When the world debated Bitcoin’s next price rally in 2020, few realized another, quieter revolution was already underway, not on exchanges, but in patent offices. Behind the volatility of tokens, innovators were building something far more enduring: a patented foundation for the next financial era.

From 2020 to 2025, 27,773 cryptocurrency patents were published worldwide, each a blueprint shaping the infrastructure of tomorrow’s digital economy. These patents chronicle the global race to solve crypto’s biggest challenges, from security and privacy to payment and transaction systems that can scale across borders.

Leading this charge are nChain, State Grid Corporation of China and IBM companies united by one goal: to command the intellectual property (IP) backbone of the blockchain age. From cryptographic protocols and transaction frameworks to distributed energy trading and enterprise-grade ledgers, their portfolios reveal where competition has quietly been most intense.

By 2025, this silent IP arms race has already reshaped how the world views innovation in blockchain. Decentralized finance (DeFi) now underpins trillion-dollar ecosystems, non-fungible tokens (NFTs) redefine digital ownership, and Layer-2 scaling transforms performance bottlenecks into business opportunities. Across continents, from Silicon Valley’s AI-blockchain startups to Shenzhen’s quantum-secure payment labs, research teams continue filing for protection over zero-knowledge proofs (ZKPs), cross-chain interoperability, and post-quantum cryptography. These aren’t just buzzwords; they’re the cornerstones of the next phase in digital asset protection and blockchain scalability.

And what lies ahead is even more striking.

Analysts project the global cryptocurrency market is projected to grow at over 30 % CAGR in the next 5 years, deeper institutional adoption, DeFi maturity, tokenization of real-world assets and regulatory normalization.

This article unravels five transformative years (2020–2025) of cryptocurrency patent activity, spotlighting the innovators, technologies and trends that are setting the course toward 2030. But before we explore the breakthroughs, it’s crucial to understand the obstacles, the persistent challenges in crypto that patent intelligence is uniquely positioned to illuminate and resolve.

Key Challenges: Why the Patent Lens Matters

1. The Scalability Bottleneck

Even with rollups, sharding and Layer-2 scaling, most blockchains struggle with throughput and cost. Patent data reveals promising advances in data availability, sequencer optimization and transaction batching, technologies driving the future of blockchain scalability.

2. Balancing Privacy and Regulation

Crypto’s greatest paradox is privacy versus compliance. Innovations around zero-knowledge proofs and selective disclosure show how inventors are achieving transparency without exposing user data, reshaping the future of regulatory compliance in crypto.

3. Government Regulatory Compliance

From the US to Europe, crypto laws are evolving faster than the technology itself. The MiCA regulation in Europe, evolving SEC oversight, and periodic China crypto ban rumors all impact patent strategy. IP foresight helps firms design modular systems that adapt to jurisdictional shifts without losing compliance.

4. Cross-Chain Interoperability

The future of decentralized exchanges (DEXs) and DeFi depends on seamless chain-to-chain interaction. Patent clusters around cross-chain messaging, oracle networks and interoperability protocols show how innovators are connecting fragmented ecosystems.

5. The Quantum Threat

The next disruption won’t come from a blockchain fork but from quantum computing. The race to quantum-safe cryptography and post-quantum cryptographic standards is already underway and crypto patent filings reveal who’s preparing for that reality.

6. Security and Smart Contract Vulnerabilities

Bridge hacks, rug pulls, and wallet breaches have exposed crypto’s weakest links. Inventors are responding through patents on multi-party computation (MPC), threshold cryptography and formal verification, fortifying the backbone of smart contract security.

7. The Data Paradox: Immutability vs. Privacy Rights

Can a blockchain forget? As GDPR and privacy frameworks tighten, innovators are patenting hybrid architectures that blend on-chain transparency with off-chain erasure mechanisms, enabling compliant digital asset protection.

8. Strategic White-Space and Innovation Opportunities

Certain domains like key management and transaction processing are saturated. But patent analytics reveal untapped frontiers in Web3 patents, stablecoin infrastructure and blockchain-AI convergence, offering new arenas for IP leadership.

What will happen in Cryptocurrency in the next 5 years?

