In October 2022, India flipped the switch on a telecommunications revolution. What began as the next step in mobile connectivity: 5G, quickly transformed into one of the fastest technology rollouts in the world. Within three years, the nation logged over 365 million 5G subscribers, underscoring both consumer demand and infrastructure scale-up across urban and rural landscapes alike.

By late 2025, India’s 5G footprint extended to virtually every district across the country, a milestone achieved without legacy public sector deployments, a testament to private and policy-led momentum in digital expansion. Yet, beneath the headlines of coverage statistics and subscriber growth sits a deeper narrative: the intellectual property that powers this connectivity.

Across the globe, 5G Standard Essential Patents (SEPs) have defined who leads and who merely follows, in next-generation innovation. With tens of thousands of declared 5G patents worldwide and growing annual patents, SEPs are not only technical artifacts of the 3GPP and ETSI standards but also strategic assets in licensing, implementation and competitive differentiation.

As India transitions from rapid adoption to value creation and technological sovereignty, the role of patents, particularly those declared essential, shapes how innovators compete, collaborate and negotiate in a global market.

This article leverages an India-focused ETSI-declared 5G patent dataset (2015–2025) to unpack the patterns, players and strategic shifts that define India’s position in the SEP ecosystem.

Note: For this analysis, we have considered only those patent families where at least one family member is an Indian patent (i.e., the family includes an Indian filing), ensuring that the insights reflect patent activity relevant to India’s innovation and SEP landscape.

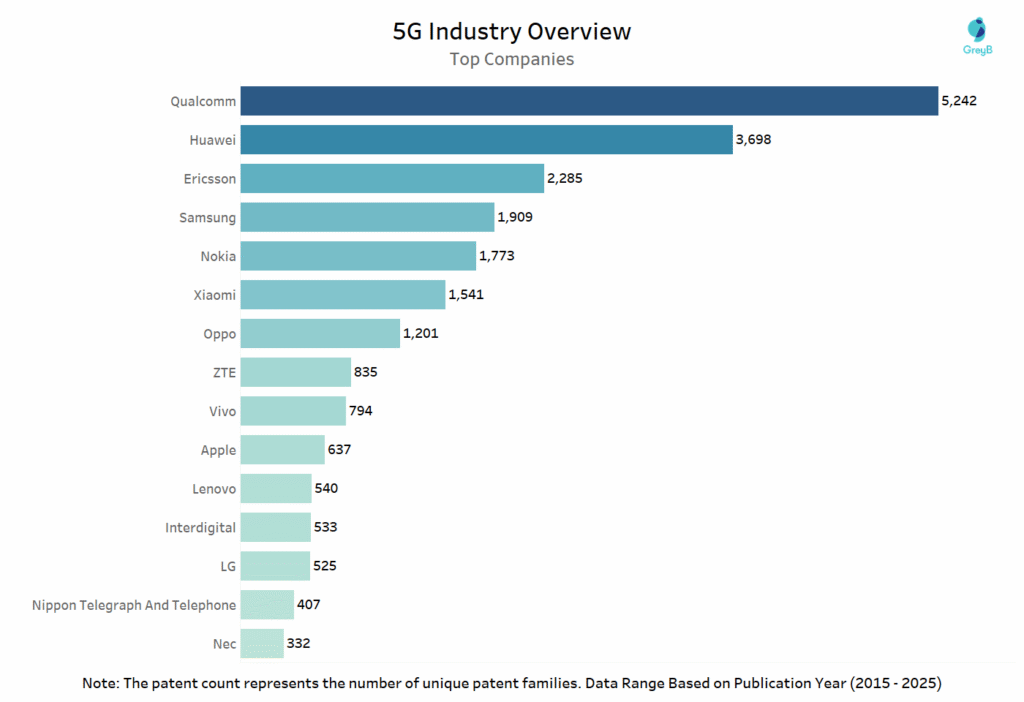

Which Are the Key Companies With the Most 5G Standard Essential Patents?

