Just a few years ago, the idea of flying without the carbon footprint seemed like a far-off dream. Aviation, a sector synonymous with high emissions, was seen as one of the hardest to decarbonize. Yet, quietly but resolutely, a solution has been gaining momentum Sustainable Aviation Fuels (SAFs).

Imagine boarding a flight, settling into your seat and knowing that the fuel powering your journey has been sourced from waste products, algae or even captured CO₂ reducing the carbon footprint of your flight by up to 80%.

In the past five years, the world has witnessed a seismic shift in the SAF landscape. The SAF market size is going to skyrocket to $82.7 billion by 2035 from just $1.87 billion in 2025. A wave of investment has followed, with hundreds of millions of dollars flooding into SAF ventures. Metafuels, a European SAF start-up has raised $22 million in just last 2 years while DG Fuels plans to open a $5 billion SAF Production Facility in Minnesota.

This revolution isn’t just about market size and funding. It’s about the real-world impact on the skies. In 2023, we saw the first transatlantic flight powered by 100% SAF was operated by Virgin Atlantic, marking a historic moment for the industry.

In this report we track the evolution of Sustainable Aviation Fuels (SAF) through patent trends, key industry players, leading research centers and top inventors to highlight where SAF technology is advancing, who’s driving the breakthroughs, and what it means for strategic decision-makers in an industry racing to decarbonize the skies.

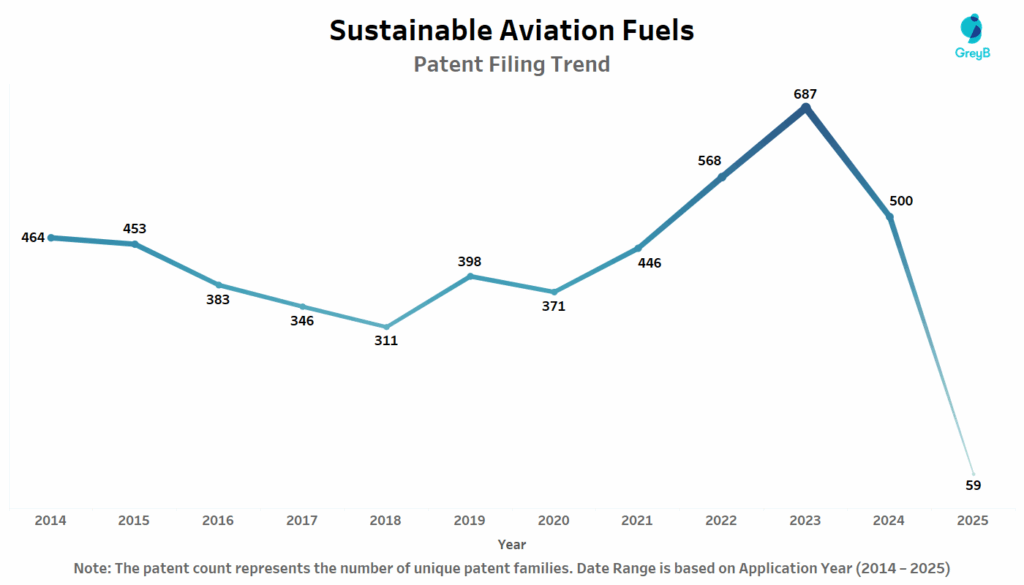

How many patents were filed in Sustainable Aviation Fuels (SAF) Industry?

This chart presents the annual trend in global SAF-related patent filings from 2014 to 2025. It tracks the total number of patent families filed each year across the SAF ecosystem.

The rise of Sustainable Aviation Fuels (SAFs) hasn’t happened overnight. For over a decade, the SAF field simmered with research and development as key players slowly honed in on the technology. But between 2019 and 2023, the pace of innovation rapidly intensified. This spike mirrors key breakthroughs in fuel production processes, feedstock diversification and advanced emission-reducing technologies, with major industry players and startups alike racing to secure core intellectual property.

However, by 2024 and 2025, patent filings began to dip significantly. Does this suggest that innovation in SAFs is slowing down? Not necessarily.

