The evolution of 5G marks a transformative leap in wireless communication, delivering unparalleled connectivity, speed, and efficiency. From its early concepts in the 2000s to global deployment, 5G has revolutionized industries and redefined digital interaction. Central to this progress is a rich collection of patents that reflect two decades of innovation and collaboration by inventors, organizations and researchers.

This report examines patents declared essential to ETSI 5G standards, combining updated 2025 data with 2024-based strategic insights to highlight leading contributors, key inventors, and litigation trends shaping the global 5G SEP landscape.

This retrospective serves as a roadmap for future innovation, illustrating how the patent landscape has supported technologies such as smart cities, autonomous vehicles, and the Internet of Things. This report underscores the pivotal role of 5G patents in driving global technological progress and competitiveness.

5G innovation extends beyond core patents—RedCap simplifies connectivity, NTN expands coverage, AI/ML enhances networks, IAB optimizes backhaul for scalable deployment, Edge Computing powers ultra-low latency processing and Extended Reality (XR) unlocks immersive, real-time experiences. Explore key patents driving 5G’s future.

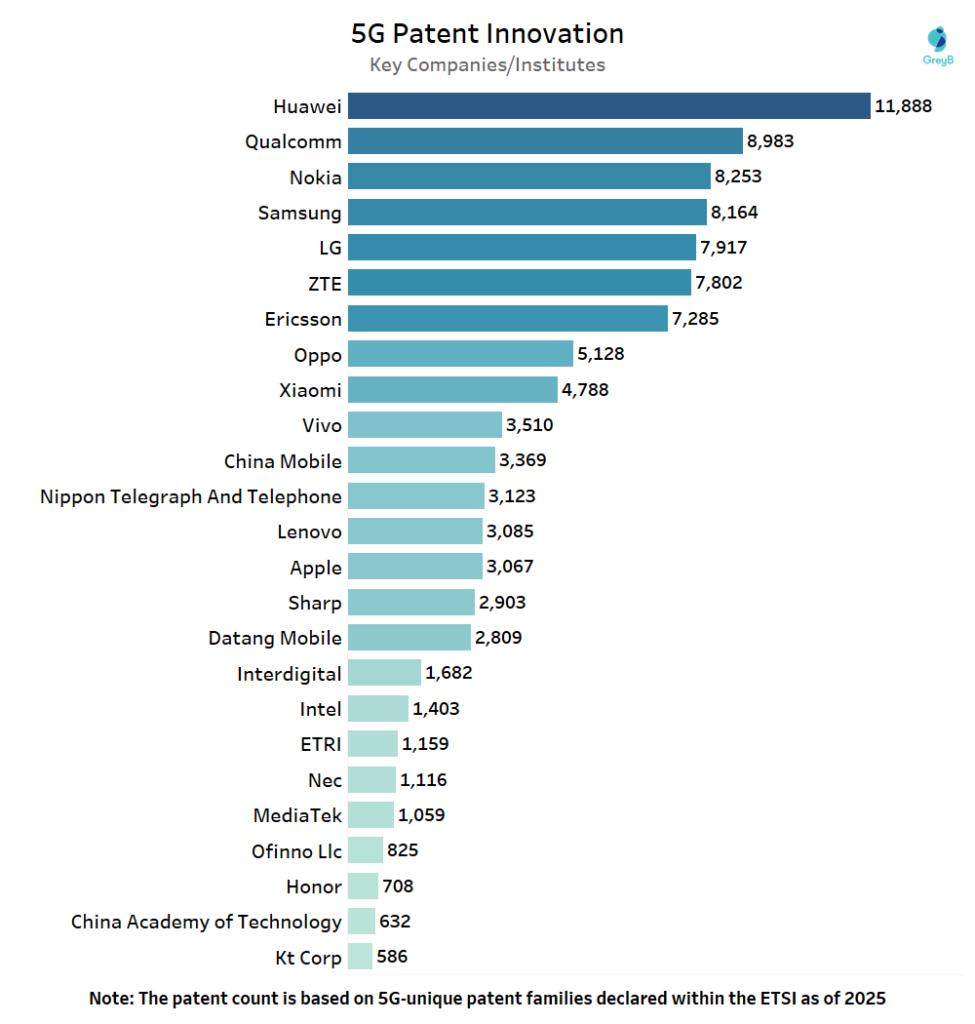

Who are the leaders in 5G Patents?

This chart represents the leading companies and institutes with the largest patent portfolios in the 5G technology field. Discover the major players and assess the competitive landscape in the industry.

Qualcomm (8,983) and Nokia (8,253) follow closely, reflecting their long-standing roles in cellular standards development and core wireless technologies. Samsung (8,164) and LG (7,917) further highlight South Korea’s sustained investment in next-generation communication technologies, while ZTE (7,802) and Ericsson (7,285) underscore the strong presence of Chinese and European players in the 5G standards race.

A major factor in this dominance is the strategic acquisitions made by companies like Nokia, which boasts more than 7,000 Standard Essential Patents (SEPs) in 5G. This impressive figure is partly attributed to Nokia’s 2015 acquisition of Alcatel-Lucent, a move that significantly boosted its patent portfolio and strengthened its position in the 5G space.

The geographical concentration of 5G patent filings reveals a heavy presence of companies from China, South Korea, Japan and the United States. Huawei, ZTE and Qualcomm represent China’s leadership in telecom innovation, while companies like Samsung and LG reflect South Korea’s strong footing in the industry. Nokia and Ericsson, representing Finland and Sweden, further exemplify Europe’s leadership. Interestingly, institutes such as ETRI and China Academy of Telecommunications Technology show the growing contributions from research institutions, demonstrating how academic and research-oriented organizations are becoming significant players in the 5G patent race.

