Over the past five years (2021 – 2025), more than 90 US start-ups across 50+ industries were acquired, marking a clear shift in how innovation scales in America. While the overall trend has been steady, the real action has picked up post-2023, with sectors like Fintech, AI, Cybersecurity, and E-commerce seeing the most traction.

These aren’t just routine M&A events they are strategic blueprints revealing where capital is flowing, what technologies are gaining ground, and which start-ups have cracked the code to get acquired.

In this article, we break down the most recent acquisitions, highlight top technology sectors, and explore the profiles of acquirers shaping the innovation economy.

Do read about some interesting highlights of the US AI Startups and Recent Acquisitions of US.

How many startups are acquired in the USA every year?

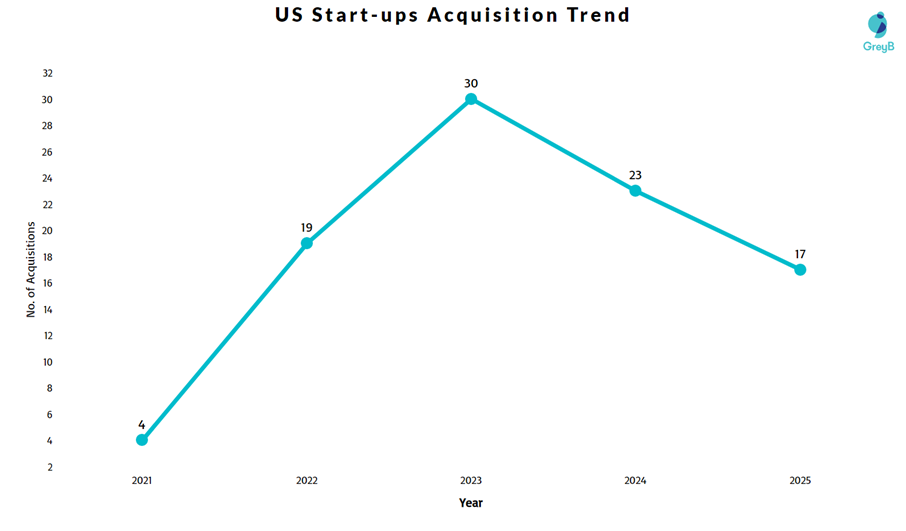

From 2021 to mid-2025, acquisitions surged from 4 in 2021 to a peak of 30 in 2023. This post-pandemic spike reflects a strategic shift: instead of building new capabilities internally, companies increasingly opt to buy innovation. Acquisitions have become an accelerated R&D model.

Which are the key technology areas where most US startup acquisitions are happening?

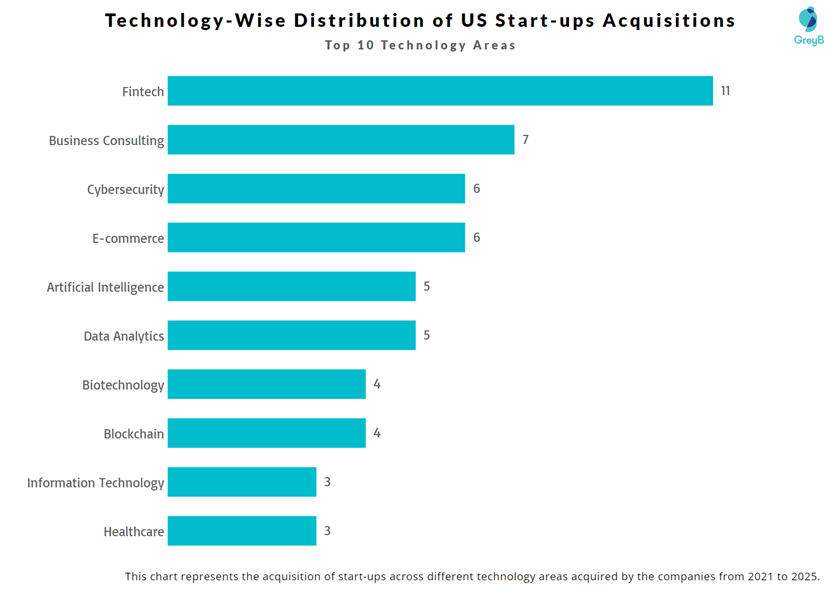

Fintech led with 11 acquisitions, reflecting strong demand for digital financial solutions. Business Consulting followed with 7 acquisitions, while Cybersecurity and E-commerce each saw 6 acquisitions, driven by the need for digital transformation and secure online platforms. Artificial Intelligence and Data Analytics had 5 acquisitions each, showing continued investment in intelligent and data-driven technologies.

