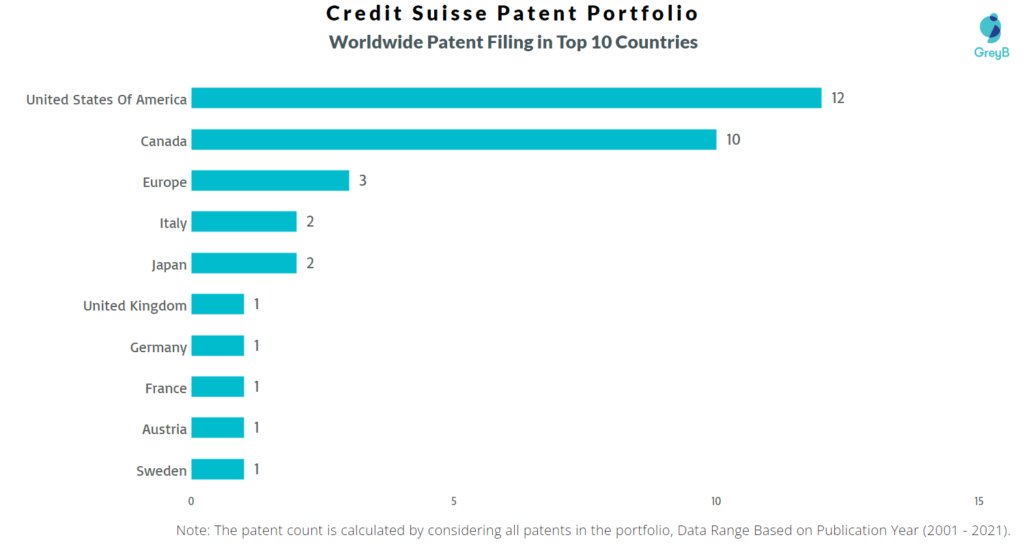

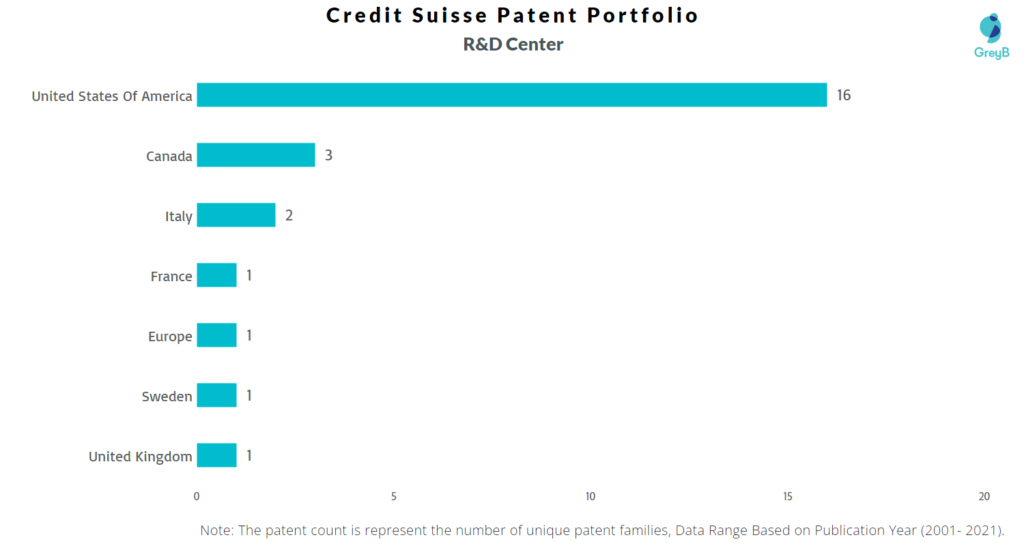

Credit Suisse has a total of 43 patents globally, out of which 26 have been granted. Of these 43 patents, more than 28% patents are active. The United States of America is where Credit Suisse has filed the maximum number of patents, followed by Canada and Europe and it also seems reasonable as the biggest market for Credit Suisse is USA. Parallelly, USA seems to be the main focused R&D center and Switzerland is the origin country of Credit Suisse.

Credit Suisse was founded in 1856 by Alfred Escher, Credit Suisse is doing business in financial services industry. Credit Suisse’s Group focus on strengthening and simplifying the integrated model and investing in sustainable growth, while placing risk management at the very core of the Bank. With a global business and regional structure, Credit Suisse strengthens cross-divisional collaboration within the Bank to promote sustainable growth and economic profit. As of January 2022, Credit Suisse has a market cap of $23.63 Billion.

Do read about some of the most popular patents of Credit Suisse which have been covered by us in this article and also you can find Credit Suisse patents information, the worldwide patent filing activity and its patent filing trend over the years, and many other stats over the Credit Suisse patent portfolio.

How many patents does the CEO of Credit Suisse have?

The CEO, Thomas P Gottstein have 0 patents.

How many patents does Credit Suisse have?