Huawei’s significant lead in 5G patents is also bolstered by its extensive R&D investment in 5G technologies, alongside partnerships with governments and enterprises. Meanwhile, Qualcomm’s focus on chipsets and its pivotal role in the development of 5G standards has allowed it to remain a major contender.

Beyond traditional telecom infrastructure companies, device-focused firms such as Oppo, Xiaomi, Vivo, Apple, and Lenovo have built sizable 5G patent portfolios, signaling a strategic shift by handset and consumer electronics manufacturers toward deeper participation in standards ownership and licensing ecosystems. At the same time, network operators and research institutions including China Mobile, NTT, ETRI, and Datang Mobile continue to play an important role, particularly in foundational and system-level innovations.

This landscape not only reflects the global competition in 5G technology but also indicates how strategic partnerships and acquisitions have accelerated innovation in this sector.

Who are the Top 50 players driving 5G technology through Patents?

| Companies/Institutes | Patent Count |

| Huawei | 11888 |

| Qualcomm | 8983 |

| Nokia | 8253 |

| Samsung | 8164 |

| LG | 7917 |

| ZTE | 7802 |

| Ericsson | 7285 |

| Oppo | 5128 |

| Xiaomi | 4788 |

| Vivo | 3510 |

| China Mobile | 3369 |

| Nippon Telegraph And Telephone | 3123 |

| Lenovo | 3085 |

| Apple | 3067 |

| Sharp | 2903 |

| Datang Mobile | 2809 |

| Interdigital | 1682 |

| Intel | 1403 |

| ETRI | 1159 |

| Nec | 1116 |

| MediaTek | 1059 |

| Ofinno Llc | 825 |

| Honor | 708 |

| China Academy of Technology | 632 |

| Kt Corp | 586 |

| Spreadtrum Communications | 554 |

| Sony | 533 |

| Shanghai Langbo Communication Technology Co Ltd | 442 |

| Fujitsu | 407 |

| Asus | 387 |

| Apogee Networks Llc | 338 |

| Panasonic | 281 |

| 275 | |

| Fraunhofer Society | 238 |

| Transsion Holdings Co Ltd | 235 |

| Kyocera Corp | 225 |

| Htc Corp | 209 |

| Quectel Wireless Solutions Co Ltd | 206 |

| Unisoc | 190 |

| Hyundai | 168 |

| Motorola | 164 |

| Kia Motors | 162 |

| Philips | 152 |

| Denso | 141 |

| Toyota | 136 |

