The emergence of 5G technology has opened up exciting possibilities for connectivity, but there’s one key challenge that still needs to be addressed: providing reliable, high-speed networks in remote or hard-to-reach areas. This is where Non-Terrestrial Networks (NTN) come in. By utilizing satellites, drones, and other airborne systems, NTNs extend the reach of 5G beyond the confines of traditional ground-based infrastructure. As a result, NTNs ensure that 5G’s promise of ultra-fast, low-latency communication is not limited to urban centers but extends globally-from vast deserts to the open ocean.

As 5G becomes the foundation for next-generation applications, from the Internet of Things (IoT) to autonomous vehicles, NTNs are vital in bringing that vision to life. The integration of NTN with 5G enhances the technology’s ability to deliver on its promises of ultra-fast, low-latency communication, no matter the location. Behind these innovations lies a growing number of patents, shedding light on the technological advancements and trends shaping the future of NTN in the 5G landscape. Exploring these patent data insights not only reveals the evolution of NTN technology but also uncovers emerging opportunities in the rapidly advancing 5G landscape.

NTN technology is a key piece of the broader 5G patent landscape. Explore how ETSI-declared 5G patents shape the industry.

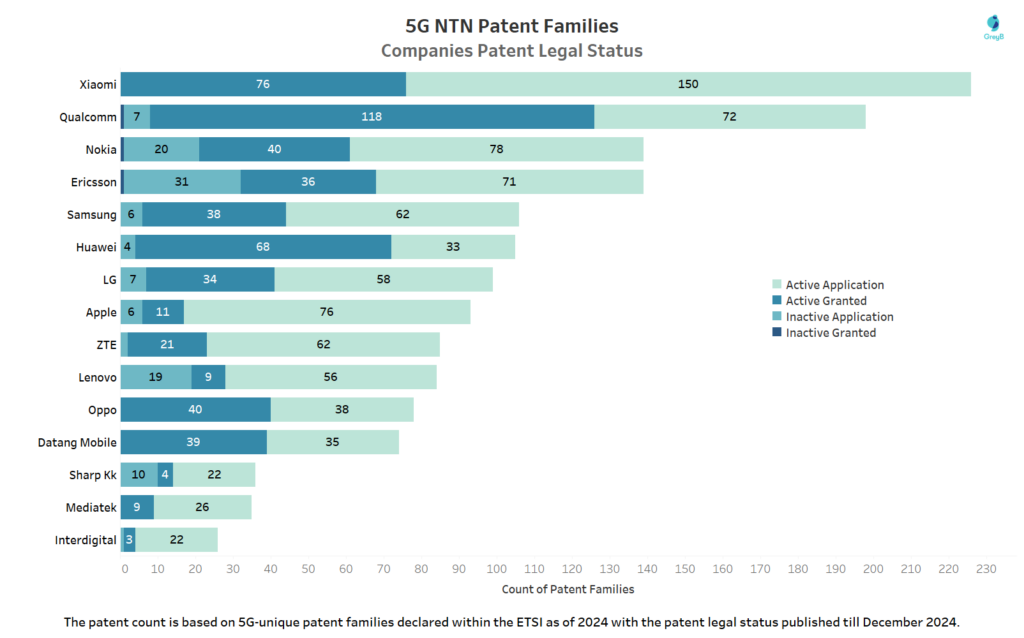

Which Companies Are Leading in Declaring 5G NTN Core SEPs and Their Patent Legal Status?

The landscape of 5G NTN patent families declared to ETSI vividly illustrates the strategic innovation drives of global tech leaders, with Chinese companies Xiaomi, Oppo and Datang Mobile exclusively maintaining active patent families, indicative of China’s aggressive positioning in the 5G domain. This active engagement in patent legal status-both applications and grants-underscores a robust commitment to dominating future telecommunications technologies. Meanwhile, other major players like Qualcomm, Huawei and Nokia demonstrate their prowess through significant numbers of active granted patent families.