Between 2025 and 2030, the cryptocurrency industry will pivot from foundational growth to targeted, high-impact innovation, with quantum-resistant cryptography, blockchain-AI convergence, and green consensus mechanisms driving new patent filings. India is poised to emerge as a global innovation hub, while CBDCs and compliance technologies will dominate state-led IP activity. As interoperability becomes critical, cross-chain solutions will intensify competition, and the sector will enter an era of IP enforcement, where litigation and licensing define competitive edge. Security will remain paramount as the backbone of trust and resilience in the evolving digital economy.

How Have Patent Filings in Cryptocurrency Evolved Over the Years?

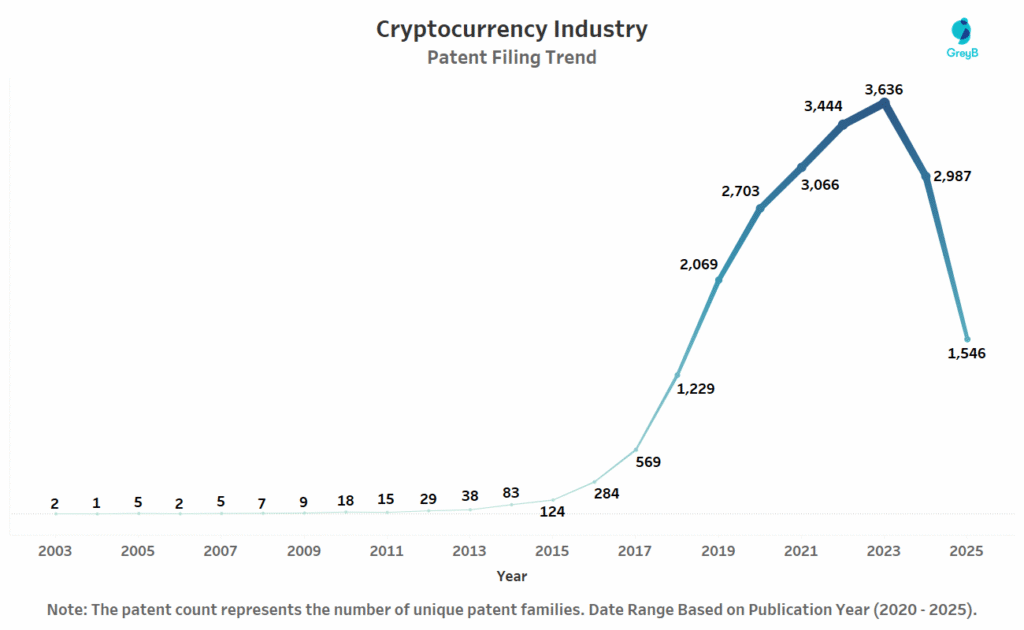

The chart illustrates the annual trend of unique cryptocurrency-related patent families published between 2006 and 2025.

For over a decade, cryptocurrency patents barely registered. It wasn’t until 2020 that filings began their dramatic climb, reflecting a broader global pivot: institutional adoption, DeFi platforms attracting billions in capital and governments beginning to seriously explore central bank digital currencies (CBDCs).

By 2023, the cryptocurrency patent landscape reached its zenith, with more than 3,600 unique families published. However, the chart also reveals a striking reversal. Publications in 2025 drop sharply, nearly halving from their peak. This decline may be due to the following possibilities:

- Patent publication lag: Many applications filed in 2023–2024 are still in the pipeline and will only appear in subsequent years, making the fall partly illusory.

- Market correction and regulatory headwinds: The 2022–2023 crypto market crash, coupled with stricter regulatory scrutiny in the US, EU and Asia, cooled the pace of speculative R&D and may have redirected patenting budgets.

- Shift in innovation focus: Instead of basic blockchain protocols, innovators are now targeting specific niches like quantum-resistant encryption, stablecoin mechanisms and AI-driven fraud detection, leading to fewer but more specialized filings.

These numbers alone don’t reveal the whole picture. A surge in filings doesn’t always translate to strong, enforceable patents. To truly gauge the durability of crypto innovation, we need to ask: how many of these patents survived examination, and what proportion were abandoned along the way? That’s where the legal status of these filings becomes critical.

