The deployment of 5G networks is accelerating, but as with any technological leap, it brings its own set of challenges. One of the most pressing is ensuring that backhaul—the critical link between the access network and the core infrastructure—can handle the sheer volume of data that 5G promises to deliver. This is where Integrated Access and Backhaul (IAB) technology steps in, combining both access and backhaul functions into a single, integrated solution. IAB is quickly emerging as a cornerstone of efficient 5G deployment, allowing for faster, more cost-effective network rollouts in both urban and remote areas.

As telecom operators and technology developers adopt this approach, they are increasingly turning to patent filings to safeguard their innovations and establish industry standards. By analyzing patent data from the European Telecommunications Standards Institute (ETSI), we gain valuable insights into how IAB is transforming 5G technology—paving the way for more scalable, efficient, and cost-effective network solutions.

5G innovations like IAB are reshaping network access and backhaul. Discover the latest ETSI-declared 5G patents defining the next era of telecom.

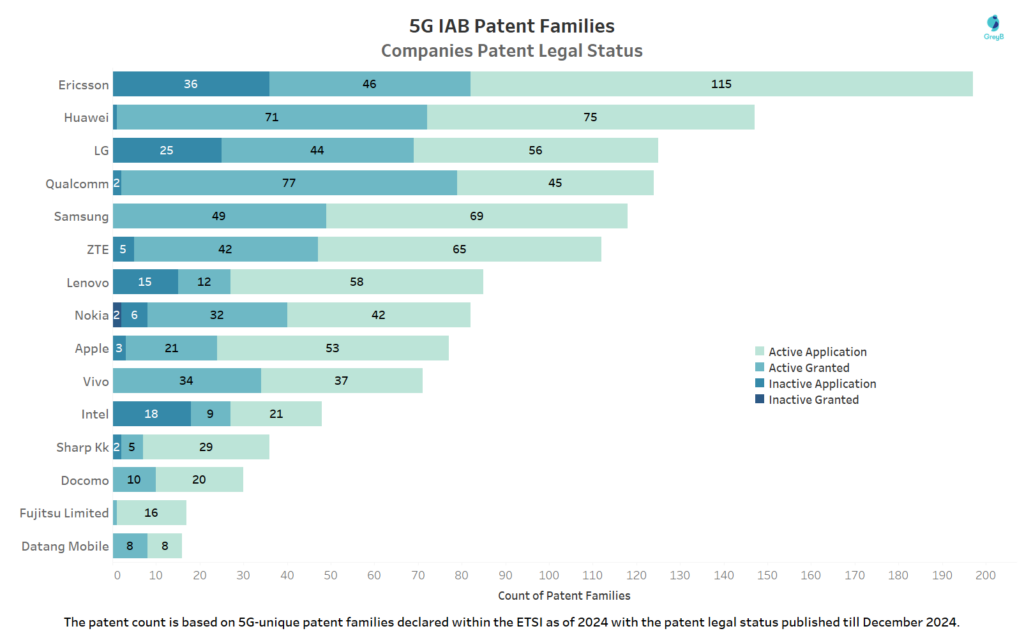

Which Companies Are Leading in Declaring 5G IAB Core SEPs and Their Patent Legal Status?

Ericsson leads the IAB technology patent landscape, followed closely by Huawei, with Qualcomm holding the highest number of active granted patents. Companies like Samsung, Vivo, Docomo, Fujitsu Limited and Datang Mobile have only active applications and active granted patents. As IAB technology evolves, the concentration of active patents from these major players highlights their strategic role in shaping 5G network architecture.

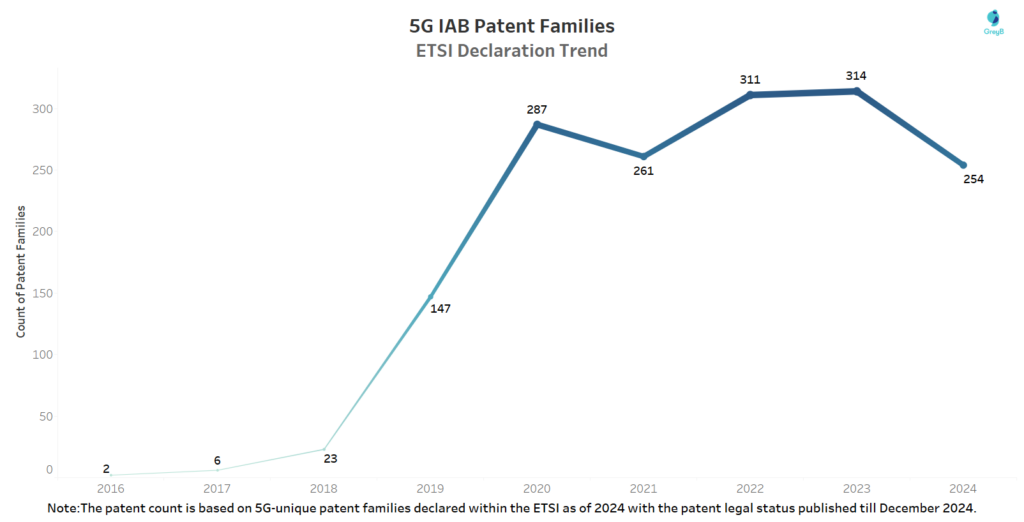

What Are the Declaration Year Trends for 5G IAB Patent Families in ETSI Data?