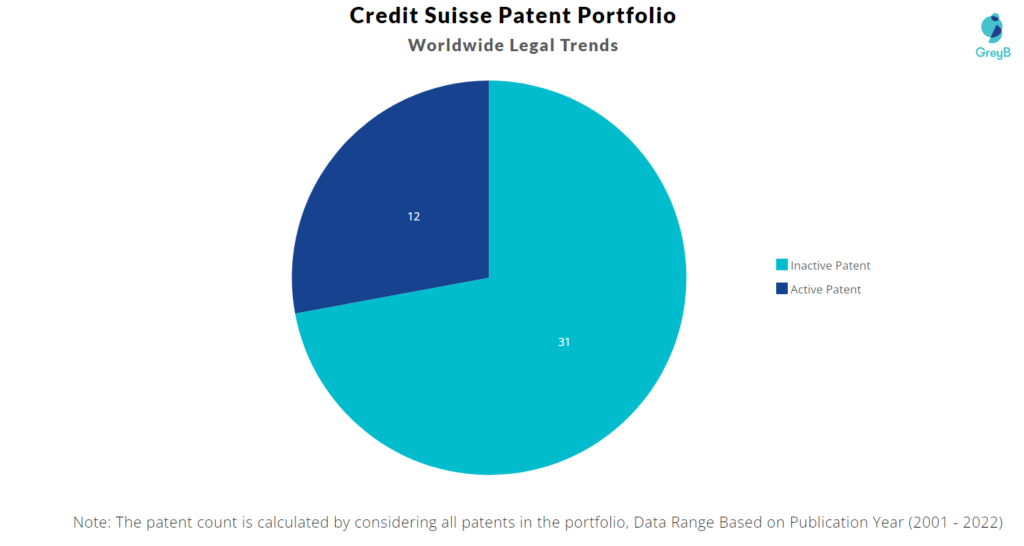

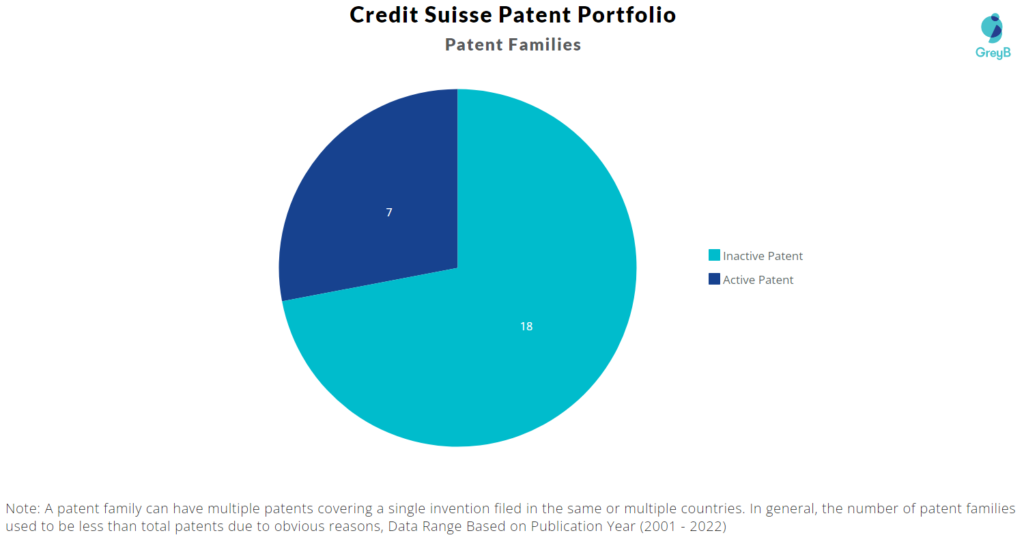

Credit Suisse has a total of 43 patents globally. These patents belong to 25 unique patent families. Out of 43 patents, 12 patents are active.

How many Credit Suisse patents are Alive/Dead?

Worldwide Patents

Patent Families

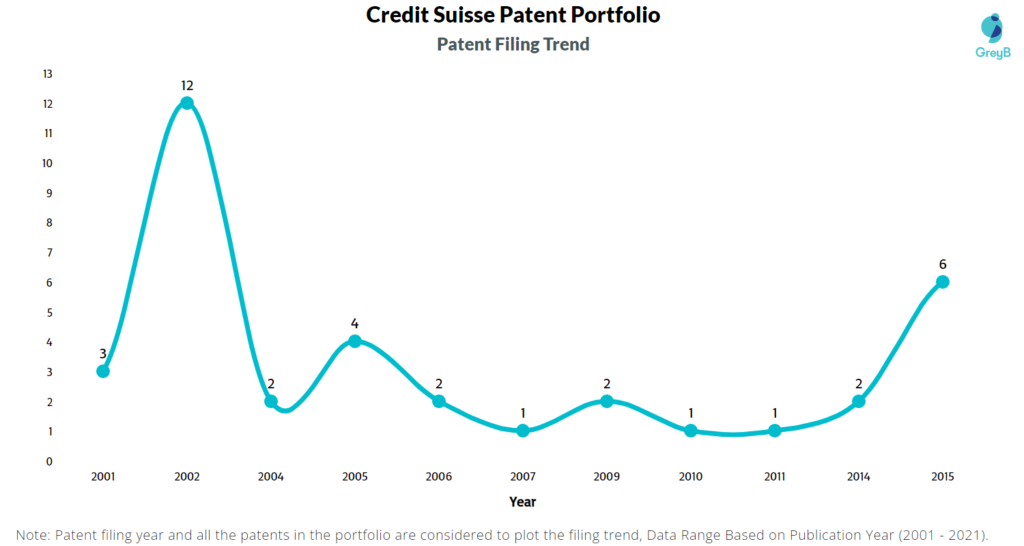

How Many Patents did Credit Suisse File Every Year?

