In 2025, as the world faces rising energy demands, a quiet revolution is reshaping the nuclear energy landscape. It’s not the hum of power grids that signals this shift, but the surge in nuclear energy innovation reflected in the filing of patents.

Small Modular Reactors (SMRs) are at the forefront of this transformation. Companies like NuScale and Rolls-Royce are pushing the boundaries with compact, scalable reactors designed to deliver efficient, clean energy to diverse communities. NuScale’s VOYGR and Rolls-Royce’s AP300 are setting new benchmarks for what’s possible in nuclear technology.

At the same time, the fusion energy sector is experiencing a surge in activity. Proxima Fusion, a German startup, has unveiled open-source plans for a commercial nuclear-fusion power plant while tech giants such as Google are accelerating progress by backing companies like Commonwealth Fusion Systems.

Behind these technological strides, Intellectual Property (IP) is playing a crucial role. NANO Nuclear Energy, for example, has fortified its position with four new patent applications related to its Annular Linear Induction Pump (ALIP) technology, a key component for liquid metal and molten salt-based nuclear reactors, underscoring the strategic importance of IP in the sector.

In this article, we’ll explore how patent trends are shaping the future of nuclear energy, offering key insights into technological advancements and the role of IP in this rapidly evolving industry.

How Have Patent Filings in the Nuclear Energy Industry Evolved Over the Years?

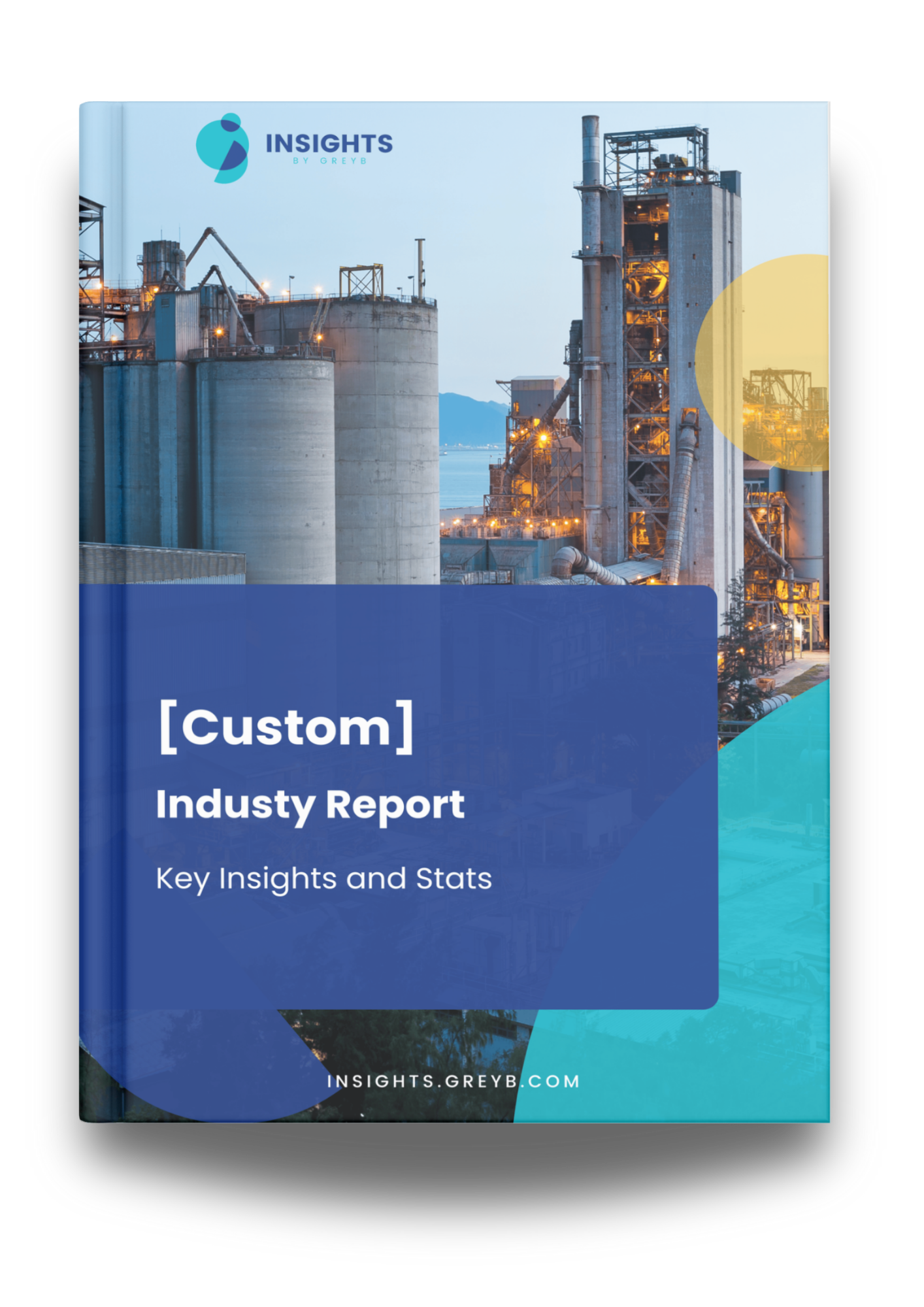

This chart illustrates the annual patent filing trend in the nuclear energy sector from 2006 to 2024.

From 2006 to 2022, patent filings in the nuclear energy sector saw a remarkable rise, peaking at over 31,000 patents in 2022. This surge reflects rapid advancements in nuclear technologies, including Small Modular Reactors (SMRs) and fusion energy innovations.

However, the dip in patent filings over the past two years, dropping to around 17,000 in 2024 and around 3000 in 2025, doesn’t indicate a slowdown. This is because patent applications can take up to 18 months to be published, meaning the filings from recent years are likely still in the pipeline. This trend highlights the industry’s dynamic pace and the critical role of intellectual property in shaping the future of nuclear energy.

What Is the Grant Timeline for Patents in the Nuclear Energy Industry?

