As the 5G landscape continues to evolve, RedCap technology in 5G is emerging as a pivotal solution to support a wide range of use cases, particularly in the Internet of Things (IoT) sector. RedCap (Reduced Capability) technology enhances network efficiency and scalability while offering a cost-effective solution for low-complexity devices. Introduced as part of the 5G standardization efforts by ETSI (European Telecommunications Standards Institute), RedCap enables simpler, more affordable devices to leverage the benefits of 5G connectivity without requiring the full capabilities of advanced 5G features.

With the growing demand for IoT applications, 5G RedCap technology is unlocking new opportunities in industries such as healthcare, automotive and smart cities, by providing low-cost and energy-efficient solutions. This advancement plays a crucial role in broadening the scope of 5G networks, making IoT connectivity more accessible to applications that require simplified, cost-effective solutions. Behind these innovations is a growing body of patent data, offering valuable insights into the technological evolution of RedCap within the 5G ecosystem. Analyzing 5G RedCap patents not only highlights the challenges and opportunities for companies but also provides a roadmap for understanding the trajectory of RedCap’s development and its increasing influence on the future of 5G connectivity.

As RedCap technology reshapes the 5G ecosystem, the patent landscape continues to expand. Dive into the latest insights on ETSI-declared 5G patents.

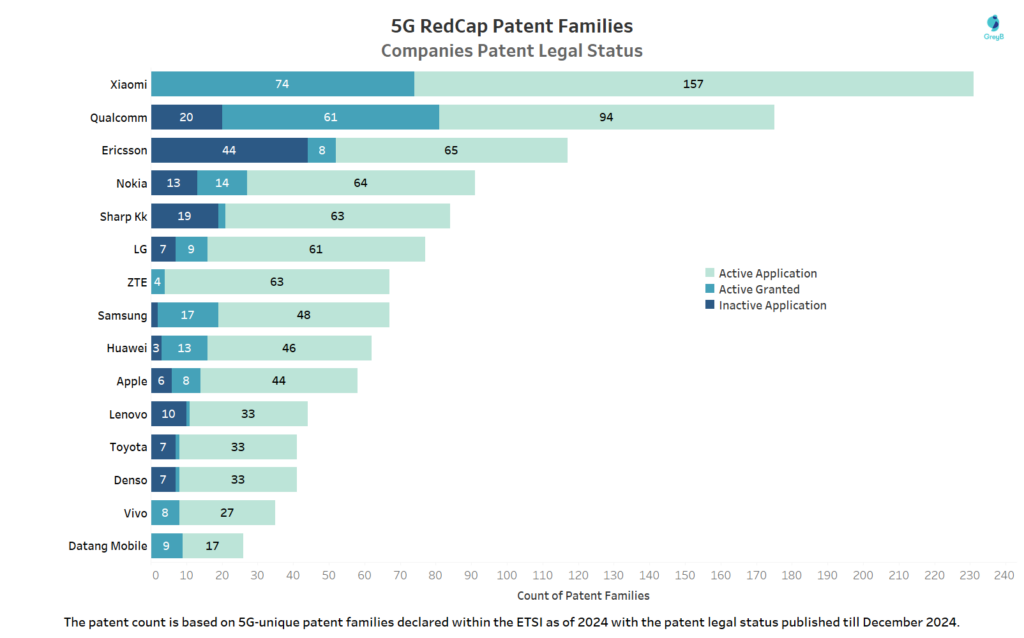

Which Companies Are Leading in Declaring 5G RedCap Core SEPs and Their Patent Legal Status?

Chinese players like Xiaomi, ZTE, Vivo and Datang Mobile are leading the charge with active patent filings, showing a clear strategy to dominate the 5G RedCap space. Their lack of inactive applications further underscores this forward-focused approach. On the other hand, Ericsson has a higher share of inactive applications, signaling a more cautious or experimental stance. Meanwhile, companies like Qualcomm and Nokia strike a balance between both active applications and granted patents, reflecting a strategic blend of innovation and consolidation.