Are you wondering why there is a drop in patent filing for the last two years? It is because a patent application can take up to 18 months to get published. Certainly, it doesn’t suggest a decrease in the patent filing.

| Year of Patents Filing or Grant | Credit Suisse Applications Filed | Credit Suisse Patents Granted |

| 2001 | 3 | 3 |

| 2002 | 12 | 2 |

| 2003 | – | 2 |

| 2004 | 2 | 4 |

| 2005 | 4 | 1 |

| 2006 | 2 | – |

| 2007 | 1 | 1 |

| 2009 | 2 | 6 |

| 2010 | 1 | – |

| 2011 | 1 | 2 |

| 2012 | – | 1 |

| 2014 | 2 | – |

| 2015 | 6 | – |

| 2016 | – | 1 |

| 2017 | – | 1 |

| 2021 | – | 2 |

How Many Patents did Credit Suisse File in Different Countries?

Countries in which Credit Suisse Filed Patents

| Country | Patents |

| United States Of America | 12 |

| Canada | 10 |

| Europe | 3 |

| Italy | 2 |

| Japan | 2 |

| United Kingdom | 1 |

| Germany | 1 |

| France | 1 |

| Austria | 1 |

| Sweden | 1 |

| Australia | 1 |

| Brazil | 1 |

| Mexico | 1 |

| Portugal | 1 |

| Spain | 1 |

Where are Research Centers of Credit Suisse Patents Located?

10 Best Credit Suisse Patents

US20060184444A1 is the most popular patent in the Credit Suisse portfolio. It has received 72 citations so far from companies like Archipelago Holdings, Trillium Labs and Research Affiliates llc.

Below is the list of 10 most cited patents of Credit Suisse:

| Publication Number | Citation Count |

| US20060184444A1 | 72 |

| US7917416B2 | 33 |

| US20070033119A1 | 16 |

| US20080208655A1 | 9 |

| US20110174457A1 | 6 |

| US20070094119A1 | 6 |

| US20090125438A1 | 5 |

| US7574390B1 | 4 |

| EP1691332A1 | 4 |

| US20090138413A1 | 2 |

Starting from January 2022, the Group will be reorganized into four divisions – Wealth Management, Investment Bank, Swiss Bank and Asset Management — and four geographic regions – Switzerland, Europe, Middle East and Africa (EMEA), Asia-Pacific (APAC) and Americas — reinforcing the integrated model with global businesses and strong regional client and regulatory accountability. The new leadership structure will be announced nearer to the implementation date.

The Group is making clear choices across all four divisions to strengthen the bank and accelerate growth:

The Wealth Management division plans to expand its market leading UHNW and Upper HNW franchises and accelerate Core HNW growth in selected scale markets. It has an objective of approximately CHF 1.1 trillion in assets under management by 2024, an increase of CHF 200 billion from current levels. Investments in technology are expected to increase by approximately 60% in 2024 versus 2021. The 2024 ambition is to exceed a return on regulatory capital of 18% on an adjusted basis and grow net new assets by a mid-single digit p.a.

The Investment Bank plans to exit Prime Services (with the exception of Index Access and APAC Delta One), optimize the Corporate Banking exposure and reduce the longduration structured derivatives book. The 2024 ambition is to exceed a return on regulatory capital of 18% on an adjusted basis, excluding significant items.

The Swiss Bank will include the domestic retail, corporate and institutional client segments as a business. Our 2024 ambition is to exceed a return on regulatory capital of 12% on an adjusted basis excluding significant items and grow client business volumes at low- to mid-single digit over 2022 to 2024.

· In Asset Management, the focus will be on investing in core product capabilities, on expanding distribution in select European and APAC markets, and building a strong connectivity to our Wealth Management division. The division plans to exit non-core investments & partnerships, which is expected to result in an approximate 40% RWA reduction.

The Group has clear financial goals for each of the new divisions for 2022 to 2024 and will deliver on its strategy with disciplined and relentless execution.

EXCLUSIVE INSIGHTS COMING SOON!

What are Credit Suisse’s key innovation segments?

What Technologies are Covered by Credit Suisse?

The chart below distributes patents filed by Credit Suisse in different countries on the basis of the technology protected in patents. It also represents the markets where Credit Suisse thinks it’s important to protect particular technology inventions.

R&D Focus: How Credit Suisse search focus changed over the years?

EXCLUSIVE INSIGHTS COMING SOON!

Interested in knowing about the areas of innovation that are being protected by Credit Suisse?