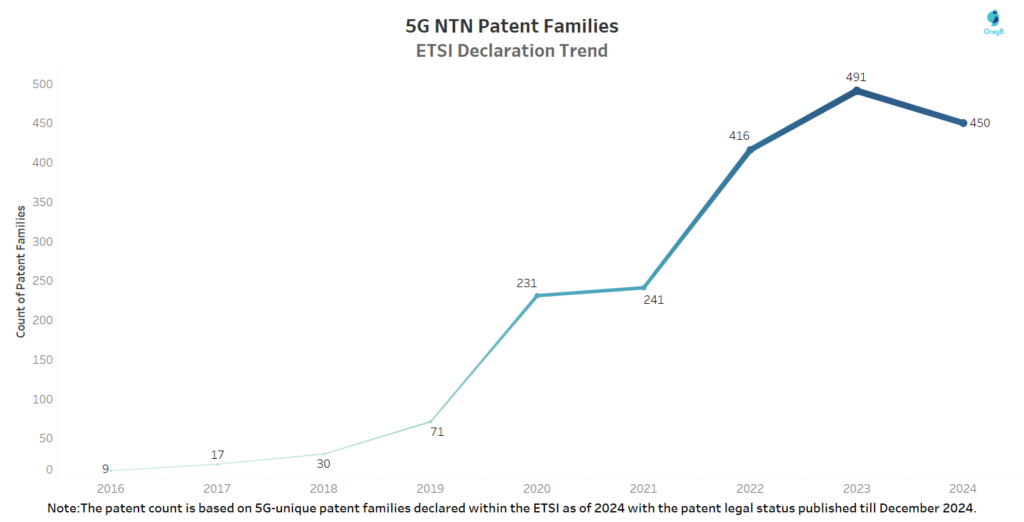

What Are the Declaration Year Trends for 5G NTN Patent Families in ETSI Data?

This chart illustrates the yearly trends in 5G NTN SEPs submitted to ETSI, highlighting the progression of NTN-related advancements in the 5G ecosystem.

Which 3GPP Specifications Have the Most 5G NTN Patent Families Declared by ETSI?

The 3GPP specification numbers (TGPP Number) serve as vital identifiers within the technical standards developed by the 3rd Generation Partnership Project (3GPP), enabling the seamless integration of mobile network technologies, including 5G. These numbers correspond to specific features or technologies, such as Non-Terrestrial Networks (NTN), and play a pivotal role in mapping patents declared as 5G-related in the ETSI dataset. By linking patents to their relevant 3GPP specifications, this dataset provides valuable insights into the focus areas of innovation within NTN technology.

| TGPP Number | 5G NTN Patent Families | 3GPP Specification |

| 38.331 | 494 | NR; Radio Resource Control (RRC); Protocol specification |

| 38.213 | 222 | NR; Physical layer procedures for control |

| 38.211 | 170 | NR; Physical channels and modulation |

| 38.214 | 139 | NR; Physical layer procedures for data |

| 38.321 | 136 | NR; Medium Access Control (MAC) protocol specification |

| 38.3 | 118 | NR; NR and NG-RAN Overall description; Stage-2 |

| 23.501 | 98 | System architecture for the 5G System (5GS) |

| 38.212 | 98 | NR; Multiplexing and channel coding |

| 36.331 | 82 | Evolved Universal Terrestrial Radio Access (E-UTRA); Radio Resource Control (RRC); Protocol specification |

| 38.133 | 73 | NR; Requirements for support of radio resource management |

| 38.304 | 42 | NR; User Equipment (UE) procedures in Idle mode and in RRC Inactive state |