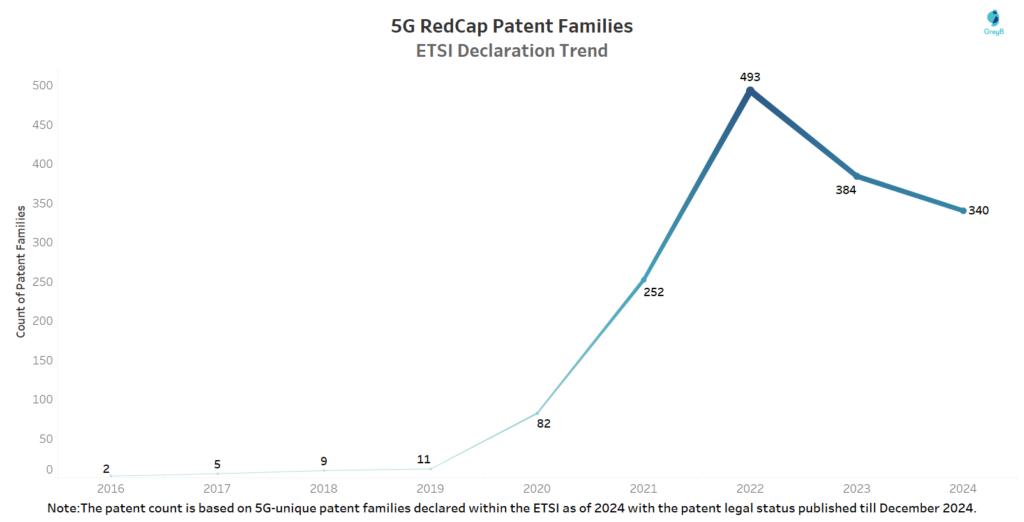

What Are the Declaration Year Trends for 5G RedCap Patent Families in ETSI Data?

This chart illustrates the yearly trends in 5G RedCap SEPs submitted to ETSI, highlighting the progression of RedCap-related advancements in the 5G ecosystem.

Which 3GPP Specifications Have the Most 5G RedCap Patent Families Declared by ETSI?

The 3GPP specification numbers (TGPP Number) serve as vital identifiers within the technical standards developed by the 3rd Generation Partnership Project (3GPP), enabling the seamless integration of mobile network technologies, including 5G. These numbers correspond to specific features or technologies, such as Reduced Capability (RedCap) technology, and play a pivotal role in mapping patents declared as 5G-related in the ETSI dataset. By linking patents to their relevant 3GPP specifications, this dataset provides valuable insights into the focus areas of innovation within RedCap technology.

| TGPP Number | 5G RedCap Patent Families | 3GPP Specification |

| 38.213 | 342 | NR; Physical layer procedures for control |

| 38.331 | 325 | NR; Radio Resource Control (RRC); Protocol specification |

| 38.321 | 168 | NR; Medium Access Control (MAC) protocol specification |

| 38.211 | 157 | NR; Physical channels and modulation |

| 38.214 | 149 | NR; Physical layer procedures for data |

| 38.212 | 115 | NR; Multiplexing and channel coding |

| 38.3 | 89 | NR; NR and NG-RAN Overall description; Stage-2 |

| 38.304 | 72 | NR; User Equipment (UE) procedures in Idle mode and in RRC Inactive state |

| 38.133 | 67 | NR; Requirements for support of radio resource management |

| 38.306 | 49 | NR; User Equipment (UE) radio access capabilities |

| 37.355 | 15 | LTE Positioning Protocol (LPP) |

| 38.322 | 14 | NR; Radio Link Control (RLC) protocol specification |

| 23.501 | 13 | System architecture for the 5G System (5GS) |

| 36.213 | 13 | Evolved Universal Terrestrial Radio Access (E-UTRA); Physical layer procedures |

