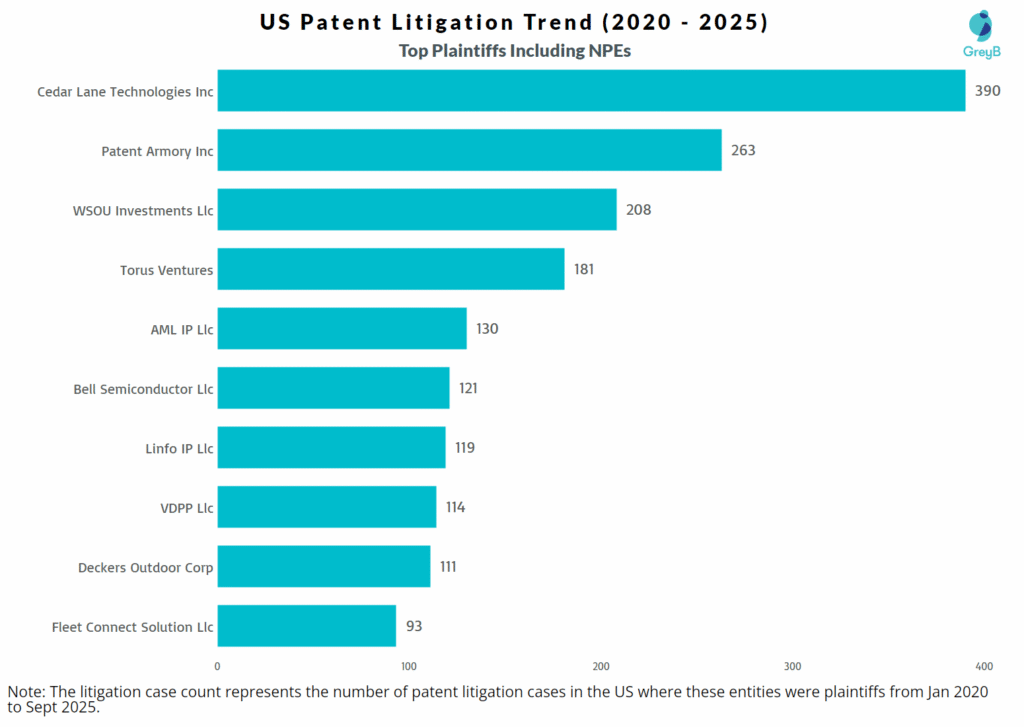

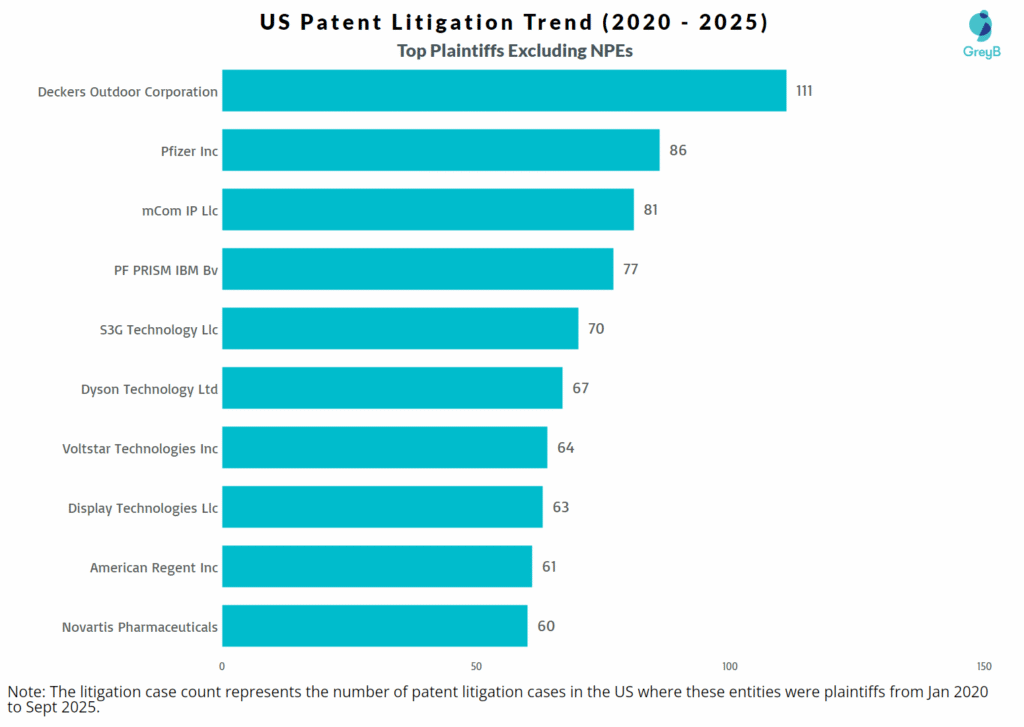

Now that we’ve seen which judges dominate the docket, the next insight shifts focus to the entities behind the enforcement: who are the top plaintiffs, both including and excluding NPEs? We’ll explore that in two subsequent charts: first capturing the full plaintiff landscape, then isolating NPEs.

Who Are the Top Plaintiffs in US Patent Litigation Race?

These charts capture the top plaintiffs in the US patent litigation cases from 2020 to 2025.

The heavy concentration of NPEs here top suggests an assertor economy: a few entities file many suits, pushing costs and risk onto defendants. These NPEs often target large defendant pools, multiple patents, and use a shotgun approach to build negotiating leverage.

NPEs continue to file a large chunk of cases, often with multi-patent strategies. We took a closer look at how NPE litigation has evolved in recent years

Operating companies tend to assert narrower, strategic cases, often where core product lines or brand value are threatened. Because NPEs often lack product stakes, their cost/benefit calculus tolerates more risk, whereas operating companies deploy litigation only when ROI is solid.

Defendants facing cases from top NPEs should expect aggressive posturing, early motions and settlement pressure. In operating company suits, defendants may push harder on technical and factual invalidity or non-infringement defences, given the plaintiff’s stronger incentive to protect value. When a plaintiff is an operating company, there may also be cross‑motions to keep the case in districts favorable to the defendant or to introduce counterclaims.

Access the Full List of Patents Acquired by NPEs in 2024

Fill out the form to submit your request for the data.