Patents, particularly in emerging industries like SAFs, often take time to mature. A patent filing typically takes 18 months to become public, meaning that many of the innovations from 2024 and 2025 might not yet be reflected in the filing data. What we’re observing now may simply be the lag of earlier filings waiting for publication, rather than a lack of ongoing innovation.

While the surge in patent filings provides a clear picture of R&D momentum, understanding how these innovations translate into active, commercially viable intellectual property is equally crucial. Patent legal status plays a pivotal role in determining the real impact of these filings. In the next insight, we’ll explore the share of active versus inactive patents in the SAF industry, shedding light on how many innovations are being actively protected.

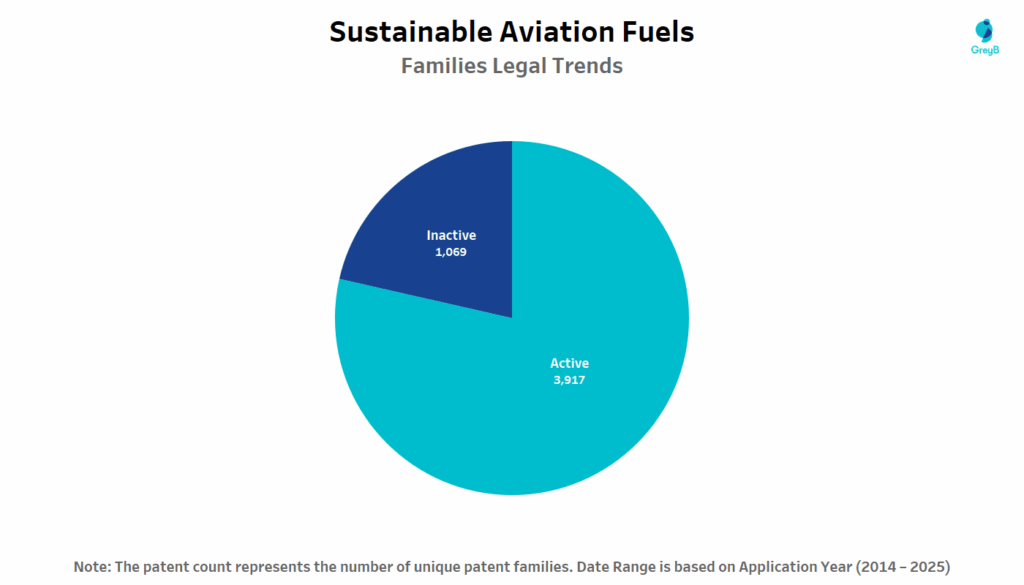

How many Sustainable Aviation Fuels (SAF) Patents are Active and Inactive?

This chart shows the patent legal status of patent families in the SAF industry.

As the SAF industry accelerates toward commercialization, the number of active patents tells a crucial story. With over 78% of the patents still active (3,917 out of 4,986 total filings), it’s clear that innovation is not only ongoing but is protected for the long haul. These active patents represent the cutting-edge technologies that companies are relying on to scale SAF production and meet aviation’s carbon-neutral goals.

What does the future hold for these patents? While the majority are still actively maintained, it’s also worth noting the 1,069 inactive patents. These could signal technologies that have either reached their commercial potential or been overtaken by newer, more efficient innovations. The next insight explores the geographical landscape of SAF innovation, breaking down patent activity by country and highlighting where the most impactful developments are taking place.