| Fg Innovation Co Ltd | 131 |

| HFI Innovation | 130 |

| Industrial Technology Research Institute | 117 |

| Idac Holdings Inc | 114 |

| Mitsubishi | 110 |

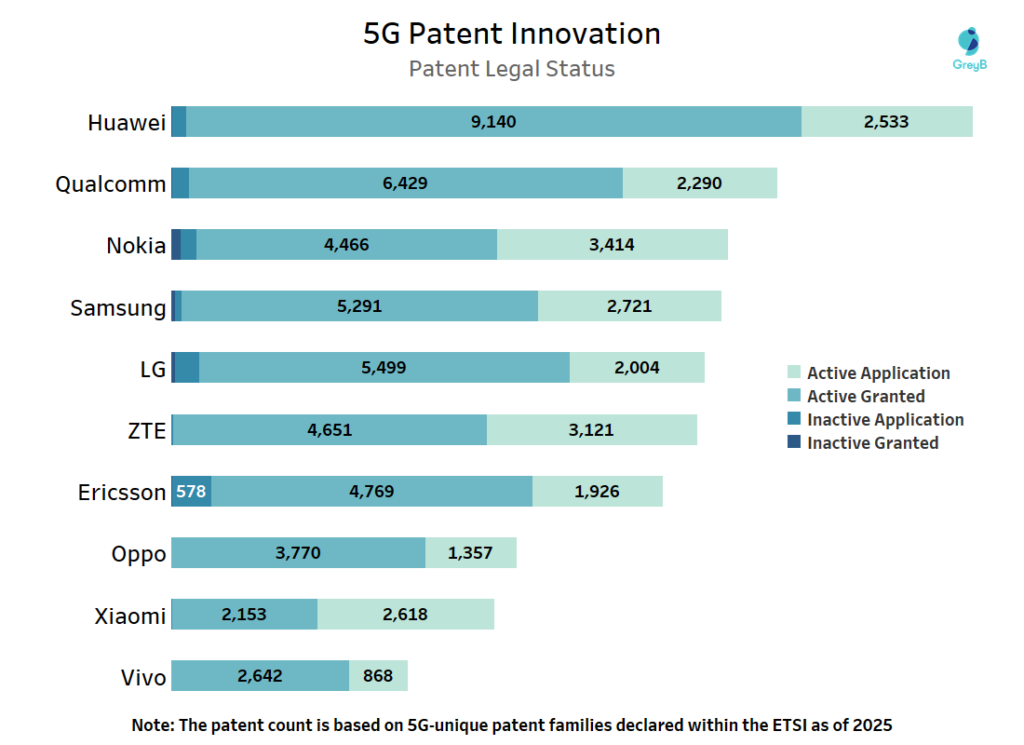

Patent Legal Status of Key Players in 5G Patents

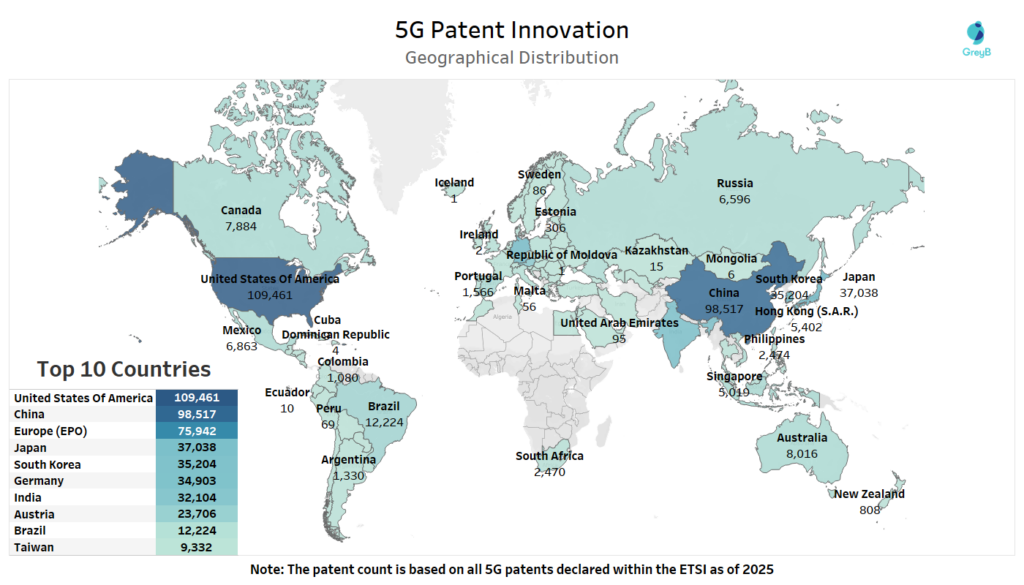

Geographical Distribution of 5G Standard-Essential Patents (SEPs)

This chart highlights the geographic regions where 5G-related patent applications have been filed, indicating key target markets for commercialization. This information helps companies plan filing strategies, ensuring coverage in top jurisdictions to enhance portfolio value and identify untapped markets for growth.

The geographical distribution of 5G patents highlights where innovation and standardization efforts are most concentrated globally. As of 2025, the United States leads with 109,461 5G patents, reflecting its strong presence in core wireless technologies and standards-driven innovation.

China follows with 98,517 patents, demonstrating its significant investment in 5G R&D and active participation in global standard-setting activities. Europe (EPO) collectively accounts for 75,942 patents, with countries such as Germany playing a key role in strengthening the region’s position in the 5G patent landscape.

In Asia, Japan (37,038) and South Korea (35,204) continue to be major contributors, supported by strong collaboration between industry players and research institutions. India (32,104) also features among the top contributors, indicating growing engagement in 5G-related patent filings.

Overall, the distribution shows that 5G patent activity is largely concentrated in a handful of regions, emphasizing the dominance of the U.S., China, Europe, and East Asia in shaping the global 5G ecosystem.

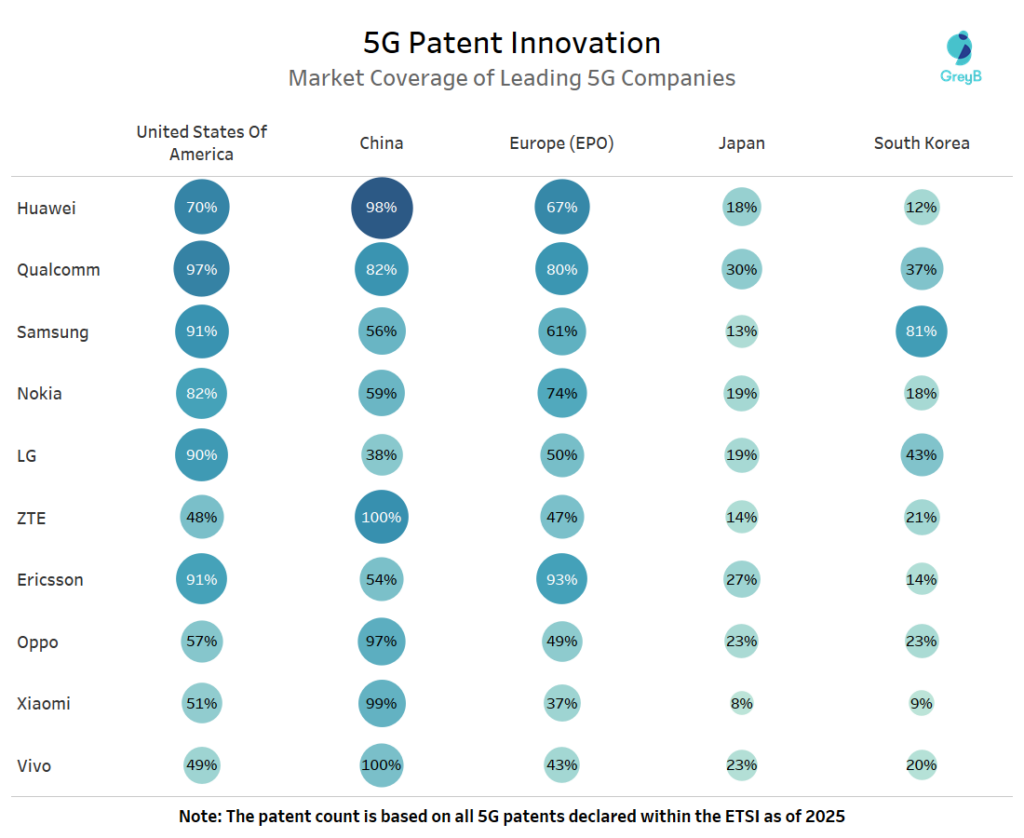

Market Coverage of Leading 5G Companies

Global 5G Patent Landscape: A Cross-Market Analysis of Industry Leaders

The chart below unveils a fascinating landscape of how the world’s leading telecommunications companies are positioning themselves across major markets – the United States, China, Europe, South Korea, and Japan.