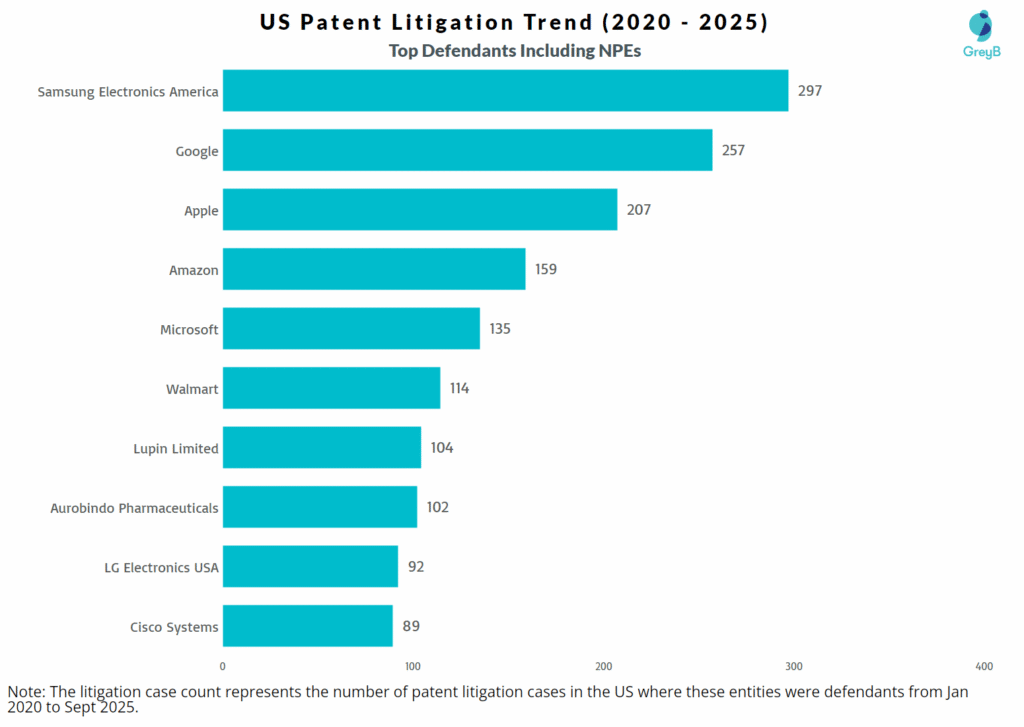

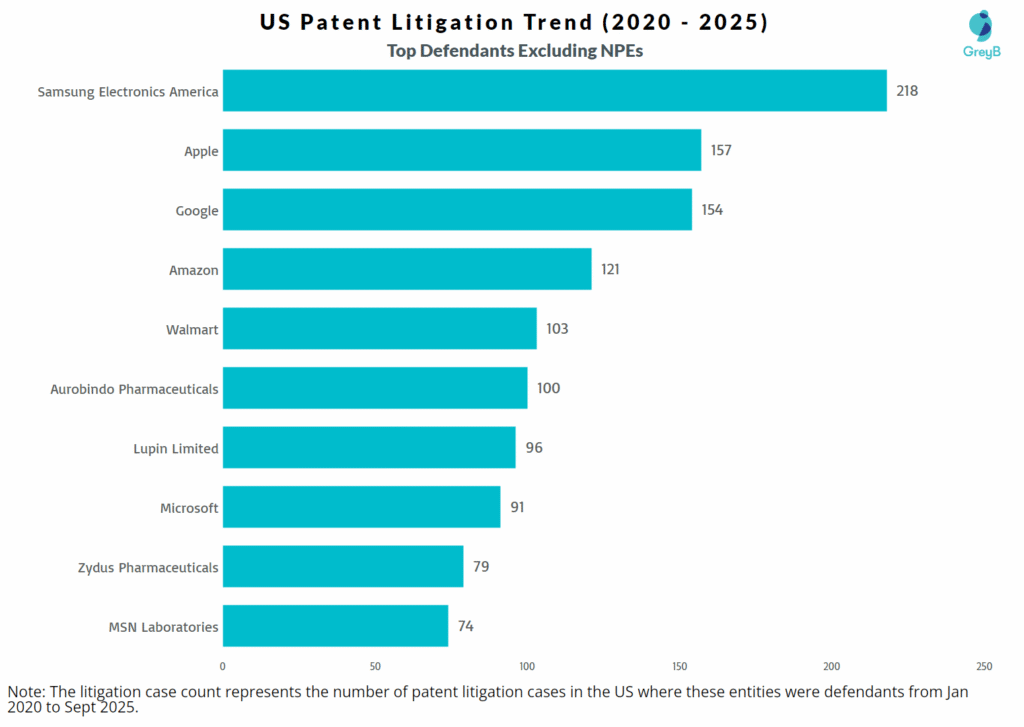

Now that we’ve identified who is bringing suits, the next question is against whom. Which entities or corporations are most frequently named as defendants: both broadly and after excluding NPEs? That comparison will reveal where enforcement pressure is concentrated in industry sectors and technology verticals.

Who Are the Top Defendants in US Patent Litigation Race?

These charts capture the top defendants in the US patent litigation cases from 2020 to 2025.

Examining defendants, both excluding and including NPE-driven litigation, reveals which industries bear the brunt of assertion pressure.

Defendants should tailor defense readiness: tech firms need broad portfolio defenses and proactive monitoring, while pharma firms need technical invalidity strategies, prior art diligence and regulatory linkage defenses.

Samsung remains the top target, regardless of NPE inclusion. This reflects Samsung’s scale in electronics, high patent density, global presence, and participation in overlapping value chains. The company’s frequent involvement in patent wars, especially with Apple, underscores this exposure.

Want to Explore Patent Litigation in Your Tech Domain?

Looking for in-depth insights on US patent litigation cases in your specific area of expertise? Fill out the form to gain access to comprehensive case details that could refine your legal strategy and give you a competitive edge!

Having mapped who sues and who is sued, the next logical front is who defends them. In patent litigation, law firms, especially specialized IP practices, play a pivotal role. The next insight will spotlight the top law firms in US patent litigation from 2020–2025, including their case counts and sector specialties.