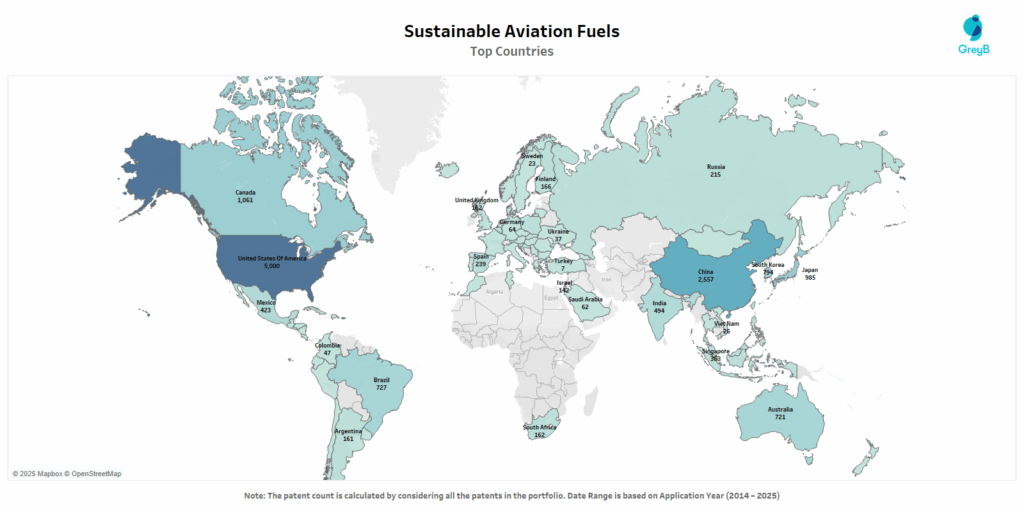

Which Countries Are Shaping the Global Sustainable Aviation Fuels (SAF) Patent Landscape?

This map visualizes the geographic distribution of SAF patent filings across key countries.

The global distribution of patent filings in the Sustainable Aviation Fuels (SAF) domain reveals a strategic blend of innovation powerhouses and emerging players. The United States stands as the leader, with 5,000 patents, largely driven by the extensive R&D from aerospace giants, energy companies and tech firms pushing the boundaries of SAF technology. This surge reflects the US’s strong industrial policy support and its role in advancing large-scale production technologies.

China follows closely behind with 2,557 patents, positioning itself as a key player focused on scaling feedstock innovation and sustainable fuel production processes. This aligns with China’s growing commitment to renewable energy and green aviation as part of its broader environmental goals. Meanwhile, countries like Canada, Japan and South Korea are making notable contributions, with each focusing on specialized areas such as feedstock conversion, production efficiency, and chemical processes, with South Korea also benefiting from strong governmental backing in green technologies.

Europe’s players Sweden, Germany and Finland are driving advancements in industrial-scale SAF production and regulatory frameworks, with major corporations such as Neste and Siemens making substantial patent filings.

However, the true backbone of SAF’s evolution lies not only in national efforts but in the physical hubs where research is taking place. In the next section, we will delve into the top R&D centers leading the charge in SAF innovation, revealing where the most impactful developments are occurring globally.

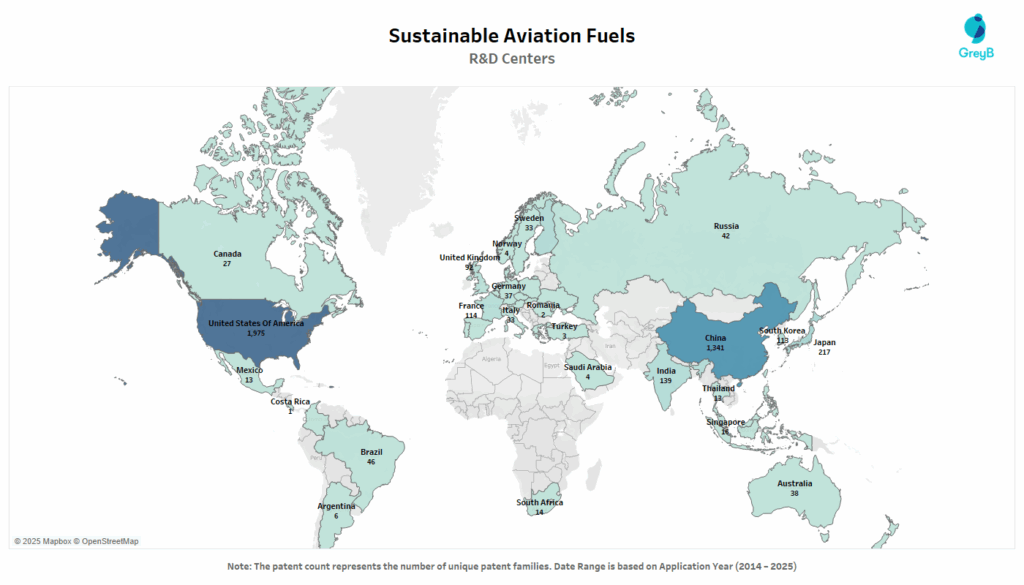

Where Are Sustainable Aviation Fuels (SAF) R&D Centers Concentrated Across the Globe?