| 38.215 | 13 | NR; Physical layer measurements |

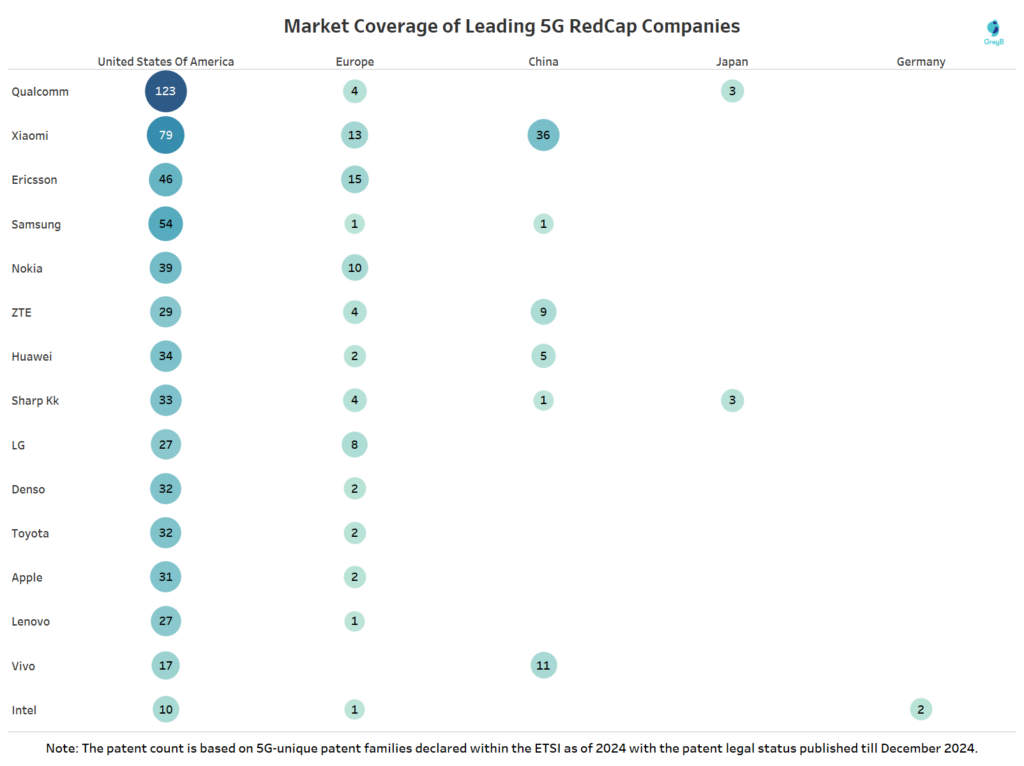

Which Companies Lead in 5G RedCap Patent Families Share in the Top 5 Countries?

The global 5G RedCap patent landscape is dominated by the United States, with Qualcomm leading the charge. China follows closely, with Xiaomi and ZTE securing significant patent filings. Europe remains engaged through Ericsson and Nokia, but with fewer patents overall. Meanwhile, Japan and Germany show limited involvement, reflecting a more selective approach to 5G RedCap innovation in these regions.