The United States, China, and Europe (EPO) emerge as the most consistently prioritized regions across nearly all leading companies. Huawei shows its highest coverage in China, while maintaining substantial presence in the United States and Europe. Qualcomm exhibits strong coverage across all major regions, particularly in the United States and Europe.

Samsung and LG demonstrate strong coverage in South Korea, alongside significant filings in the United States and Europe. European players such as Ericsson and Nokia show dominant coverage in Europe and the United States, reflecting their focus on key standard-setting and enforcement markets.

Chinese handset manufacturers including Oppo, Xiaomi, and Vivo show near-complete coverage in China, with more selective patent presence in Japan and South Korea. Overall, the distribution indicates that leading 5G companies focus their patenting efforts on a small set of high-value regions, aligning patent strategies with commercialization and licensing priorities.

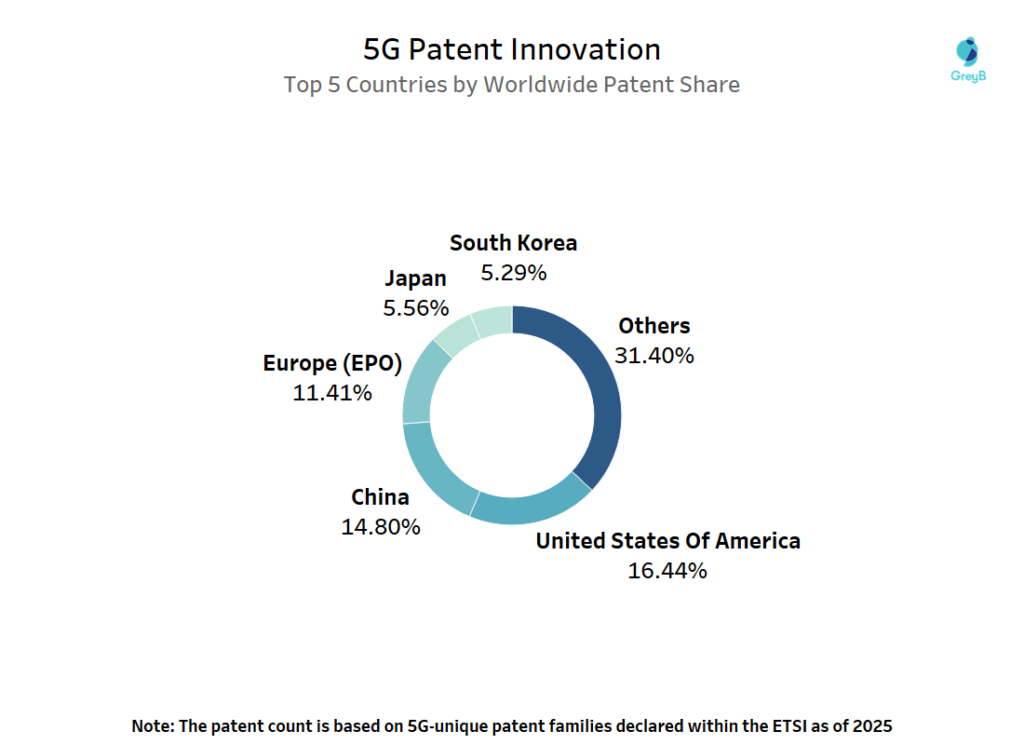

Which are the Top 5 Countries Leading in 5G Patents?

Top 25 Countries by Patent Share in 5G Standard-Essential Patents (SEPs)

