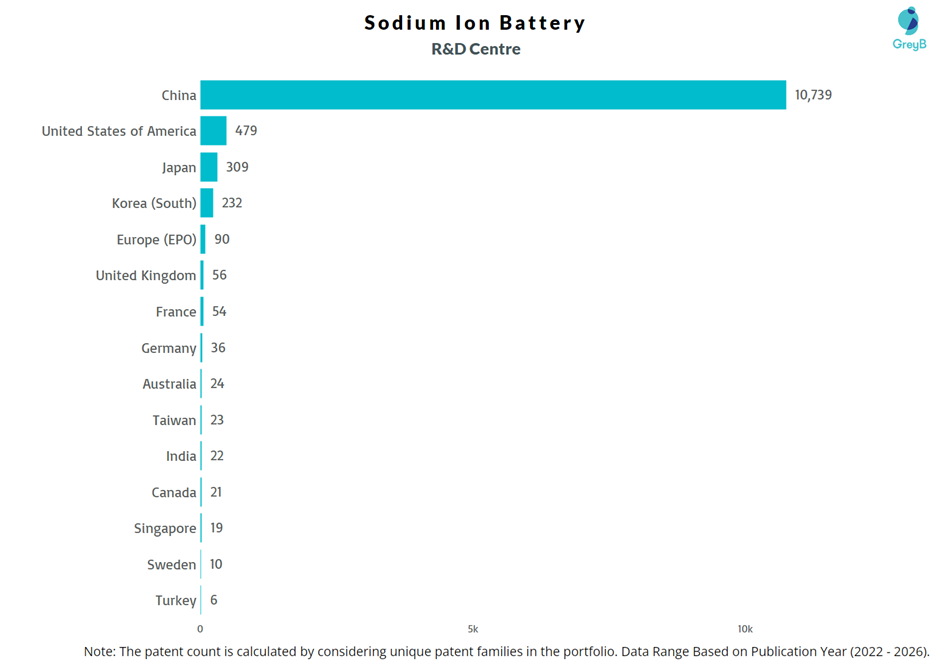

An analysis of patent activity since January 1, 2022 shows that more than 14,000 sodium-ion battery patents have been published worldwide in the last five years. Most of this activity is concentrated in China, with over 10,000 publications, followed by the United States and Japan. Among companies, CATL stands out as the leading filer, highlighting its strong focus on bringing sodium-ion technology closer to commercial use.

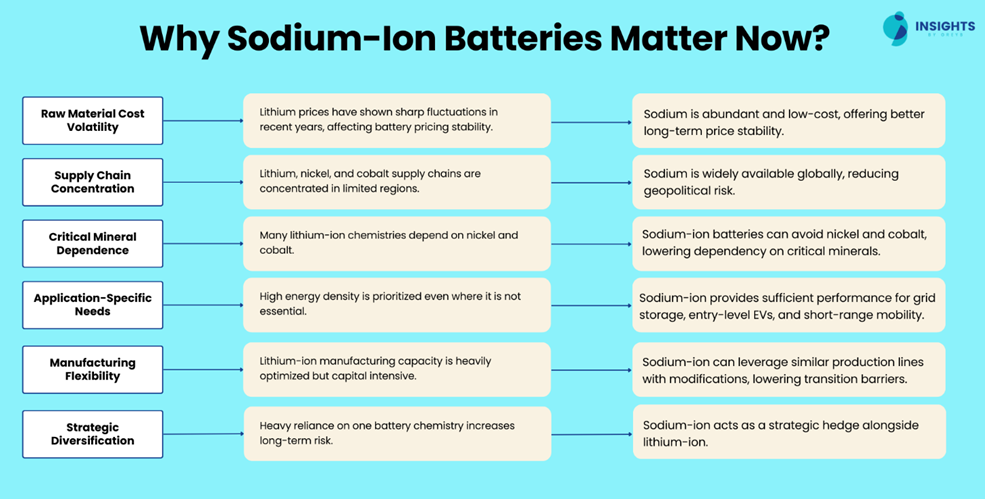

Why Sodium-Ion Batteries Matter Now?

Lithium-ion batteries dominate the market today, but they are not perfect for every use case. Their cost depends heavily on lithium and other critical minerals, whose prices have fluctuated sharply in recent years. At the same time, supply chains remain concentrated in a few regions, creating long-term security concerns.