What is the Patent Legal Status of the Cryptocurrency Patents?

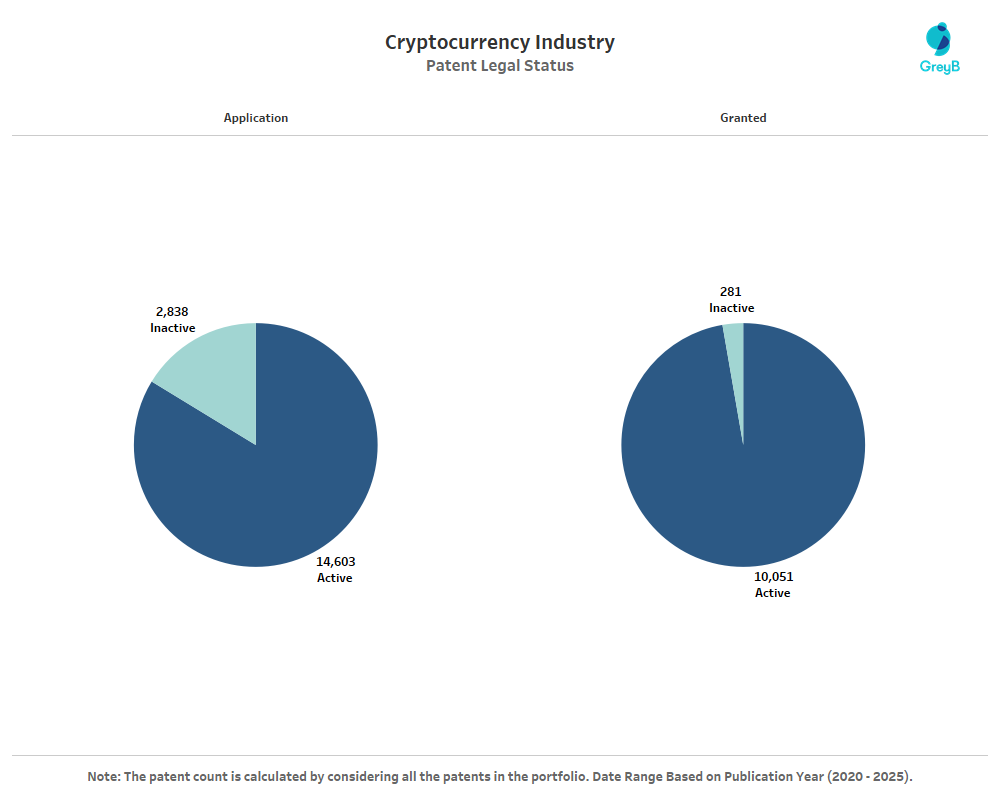

This chart shows the patent legal status of patents in the crytocurrency industry.

Numbers tell a different story when you examine not just how many patents were filed, but how many are alive and enforceable. In the cryptocurrency industry, this distinction is critical—because it reveals which innovations are still being actively defended and which ones have already lost their relevance.

On the application side, over 14,600 filings remain active, while around 2,800 have already gone inactive. This suggests that while enthusiasm for filing was high in the early boom years, not every invention survived prosecution or renewal.

On the granted side, the story is even more striking: more than 10,000 active patents are already in force, with fewer than 300 inactive. This is unusually high for a sector that grew so quickly. It highlights two important dynamics:

- High grant-to-abandonment ratio – Many crypto inventions managed to cross the hurdles of novelty and inventive step, suggesting that a large share of filings were not just speculative but technically substantive.

- Aggressive protection strategies – Large corporations and blockchain-native firms alike are holding on to their granted assets, reinforcing the sense that these patents are seen as strategic weapons in an industry where ownership of protocols and transaction methods can influence entire markets.

However, the real story lies in what kind of technologies are being patented. Are companies protecting transaction systems, compliance architectures or next-generation cryptographic methods? In the next section, we’ll break down the top technology areas in cryptocurrency patenting—and reveal where innovators are betting on the future.

Which Technologies Dominate the Cryptocurrency Patent Landscape?