This chart illustrates the yearly trends in 5G IAB SEPs submitted to ETSI, highlighting the progression of IAB-related advancements in the 5G ecosystem.

Which 3GPP Specifications Have the Most 5G IAB Patent Families Declared by ETSI?

The 3GPP specification numbers (TGPP Number) serve as vital identifiers within the technical standards developed by the 3rd Generation Partnership Project (3GPP), enabling the seamless integration of mobile network technologies, including 5G. These numbers correspond to specific features or technologies, such as Integrated Access and Backhaul (IAB) technology, and play a pivotal role in mapping patents declared as 5G-related in the ETSI dataset. By linking patents to their relevant 3GPP specifications, this dataset provides valuable insights into the focus areas of innovation within IAB technology.

| TGPP Number | 5G IAB Patent Families | 3GPP Specification |

| 38.331 | 368 | NR; Radio Resource Control (RRC); Protocol specification |

| 38.213 | 218 | NR; Physical layer procedures for control |

| 38.321 | 200 | NR; Medium Access Control (MAC) protocol specification |

| 38.3 | 158 | NR; NR and NG-RAN Overall description; Stage-2 |

| 38.473 | 127 | NG-RAN; F1 Application Protocol (F1AP) |

| 38.211 | 110 | NR; Physical channels and modulation |

| 38.214 | 98 | NR; Physical layer procedures for data |

| 38.212 | 89 | NR; Multiplexing and channel coding |

| 38.423 | 74 | NG-RAN; Xn Application Protocol (XnAP) |

| 38.401 | 57 | NG-RAN; Architecture description |

| 38.34 | 48 | NR; Backhaul Adaptation Protocol (BAP) specification |

| 38.201 | 33 | NR; Physical layer; General description |

| 38.306 | 29 | NR; User Equipment (UE) radio access capabilities |

| 23.501 | 28 | System architecture for the 5G System (5GS) |

| 38.413 | 24 | NG-RAN; NG Application Protocol (NGAP) |

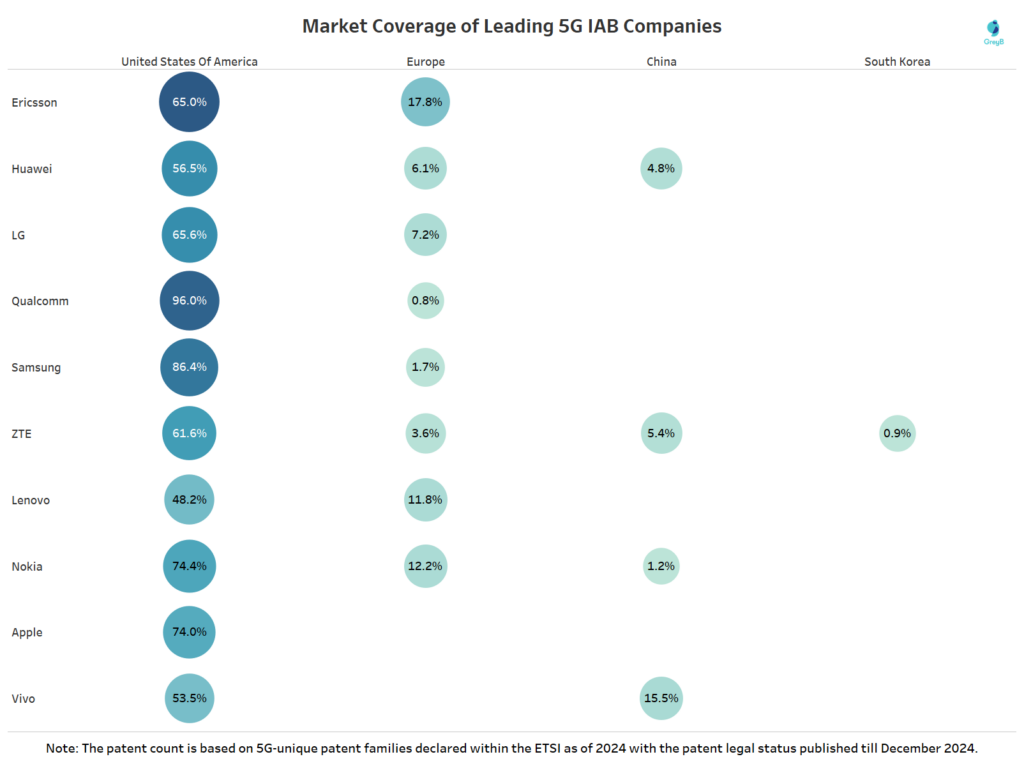

Which Companies Lead in 5G IAB Patent Families Share in the Top Countries?