Sodium-ion batteries offer a different value proposition. Sodium is abundant and inexpensive, and the technology does not rely on nickel or cobalt. While sodium-ion batteries do not yet match lithium-ion in energy density, they can deliver sufficient performance for grid storage, entry-level electric vehicles, and short-range mobility where cost, safety, and supply stability matter more than maximum range.

In this context, sodium-ion is not replacing lithium. It is filling the economic and strategic gaps that lithium-ion cannot efficiently serve.

What are the industry challenges of Sodium-Ion Battery?

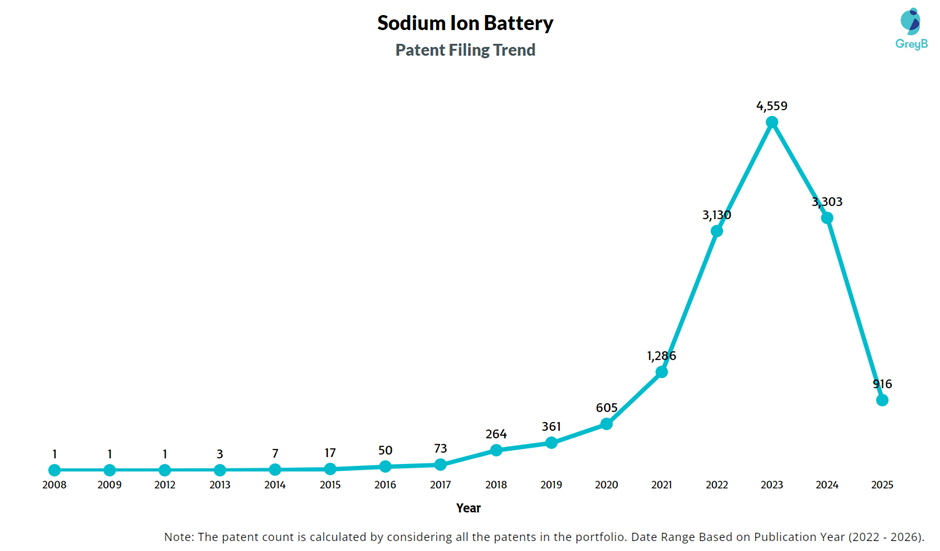

How has been Sodium-Ion Batteries patent filing has changed over the year?

Are you wondering why there is a drop in patent filing for the last two years? It is because a patent application can take up to 18 months to get published. Certainly, it doesn’t suggest a decrease in the patent filing.

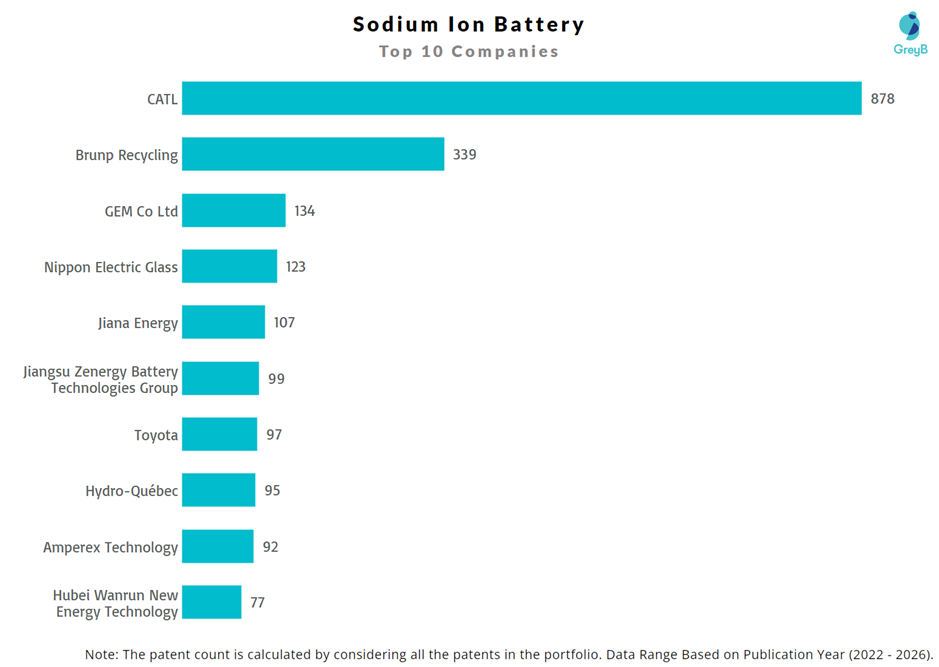

Which companies targeting their market in Sodium-Ion Batteries?

