In today’s patent world, Non-Practicing Entities (NPEs) are more active and strategic than ever. Rather than manufacturing products, these entities acquire patents and enforce them through litigation-often targeting large technology companies with market-leading products.

The semiconductor and display industries, in particular, have seen a sharp rise in NPE-driven litigation. Even industry giants like Samsung Electronics are not immune. A recently concluded case highlights how a small portfolio of acquired patents can result in massive financial exposure for operating companies.

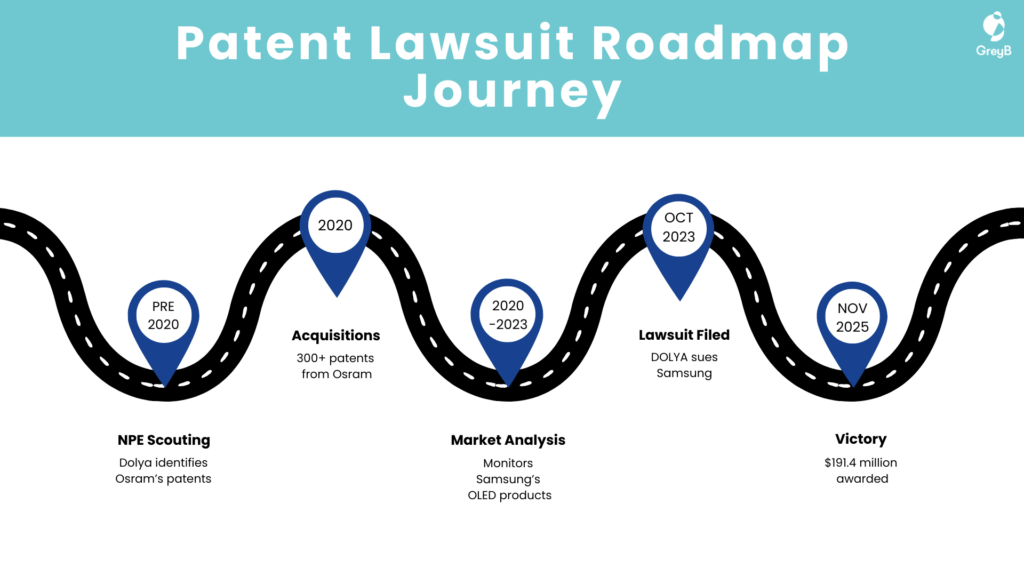

This article examines a recent NPE lawsuit against Samsung, finalized in November 2025, and explains how NPEs identify high-value patents, structure their enforcement strategy, and generate extraordinary returns.

If you’re looking to better understand NPE strategies, we recommend reading our earlier article on NPE Litigation Trend, which explains how patent acquisitions and valuation gaps drive modern patent monetization.

Are you concerned about NPEs in your industry?

We maintain a comprehensive list of over 1,000 NPEs who have been highly active in patent litigation over the last five years (2021-2025). Whether you work in semiconductors, AI, telecom, or any other field, we can help you identify which NPEs are targeting your industry.

Fill out the form below to get insights on NPEs in your domain

Case Number and Case Name

Case Name: Pictiva Displays International Ltd. v. Samsung Electronics Co Ltd et al.

Case Number: 2:23-cv-00495

Court: U.S. District Court, Eastern District of Texas

Technology Area: OLED display technology

Verdict Date: November 3, 2025

Total Damages Awarded: $191.4 million

How NPEs Find and Buy High-Value Patents

NPEs like Pictiva Displays International Ltd. (backed by Key Patent Innovations) follow a disciplined, data-driven approach to patent enforcement. Their strategy typically involves:

The NPE Strategy: Step by Step

- Scout for Technology Companies: NPEs look for smaller tech companies or legacy firms that own valuable patents but may be restructuring, selling assets, or exiting certain business lines.

- Identify High-Value Patents: They analyze patent portfolios to find patents that cover widely-used technology. In this case, OLED display technology was the goldmine.

- Acquire Patents at Lower Costs: NPEs buy these patents, often at prices far below their potential litigation value.

