Imagine spending years developing a product, filing patents, responding to examiners, and finally protecting your invention – only to lose it because a renewal fee wasn’t paid or a deadline slipped through the cracks.

That’s exactly what happened inside Teva Pharmaceutical’s U.S. patent portfolio.

A Closer Look at Teva Pharma: How Are Patents Being Lost?

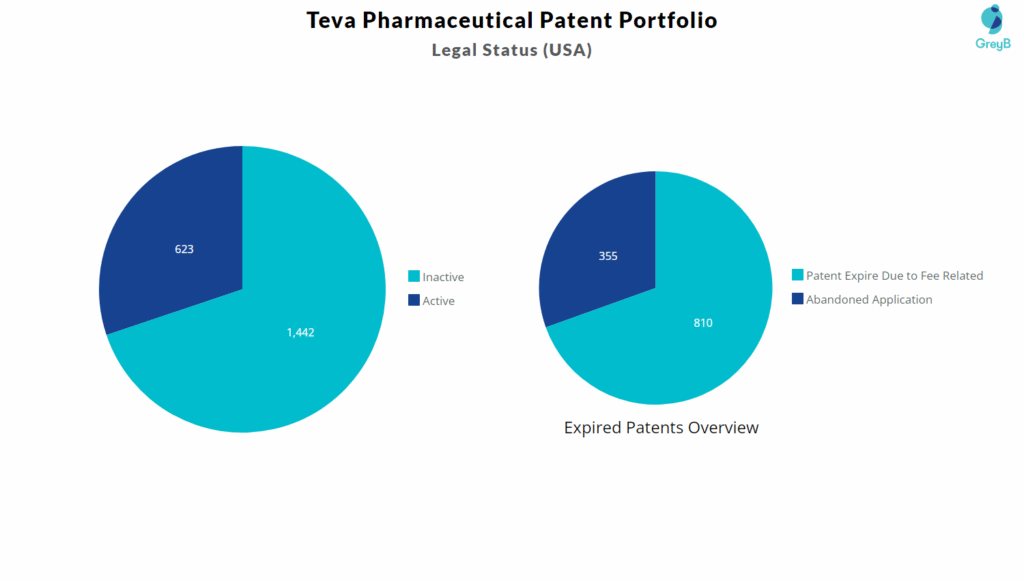

A closer look at Teva Pharmaceutical’s U.S. patent portfolio-which includes 2,065 patents and applications-shows that 1,165 assets were lost over time due to missed deadlines, unpaid maintenance fees, untracked Office Actions, and unpaid Issue Fees.

We understand that some patents may have been intentionally allowed to lapse because they were no longer essential or strategically relevant. This is normal for large portfolios. However, the sheer volume of expired and abandoned filings suggests that many of these losses were likely unplanned and carry real financial and strategic impact.

Even when expected, unintentional attrition represents a substantial loss of investment – especially when viewed alongside the 810 abandoned applications that were dropped during prosecution. Every single filing took drafting time, attorney involvement, and R&D effort before eventually being lost.

There are also 355 patents that expired solely because maintenance fees were not paid. These are assets that once had enforceable protection but slipped out of the portfolio simply due to missed administrative steps-something that could have been avoided with timely tracking and reminders.

To understand this shift visually, here’s a breakdown of active vs. inactive patent assets across the U.S portfolio.

See How much Teva patents are alive, expired, and where the action is – from country trends to law firms. Click here to explore the full portfolio.

Orange Book Patent Expires – The Case of Azilect (Rasagiline)

Among the 1,165 expired and abandoned patents in Teva’s U.S. portfolio, one particularly notable loss is an Orange Book-listed patent for Azilect (rasagiline), a drug used in the treatment of Parkinson’s disease.

The expiration of this patent carries real market implications. In 2024, Azilect generated $240 million in U.S. sales. With the patent now expired, the drug is theoretically open to generic competition. However, as of now, no ANDA (Abbreviated New Drug Application) has been filed for a generic version, meaning Teva continues to retain market exclusivity for the moment.