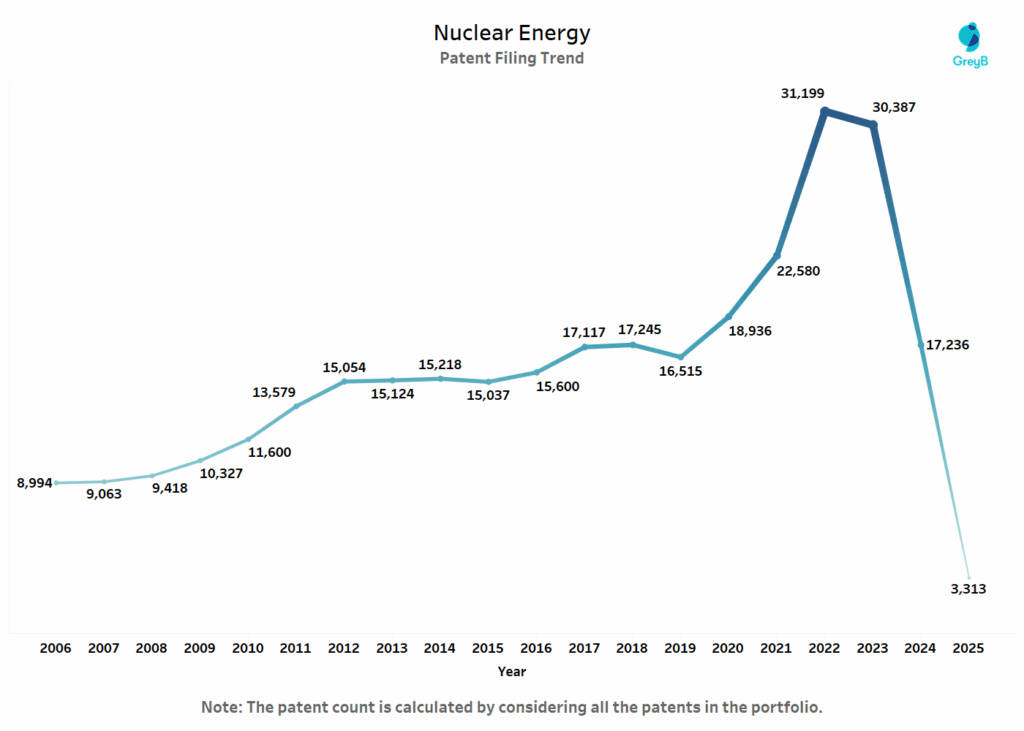

This chart illustrates the distribution of nuclear energy patents granted across different timelines.

The chart above shows the patent grant timeline for nuclear energy patents, reflecting the typical wait times for patent approvals. Notably, the largest number of patents are granted within the 25–36 month range, with 59,852 patents granted in that period. This highlights that while patent filings surge, it takes several years for those patents to go through the rigorous process of approval.

The second highest number of grants falls in the 13–24 months range (57,168), while the 7–12 month range also sees significant activity with 39,206 patents granted. On the other end, patents granted in the first 6 months (28,658) and those granted after 37–48 months (49,284) show relatively fewer approvals, reflecting the longer process of scrutiny and examination during patent approval.

Which Countries Are Leading the Global Nuclear Energy Patent Race?

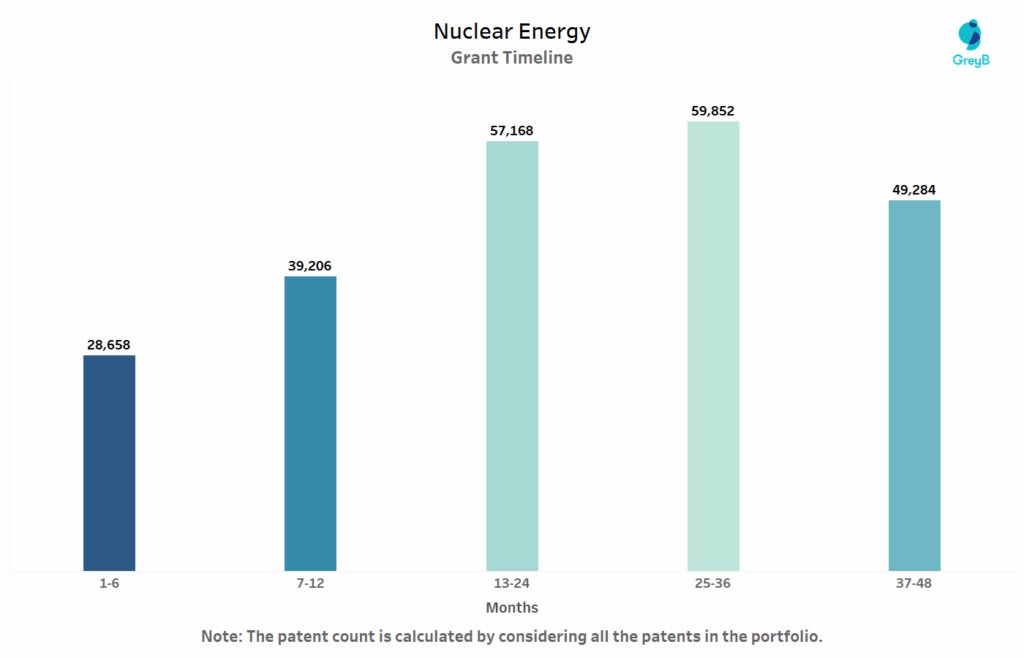

The chart offers a visual representation of where most nuclear energy patents are being filed globally, highlighting the countries driving technological advancements in the sector.

The global landscape of nuclear energy innovation is dominated by a few countries, with China leading the charge by a significant margin, holding a staggering 137,765 patents. The United States follows closely behind with 63,297 patents, while Japan and South Korea also contribute significantly, with 90,982 and 23,722 patents, respectively. These countries are not only pioneers in nuclear energy development but also major players in patent filings, demonstrating their leadership in the race for clean and sustainable energy solutions.

Other notable contributors include Germany, France and Great Britain, highlighting their ongoing commitment to nuclear energy research. Meanwhile, countries like India, Russia and Brazil also contribute to the global patent pool, albeit at a smaller scale. The chart clearly illustrates the geographical concentration of nuclear energy innovation, with a few countries consistently leading the way in patent filings, while others are still emerging players.