| Country | Patent Share |

| United States Of America | 16.44% |

| China | 14.80% |

| Europe (EPO) | 11.41% |

| Japan | 5.56% |

| South Korea | 5.29% |

| Germany | 5.24% |

| India | 4.82% |

| Austria | 3.56% |

| Brazil | 1.84% |

| Taiwan | 1.40% |

| Spain | 1.25% |

| Australia | 1.20% |

| Indonesia | 1.19% |

| Canada | 1.18% |

| Mexico | 1.03% |

| Russia | 0.99% |

| Viet Nam | 0.92% |

| Hong Kong (S.A.R.) | 0.81% |

| Singapore | 0.75% |

| Malaysia | 0.49% |

| Italy | 0.48% |

| United Kingdom | 0.43% |

| Poland | 0.39% |

| Philippines | 0.37% |

| South Africa | 0.37% |

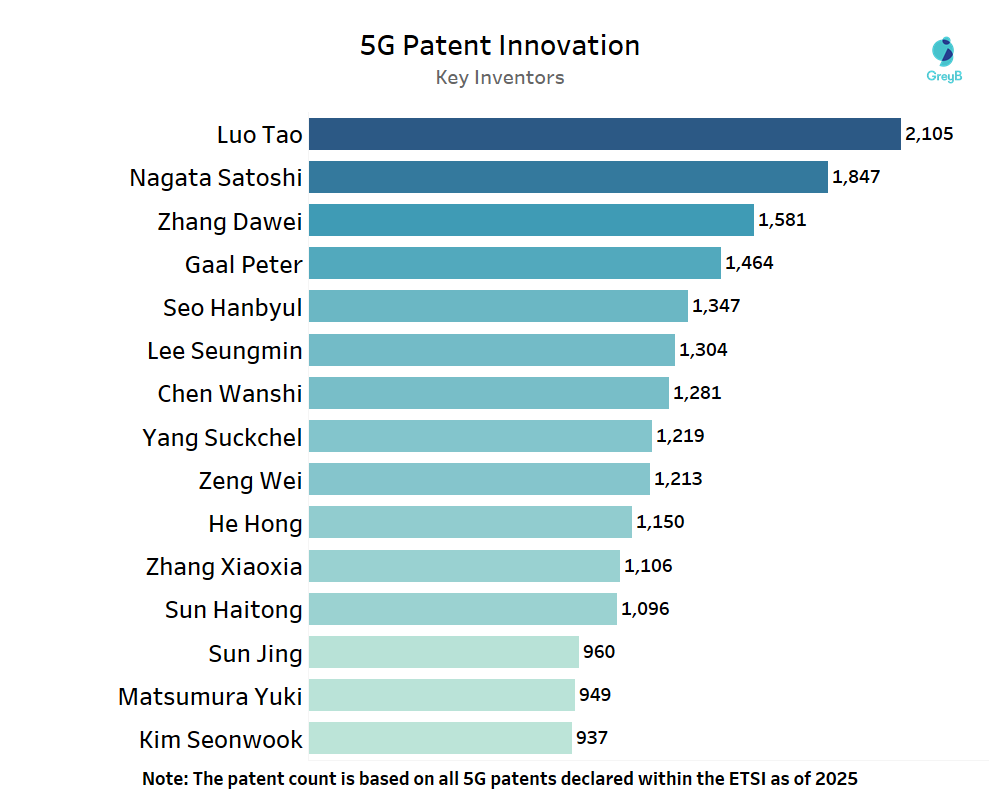

Who are the Top Inventors shaping the 5G Patent Landscape?

Luo Tao leads with 2,105 patents, followed by Nagata Satoshi (1,847) and Zhang Dawei (1,581), indicating a high concentration of innovation output among a small group of individuals. Other prominent contributors include Gaal Peter, Seo Hanbyul, and Lee Seungmin, each with over 1,300 declared 5G patents.

The presence of inventors from different regions reflects the global nature of 5G standards development, with strong representation from Asia, Europe, and North America. Overall, the distribution shows that 5G innovation is driven not only by leading companies but also by a relatively small number of highly productive inventors who contribute extensively to standard-essential technologies.

Luo Tao stands at the forefront of this revolution. As a systems lead for wireless research and development at Qualcomm, Dr. Luo has been pivotal in advancing millimeter-wave (mmWave) technologies, which are essential for the high-speed, low-latency promises of 5G. His work ensures that 5G smartphones maintain robust connections with cell towers, a critical component for seamless user experiences.

Nagata Satoshi has been a driving force in 5G standardization efforts. As a manager at NTT Docomo’s 6G Laboratories, he has played a significant role in the research and development of wireless access technologies for LTE, LTE-Advanced, and 5G. His leadership in 3GPP standardization has been instrumental in shaping the global 5G landscape, ensuring interoperability and cohesive development across the industry.

Zhang Dawei ranks among the top individual contributors to 5G standard-essential patents, with over 1,500 ETSI-declared 5G patents to his name. Associated with Apple Inc, his patent portfolio reflects sustained involvement in the development of core 5G technologies, particularly in areas related to radio access procedures, mobility management, and signaling mechanisms within New Radio (NR) systems. His contributions underscore Apple’s strategic focus on strengthening its position in cellular standards and long-term wireless innovation.

Gaal Peter has been a cornerstone in Qualcomm’s contributions to 5G. With a Ph.D. in electrical engineering from the University of Southern California, Dr. Gaal has been deeply involved in the design and development of LTE and 5G NR (New Radio). His extensive patent portfolio reflects his commitment to advancing wireless communication technologies, solidifying Qualcomm’s position as a leader in the field.

Zhang Xiaoxia is a trailblazer in wireless communications. Joining Qualcomm after completing her Ph.D. in electrical engineering from Ohio State University in 2002, Dr. Zhang has been integral to the development of 3G, 4G, and 5G systems. As a Senior Director of Technology, she leads projects focusing on Industrial IoT, shared/unlicensed spectrum, and RAN disaggregation on 5G/6G technology.

Top 15 Inventors in 5G Standard-Essential Patents

| Inventor | Patent Count | Gender | Associated Company |

| Luo Tao | 2105 | Male | Qualcomm |

| Nagata Satoshi | 1847 | Male | NTT Docomo |

| Zhang Dawei | 1581 | Male | Apple |

| Gaal Peter | 1464 | Male | Qualcomm |

| Seo Hanbyul | 1347 | Male | LG Electronics |

| Lee Seungmin | 1304 | Male | LG Electronics |

| Chen Wanshi | 1281 | Male | Qualcomm |

| Yang Suckchel | 1219 | Male | LG Electronics |

| Zeng Wei | 1213 | Male | Apple |

| He Hong | 1150 | Male | Apple |

| Zhang Xiaoxia | 1106 | Female | Qualcomm |

| Sun Haitong | 1096 | Male | Apple |

| Sun Jing | 960 | Male | Qualcomm |

| Matsumura Yuki | 949 | Male | NTT Docomo |

| Kim Seonwook | 937 | Male | Apple |

While the sections above present the latest view of the 5G patent landscape using updated 2025 data, the strategic behaviors discussed below such as expedited examinations, patent non-publication requests, and litigation activity are analyzed using ETSI-declared patent data published through 2024. These insights provide historical context on how leading companies approached speed, confidentiality, and enforcement during a critical phase of 5G commercialization.

By examining these 2024-based strategic indicators alongside current patent ownership trends, the analysis offers a more comprehensive understanding of how the global 5G patent ecosystem has evolved and where it may be headed.