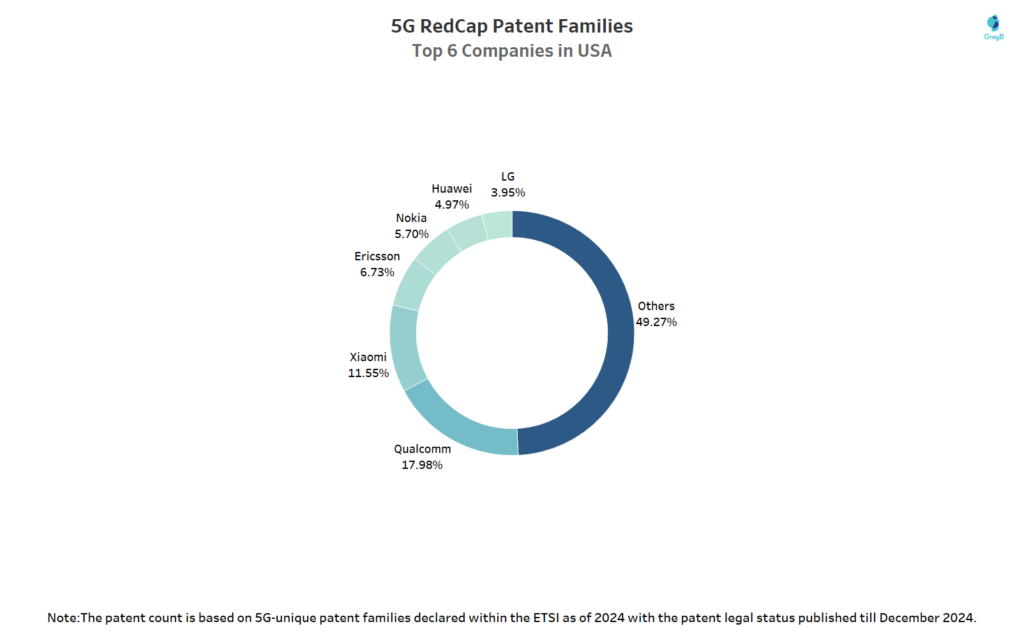

Top Companies Leading 5G RedCap Patent Families Share in the USA

Qualcomm leads the U.S. 5G RedCap patent landscape with 17.98%, followed by Xiaomi at 11.55% and Ericsson at 6.73%. Nokia and Huawei maintain steady participation with 5.70% and 4.97%, respectively. Meanwhile, nearly 50% of patents come from smaller players, showcasing the highly competitive and fragmented nature of the 5G RedCap patent ecosystem, with both established and emerging companies vying for their share of innovation.

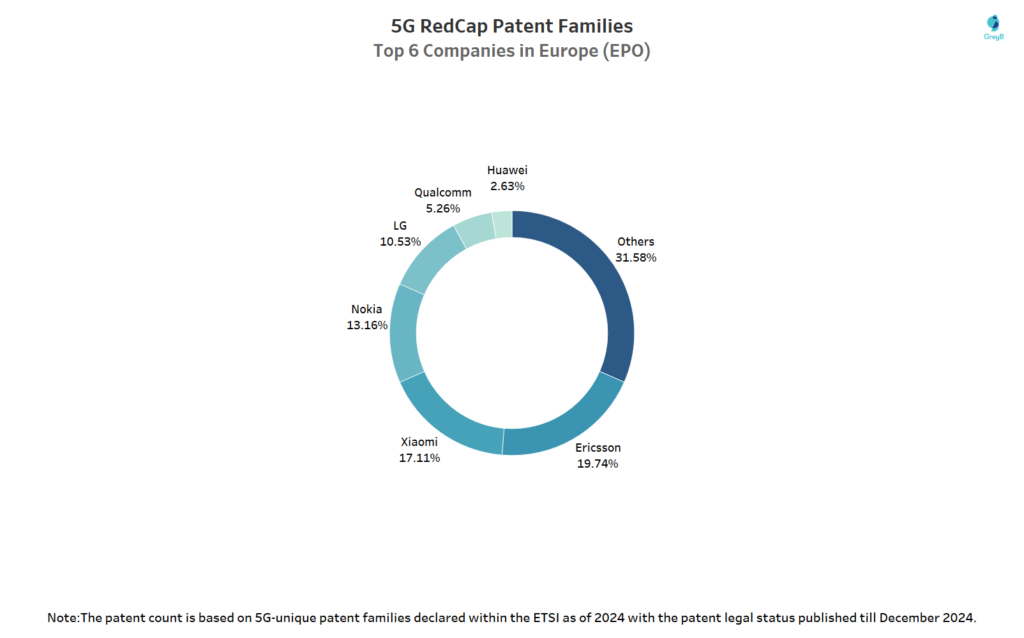

Leading Companies in 5G RedCap Patent Families across Europe (EPO)