This map visualizes the number of SAF-related R&D centers worldwide, represented by the count of unique patent families which is a strong indicator of active innovation labs and research units.

As the race to develop Sustainable Aviation Fuels (SAF) intensifies, it’s not just the number of patents that matters but where the innovation is actually happening. The United States leads by a significant margin with over 2,000 patents, with key research and development centers spread across areas like Silicon Valley and Texas. These hubs are home to some of the world’s largest players in aerospace and energy, including companies like Boeing and ExxonMobil, who are deeply invested in SAF technology.

China follows closely with more than 1,300 patents, driven by state-supported tech parks and a national push for clean energy innovation, particularly in cities like Beijing and Shanghai. South Korea and Japan round out the top four, each with robust R&D ecosystems focusing on the chemical processes and feedstock efficiency critical to SAF production.

The presence of R&D centers in Europe particularly in Germany, Sweden and France signals the continent’s commitment to pioneering sustainable technologies, with corporate labs and academic collaborations powering advances in SAF production and processing.

This map of innovation reveals not only the key regions but also the global distribution of expertise driving SAF technology forward. Now that we know where the research is happening, let’s take a closer look at the top companies fueling this innovation and driving the SAF industry’s growth.

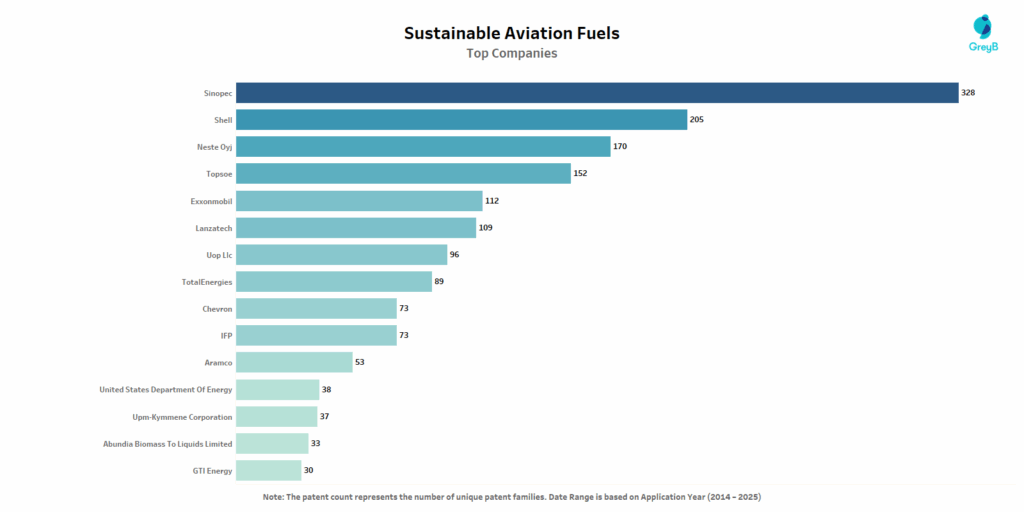

Which Are the Top Companies in the Sustainable Aviation Fuels (SAF) Industry?

This chart ranks companies by their total number of SAF-related patents.

The race for Sustainable Aviation Fuels (SAF) is being powered by some of the world’s largest energy companies, with Sinopec leading the pack, holding 328 patents. Following Sinopec is Shell, with 205 patents, demonstrating its commitment to decarbonizing aviation through technological advancements in fuel synthesis and processing.

ExxonMobil and Lanzatech are also prominent innovators in the SAF space, with ExxonMobil contributing to novel fuel production methods, while Lanzatech focuses on its proprietary carbon recycling technologies, helping to reduce the aviation industry’s carbon footprint.