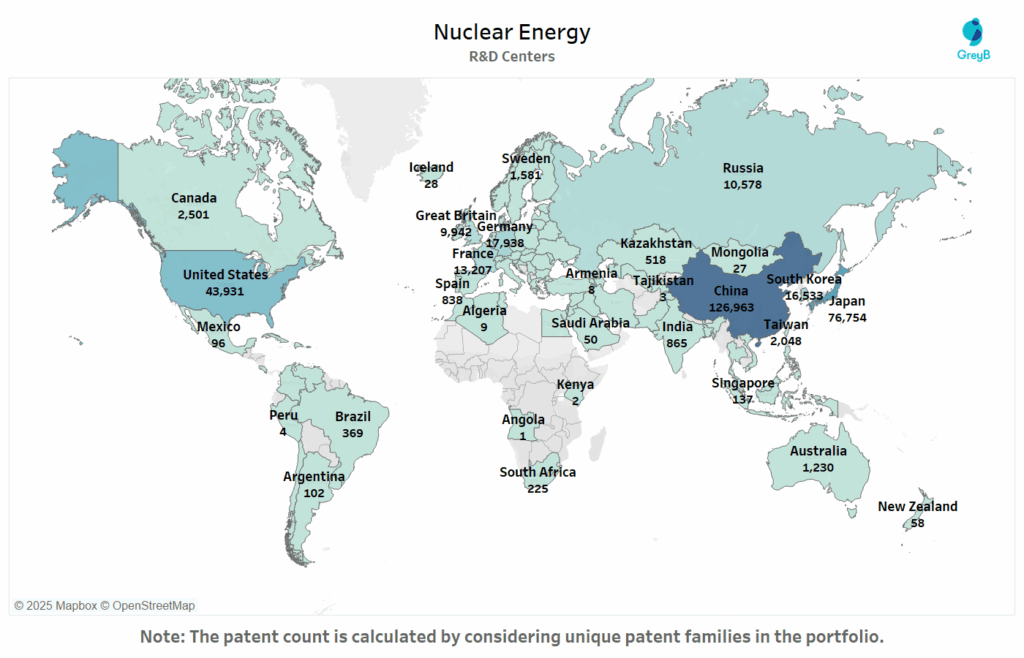

Which Countries Are Leading in Nuclear Energy Research and Development?

This map visualizes the number of nuclear energy based R&D centers worldwide, represented by the count of unique patent families which is a strong indicator of active innovation labs and research units.

The global distribution of nuclear energy R&D centers reveals where the bulk of innovation in the field is happening. Leading the way is China, with an impressive 126,963 unique patent families, indicating its massive investment in nuclear energy research and development. The United States follows with 43,931 unique patents, reflecting its ongoing focus on nuclear innovation. Japan and South Korea also stand out, contributing significantly with 76,754 and 16,533 unique patents, respectively.

In essence, the data shows that Asia dominates nuclear R&D, with China and Japan at the forefront, while the US and Europe remain strong secondary centers. This global distribution underscores the strategic importance of nuclear innovation in regions prioritizing energy security and clean power generation.

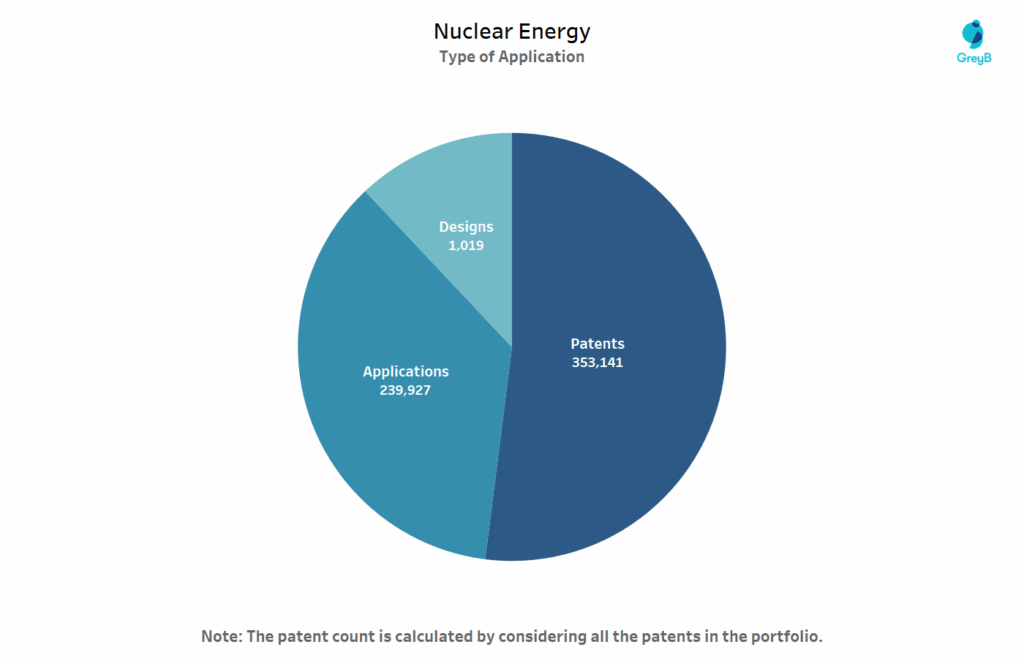

What Types of Patents Dominate the Nuclear Energy Sector?

This pie chart illustrates the composition of patent filings in the nuclear industry. This breakdown reveals how innovation in nuclear energy is primarily protected through technical IP (patents and applications), with minimal emphasis on industrial design filings.

The chart illustrates the breakdown of nuclear energy-related intellectual property by type of application. A clear dominance of patents is visible, with over 353,000 patent filings compared to just 240,000 applications and 1,019 designs. This indicates that the majority of innovation in the nuclear energy sector is focused on securing patents, which are crucial for protecting technological advancements.

While designs account for a tiny fraction of the filings, the applications category, which typically involves proposals for new technologies or methods, represents a significant part of the sector’s ongoing research efforts.

The overwhelming focus on patents underscores the nuclear energy industry’s emphasis on developing and safeguarding practical, implementable technologies that can transform the sector. These innovations likely range from advanced reactor designs to fuel technologies and safety systems, all of which require intellectual property protection to ensure competitive advantage and long-term viability.