The increase in sodium-ion patent filings is now being reflected in real manufacturing plans. CATL, the leading filer in this space, has already introduced its first-generation sodium-ion battery and is working toward scaled production. The company is positioning sodium-ion cells for entry-level electric vehicles and energy storage systems, showing that its patent strength is backed by real commercial intent.

Other players are also moving forward. HiNa Battery has announced sodium-ion production lines, while companies like Toyota are exploring sodium-based chemistries as part of broader battery strategies. These developments suggest that sodium-ion technology is shifting from research to early commercialization. The connection between rising patent activity and manufacturing announcements indicates that sodium-ion batteries are no longer just an alternative idea they are gradually becoming part of the industry’s practical roadmap.

Get our complete Battery Industry Outlook covering?

Comparative chemistry analysis (Lithium-ion vs Sodium-ion vs Solid-state), Patent leadership by company & region, Cost-per-kWh projections through 2035, manufacturing capacity expansion roadmap, emerging white-space innovation opportunities, Scenario analysis: What happens if lithium prices crash?

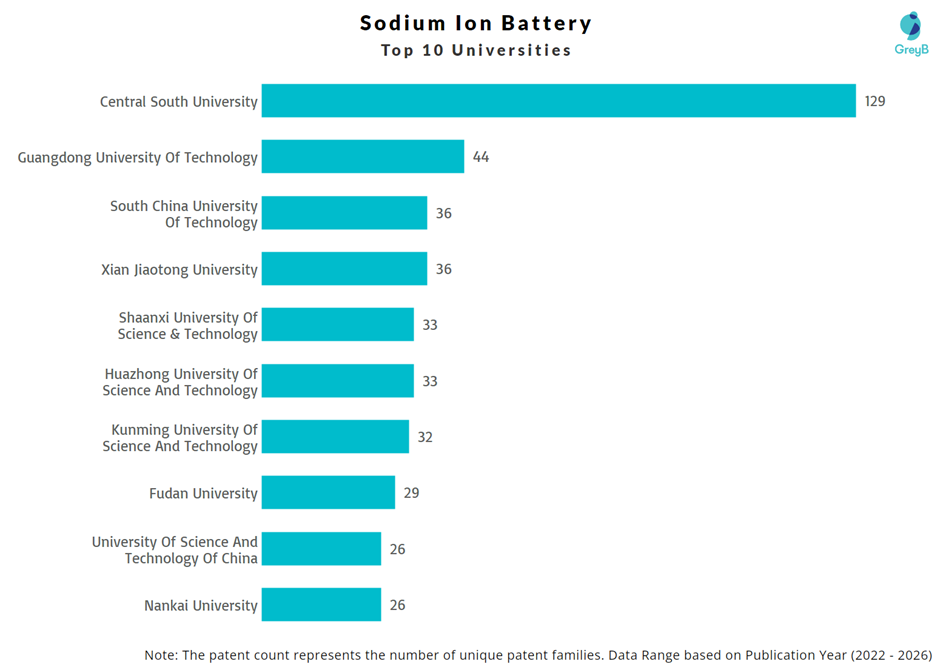

Where are the research centre located of Sodium-Ion Batteries patent innovation?