Their innovations and investments in SAF are laying the groundwork for a more sustainable future in air travel. But who exactly are the individuals behind these ideas? In the next insight, we’ll take a closer look at the top inventors driving this revolution, highlighting the innovators who are shaping the technologies that could fuel the future of aviation.

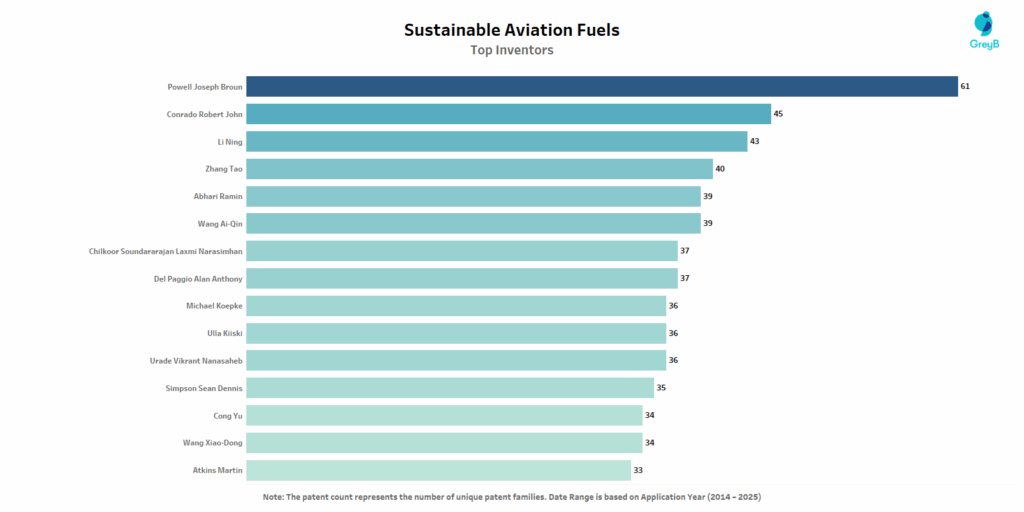

Who Are the Top Inventors behind Sustainable Aviation Fuels (SAF) Patents?

This chart ranks inventors by the number of SAF-related patents they’ve contributed to.

These inventors are at the forefront of SAF research, shaping the future of aviation by creating the technologies that could drastically reduce the industry’s carbon footprint. But as these individual minds continue to innovate, the next crucial piece of the puzzle lies in understanding the technology focus areas what are these inventors actually working on? In the next section, we’ll explore the key technology areas driving the SAF revolution.