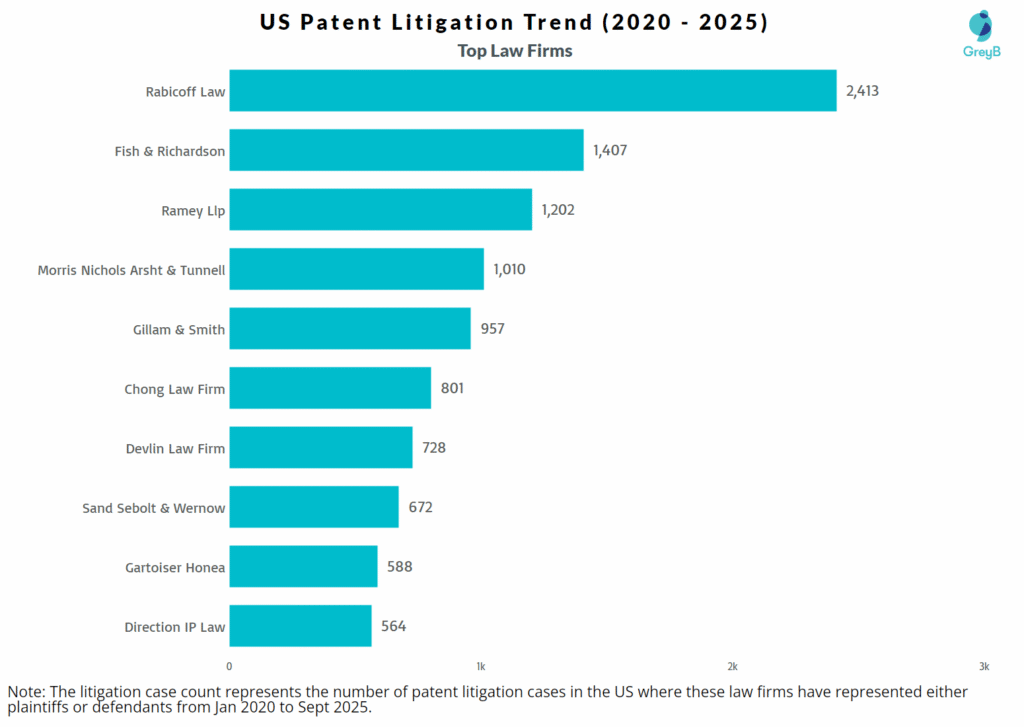

Which Are the Top Law Firms Dominating US Patent Litigation?

This charts presents the top 10 law firms by number of patent litigation cases handled from January 2020 through September 2025.

While plaintiffs bring the claims and defendants respond, the law firms that litigate those cases become the engine behind legal strategy, motion practice and doctrinal influence. Let’s see which firms have carried the heaviest load.

Rabicoff Law handled nearly twice as many patent matters as the next firm, making it a giant in patent litigation. Ramey LLP and Morris, Nichols, Arsht & Tunnell also show strong presence, likely through Delaware dockets and corporate-oriented litigation. Gillam & Smith is known for operating in high-volume patent assertion practices, especially in Texas.

While firms shape strategy, the attorneys themselves often carry the case. Meet the top patent attorneys who led the most IP battles in 2024.

Firms play the structural role, but individual attorneys execute the arguments, strategies and courtroom presence. The next insight will shift focus to the top patent attorneys who have handled the most US patent litigation cases from 2020 to 2025.

Who Are the Most Active Patent Attorneys in US Litigation?

This table lists the top 10 patent attorneys in the US based on the number of patent litigation cases they handled.

| Patent Attorney | Associated Law Firm | Number of Patent Litigation Cases Handled |

| Isaac Rabicoff | Rabicoff Law | 2413 |

| William P Ramey III | Ramey Llp | 1189 |

| Melissa R Smith | Gillam & Smith | 935 |

| Neil J McNabnay | Fish & Richardson | 848 |

| Jimmy Chong | Chong Law Firm | 801 |

| Jack B Blumenfeld | Morris Nicols Arsht & Tunnell | 636 |

| David R Bennett | Direction IP Law | 555 |

| Randall T Garteiser | Garteiser Honea | 525 |

| M Scott Fuller | Garteiser Honea | 503 |

| Timothy Devlin | Devlin Law Firm Llc | 500 |

In high-stakes patent battles, the name on the docket often carries as much weight as the plaintiff or defendant because seasoned attorneys bring procedural acumen, doctrinal foresight and courtroom reputation.

Strategic Implications:

- Attorneys with thick litigation resumes often develop playbooks, citation networks and reputational weight that can influence settlement leverage, opposing counsel strategy and judge expectations.

- Their presence in a case can signal to defendants that the matter is not trivial but is likely to be handled with full-scale procedural rigor.

- For clients, selecting an attorney with high exposure may increase predictability in process, but also may carry cost implications for reputation, demand and fee structures.

Need Specific Insights or a Custom Analysis?

If you’re exploring a particular tech domain, need data on a specific company, or want a deeper analysis of litigation trends tailored to your business — we’ve got you covered.

Fill out the form below to request additional data or a custom analysis on US patent litigation cases. Whether you’re tracking competitors, evaluating risk or building strategy, we will help you get the answers you need.