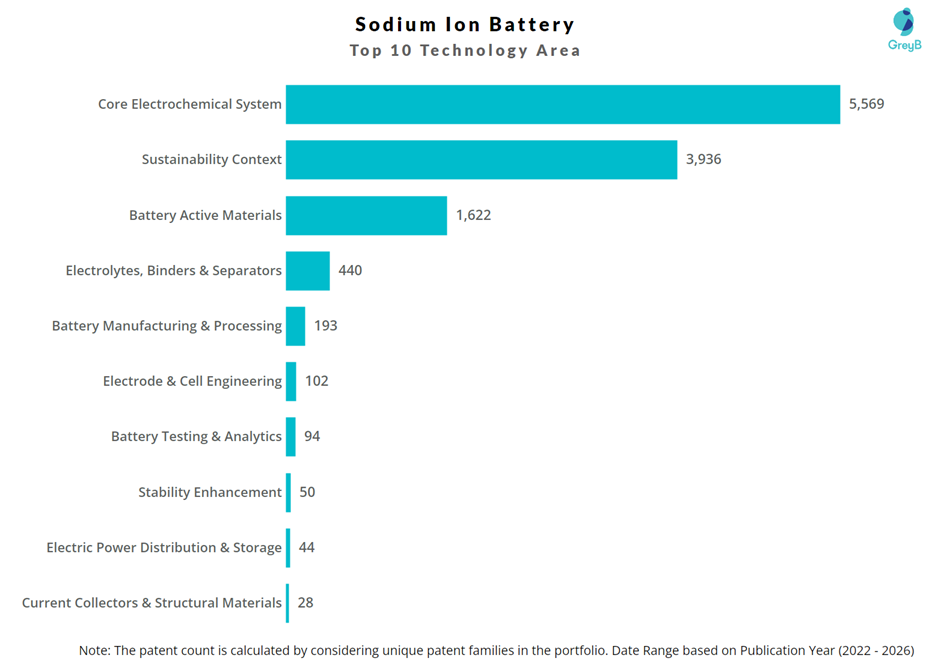

What technologies were covered under Sodium-Ion Batteries patent innovation?

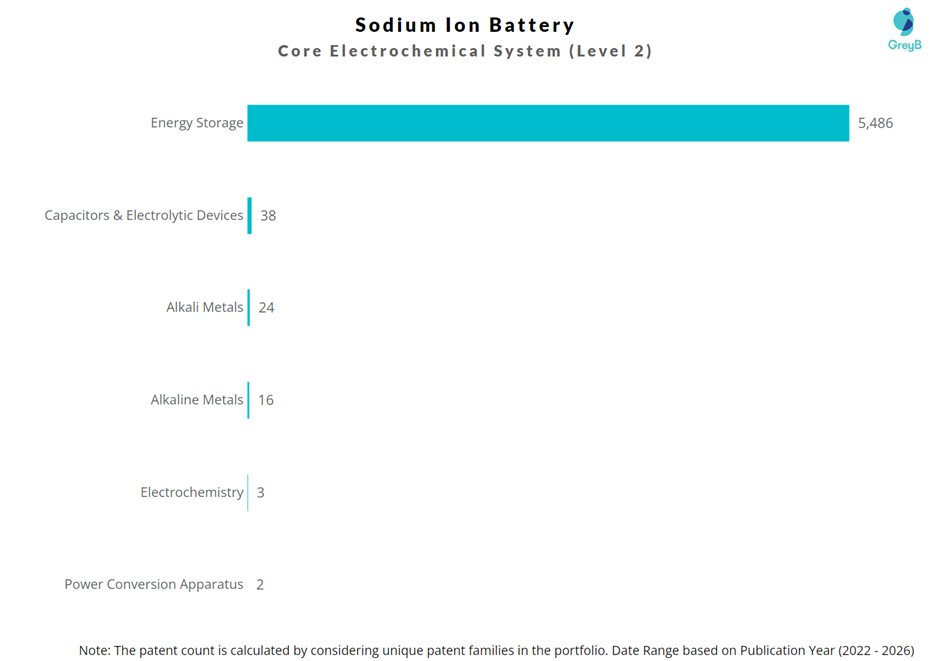

The technology breakdown shows that sodium-ion innovation is heavily focused on the core chemistry. The largest share of patent families 5,569 falls under the Core Electrochemical System category. This indicates that companies are still working on improving the fundamental battery design, including how sodium ions move within the cell and how the overall system performs.

The patent CN113921809A which relates to core electrochemical system design for energy storage, is among the most cited filings within the portfolio. This citation activity suggests that foundational cell architecture remains a central competitive focus for companies seeking technological advantage.

Another one of the most cited patents US11444338B1 in the sodium-ion battery portfolio relates to a cooling-type dry powder fire extinguishing agent designed specifically for battery fire suppression. The invention describes a method for preparing a fire-extinguishing powder that combines aqueous solutions with hydrophobic solid materials to rapidly cool and control battery fires.

The key problem it addresses is thermal runaway a major safety risk in battery systems where conventional extinguishing agents may not effectively reduce internal cell temperature. By enabling faster cooling and improved fire control, this patent highlights the growing importance of safety solutions alongside electrochemical performance in the competitive battery landscape.

The second-largest area, with 3,936 patent families, is linked to sustainability context, reinforcing the idea that sodium-ion batteries are being developed as a resource-secure and cost-stable alternative. Meanwhile, battery active materials (1,622 families) represent another major focus area, suggesting ongoing efforts to improve cathodes and anodes to enhance performance and lifespan.