Biotechnology and Blockchain recorded 4 acquisitions each, often tied to innovation and emerging tech. Information Technology and Healthcare had 3 acquisitions each. Several sectors like Social Media, SaaS, Real Estate, Biopharmaceuticals, Gaming, Finance, and Web3 saw 2 acquisitions each.

A wide range of niche industries such as HR Tech, IoT, Renewable Energy, and AdTech had 1 acquisition each, indicating targeted or early-stage investments. Overall, the trend highlights strong interest in tech-driven, future-ready industries.

Who Is Buying and Why?

While most acquirers made a single purchase, giants like IBM, Nvidia, Salesforce, and Wipro made strategic moves, often targeting firms with specialized IP or niche dominance. This indicates a high premium on proprietary tech and talent.

List of US Startup Acquisitions –

| Sr.No | Company Name | Acquired by | Industry | Acquired In |

| 1 | Capiche Research Corp | Vendr | SaaS | 2021 |

| 2 | Aligned Agility Llc | Adaptavist Holdings | Business Consulting | 2021 |

| 3 | Bloxbiz Co | Super League Enterprise | AdTech | 2021 |

| 4 | Psyassist Llc | Tripp | Healthcare | 2021 |

| 5 | Aceragen Inc (North Carolina) | Aceragen Inc | Biopharmaceuticals | 2022 |

| 6 | Trustline Inc | Linqto Inc | Finance | 2022 |

| 7 | Worksphere Technologies Inc | Envoy Inc | Office Administrative Services | 2022 |

| 8 | Mint State Labs Inc | Orange Comet Inc | Web3 | 2022 |

| 9 | Fanfixapp Inc | Superordinary | Social Media | 2022 |

| 10 | Datajoy Inc | Databricks Inc | Business Consulting | 2022 |

| 11 | Wonderblocks Labs Inc | Playstudios Inc | Gaming | 2022 |

| 12 | Furmacy Inc | Wag! Group | Real Estate | 2022 |

| 13 | Makara Digital Corp | Betterment Holdings | Fintech | 2022 |

| 14 | Peblo | Wayflyer Ltd | Fintech | 2022 |

| 15 | Fidap Inc | Nexla Inc | Data Analytics | 2022 |

| 16 | Linear Financial Technologies Llc | Amount Inc | Fintech | 2022 |

| 17 | Kno Technologies Inc | Tiny Ltd | E-commerce | 2022 |

| 18 | Openlocker Inc | Descrypto Holdings | Sports Marketing | 2022 |

| 19 | Nexlevel Gaming | Grover Gaming | Gaming | 2022 |

| 20 | Digital Payments Torana Inc | Huntington National Bank | Fintech | 2022 |

| 21 | Replier.Ai | Tailwind | Artificial Intelligence | 2022 |

| 22 | Ranta Digital Llc | Nimble Gravity | Business Consulting | 2022 |

| 23 | Autosigma Llc | Purecars | Automotive | 2022 |

| 24 | Xinthera Inc | Gilead Sciences Inc | Biotechnology | 2023 |

| 25 | Revela Inc | Oddity Tech Ltd | Biotechnology | 2023 |

| 26 | Beehiiv Inc | Menlo Media Sl | Digital Media | 2023 |

| 27 | D1 Brands Inc | Suma Brands Inc | E-commerce | 2023 |

| 28 | Haystack Oncology Inc | Quest Diagnostics | Biotechnology | 2023 |

| 29 | Nue Life Health Inc | Beckley Waves Ltd | Healthcare | 2023 |

| 30 | Neosec Inc | Akamai Technologies | Cybersecurity | 2023 |

These 90+ acquisitions are more than transactions. They represent a strategic roadmap for what’s coming next. Whether you’re an enterprise strategist, investor, or founder, understanding these patterns offers a competitive edge in navigating the next decade of innovation.

Looking for the Complete List – or Just the Ones with Patents?

This article offers a curated glimpse into the US start-ups acquisitions, but it’s not exhaustive.

If you’d like access to the full list of Start-ups acquisitions from 2021 – 2025 or a refined version showing which start-ups hold patents, just fill out the form below.