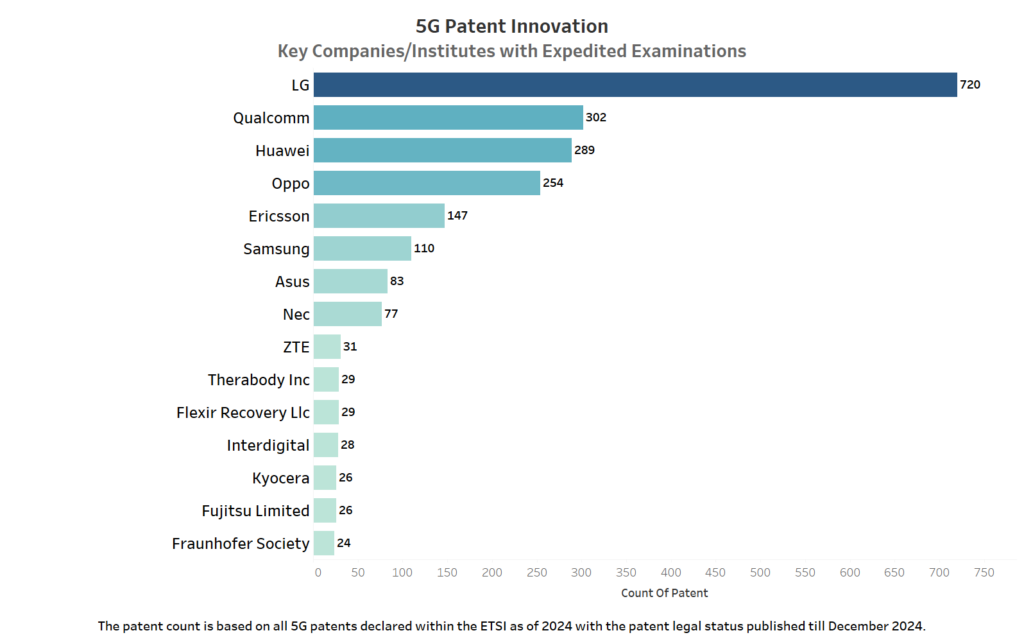

Who are the Top 5G Patent holders with Expedited Examinations?

In the accelerating 5G patent landscape, patent strategies like expedited examinations are revealing a fierce global innovation race. LG leads with 720 patents, commanding 37% in the accelerated examination space, while the top five companies—LG, Qualcomm, Huawei, Oppo, and Ericsson—collectively represent 84% of strategic patent filings. This concentrated ecosystem underscores the strategic importance of rapid intellectual property development in shaping the future of telecommunications.

Who are the leading 5G SEP Owners with Patent Non-Publication Requests?

In the rapidly evolving 5G technology, patent non-publication requests reveal a strategic battleground where technology leaders like Cisco, Vecima Networks, and Alcatel Lucent are meticulously guarding their innovation. The data demonstrates a calculated approach to protecting cutting-edge 5G innovations, signaling intense technological competition and a race to secure future market dominance. This underscores the transformative potential of 5G technology and the critical role of strategic patent management in shaping the next generation of global connectivity.

| Company | Patent Count |

| Cisco | 12 |

| Alcatel Lucent | 6 |

| Vecima Networks Inc | 6 |

| Willo Products Company Inc | 5 |

| Qualcomm | 4 |

| Amazon | 3 |

| LG | 2 |

| Snap Inc | 2 |

| Apple | 1 |

| Cellco Partnership | 1 |

| Ericsson | 1 |

| Honor | 1 |

| Intel | 1 |

| Micron Technology | 1 |

| Shanghai Langbo Communication Technology Company Ltd | 1 |

| Tennibot Inc | 1 |

The patent count is based on all 5G patents declared within the ETSI as of 2024 with the patent legal status published till December 2024.

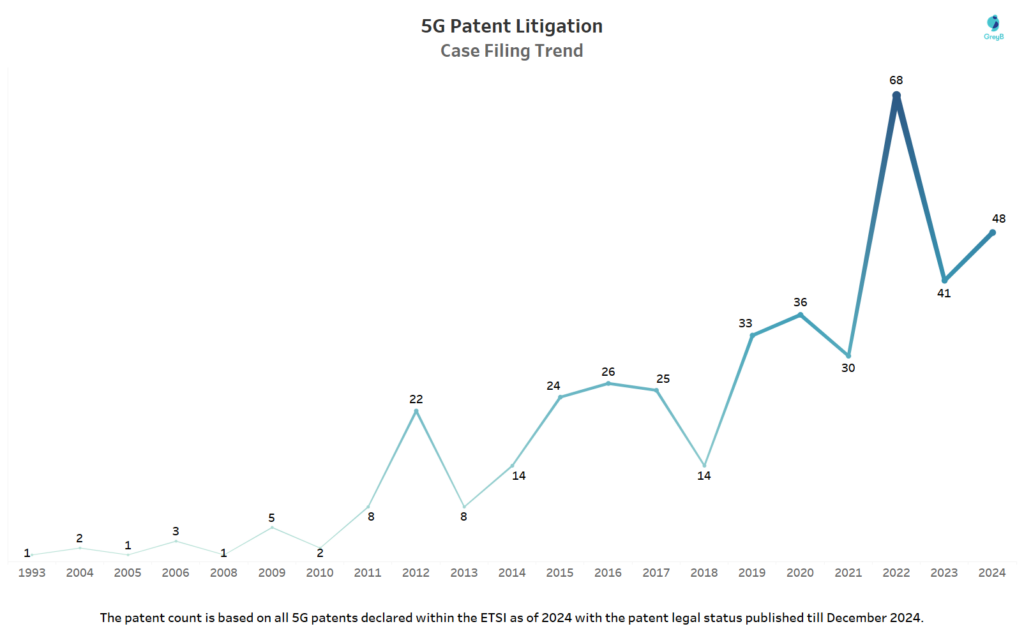

How have 5G Patent Litigations evolved over the years?

Which 5G Patents Are Involved in the Most Litigation Cases?