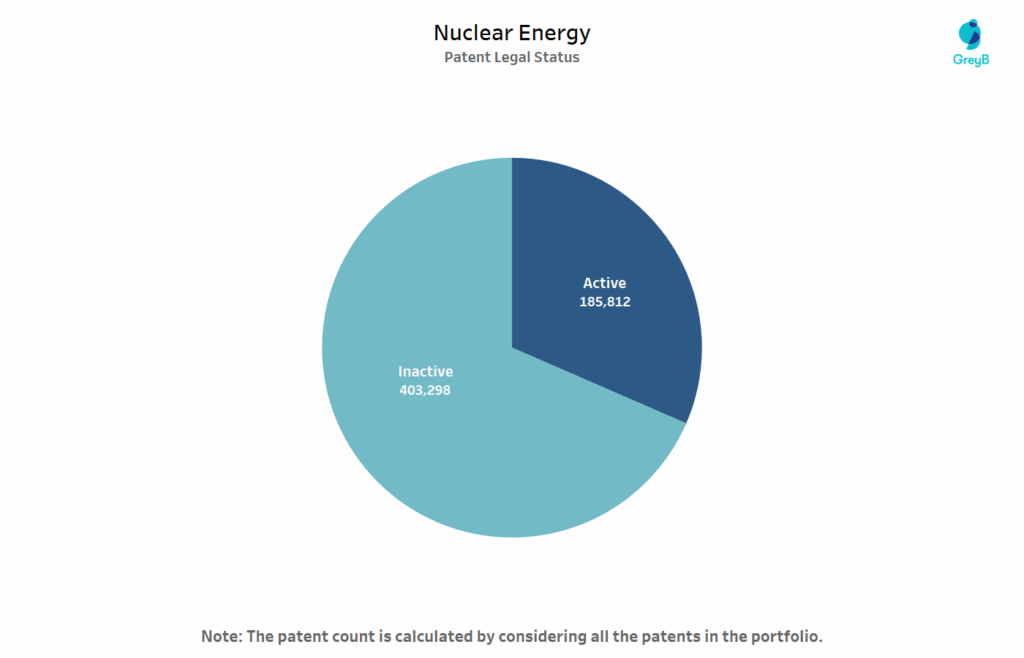

How many Nuclear Energy Patents are Active and Inactive?

This chart shows the patent legal status of patents in the nuclear energy industry.

Nearly 69% of nuclear energy patents are inactive, signaling that a significant portion of the sector’s past innovations are no longer in use or have been surpassed by newer technologies.

While active patents (185,812) make up 31% of the total, they continue to cover core nuclear advancements, including reactor designs, safety systems and energy efficiency technologies. This trend reflects the fast-paced evolution of nuclear technology, where older patents may not keep up with the industry’s demands for more efficient, scalable, and sustainable energy solutions.

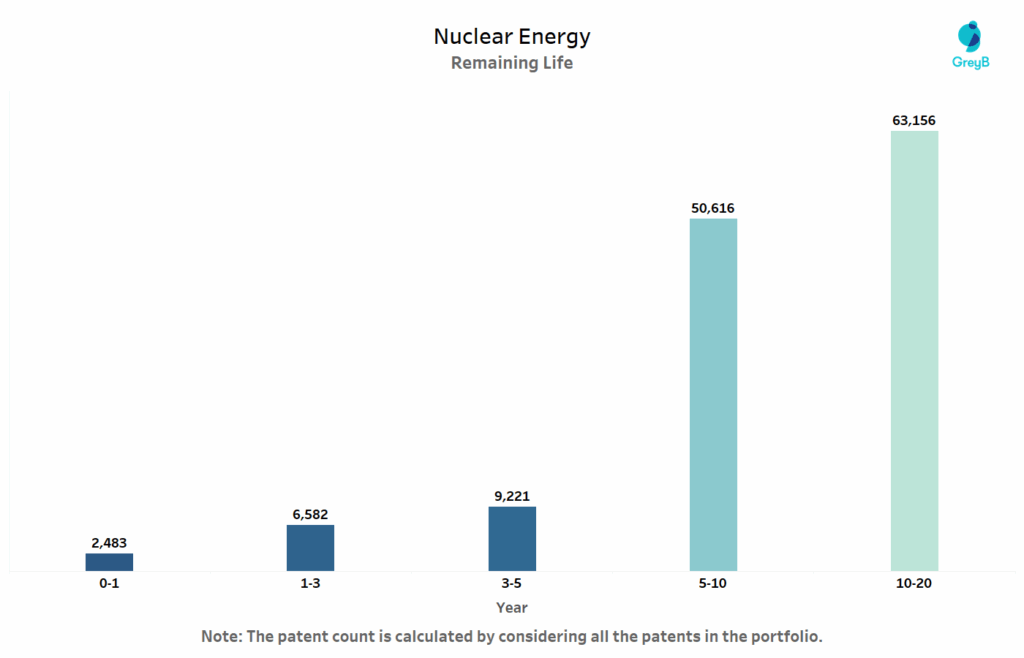

How Much Life Does Nuclear Energy Industry’s Patent Portfolio Really Have?

This chart illustrates the remaining life of active Nuclear Energy patents, segmented into year blocks. This distribution highlights the long-term enforceability and licensing potential of Nuclear Energy Industry’s current IP landscape.

A significant proportion of nuclear energy patents are nearing the end of their life cycle. Over 63,000 patents have between 10-20 years of remaining life, indicating that these innovations are still relevant and may be actively used in the industry.

However, only a small fraction (2,483) of patents have less than a year left, suggesting that the majority of recent nuclear energy innovations still have ample time to make an impact.

Patents with 5-10 years of remaining life account for 50,616 patents, reflecting the long-term viability and ongoing relevance of key technologies, while 3-5 years and 1-3 years patents represent shorter-term, but still valuable innovations.

This distribution emphasizes the fact that while many innovations have already been implemented, there’s a strong pipeline of patents still holding significant commercial potential for years to come.