| 23.502 | 38 | Procedures for the 5G System (5GS) |

| 38.306 | 34 | NR; User Equipment (UE) radio access capabilities |

| 37.355 | 34 | LTE Positioning Protocol (LPP) |

| 24.501 | 31 | Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3 |

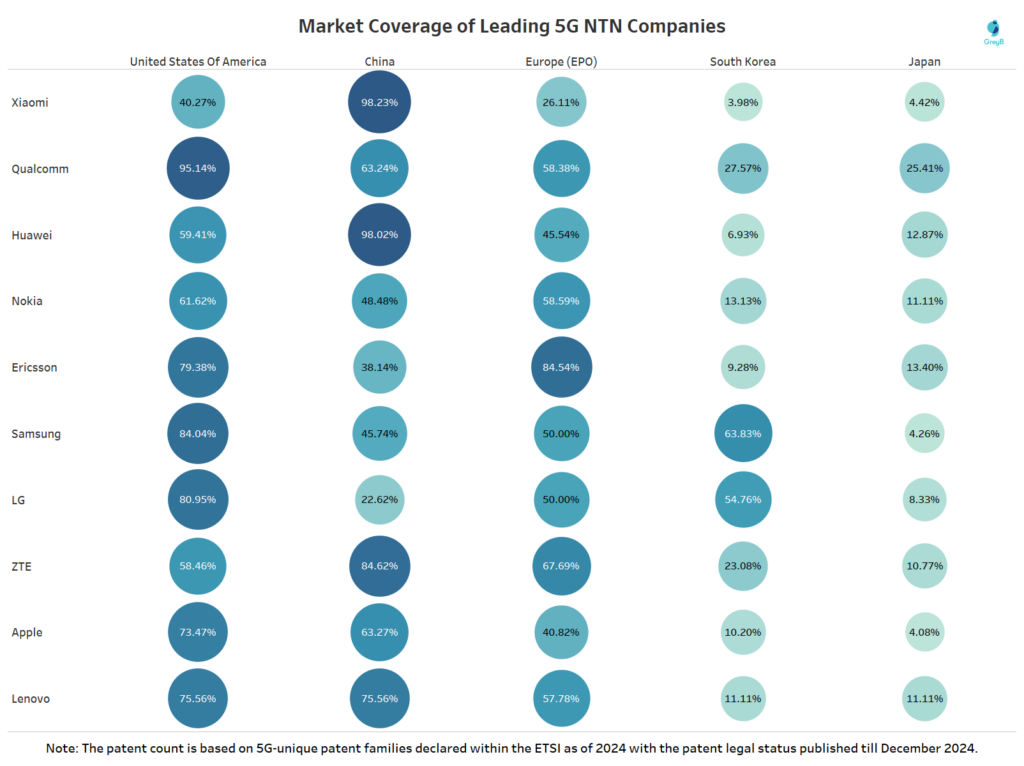

Which Companies Lead in 5G NTN Patent Families Share in the Top 5 Countries?

The global distribution of 5G NTN patent families highlights significant regional strategies among leading tech firms, with a strong emphasis on local markets and innovation hubs. Qualcomm, Apple, Samsung, and Ericsson, for example, have secured more than 70% of their patent families in the United States, underscoring the country’s pivotal role in global tech innovation and its strong intellectual property protection framework. In contrast, Xiaomi stands out with a dominant share of its patent families (98.23%) filed in China, mirroring the country’s rapid advancements in 5G technology. Additionally, companies like Huawei, ZTE, and Lenovo also show substantial filings in China, while firms like Nokia, Ericsson, and Samsung diversify their filings across Europe (EPO) and other regions.