In comparison, areas such as manufacturing, testing, stability enhancement, and structural components show significantly lower patent activity. This suggests that the industry is still prioritizing chemistry optimization before fully scaling system-level improvements.

Sodium-Ion Batteries Core Electrochemical System (Level 2)

Overall, the data suggests that sodium-ion innovation is currently material-driven. Companies are prioritizing core chemistry improvements before aggressively expanding into downstream system-level optimization.

Accelerate Your Battery R&D Market Opportunity with Slate R&D

Explore battery industry & market opportunity

Navigating the complex landscape of battery technology innovation requires cutting-edge research tools. Slate empowers R&D professionals with AI-driven agents that streamline technical intelligence gathering, patent analysis, and competitive benchmarking.

Sodium-Ion Batteries: What Track One Filings Reveal About Strategic Urgency in the U.S.

Out of more than 800 sodium-ion battery patent applications filed in the United States, 96 applications have been submitted under the Track One prioritized examination program of the USPTO.

This means roughly 12% of applicants are actively seeking accelerated examination, opting for a faster path to patent grant.

This is not a routine choice. Track One involves additional cost and is typically used when companies want:

Faster enforceable rights

Stronger positioning in negotiations

Early investor confidence

Rapid commercialization readiness The filing trend further reinforces this urgency. Track One activity remained limited before 2020, but filings increased sharply from 2021 onward, peaking in 2022 and maintaining strong momentum through 2023–2025.

| Patent Application Year | Patent Count |

| 2015 | 1 |

| 2017 | 1 |

| 2018 | 1 |

| 2019 | 3 |

| 2020 | 5 |

| 2021 | 8 |

| 2022 | 25 |

| 2023 | 16 |

| 2024 | 19 |

| 2025 | 17 |

Another important insight: nearly two-thirds of Track One filings are concentrated in core electrochemical systems, indicating that companies are prioritizing protection around foundational battery architecture rather than incremental improvements.

Who Is Driving the Acceleration?

Track One filings are not evenly distributed. A limited number of players account for a significant share of the 96 prioritized applications.

The most active filer is:

| Company | Patents |

| CATL | 22 |

| Guangdong Brunp Recycling Technology Co Ltd (Subsidiary of CATL) | 11 |

| Echion Technologies Limited | 3 |

| Unigrid Inc | 3 |

| 24M Technologies Inc | 3 |

Technology Focus – Where Is the Protection Concentrated?

| Technology Area | Patents |

| Core Electrochemical System | 64 |

| Sustainability Context | 13 |

| Battery Active Materials | 9 |

| Electrolytes, Binders & Separators | 4 |

| Fire Safety | 2 |

| Electrode & Cell Engineering | 2 |

| Battery Manufacturing & Processing | 1 |

| Stability Enhancement | 1 |

Keep track of every patent move and monitor competitor activity in real-time. Click here for full insights:

Top Universities and Innovation in Collaboration in Sodium-Ion Batteries

Best 10 Patent Filed in Sodium-Ion Batteries

CN113921809A is the most popular patent in the Sodium-Ion Batteries portfolio. It has received 57 citations so far from companies like CATL, Ningbo Ronbay New Energy Technology Co and Huawei.

Below is the list of 10 most cited patents of Sodium-Ion Batteries:

| Publication Number | Citation Count |

| CN113921809A | 57 |

| US11444338B1 | 57 |

| WO2023087485A1 | 38 |

| WO2022155056A1 | 37 |

| CN114975982A | 35 |

| CN116230923A | 34 |

| CN115000399A | 30 |

| CN114335523A | 28 |

| CN114538403A | 28 |

| CN115196691A | 28 |

The chart below distributes patents filed in Sodium-Ion Battery in different countries on the basis of the technology protected in patents. It also represents the markets where Sodium-Ion Batteries thinks it’s important to protect particular technology inventions.

R&D Focus: How has Sodium-Ion Batteries search focus changed over the years?

Want to go deeper into the sodium-ion landscape? Our detailed Sodium-Ion Battery Intelligence Report moves beyond surface-level patent data to uncover how R&D focus has evolved over time, which players are shaping the competitive landscape, where critical white-space opportunities exist, and what technical or investment risks could influence commercialization.

Request your copy to access comprehensive insights on innovation trends, patent concentration, and strategic opportunities and if you have a specific focus area, let us know so we can tailor the analysis to your needs.