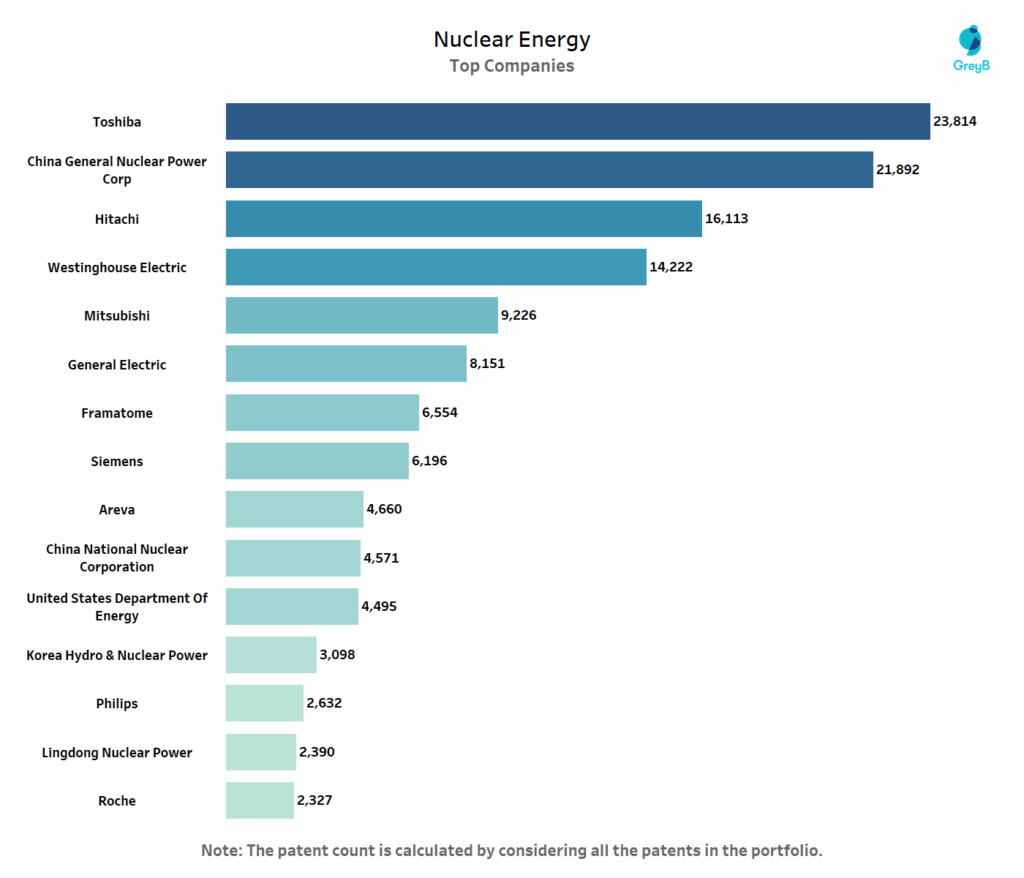

Which Are the Top Companies in the Nuclear Energy Industry?

This chart highlights the top companies in the nuclear energy sector based on patent filings.

The chart clearly shows that leading corporations, particularly from Japan, China, and the United States, dominate the nuclear energy patent space, highlighting their significant investments in advancing nuclear technologies. These companies not only lead in patent filings but also continue to shape the future of nuclear energy innovation.

The inclusion of government entities like the United States Department of Energy alongside corporate giants further highlights the critical role of public sector research in nuclear innovation.

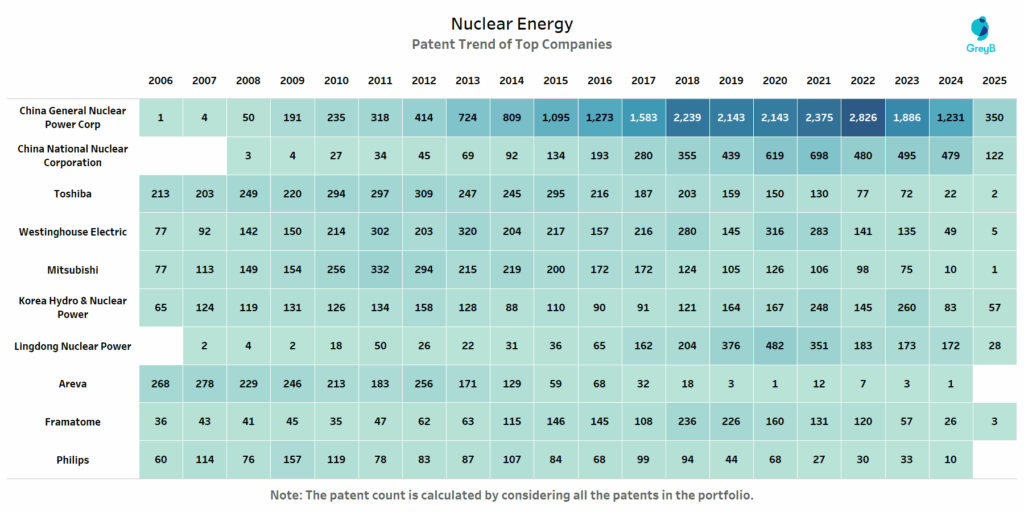

How Have Patent Filing Trends Evolved Among Leading Nuclear Energy Companies?

This chart displays the patent filing trends of the top nuclear energy companies from 2006 to 2025, offering a clear view of their evolving innovation strategies.

This patent trend analysis reveals dramatic shifts in global nuclear energy innovation leadership over nearly two decades, highlighting the rise of Chinese dominance and the decline of traditional industry leaders.

The most striking trend is China General Nuclear Power Corp’s explosive growth from just 1 patent in 2006 to a peak of 2,826 patents in 2022, representing an unprecedented scale of innovation investment. Similarly, China National Nuclear Corporation shows steady growth from 3 patents in 2008 to peaks around 600-700 patents in recent years. Together, these Chinese entities have fundamentally transformed the global patent landscape, shifting from negligible presence to market dominance within 15 years.

The recent decline across most companies in 2023-2025 may reflect the 18-month patent publication delay, but the overall trend indicates that China has successfully captured nuclear innovation leadership while traditional nuclear powers have scaled back their R&D investments.