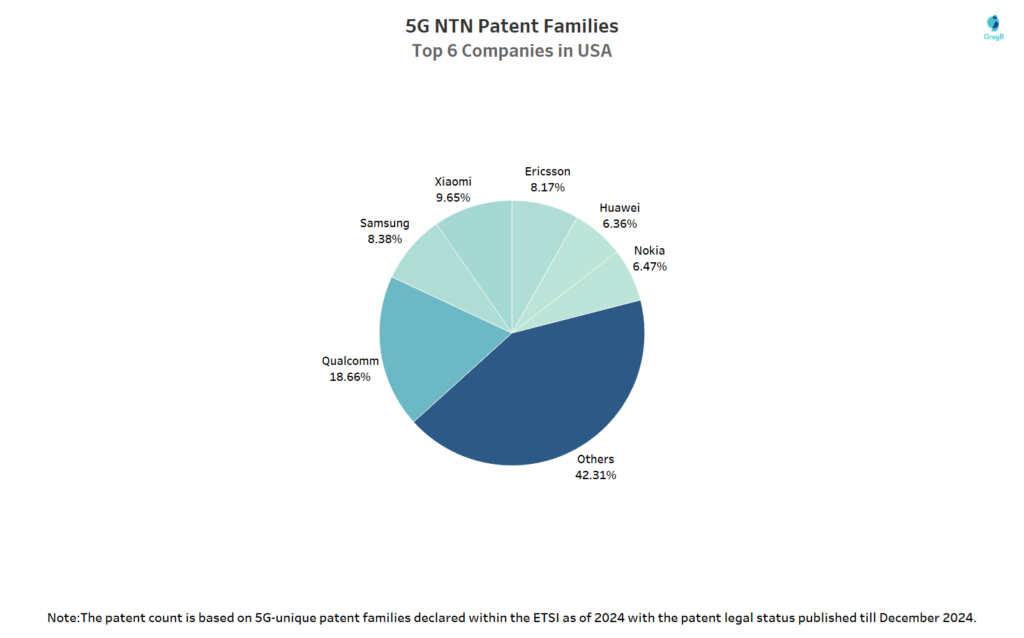

Top Companies Leading 5G NTN Patent Families Share in the USA

The 5G NTN patent landscape in the USA reveals Qualcomm’s leadership with nearly 18.66% of the patent families, highlighting its dominant role in 5G technologies. Xiaomi, Ericsson and Samsung also mark significant stakes, illustrating the competitive dynamics within this key market. The substantial 42.31% share held by other companies points to a vibrant, diverse technological ecosystem driving the evolution of 5G in the United States.

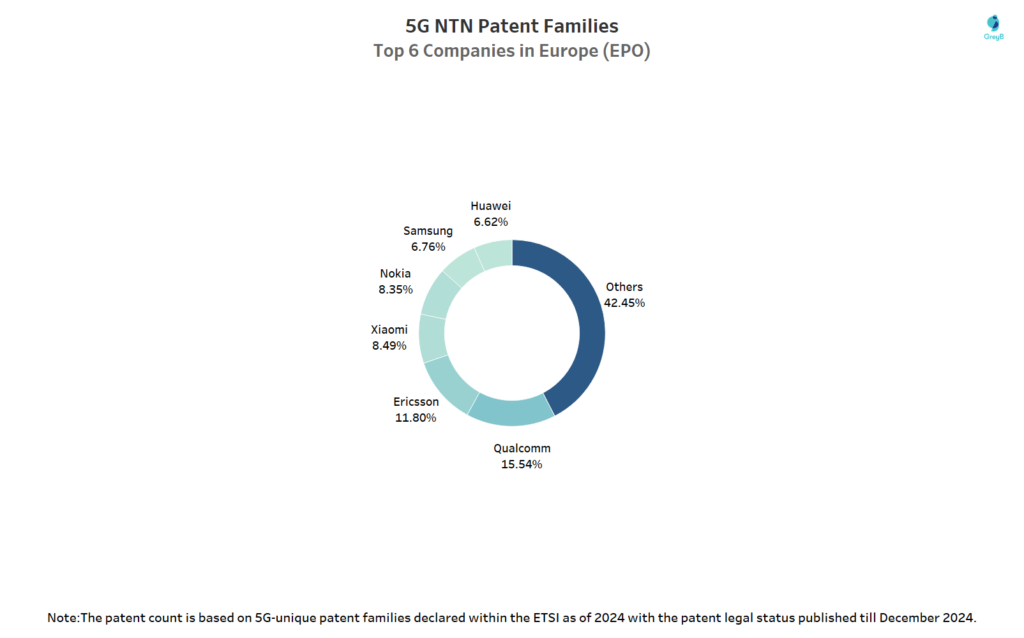

Leading Companies in 5G NTN Patent Families across Europe (EPO)

In Europe’s 5G NTN patent landscape, Qualcomm and Ericsson lead with significant shares of 15.54% and 11.80% patent families, respectively, reinforcing their strong influence in driving 5G advancements in the region. Xiaomi follows with a notable 8.49% of patent families, reflecting its growing global strategy and ambition to extend its technological reach outside of China. Other companies collectively hold 42.45% of patent families, emphasizing the diverse and collaborative nature of the European 5G ecosystem.