The chart displays the top global companies ranked by the number of unique ETSI‑declared 5G patent families where at least one member is an Indian Patent. These declarations reflect firms’ contributions to 5G standards, an important indicator of technology leadership and future licensing relevance.

In the fiercely competitive 5G SEP landscape, a small cohort of companies holds the vast majority of declared patents, underlining concentrated innovation leadership in telecom standards. According to recent analyses of ETSI‑declared patent data, the number of 5G patent families has surged rapidly in recent years, with declared 5G granted patent families growing from around 25,000 in 2021 to well over 57,000 by 2024, a testament to accelerating investment in 5G technology.

At the forefront, Qualcomm’s leading position reflects its historic strength in cellular technologies and chipset design, which form the backbone of 5G implementations. The company’s large portfolio suggests deep involvement in core air‑interface standards and interoperability essentials. Huawei and Ericsson, occupying the next ranks, illustrate how both Chinese and European players also command extensive declared patent portfolios, with Huawei’s R&D scale and Ericsson’s infrastructure focus driving high SEP counts.

Industry observers caution that raw ETSI declaration counts do not equate perfectly to essentiality, as not all declared patents are truly essential to the final 5G standard. Nevertheless, these figures remain a key barometer for SEP strategy, licensing negotiations and competitive positioning.

This concentration of declared 5G SEPs among a few global players signals where technological leverage and licensing power currently reside, setting a benchmark against which emerging ecosystems, including India’s growing 5G patent activity, will be compared.

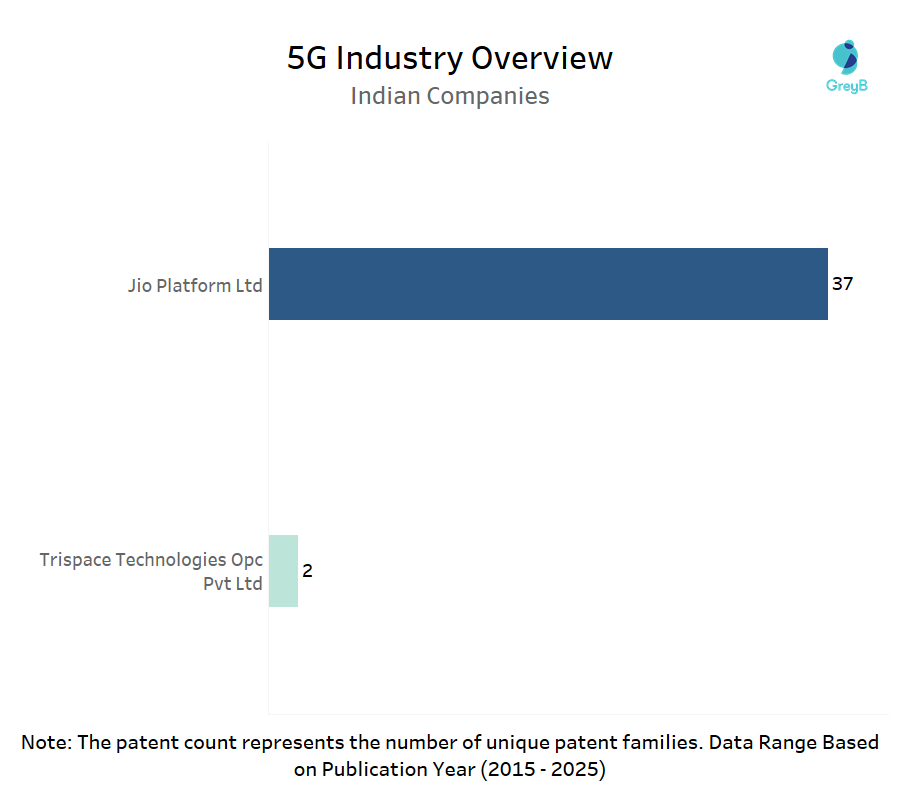

How Active Are Indian Companies in the ETSI‑Declared 5G SEPs?