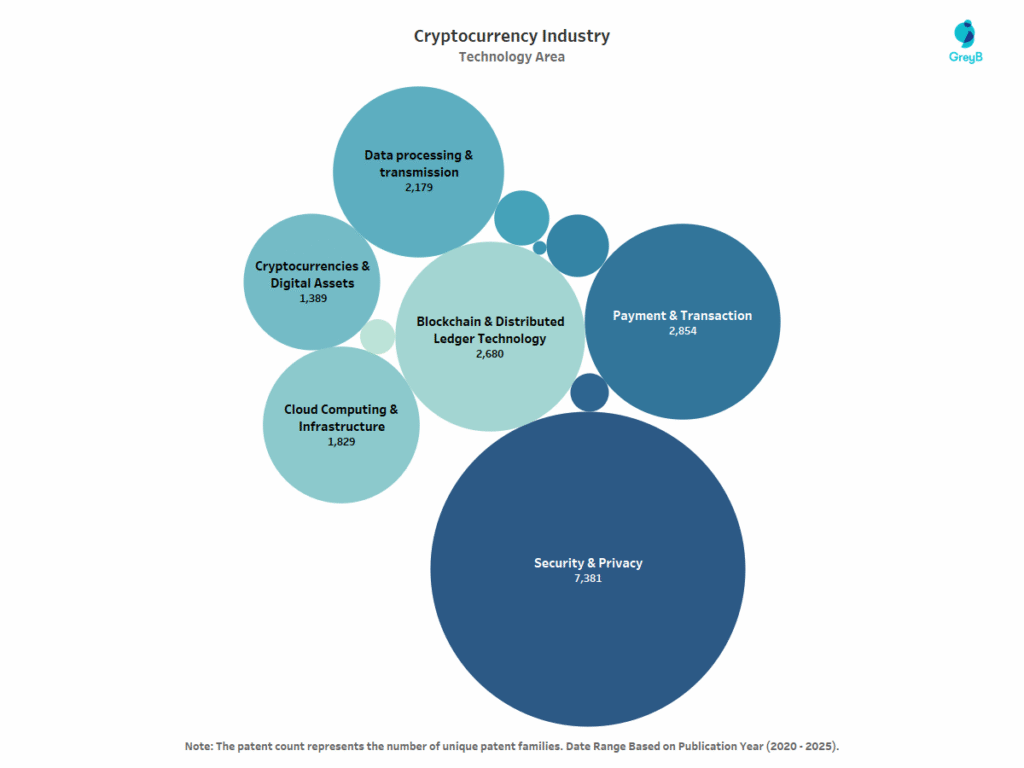

The chart highlights the top technology areas of cryptocurrency-related patents published between 2020 and 2025.

A quick glance at the technology distribution tells us one thing: in cryptocurrency, trust is everything. More than 7,300 patent families, the single largest cluster, are focused on Security & Privacy. This dominance reflects the very foundation of digital currencies: if users cannot trust that their transactions are secure, or that their assets are protected from cyberattacks, the system collapses.

The second-largest block, Payment & Transaction technologies (2,854 families), underscores the industry’s push to make cryptocurrencies usable beyond speculation. Companies like Visa and Mastercard have actively filed in this space, reflecting their efforts to integrate blockchain with existing payment infrastructure.

What this distribution shows is a layered innovation ecosystem: at the base lies infrastructure and security, on top of which payments, transactions and assets are built. This patent footprint reflects both where the industry has been, solving for trust and scalability, and where it is heading, toward mass adoption and integration with existing financial systems.

The technology priorities evolve as new challenges and opportunities emerge. To understand the true trajectory of crypto innovation, we must look at how these technology areas have shifted over time. In the next section, we’ll explore the yearwise evolution of technology domains in cryptocurrency patents.

How Have Cryptocurrency Technology Areas Shifted Over the Years?

