The semiconductor industry is experiencing a wave of patent transactions, with operating companies and NPEs (Non-Practicing Entities) reshaping the IP landscape.

Patent sales are no longer just about divesting non-core assets – they have become a strategic play that fuels litigation campaigns, portfolio reshuffling, and competitive positioning.

According to our analysis, a total of 914 semiconductor patents have been sold in recent years, creating a treasure trove for potential enforcement actions.

Patent transactions often go hand-in-hand with legal disputes. To see how these transfers translate into real-world lawsuits, explore our in-depth analysis of NPE litigation trends

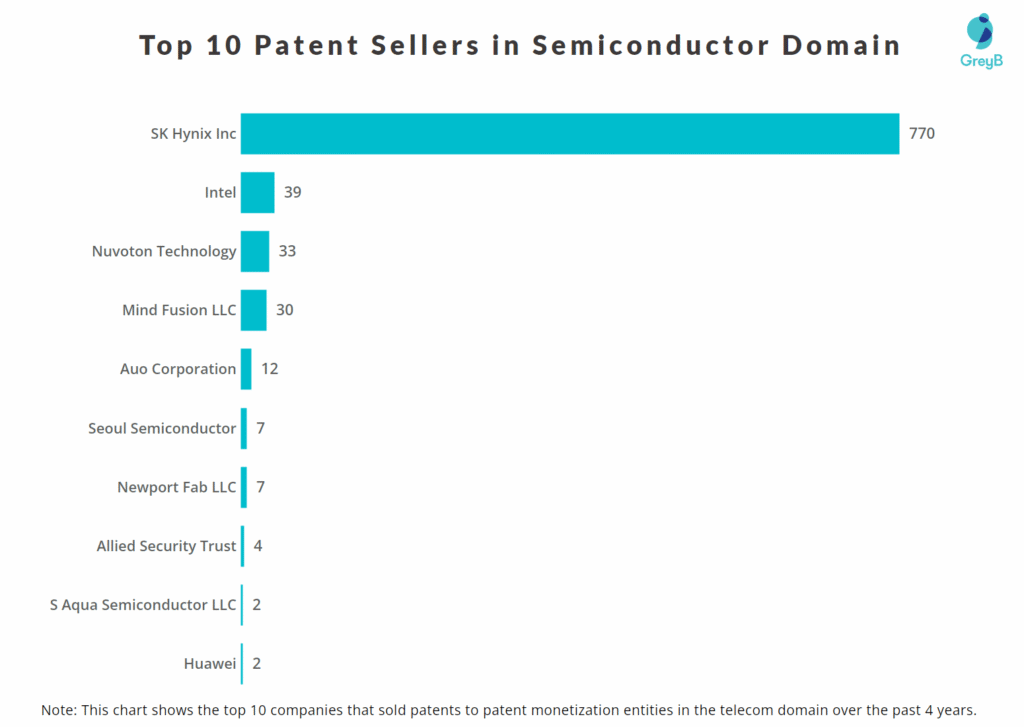

Top 10 Companies / NPEs that have sold patents to patent monetization companies in the semiconductor domain in the past 4 years

| Name | No of Patents |

| SK Hynix Inc | 770 |

| Intel | 39 |

| Nuvoton Technology | 33 |

| Mind Fusion LLC | 30 |

| Auo Corporation | 12 |

| Seoul Semiconductor | 7 |

| Newport Fab LLC | 7 |

| Allied Security Trust | 4 |

| S Aqua Semiconductor LLC | 2 |

| Huawei | 2 |

| Zarbana Digital Fund LLC | 1 |

| Transpacific Image LLC | 1 |

| Terrace Licensing LLC | 1 |

| Telecommunications Systems | 1 |

| Smart Handover LLC | 1 |

| L3Harris Technologies | 1 |

| Gula Consulting LLC | 1 |

| Callahan Cellular LLC | 1 |

In 2024, most semiconductor patent sales came from a few key players. SK Hynix Inc led the activity, selling 770 patents, nearly 84% of the total. Intel, Nuvoton Technology, and Mind Fusion LLC followed with 39, 33, and 30 patents sold.