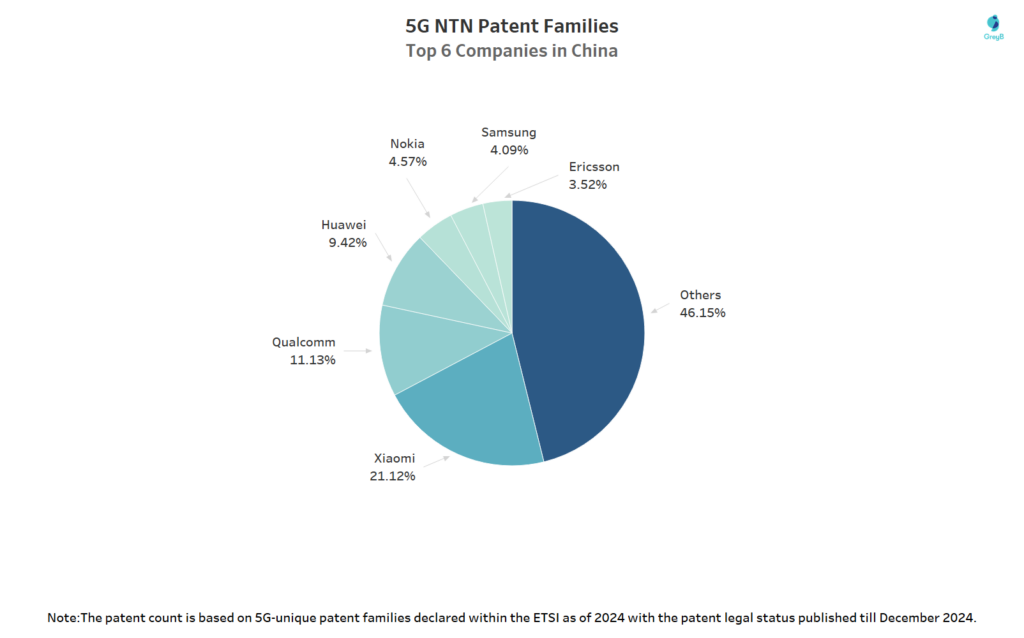

Key Players in China’s 5G NTN Patent Families Share

In China’s 5G NTN patent landscape, Xiaomi leads with a 21.12% share in patent families, followed by Qualcomm (11.13%) and Huawei(9.42%), reflecting the strategic focus of major players in the region. While global tech giants like Ericsson (3.5%), Samsung (4%), and Nokia (4.5%) have smaller shares in patent families, Xiaomi’s dominant position highlights its aggressive push in the local 5G development race. The other companies, comprising a various entities, holds the largest share of 46% patent families, emphasizing the diverse and competitive nature of China’s 5G innovation landscape.

Methodology

This report is based on a detailed analysis of patents and applications declared essential to the 5G standard as of 2024, listed in the ETSI 5G Declaration List. It focuses exclusively on 5G-specific technologies identified through the 3GPP portal, consolidating 4,22,827 patent documents into 84,940 patent families for a clear view of the innovation landscape. For identifying NTN SEPs declared to ETSI, we have relied on search queries to capture the patent families related to NTN technology.

How Does the Essentiality Ratio of Top Companies’ Core SEPs Shape the 5G NTN Patent Landscape?

How is the ownership of True SEPs in 5G NTN technology distributed?

Exploring the NTN in 5G patent landscape? Get a detailed report on key NTN technology in 5G patents declared under the ETSI framework. Stay ahead with insights into essential filings, patent trends and competitive positioning. Fill out the form below to access expert-driven analysis.