Here’s a list of 5G patents along with how many times they’ve been involved in legal issues. This table shows us which patents are most often disputed, pointing out the key areas where competition and innovation are especially intense.

| 5G Patent Number | Litigation Case Count |

| US8055820B2 | 22 |

| US7675941B2 | 13 |

| US7362867B1 | 12 |

| US7200792B2 | 12 |

| US7386001B1 | 12 |

| US7809373B2 | 12 |

| US7447516B2 | 11 |

| EP2229744B1 | 10 |

| US6810019B2 | 10 |

| US7050410B1 | 9 |

| EP1114528B1 | 9 |

| EP1188269B3 | 9 |

| EP2119287B1 | 8 |

| US9014667B2 | 8 |

| US7941151B2 | 8 |

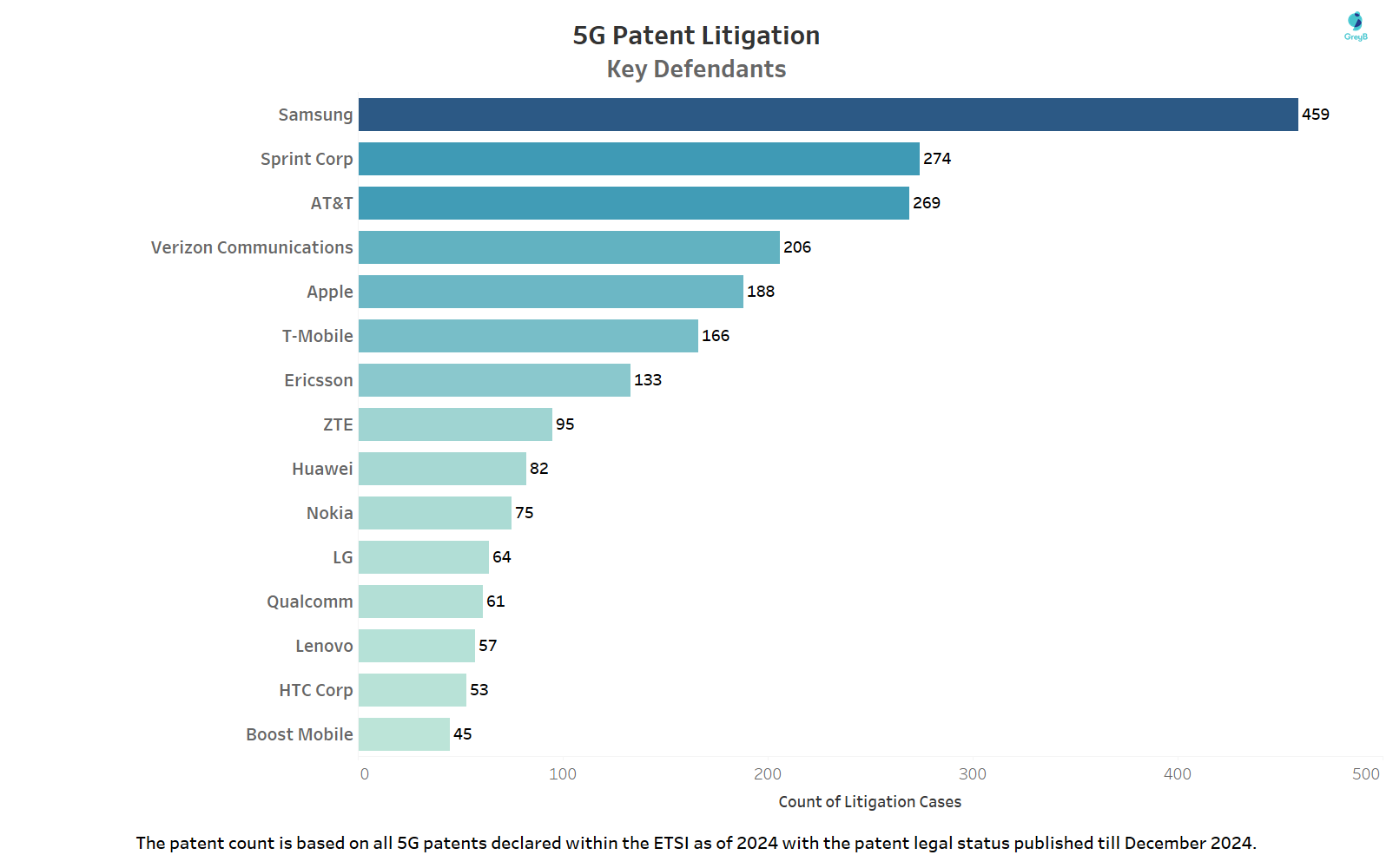

Which Companies Have Faced the Most 5G Patents Litigation Cases?

In the competitive arena of 5G patents, litigation plays a significant role, as demonstrated by Samsung’s frequent appearances as a defendant in legal disputes. This pattern is also seen among telecom giants like Sprint Corp, AT&T and Verizon Communications, who often find themselves involved in patent disputes, typically over infringement issues as they roll out new technologies.

Similarly, technology leaders such as Apple, T-Mobile and Ericsson are regularly involved in lawsuits, underscoring the contentious environment surrounding 5G technology deployment. The involvement of a wide range of companies, from Huawei to smaller players like Boost Mobile, illustrates the widespread challenges and the necessity for strategic legal defenses to navigate the complex patent landscape that is critical to succeeding in the global 5G market.