Qualcomm leads the U.S. market with an impressive 96% share of IAB technology patents, showcasing its dominance in the telecom innovation space. Ericsson and LG also maintain strong global coverage, with Ericsson excelling in both the U.S. and Europe. Vivo leads in China, securing 15.5% of the market, while ZTE is the only company with patent share in South Korea. These trends underscore the strategic positioning of key players shaping the global 5G IAB patent landscape.

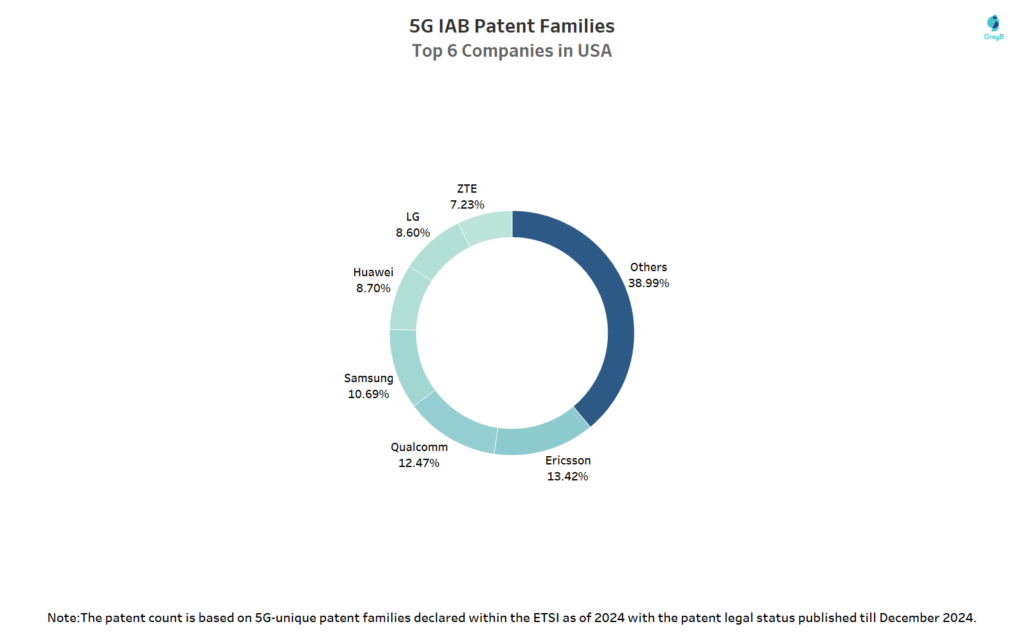

Top Companies Leading 5G IAB Patent Families Share in the USA

Ericsson leads the 5G IAB patent landscape in the U.S. with 13.42% of patent families, closely followed by Qualcomm at 12.47%. Samsung, Huawei, and LG also hold strong positions, while ZTE maintains a modest share. Notably, nearly 39% of patents belong to other companies, highlighting a diverse and competitive innovation ecosystem in the U.S. 5G IAB market.