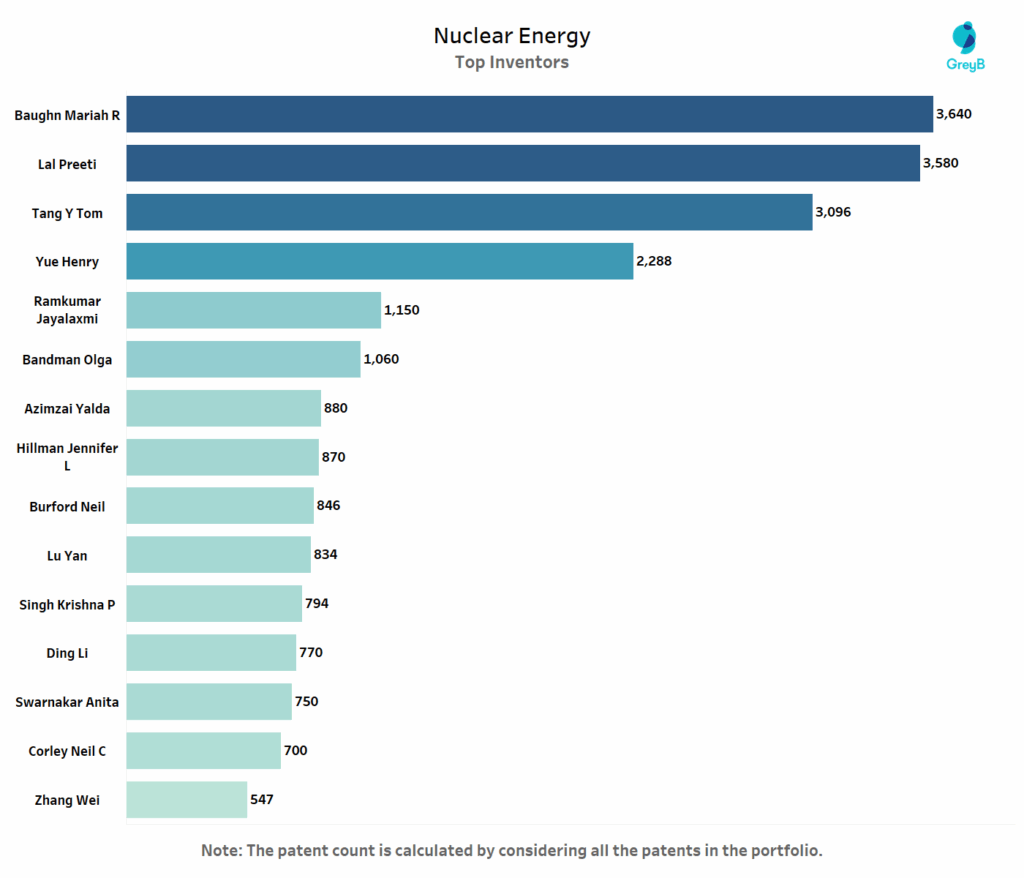

Who Are the Top Inventors in Nuclear Energy Innovation?

This chart showcases the top inventors in the nuclear energy sector. These inventors have filed thousands of patents, contributing significantly to the evolution of nuclear energy technologies.

The data shows a significant concentration of innovation among the top inventors, with the leading three holding substantially more patents than the rest of the inventors.

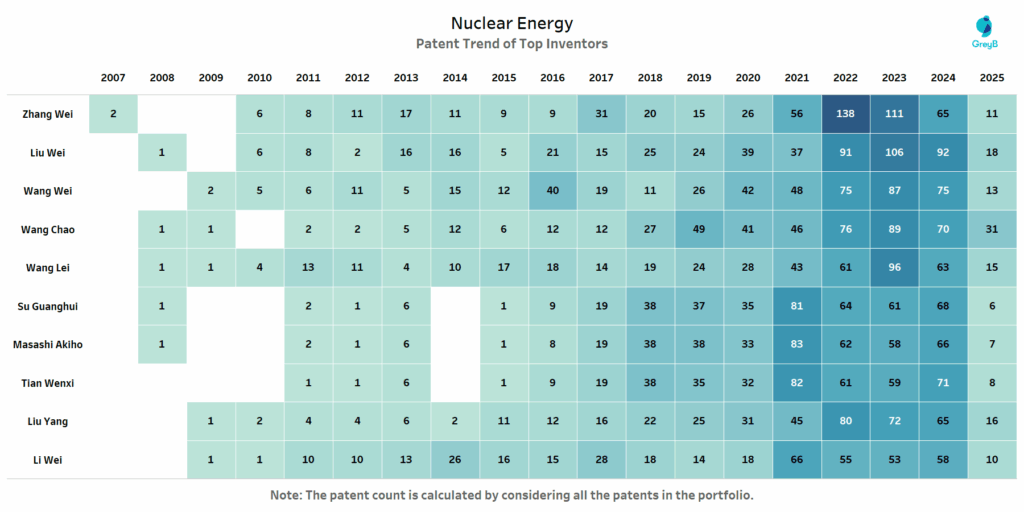

How Have Top Nuclear Energy Inventors’ Patent Filing Trends Evolved Over Time?

This chart tracks the patent filing trends of top nuclear energy inventors from 2007 to 2025.

The data reveals three distinct phases across the timeline: the foundational phase (2007-2012) characterized by low, sporadic patent activity; the acceleration phase (2013-2018) where most inventors began ramping up their output significantly; and the maturation phase (2019-2023) marked by peak productivity for most inventors.

The recent decline visible in 2024-2025 across multiple inventors should be interpreted cautiously, as patent applications can take up to 18 months to be published. This apparent downturn likely reflects the natural publication lag rather than any actual decrease in innovation activity.