- Monitor the Market: They watch which big companies are using similar technology in their products.

- File Lawsuits: Once they identify clear targets with popular products using the technology, they file infringement cases.

- Win Damages or Settlements: Through court victories or settlements, NPEs earn returns that are many times higher than what they paid for the patents.

Here’s how this process worked in the Samsung case:

The Full Story: From Osram to a $191 Million Victory

In 2020, Dolya Holdco 5 Ltd acquired more than 300 patents from Osram, a well-known lighting and semiconductor technology company. Among these patents were several related to OLED display technology.

Two patents later emerged as particularly valuable (based on estimated transaction and portfolio valuations at the time of acquisition):

| Patent Number | Original Patent Value | Damages Awarded to Pictiva |

| US8314547B2 | $1.03 million | $98.8 million |

| US11828425B2 | $3.41 million | $92.6 million |

| Total | $4.44 million | $191.4 million |

After the acquisition, the patents were eventually transferred to Pictiva Displays International Ltd Rather than pursuing immediate enforcement, the NPE waited.

By 2023, Samsung had built a massive global business around OLED displays, powering flagship smartphones, premium televisions, laptops, and wearable devices. With widespread commercial adoption established, Pictiva filed an infringement lawsuit against Samsung on October 19, 2023, alleging infringement of five OLED-related patents.

Following trial, the jury found Samsung liable for infringing two of the five asserted patents. On November 3, 2025, the jury awarded $191.4 million in damages, reflecting reasonable royalty findings.

This outcome represents a return of more than 6,000% compared to the patents’ estimated original valuation.

Why This Case Matters for Your Company

This case isn’t just about Samsung. It’s a wake-up call for any company working with valuable technology, especially in semiconductors, displays, AI, and telecommunications. Here are the key takeaways:

NPEs Are Increasingly Active: Patent litigation by NPEs has increased by 20% in recent years, and they were behind most U.S. patent cases in 2025.

They Target Market Leaders: NPEs don’t sue small companies – they go after big players with deep pockets and popular products. If your company has successful products in the market, you could be next.

Patent Transfers Are Warning Signs: When you see patents being sold or transferred, especially from established tech companies to unknown entities, it often signals that litigation is coming. The USPTO’s assignment database lets you track these transfers.

High Returns Drive NPE Activity: As this case shows, NPEs can turn millions into hundreds of millions. This financial incentive means they’ll keep looking for opportunities.

How to Protect Your Company

While NPE risk cannot be eliminated, proactive IP strategy significantly reduces exposure:

- Monitor Patent Transfers: Keep an eye on who’s buying patents in your technology area. Early warning gives you time to prepare.

- Review Your Portfolio Regularly: Understand which of your patents might be valuable targets and which competitor patents could be used against you.

- Challenge Weak Patents Early: If an NPE comes after you with a questionable patent, you can file challenges with the Patent Trial and Appeal Board (PTAB) to invalidate it.

- Build Strong Defenses: Work with IP experts who understand NPE tactics and can help you create protection strategies before lawsuits happen.

- Stay Informed on Litigation Trends: Know which NPEs are active, which courts they prefer (like the Eastern District of Texas), and what technology areas they’re targeting.

For further insights into macro NPE litigation trends and acquisition strategies, check out our detailed analysis at NPE Litigation Trend

The Bottom Line

NPEs are a permanent feature of the modern patent ecosystem. The Pictiva v. Samsung case demonstrates that even the most sophisticated global companies can face substantial financial exposure from patents acquired years earlier-often without any prior direct relationship.

The real question is not whether NPEs will continue enforcing patents, but whether your company is prepared to identify risks early and respond strategically.

Protecting your intellectual property isn’t just about having patents – it’s about understanding the landscape, spotting risks early, and building smart defenses. Don’t wait until a lawsuit arrives. Take action today.

Want to identify high-value patents in your portfolio before NPEs do?

We can help you understand which patents in your portfolio – or your competitors’ portfolios – might attract NPE attention. Our expert analysis identifies valuable patents and helps you make strategic decisions to protect your business.

Fill out the form below to get started with a portfolio assessment