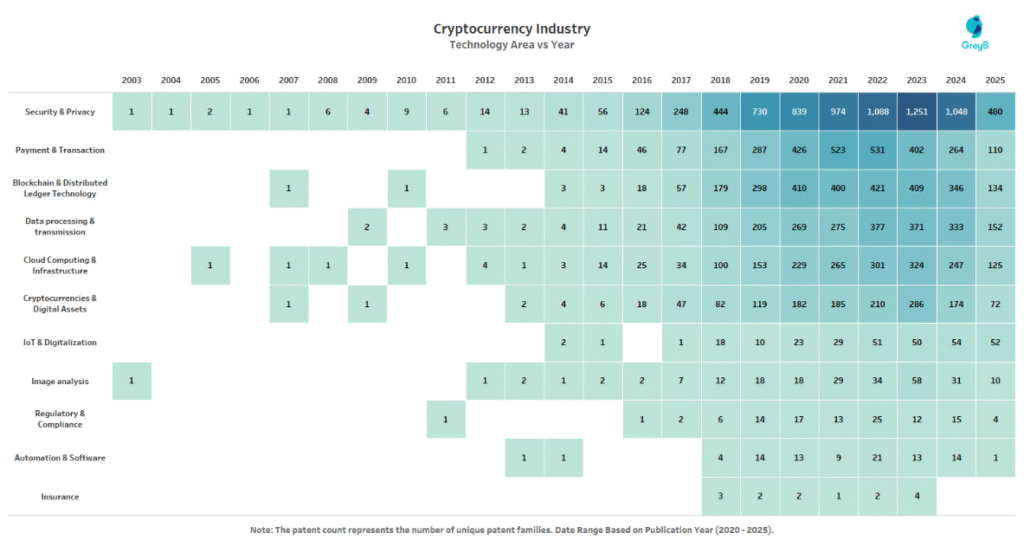

The chart tracks the yearwise distribution of cryptocurrency-related patent families from 2003 to 2025, segmented by technology areas.

The cryptocurrency innovation journey is not just about volume, it’s about where innovators chose to focus at different points in time. This chart shows that story vividly.

In the early 2000s to 2010s, filings were sporadic. A handful of patents touched on cloud infrastructure, digital assets and distributed ledger ideas. At this stage, the technology was experimental, with inventors laying the groundwork for concepts that would later become central to the crypto ecosystem.

Things changed dramatically around 2016–2017, when Security & Privacy patents began to surge. This coincides with the first mainstream crypto boom, where exchange hacks and wallet breaches became front-page news. Companies recognized that without robust cryptographic protections, blockchain adoption would falter. By 2020, security filings hit 839 families, cementing this domain as the backbone of crypto IP.

Post-2020, Blockchain & Distributed Ledger Technology patents gained momentum, peaking in 2021–2022, reflecting the DeFi boom and innovations in consensus models, interoperability, and smart contracts.

By 2023–2024, the technology map was more diversified than ever: Security, Payments, Infrastructure and Compliance had become the four pillars of crypto innovation. This diversification suggests a sector moving beyond speculative hype toward integration with mainstream finance, enterprise systems and digital infrastructure.

Behind these trends lie the companies that are shaping the IP battlefield. In the next section, we’ll examine the top assignees in the cryptocurrency patent landscape and uncover who is building the strongest portfolios to control the future of digital finance.

Who Are the Top Companies in the Cryptocurrency Patent Race?