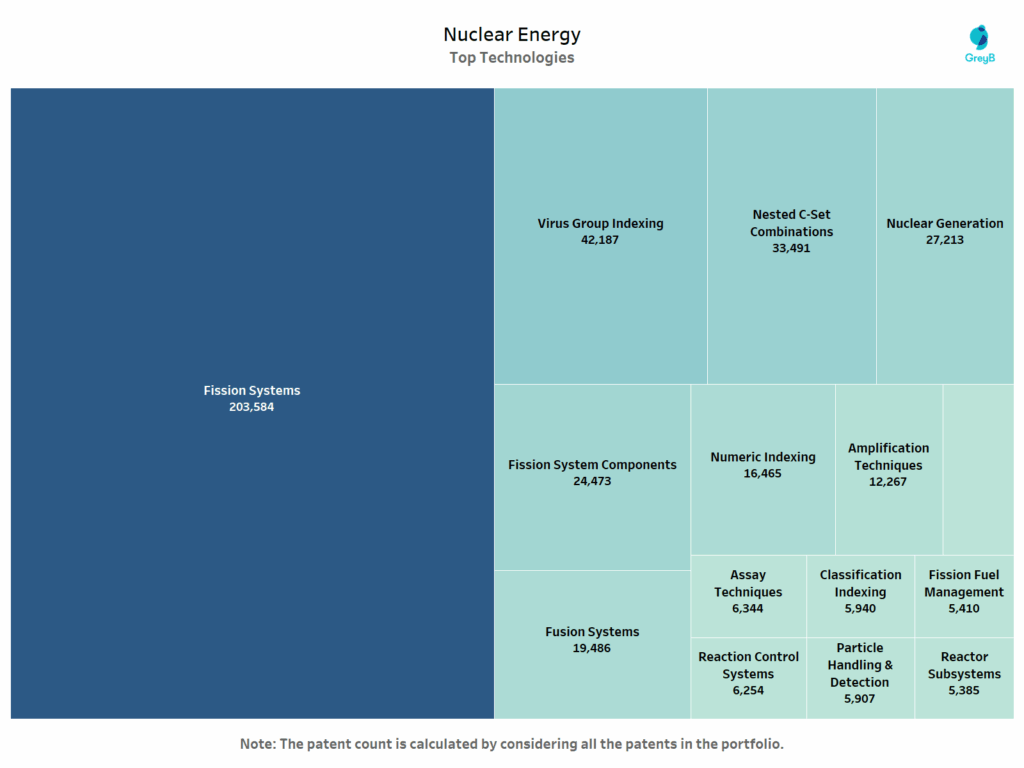

Which Key Technologies Are Shaping the Future of Nuclear Energy?

This chart displays the leading technology areas in the Nuclear Energy patent landscape by volume.

The overwhelming concentration in Fission Systems demonstrates that nuclear fission remains the primary technological focus, representing roughly two-thirds of all nuclear energy patents. This massive investment reflects ongoing efforts to optimize reactor designs, improve efficiency, enhance safety systems and develop next-generation fission technologies.

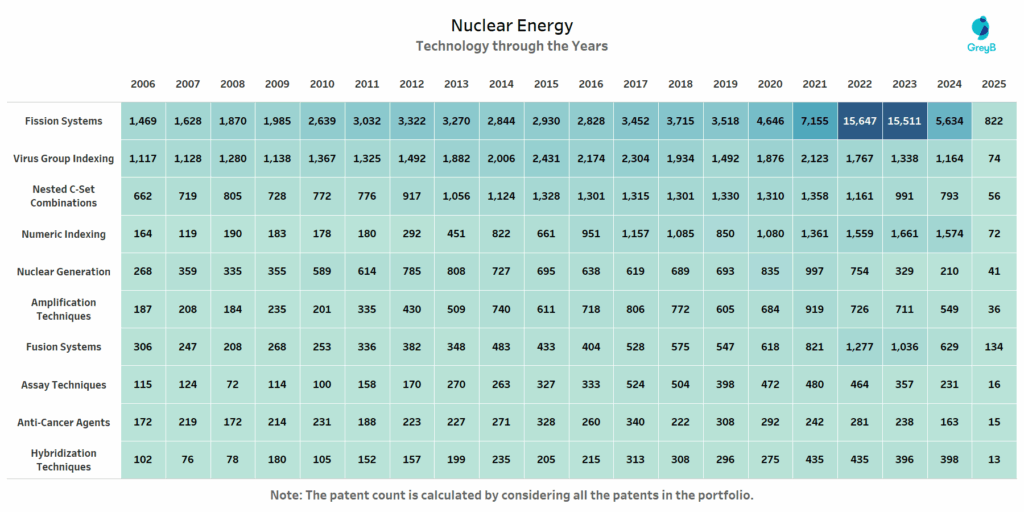

How Have Key Nuclear Energy Technologies Evolved Over Time?

This chart tracks the annual patent filings for major nuclear energy technologies from 2006 to 2025.

Fission Systems stands out as the most significant technology in terms of patent filings, with a remarkable surge in 2022 and 2023, reaching over 15,000 patents each year. This trend reflects a continued focus on fission technology, which remains central to nuclear energy production.

Other technologies, such as Nested C-Set Combinations and Fusion Systems, also show consistent growth, particularly between 2015 and 2023, underscoring the increasing diversification in nuclear technology development. Nuclear Generation and Amplification Techniques demonstrate moderate growth, with annual filings increasing gradually over the years.

The steady increase in patent filings for these core technologies suggests that nuclear energy innovation continues to grow at a strong pace, with particular emphasis on improving fission systems and related processes.

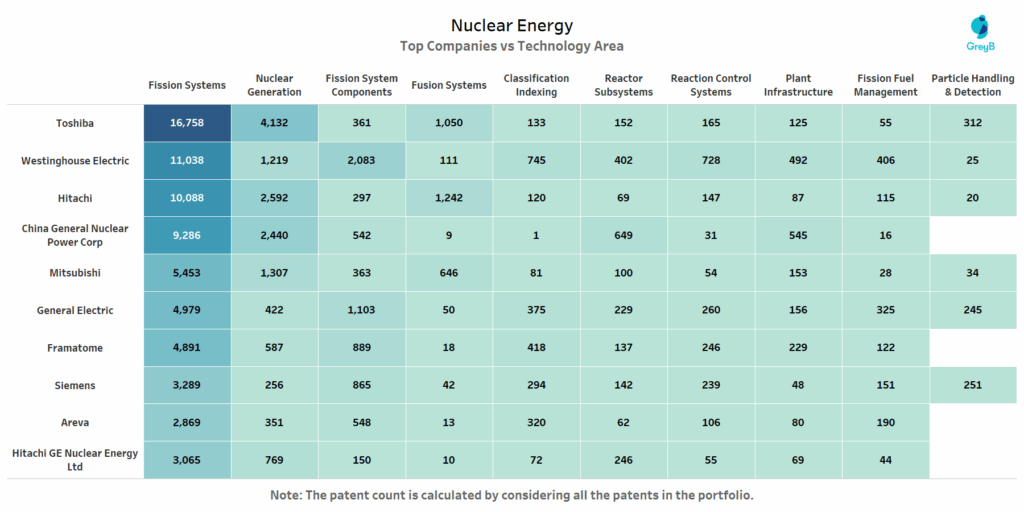

Which Companies Are Leading in Specific Nuclear Energy Technologies?

The chart illustrates the alignment between top nuclear energy companies and their contributions across various technology areas.

Toshiba emerges as the leader in Fission Systems and it also shows strong contributions to Nuclear Generation and Fission System Components, indicating Toshiba’s broad involvement in core nuclear technologies.