This chart presents the Indian companies with ETSI‑declared 5G patent families published between 2015 and 2025. The metric reflects how many unique patent families each entity has declared as essential to 5G standards in ETSI, offering a snapshot of India’s participation in the global SEP ecosystem.

The Indian SEP landscape for 5G remains emergent and highly concentrated, with Jio Platforms Ltd far outpacing other domestic players. With 37 ETSI‑declared patent families, Jio’s portfolio signals a deliberate shift from network deployment to standards‑level innovation, a noteworthy trajectory for a market historically characterized by adoption rather than creation of telecom standards.

By comparison, Trispace Technologies OPC Ltd appears with just 2 declared families, highlighting the nascent stage of India’s broader corporate engagement with SEP filings. This contrast reflects a global pattern where a small number of firms dominate SEP ownership but also underscores India’s early steps toward participation in 5G innovation beyond service provisioning.

Industry context reinforces this observation: India’s telecom incumbents have traditionally been licensees of global SEP holders rather than originators of declared essential patents. Even as 5G deployment scaled rapidly in India, most infrastructure and chipset innovation came from foreign entities like Qualcomm, Huawei and Ericsson.

Jio’s position, therefore, marks a strategic inflection point for India’s IP ecosystem. Jio Platforms has publicly signaled ambitions to deepen technology development including 5G software, cloud services and potentially next‑generation standards engagement which may now be reflected in increasing patent activity. In November 2023, Jio announced trial partnerships exploring Open RAN and cloud‑native 5G solutions, signaling a push toward more modular, software‑centric network innovation where patentable inventions are abundant.

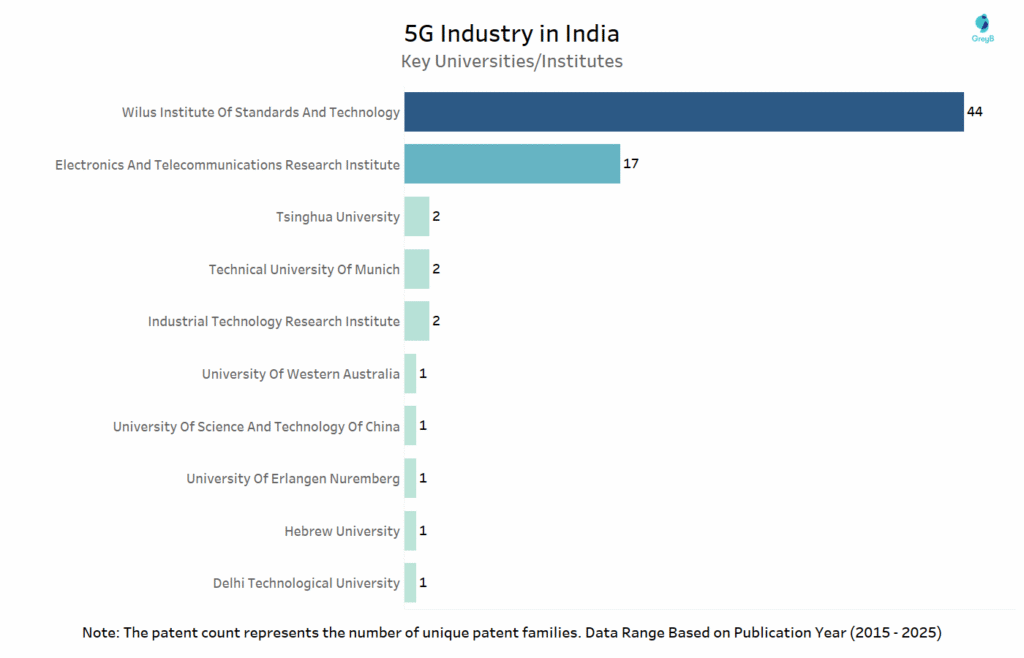

Which Universities & Research Institutions Drive India’s 5G Patent Activity?