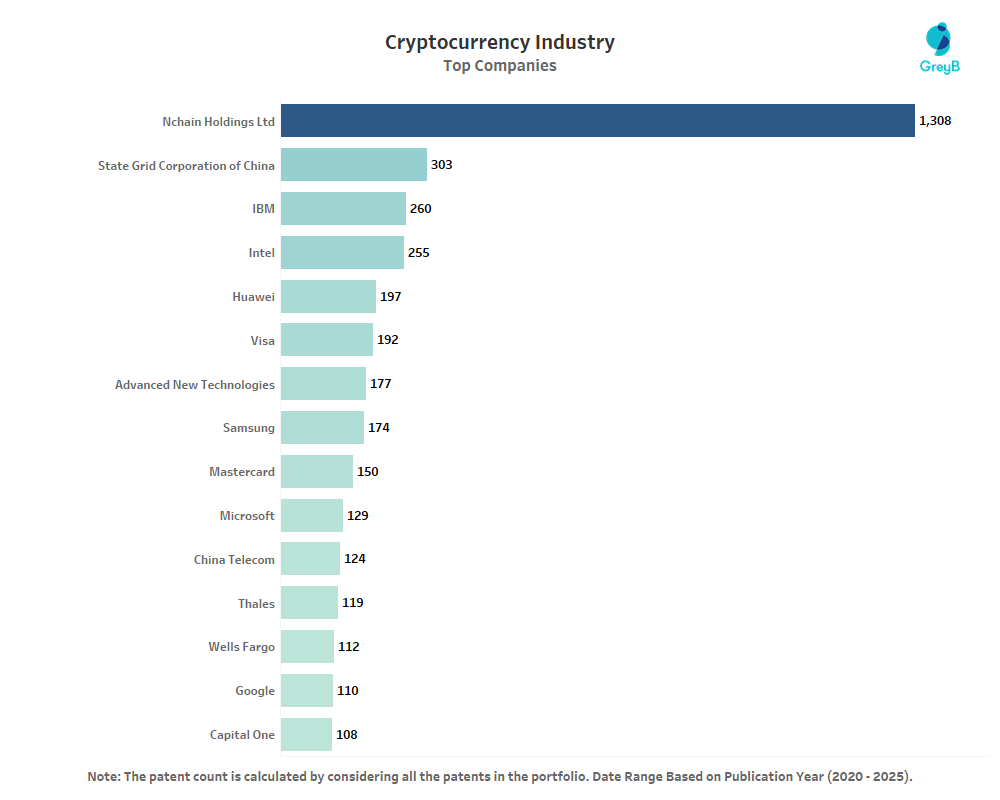

The chart lists the top companies in cryptocurrency patents between 2020 and 2025.

Behind every wave of filings lies a handful of companies driving the momentum—and in cryptocurrency, one name towers over the rest: Nchain Holdings Ltd, with an astonishing 1,308 patents. This volume is more than four times that of the next assignee and reflects Nchain’s strategy of aggressively securing IP rights around blockchain protocols and Bitcoin SV applications.

Tech multinationals also make their presence felt. IBMand Intelhave long histories of patenting in emerging technologies. Their crypto-related filings span blockchain infrastructure, security and integration with enterprise systems mirroring their broader push to own the digital backbone of next-gen finance and computing. Huaweisimilarly reflects China’s dual focus on telecommunications and digital assets, leveraging its expertise in cryptography and 5G/IoT connectivity.

The list also reveals unexpected entrants: China Telecom, Thales and Microsoft are carving positions that bridge digital security, infrastructure and fintech applications. The presence of Google underscores the growing overlap between crypto, AI, and cloud ecosystems.

Taken together, this landscape shows a fascinating mix: blockchain-native companies racing for dominance, financial giants patenting their future rails and tech titans weaving crypto into broader ecosystems.

However, the filing volumes alone don’t capture the full picture. Timing matters just as much as numbers. Did these companies join the race early, shaping the foundations or are they late entrants trying to catch up? To answer that, our next section will examine the yearwise trend of filings by the top assignees, revealing who led the early surge and who is driving innovation today.

How Have Patent Filing Trends Evolved Among Leading Cryptocurrency Companies?