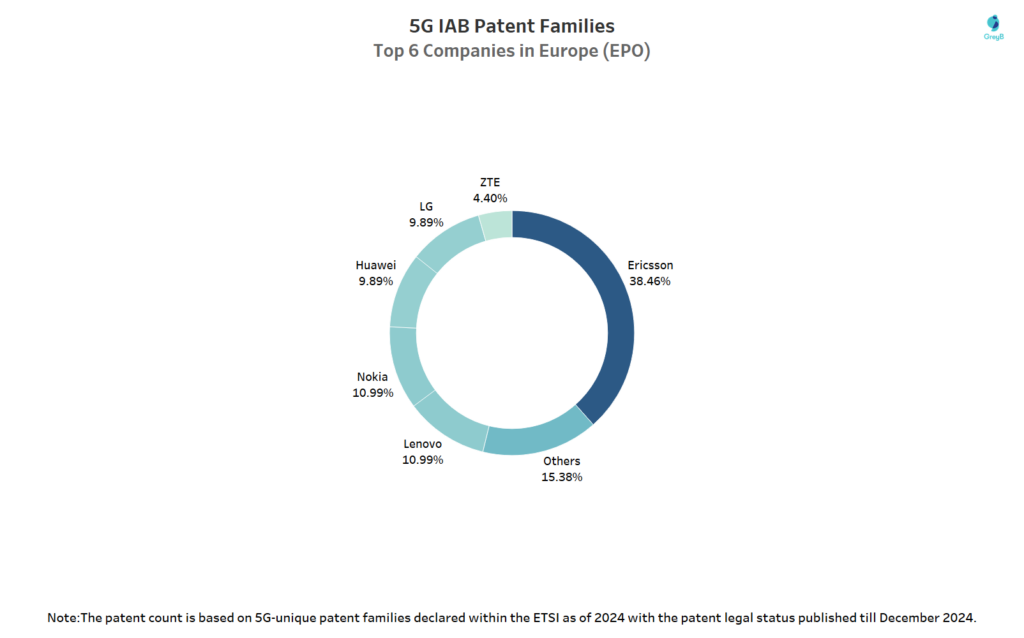

Leading Companies in 5G IAB Patent Families across Europe (EPO)

Ericsson dominates the European 5G IAB patent landscape with 38.46%, significantly ahead of Lenovo and Nokia each holding around 10%. ZTE has a smaller share, while 15.38% of patents belong to other players, indicating a diverse and competitive market shaping the region’s 5G infrastructure.

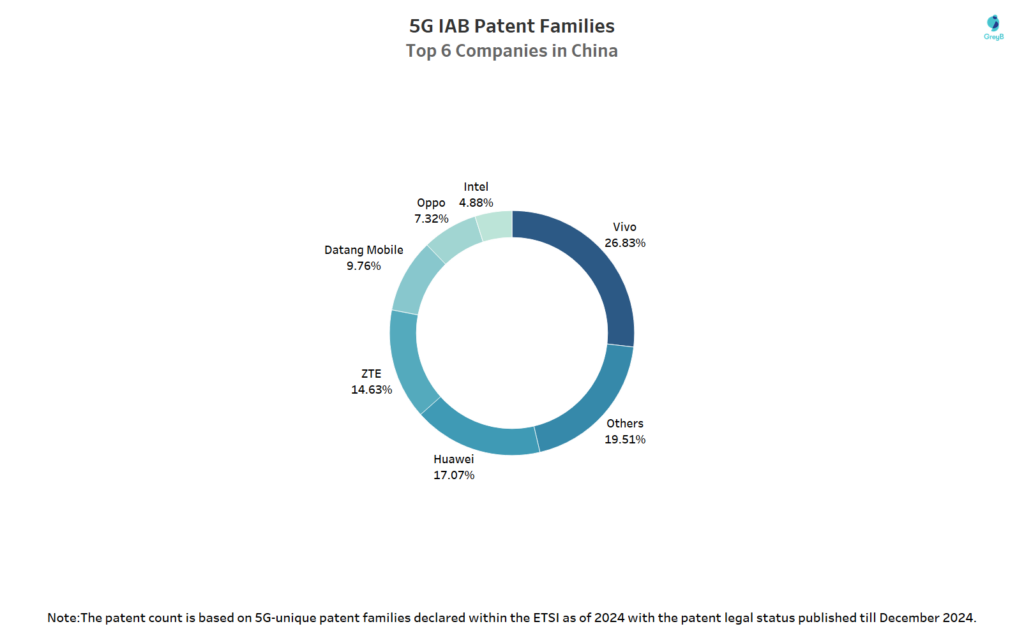

Key Players in China’s 5G IAB Patent Families Share

Vivo leads China’s 5G IAB patent landscape with 26.83%, followed by Huawei (17.07%) and ZTE (14.63%), reinforcing their dominance in telecom innovation. Datang Mobile, Oppo, and Intel also hold notable shares, with Intel being the only non-Chinese player in the top six. The 19.51% patent share from other companies highlights a diverse and competitive innovation environment in China’s 5G IAB space.

Methodology

This report is based on a detailed analysis of patents and applications declared essential to the 5G standard as of 2024, listed in the ETSI 5G Declaration List. It focuses exclusively on 5G-specific technologies identified through the 3GPP portal, consolidating 4,22,827 patent documents into 84,940 patent families for a clear view of the innovation landscape. For identifying 5G IAB SEPs declared to ETSI, we have relied on search queries to capture the patent families related to IAB technology.

Exploring the IAB in 5G patent landscape? Get a detailed report on key IAB technology in 5G patents declared under the ETSI framework. Stay ahead with insights into essential filings, patent trends and competitive positioning. Fill out the form below to access expert-driven analysis.