Xiaomi leads the European 5G RedCap patent landscape with 17.11%, while Ericsson holds 19.74%, showcasing its dominance in the region. Nokia follows with 13.16%, reinforcing its strong position in European telecom. Despite Huawei’s global presence, its share in Europe is limited to 2.63%, likely due to geopolitical factors. The 31.58% share from other companies highlights a competitive and fragmented market, with various players contributing to 5G innovation in Europe.

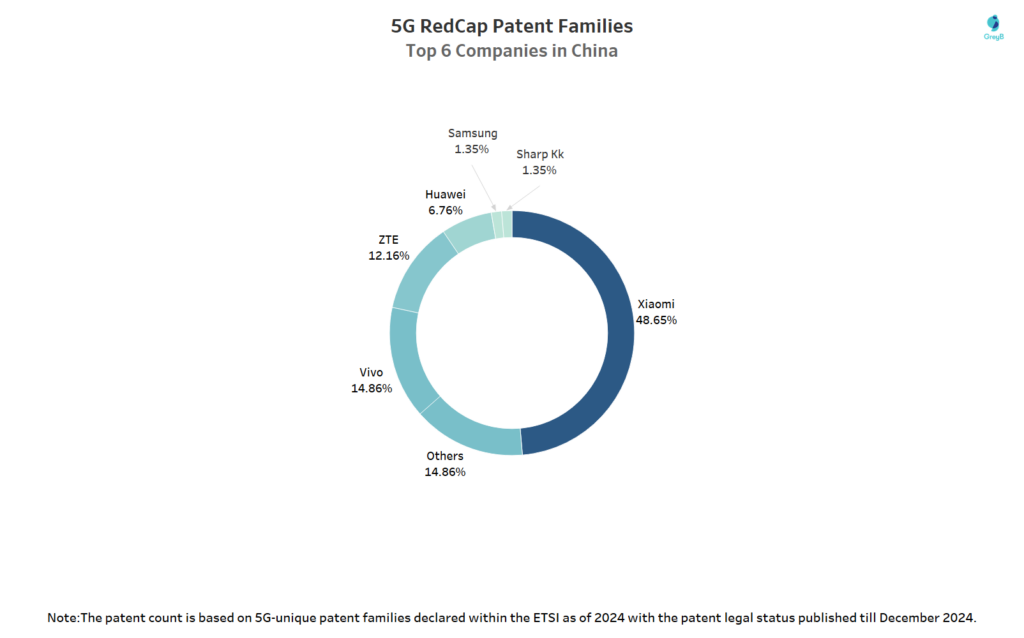

Key Players in China’s 5G RedCap Patent Families Share

Xiaomi dominates the Chinese 5G RedCap patent arena with 48.65% of the filings, indicating its aggressive strategy in the sector. Vivo and ZTE also play significant roles, with 14.86% and 12.16%, respectively. While Huawei holds a more modest 6.76%, companies like Samsung and Sharp Kk contribute only 1.35% each, showing that the Chinese market remains competitive and diverse, with significant contributions from smaller and emerging players.

Methodology

This report is based on a detailed analysis of patents and applications declared essential to the 5G standard as of 2024, listed in the ETSI 5G Declaration List. It focuses exclusively on 5G-specific technologies identified through the 3GPP portal, consolidating 4,22,827 patent documents into 84,940 patent families for a clear view of the innovation landscape. For identifying 5G RedCap SEPs declared to ETSI, we have relied on search queries to capture the patent families related to RedCap technology.

Exploring the RedCap in 5G patent landscape? Get a detailed report on key RedCap technology in 5G patents declared under the ETSI framework. Stay ahead with insights into essential filings, patent trends and competitive positioning. Fill out the form below to access expert-driven analysis.