This chart lists key universities and research institutes worldwide with patent families declared as ETSI‑essential for 5G, where at least one family member is an Indian patent, between 2015 and 2025, focusing on where foundational research contributions originate.

This chart highlights where critical foundational research for standards often originates and suggests that bolstering research‑industry linkages could accelerate the translation of academic innovation into SEP contributions.

WILUS Institute of Standards and Technology, a Korea‑based entity with 44 declared 5G patent families, stands out as an example of how standards and research institutes often bridge the gap between academic research and industrial application.

The Electronics and Telecommunications Research Institute (ETRI), another research heavyweight with 17 families, exemplifies how government‑aligned institutions contribute to core telecommunications innovations. ETRI’s role in early 5G research particularly in areas such as spectrum management, MIMO technologies and protocol optimization has been documented as part of South Korea’s coordinated national strategy for next‑gen networks.

Notably, Delhi Technological University (DTU) appears with 1 family, offering a signal (even if nascent) that Indian academia is beginning to touch the edges of SEP‑relevant research.

Given India’s growing emphasis on collaborative R&D under initiatives like the National Institute of Technology (NIT) centers of excellence for telecom research and the Telecom Standards Development Society of India (TSDSI), there is fertile ground for academic research to transition into SEP‑relevant domains.

Who Are the Key Inventors Behind 5G SEP Innovation?

This chart highlights top inventors associated with ETSI‑declared 5G patent families from 2015 to 2025, when at least one family member is an Indian patent.

The inventor landscape in 5G indicates global expertise concentrated in a few prolific individuals, primarily associated with major SEP holders, rather than a broad base of individual contributors from Indian entities.

Across multiple patent holders including Samsung and niche contributors (e.g., Belden Canada, Tempest Optics), the chart shows that collaboration crosses organisational boundaries but still centers on a handful of high‑impact inventors. This mirrors broader SEP trends where a small fraction of inventors account for a disproportionate share of standard‑relevant innovations due to deep specialization in wireless protocols, spectrum management and physical layer optimization.

For the Indian context, the absence of Indian names among top inventors suggests that while India is increasingly a market for 5G adoption and deployment, it is not yet a primary source of individual innovators driving SEP creation.