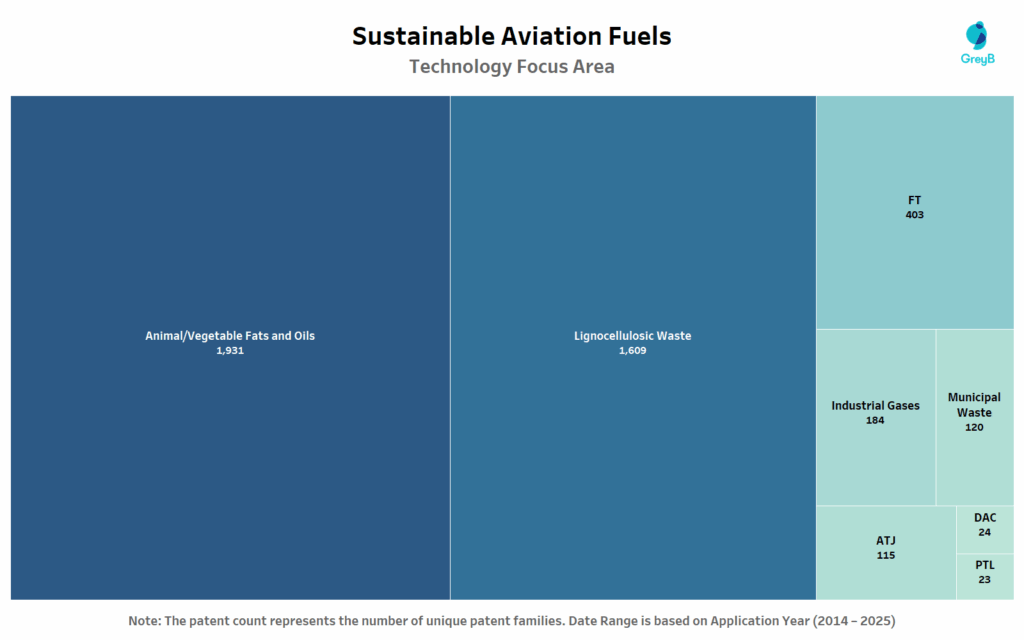

Which Key Technology Areas are dominating the Sustainable Aviation Fuels (SAF) Industry?

This chart displays the leading technology areas in the SAF patent landscape by volume.

Sustainable Aviation Fuels (SAF) innovation is not just about creating an alternative to conventional jet fuel; it’s about optimizing the entire fuel production process, and that is where the core technology focus areas come into play. Animal/Vegetable Fats and Oils dominate the SAF technology landscape, accounting for 1,931 patents. This reflects the significant reliance on oils and fats as a primary feedstock, key to producing high-efficiency biofuels.

Following closely is Lignocellulosic Waste, with 1,609 patents, underscoring the growing importance of using waste products such as agricultural residues and forestry by-products as sustainable sources for SAF. This technology is vital for scaling production while reducing environmental impact.

The Fischer-Tropsch (FT) process, with 403 patents, is also central to SAF development, representing a key method for converting biomass into liquid fuels. Technologies like Industrial Gases (184 patents) and Municipal Waste (120 patents) reflect the broader interest in diversifying feedstocks for SAF, using not just bio-based materials but also waste streams to produce cleaner aviation fuel.

Other areas like ATJ (Alcohol-to-Jet), DAC (Direct Air Capture)and PTL (Power-to-Liquid) highlight emerging methods that could play a crucial role in expanding SAF production in the coming years, driven by innovations in carbon capture and synthetic fuel processes.

As we explore these core areas, it’s essential to understand how these technologies have evolved over time, especially as the industry moves towards scaling up production. In the next section, we’ll take a look at how the focus within these technology areas has shifted over the years, shedding light on the trends that will shape the future of SAF innovation.

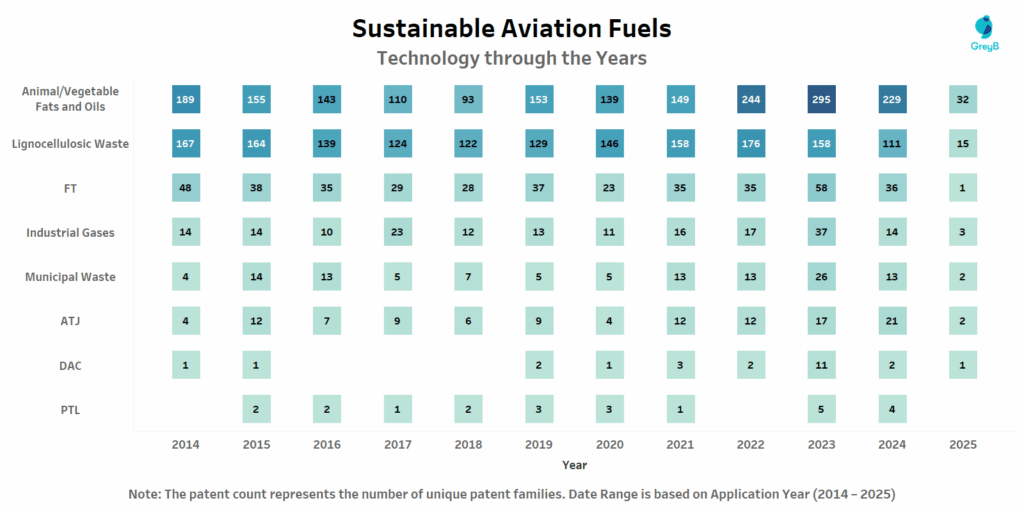

How Have Sustainable Aviation Fuels (SAF) Technology Priorities Shifted from 2014 to 2025?

This chart tracks the annual patent filing volumes across top SAF technology domains from 2014 to 2025.