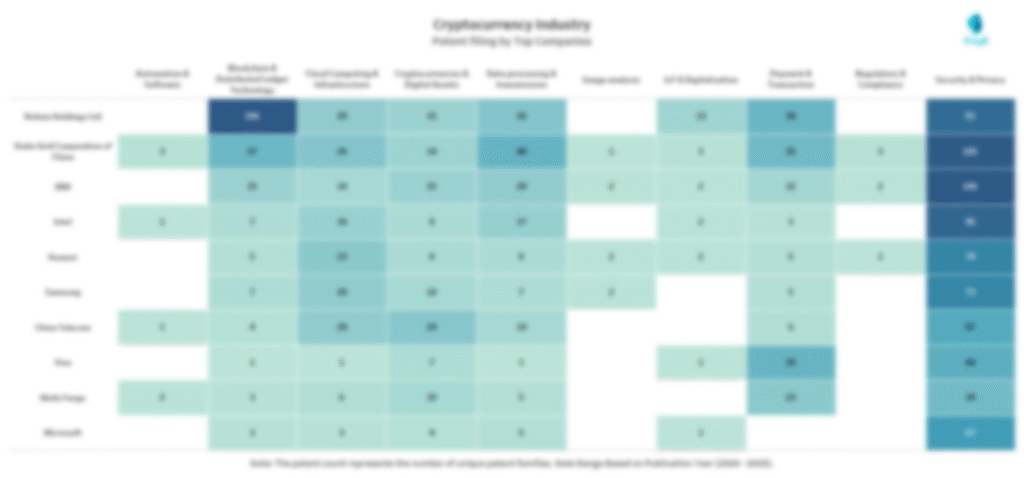

Which Companies Are Leading in Specific Cryptocurrency Technologies?

The first wave of cryptocurrency patents was all about who moved fastest — but the next one is about who’s filing smarter.

Behind the scenes, companies are quietly shaping the future of blockchain innovation through filings in security, interoperability, and quantum-resilient technologies.

Curious to see which players are leading the charge?

Unlock the complete Cryptocurrency Patent Trend Report to view the full charts, uncover hidden leaders, and explore emerging technologies defining the next era of digital finance.

Which Countries Are Leading the Global Race for Cryptocurrency Patents?

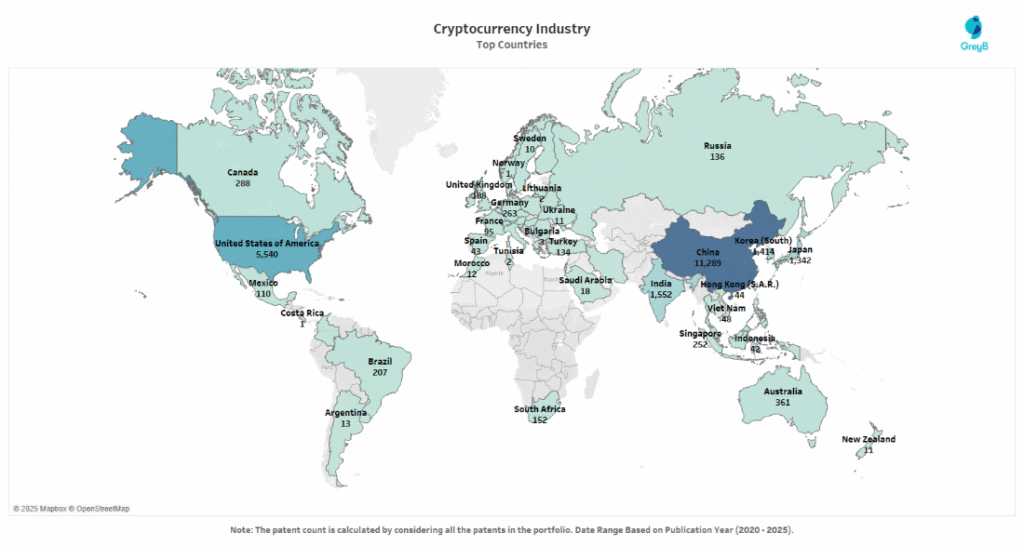

The map shows the global distribution of cryptocurrency-related patents published between 2020 and 2025.

When it comes to cryptocurrency patents, innovation is as much a geopolitical race as it is a technological one. China dominates the landscape, with over 11,000 patents, aligning with China’s rollout of the Digital Yuan (e-CNY), state-backed blockchain pilots and its 2019 designation of blockchain as a strategic technology.

The United States follows with 5,540 patents, cementing its position as a hub for enterprise blockchain innovation and fintech integration. Unlike China’s state-led surge, US patents are driven by private players, financial institutions like Visa, Mastercard and Capital One, as well as tech giants like IBM, Intel and Microsoft.

Europe shows fragmented but meaningful contributions: the UK, Germany and France lead within the EU, with patents centered on compliance, digital banking, and enterprise applications. This reflects the region’s cautious but steady approach, shaped by the EU’s MiCA (Markets in Crypto Assets Regulation) framework.

What stands out is the duality of leadership: China’s filings represent a state-directed, infrastructure-first approach, while the US reflects a market-driven, enterprise-led strategy. Meanwhile, Asia-Pacific economies like Korea, Japan, and India show how regional champions are carving their own niches.