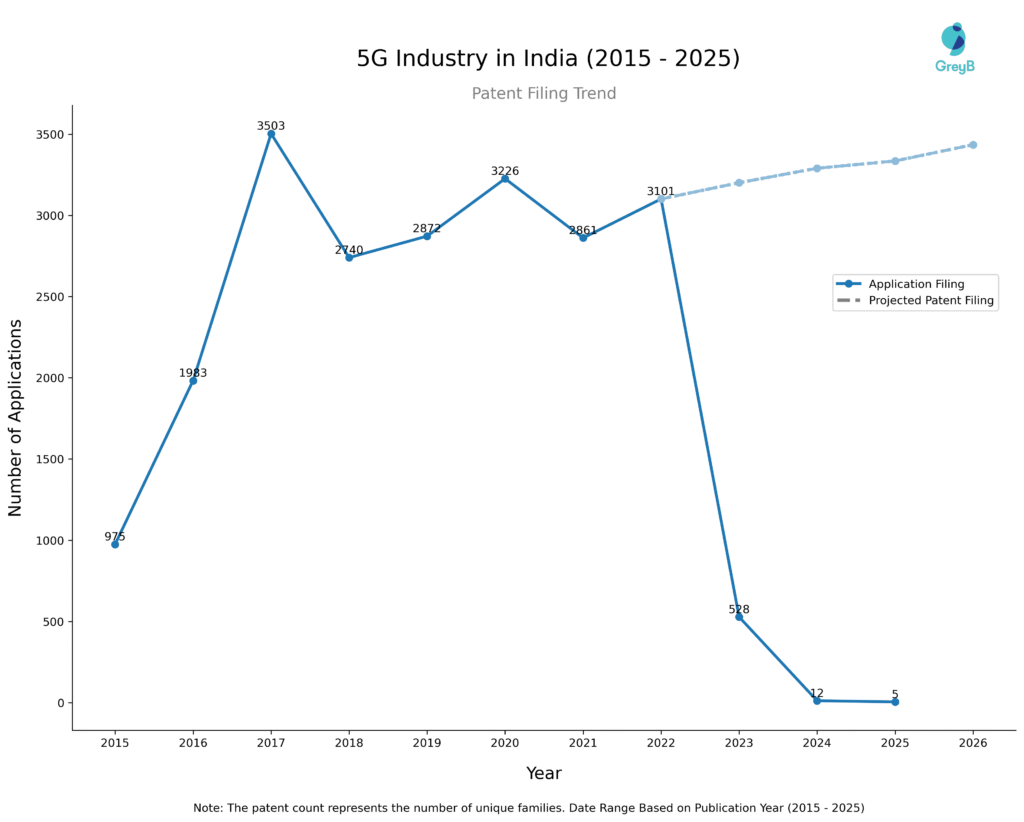

How Has 5G Patent Filing Activity Evolved?

This line chart tracks the trend in unique patent families related to 5G technology, where at least one of the family member is an Indian patent, based on the publication year from 2015 to 2025.

The 5G patent filing trend reflects accelerated activity followed by artifacts of publication timing, a pattern seen globally in SEP datasets. Between 2015 and 2017, filings surged sharply rising from 975 to 3,503 published families indicating intensified R&D investment as global 5G standards matured through 3GPP Releases 15 and 16.

From 2018 to 2022, filings fluctuate between ~2,700 and 3,200 families per year, suggesting sustained innovation but a leveling off as key technical elements of 5G solidified. This trend aligns with broader patterns in emerging SEP domains where initial growth plateaus once core standards stabilize and players pivot to specific enhancements or adjacent use cases.

The precipitous drop in 2023–2025 published filings (e.g., 528 in 2023; 12 in 2024; 5 in 2025) is not indicative of diminished R&D activity per se. Rather, this reflects publication delays inherent in patent systems, especially since patent publications typically occur 18 months after patent filing. As such, many applications filed in recent years remain confidential or unexamined, and only a small fraction has been published to date.

The projected filing curve offers a more realistic view of underlying activity suggesting a gradual increase through 2026. This aligns with India’s Viksit Bharat objectives envisioning India as a frontline contributor in the design, development, and deployment of 6G technology by 2030.

How Has Declaration Trend For 5G SEPs Changed Over Time?