Over the years, the focus areas within Sustainable Aviation Fuels (SAF) technology have evolved significantly. Between 2014 and 2015, there were a limited number of filings in Animal/Vegetable Fats and Oils. However, from 2016 onward, a sharp increase in patents reflects the industry’s growing recognition of SAF as a viable solution for aviation’s decarbonization.

The real turning point came between 2018 and 2022, with substantial growth in Lignocellulosic Waste driving much of the patent filings. This surge aligns with the industry’s push for more sustainable, renewable feedstocks, which is reflected in the patent volumes reaching their peak in 2022. Meanwhile, Fischer-Tropsch (FT) and Animal/Vegetable Fats and Oils also saw steady increases, underscoring their importance as core methods for producing SAF from various feedstocks.

Notably, ATJ (Alcohol-to-Jet) and DAC (Direct Air Capture), emerging technologies that capture CO₂ directly from the air and convert it into fuel, began to see increasing attention in the later years, particularly after 2020, signaling a shift toward next-generation fuel synthesis methods.

As the focus areas in SAF evolve, the next step is to examine how the top inventors are leading this innovation. Let’s take a closer look at the technology focus areas of the key inventors in the SAF industry.

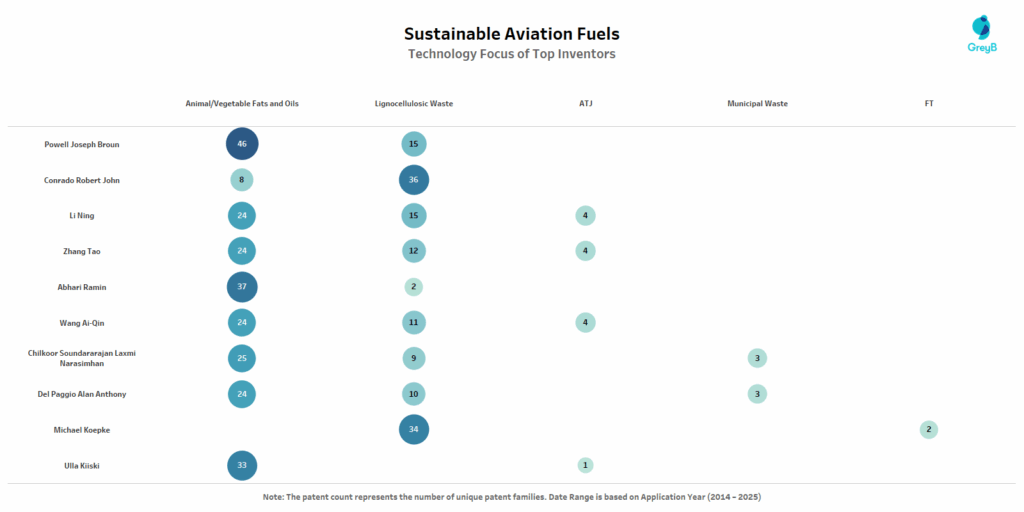

What is the Technology Focus Areas of the Top Inventors in SAF domain?

This chart highlights the key technology areas being patented by the top inventors in the SAF domain.

Now, with an understanding of how top inventors are approaching SAF innovation, let’s explore how the top countries are leading the charge in these key technology areas.