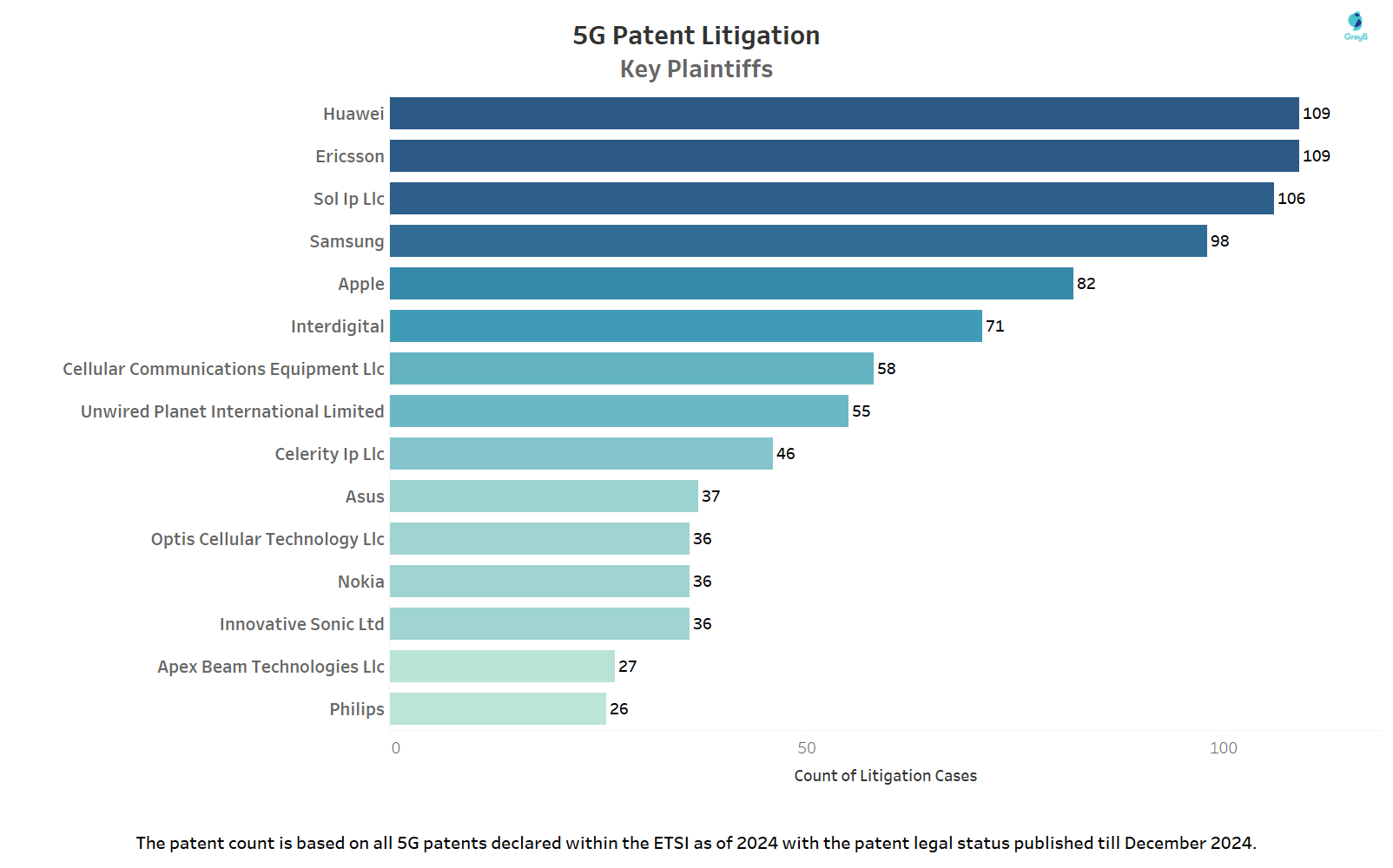

Which Companies Have Filed the Most 5G Patents Litigation Cases?

In the fiercely competitive tech sector, companies such as Huawei and Ericsson are not just innovating, they are also fiercely protecting their innovations. They take to the courts to challenge any encroachments on their intellectual property. This robust defense strategy is echoed by a diverse array of players, from industry giants like Samsung and Apple to niche IP specialized firms such as Sol Ip Llc. This highlight how crucial rigorous patent enforcement is for protecting technological advances and securing market positions.

Methodology

This report is based on a detailed analysis of patents and applications declared essential to the 5G standard and listed in the ETSI 5G Declaration List. The analysis primarily reflects the latest available data updated through 2025, focusing on 5G-specific technologies identified via the 3GPP portal. In total, 6,65,747 patent documents were consolidated into 1,09,697 patent families to present a clear and structured view of the global 5G innovation landscape.

To provide additional strategic context, certain sections of this report—specifically those covering expedited examinations, patent non-publication requests, and litigation activity—are based on ETSI declarations and legal status information published through 2024. These datasets are included to highlight historical strategic behaviors that typically unfold over time and complement the most recent patent ownership and filing trends.

A meticulous manual review process was applied across all datasets to ensure high accuracy and relevance, even if this results in a slight lag relative to real-time ETSI updates. Together, this approach enables the report to highlight current leaders, key inventors, geographical trends, and strategic patent behaviors, offering a comprehensive and reliable foundation for strategic decision-making in the evolving 5G patent ecosystem.

Who Should Leverage This Report

This report is essential for IP professionals, telecom companies, investors, policymakers, and researchers looking to understand the 5G patent landscape. Whether for strategic planning, competitive analysis, or academic research, this report provides actionable insights tailored to your needs.

Assessing 5G SEPs for Core Essentiality? Gain a detailed report on the distribution of Core SEPs among ETSI-declared 5G patents to make informed licensing and negotiation decisions. Stay ahead with expert insights into essentiality trends. Fill out the form below to access the report.

Which Companies Hold the Most Core 5G SEPs in Live Granted Patent Families?

Looking for detailed patent insights in a specific 5G area?

Submit your interest, and our team will reach out to explore a customized report for you!