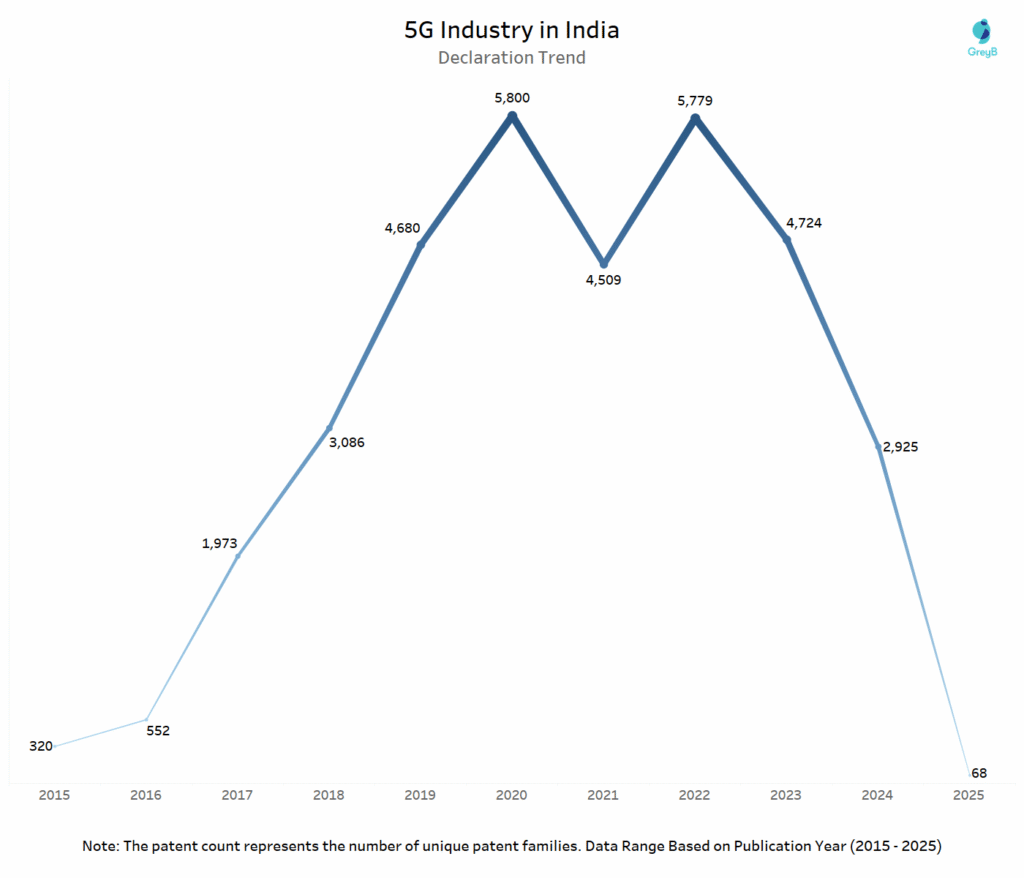

This line chart shows the annual trend in ETSI-declared 5G patent families (with at least one Indian filing) from 2015 to 2025.

The declaration trend mirrors global 5G standardization cycles, with spikes aligning closely with 3GPP Release milestones. The first peak in 2020 corresponds to the finalization of Release 15, which introduced the 5G New Radio (NR) standard, a major technical leap requiring dense SEP coverage. The second peak around 2022 aligns with Release 17, covering enhanced machine-type communications and non-terrestrial networks.

These declaration surges are consistent with ETSI’s reporting patterns, where SEP owners declare their patents once a technical specification matures even if the patent itself was filed years earlier. The subsequent decline in 2024–2025 is expected and not alarming; many recently filed patents are still unpublished due to the 18–24 month publication delay.

What’s most strategic here is not just how many patents are being declared but who is declaring them and how their contribution evolved over the decade. Did Qualcomm continue to dominate declarations? Did Xiaomi or Apple expand their SEP footprint?

How is the Declaration Pattern for Companies Evolved Over the Years?

How Are 5G SEP Players Collaborating or Licensing in India?

Which Are the Key Technology Areas Dominating in 5G SEPs?

The blurred chart tells a story most dashboards miss.

Top SEP holders don’t just file patents — they time, target and declare with intent. But beyond who filed when, the real value lies in where they filed, what they filed for and with whom.

We’ve analyzed 5G SEP patent families, where at least one member is an Indian patent, across three hidden layers of insight:

- Declaration Heatmap: Who peaked during 3GPP Release 15 & 17? Who faded and who stayed consistent?

- Key Technology Domains: See which tech areas: RAN, mmWave, massive MIMO, slicing etc. are driving India-centric SEP activity.

- Collaboration & Licensing Signals: Find out where companies are co-developing, cross-licensing or signaling future partnerships through patent filings.

The answers are just one step away. Fill out the form below to unlock all blurred charts or request a customized analysis tailored to your R&D, licensing or IP strategy.