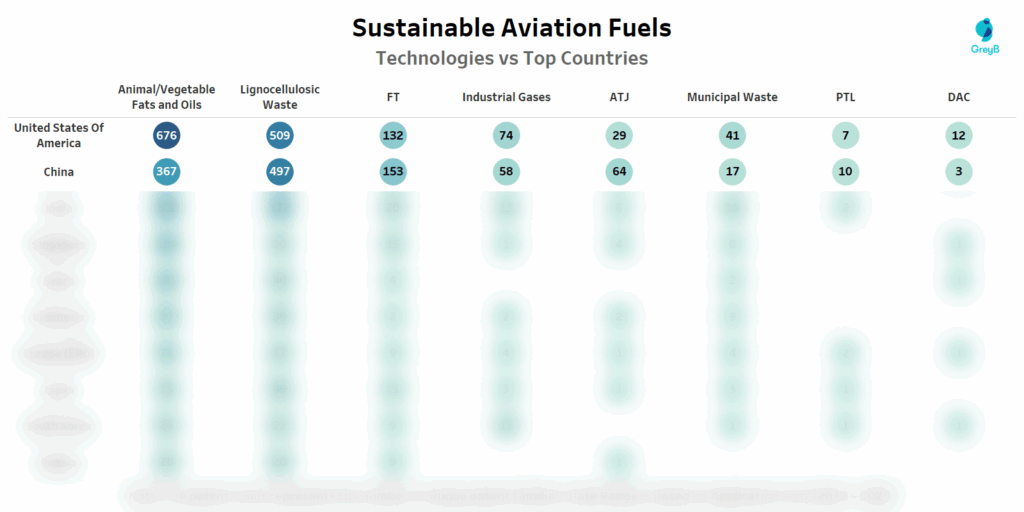

How Are Top Countries Driving Innovation in Sustainable Aviation Fuels (SAF)?

This chart showcases the leading countries in SAF patent filings, emphasizing their respective focus areas in the technology.

The diversity in technological focus among these leading countries highlights the global nature of SAF innovation, where different regions are focusing on the strengths of their resources, industries and environmental goals.

The next step is to examine how the top companies are leading this innovation. Who is driving the most progress in these key technology areas?

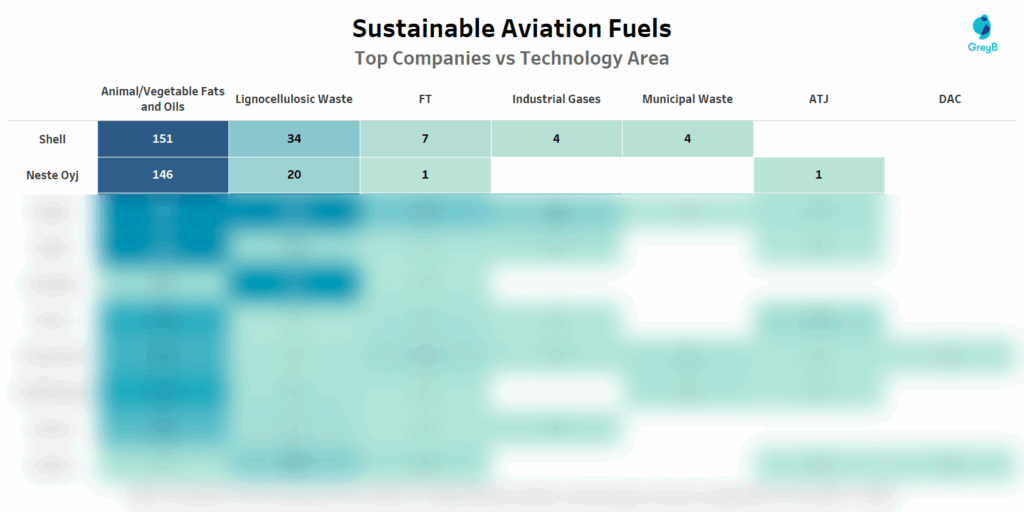

How Are Top Companies Shaping the Future of SAF Through Technology?

This chart illustrates the top companies filing patents in SAF technology highlighting each company’s innovation focus areas.

The rise of Sustainable Aviation Fuels (SAF) is a powerful reflection of the aviation industry’s commitment to a sustainable future. With patents soaring and innovation accelerating, companies across the globe are driving the next frontier of aviation fuel, from bio-based feedstocks to cutting-edge fuel synthesis methods.

As major players focus on scaling production and refining key technologies, SAF is moving beyond theory into tangible, market-ready solutions. However, the journey ahead will require continued investment, collaboration and technological refinement to meet global aviation’s decarbonization goals.

What’s Shaping the Future of Aviation Fuels? The Answer Lies in Patent Data!

Ready to discover how the top players in Sustainable Aviation Fuels are transforming the skies? The patent data we’ve uncovered holds the keys to the most exciting trends in SAF.

Want to know which countries and companies are leading the charge? The answers are just a click away!