Companies like Auo Corporation, Seoul Semiconductor, and Huawei also contributed with smaller sales.

This trend shows that both big tech companies and monetization firms are rebalancing their patent portfolios – some to focus on core innovation, others to generate revenue or prepare for potential licensing and litigation opportunities.

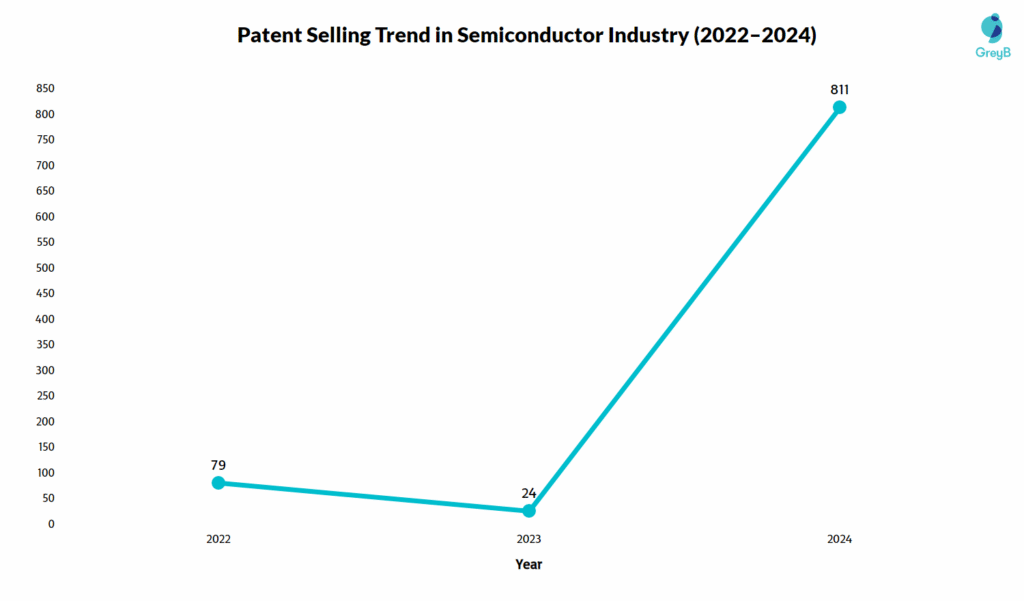

How has such patent selling in semiconductors taken place over the years?

How Many of These Patents Have Been Litigated?

Out of the 914 semiconductor patents transacted so far, 39 have already been asserted in litigation. These cases have targeted major industry players such as Samsung, Taiwan Semiconductor, Acer, and MediaTek – a clear indication that these assets are not dormant.

Rather than sitting on the shelf, these patents are being actively deployed as strategic weapons in high-stakes lawsuits. This shows how the secondary patent market is fueling disputes that can reshape licensing negotiations, product launches, and competitive dynamics.

Case Study: MimirIP LLC’s Litigation Campaign

In March 2024, SK Hynix Inc sold U.S. Patent US9472569B2 to MimirIP LLC. Just three months later, on June 3, 2024, MimirIP turned this acquisition into legal action, filing lawsuits against a lineup of major defendants, including Micron Technology, HP, Dell, Tesla, and Micron Semiconductor Products.

This case underscores how quickly newly acquired patents can be turned into litigation tools. By leveraging a single asset, MimirIP launched a multi-defendant enforcement campaign that could have significant implications for the memory and semiconductor industries.

Conclusion

If you are looking for more information, like the complete list of companies that have sold semiconductor related patents in the last 4 years, or the specific patent numbers, please fill out the form below to take subscription to GreyB’s Patent Acquisition Tracker and get the required details.