Keep track of every patent move and monitor competitor activity in real-time. Click here for full insights:

Teva Pharma: Calculating the Cost of Lost Patents

Before a patent even reaches the stage where maintenance fees come into play, a company has already invested a significant amount of time, effort, and money. Every patent in Teva’s portfolio represents years of research, careful drafting, attorney involvement, and multiple rounds of back-and-forth with the USPTO.

What Does It Really Cost to Secure a U.S. Patent?

Based on USPTO guidance, here’s a realistic breakdown of the investment required to take a patent from filing to grant:

1. Filing Costs (Application Stage)

- USPTO filing, search, and examination fees: $1,200-$2,200

- Attorney drafting and preparation: $8,000-$18,000

- Typical total filing cost: $10,000-$20,000

2. Prosecution Costs (Office Action Stage)

- Responding to Office Actions: $1,500-$3,000 per response

- Most applications face 2-3 Office Actions: $3,000-$9,000

- Additional amendments, IDS filings, and attorney communication: $2,000-$5,000

- Typical total prosecution cost: $5,000-$15,000

Estimated Total Investment Before Grant: $15,000-$35,000 per patent/application

For Teva, this is the actual investment tied up in every patent that eventually expired or was abandoned.

| Category | Category | Estimated Cost | Total Estimated Cost |

| Expired – Maintenance Fees Not Paid | 355 Patents | $15,000 – $35,000 | $5.33M – $12.43M |

| Abandoned – OA Not Answered / Issue Fee Not Paid | 810 Applications | $15,000 – $35,000 | $12.15M – $28.35M |

| Total Avoidable Losses | 1,165 Assets | – | $17.48M – $40.78M |

Interested in knowing about Teva Pharmaceutical Drug Patents Expiring in the next 10 years?

Avoidable Patent Rejections: A Hidden Loss in Teva’s Portfolio

Beyond abandoned and expired assets, another avoidable loss surfaced: 17% of Teva’s rejected applications were denied due to prior art-meaning similar inventions already existed.

These filings had a low chance of approval from the start, yet full drafting, attorney time, and prosecution costs were still invested. This not only resulted in rejection but also in avoidable financial waste, highlighting a gap in early novelty checks and competitive analysis.

Teva Pharma: Litigation Trends and Where the Pressure Is Building

From 2020 to 2025, Teva has been involved in 65 patent litigation cases globally. What stands out is how uneven the distribution is.

Out of these cases:

- 58 took place in the United States

- 4 in Europe

- 1 each in Mexico, Canada, and Spain

This pattern makes one thing clear:

- The U.S. is Teva’s biggest and toughest patent battleground, where competition is intense and pharmaceutical lawsuits are more aggressive compared to most other regions.

Below are the top 5 patents that have seen the most courtroom action.

| Publication Number | Litigation Count |

| US8445524B2 | 31 |

| US8791270B2 | 27 |

| US8436190B2 | 23 |

| US8609863B2 | 15 |

| US9155775B1 | 14 |

These repeated lawsuits indicate that these patents protect products with either strong revenue, strategic value, or high competition.

Products Facing the Most Legal Pressure

Despite the challenges,Teva continues to defend key products that remain commercially strong:

| Product | API | Revenue(US$) |

| Bendeka | Bendamustine HCL | $241M (2023) |

| Copaxone | Glatiramer Acetate | $244M (2024) |

| QVAR | Beclomethasone Dipropionate | $244M (2024) |

What if you could track every critical move in your patent portfolio – instantly?

With our 50+ country Patent Monitoring Tool, you can monitor renewals, alerts, litigation, office actions, and prosecution activity in real time. Stop losing valuable patents and millions of dollars.

Start making proactive, data-driven IP decisions today.

Request a Demo and Protect Your Portfolio Effortlessly.