Other players like China General Nuclear Power Corp, Mitsubishi and General Electric have focused patent portfolios, with particular attention to Fission Systems, Nuclear Generation and Reactor Subsystems, signaling their roles in advancing reactor designs and operational technologies.

This chart demonstrates the diversity of innovation strategies across leading nuclear energy companies, each specializing in different components while contributing to the overall technological ecosystem.

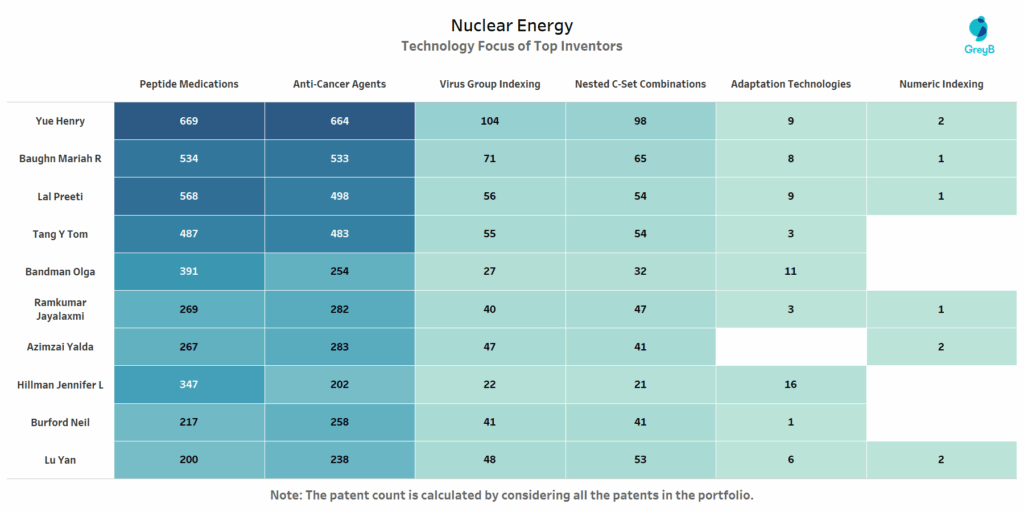

What Are the Key Technology Areas Focused on by Key Nuclear Energy Inventors?

This chart shows the technology areas most focused on by the top nuclear energy inventors.

This diverse distribution of technology areas reflects the interdisciplinary nature of nuclear innovation, where advancements are made not just in energy production, but also in applications like medical therapies and data processing.

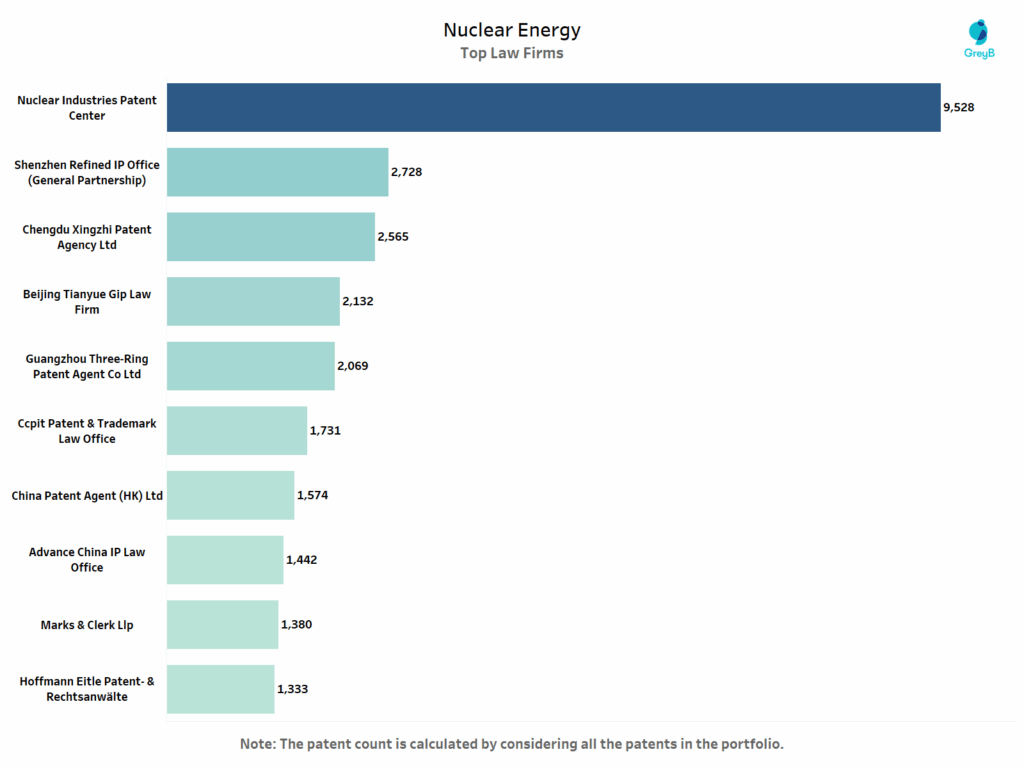

Which Law Firms Are Leading the Charge in Nuclear Energy Patent Protection?

This chart shows the top law firms handling patent prosecution in the nuclear energy sector.

This chart highlights the concentrated legal landscape of nuclear energy patents, with Nuclear Industries Patent Center leading by a wide margin, holding 9,528 patents, almost three and a half times more than its nearest competitor. This dominance indicates that the center is either a key hub for patent processing in the nuclear sector or represents a major player with a vast nuclear technology portfolio.

The nuclear energy sector is witnessing an exciting era of innovation, where technological advancements are not only reshaping the way we generate power but also influencing industries far beyond energy production. The explosive rise in patent filings, led by powerhouses like Toshiba and Hitachi, indicates that the industry is not only expanding but evolving rapidly, with more players entering the field and more innovations in the pipeline.

Looking ahead, it’s clear that the next few years will see a shift towards more sustainable, scalable and efficient nuclear energy solutions, fueled by the technologies we’ve discussed. As global energy needs grow and the push for decarbonization intensifies, nuclear energy will play a critical role in the energy mix.

Looking for detailed patent insights in a specific Nuclear Energy area?

Submit your interest, and our team will reach out to explore a customized report for you!