To understand the momentum of these countries in cryptocurrency, we need to see how their filing activity has evolved over time. Have China and the US maintained consistent growth, or are others like India and Korea accelerating faster in recent years? In the next section, we’ll analyze the yearwise evolution of patent filings across top countries to reveal shifting centers of gravity in the crypto innovation race.

How Have Leading Countries Evolved in Cryptocurrency Patent Over Time?

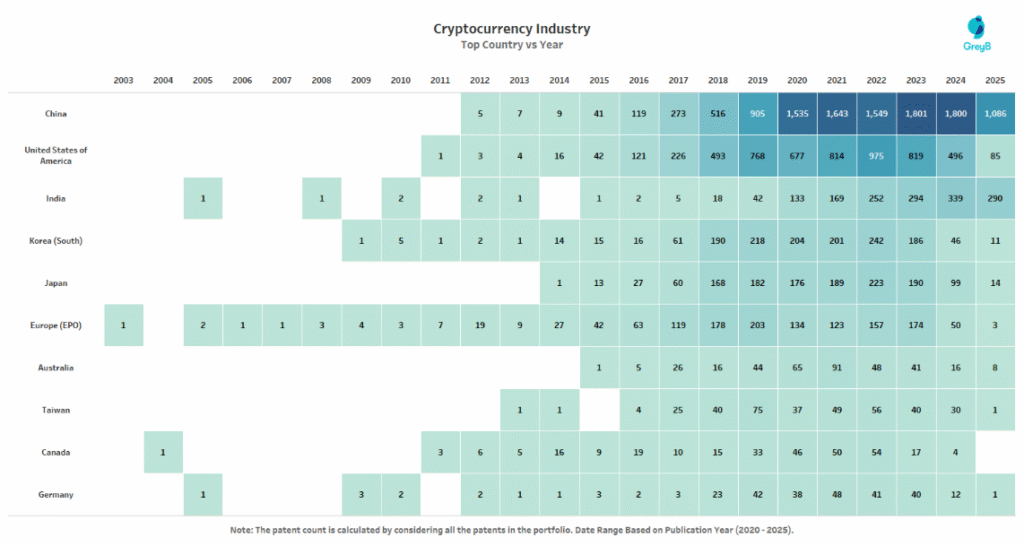

The chart illustrates cryptocurrency-related patents across top countries.

Looking at filings over time, the cryptocurrency patent race resembles a relay, different countries accelerating at different moments, each shaping the global landscape in its own way.

China’s trajectory is the most dramatic. From zero activity before 2012, filings exploded after 2016, reaching over 1,500 families annually by 2020 and peaking above 1,800 in 2023. This surge aligns with Beijing’s blockchain-first national strategy, coupled with its aggressive rollout of the Digital Yuan.

The United States, in contrast, shows a steadier but still powerful climb. Beginning with small numbers in 2011, filings rose sharply after 2016, reaching 900+ families by 2023. Unlike China’s state-led surge, the US story is enterprise-driven, pushed by financial institutions like Visa and Mastercard, and tech giants like IBM and Microsoft.

India’s rise is one of the most striking shifts. With virtually no presence before 2015, filings picked up after 2018. This growth is remarkable given India’s regulatory uncertainty, reflecting how its IT service providers, fintech startups and global R&D centers are increasingly driving blockchain innovation, particularly in payments, identity verification and supply chains.

But filing volumes alone don’t capture what countries are betting on. The next question is: Which technologies dominate each country’s portfolios? In the next section, we’ll examine the key technology areas by top countries, revealing whether they are prioritizing security, payments, infrastructure, or compliance in the cryptocurrency landscape.

What Technologies Are Countries Prioritizing in the Cryptocurrency Patent Race?

The chart breaks down the top technology areas protected by different countries in the cryptocurrency industry.

From China’s blockchain infrastructure push to the U.S. pivot toward enterprise compliance, every filing now signals intent, strategy, and control.

Explore the complete Cryptocurrency Patent Trend Report for exclusive insights into where innovation is moving, who’s filing with purpose and how IP portfolios are becoming the new battleground for digital finance.