2024 was a year that kept patent litigators on their toes. It wasn’t just about more filings or another big verdict, it was a year when the very foundations of patent litigation were tested, forcing professionals to adapt, rethink strategies and prepare for a new normal in the courtroom.

It all began with the Federal Circuit’s decision in LKQ v. GM in May, which rocked the design patent world. By replacing the Rosen-Durling test with a more flexible standard for obviousness, the court forced industries, from automotive to consumer tech, to take a long, hard look at their design portfolios. What was once considered bulletproof was now up for debate, changing the game for companies that rely on design patents to safeguard their innovations.

Just when you thought things had settled, the Supreme Court made its move, ending Chevron deference. In a moment that seemed to reverberate across every aspect of patent law, this shift handed federal courts more authority, changing how agencies like the USPTO and ITC operate.

Meanwhile, the high-profile wins and verdicts spoke for themselves. Lindis Biotech’s $50 million victory against Amgen made it clear that patent disputes, especially in pharma, are growing more complex and costly. And as if that wasn’t enough, Non-Practicing Entities (NPEs) surged back into the spotlight, adding thousands of new defendants to an already crowded field.

Throughout 2024, 2,594 patent litigation cases were filed across the US, reflecting a year where the volume and intensity of patent disputes only increased. What’s important to note is that the insights presented here include data not only from federal court cases but also from ITC proceedings, adding another layer of context to this year’s shifting litigation landscape.

Note: The data reflects active cases from January 1, 2024, to March 31, 2024, and includes both active and pending cases from April 1, 2024, to December 31, 2024 in the USA.

How Did Patent Litigation Trends Evolve in 2024 in the United States?

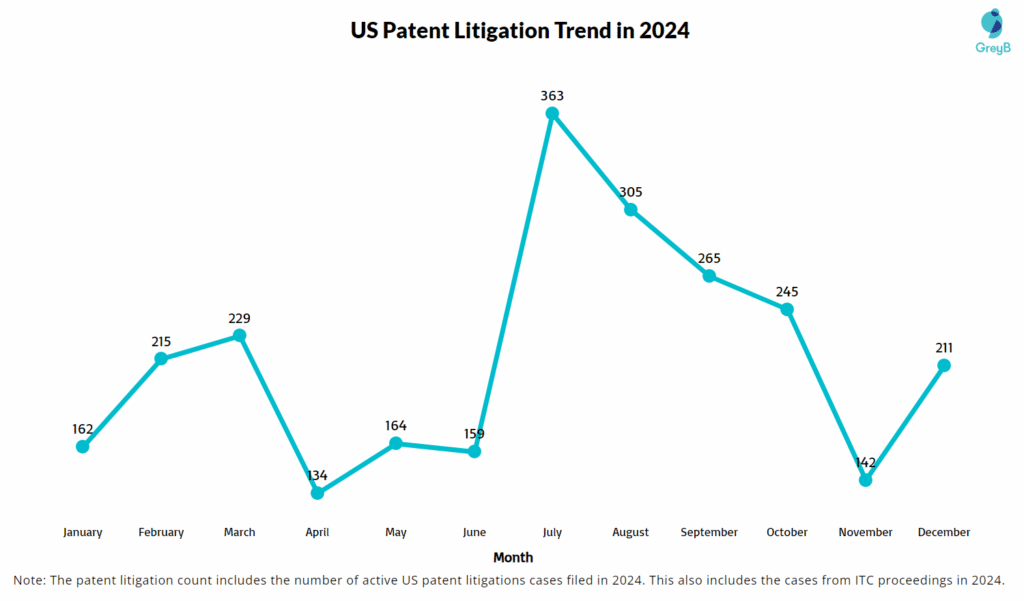

The chart illustrates the monthly trends in patent litigation cases filed in 2024 across US federal courts, with data reflecting both regular patent cases and ITC proceedings.

Patent litigation in 2024 had its ups and downs, reflecting the dynamic nature of the industry. July saw a sharp spike with 363 new cases, marking the peak of litigation activity for the year. This surge can be attributed to several factors: mid-year assessments, strategic filing after key court rulings and a rise in Non-Practicing Entity (NPE) activity.

For those interested in deepening their understanding of NPE-driven litigation, we recommend checking out our dedicated article on NPE litigation trends in 2024 for further insights on how assertion strategies shaped the filing patterns this year.

In 2024, April saw the opposite trend, with filings dropping to just 34 cases. This dip can be explained by tax season in the US, where many companies focus on compliance and financial reporting, temporarily shifting attention away from litigation.

In short, the pattern of patent litigation in 2024 was defined by tactical decision-making, with months of heightened activity followed by natural dips as companies recalibrate, assess strategy and prepare for the next legal wave.

Patent litigation is only part of the story. Want to know how PGR, IPR and ex-parte reexaminations influenced outcomes in 2024? Get the full report by filling out the form below.

With the litigation landscape shifting, the next question is: Where did all these cases land? The next section takes a closer look at the top venues across the US that received the most patent litigation suits in 2024.

Top Venues in the USA that received the Most Patent Litigation Suits in 2024

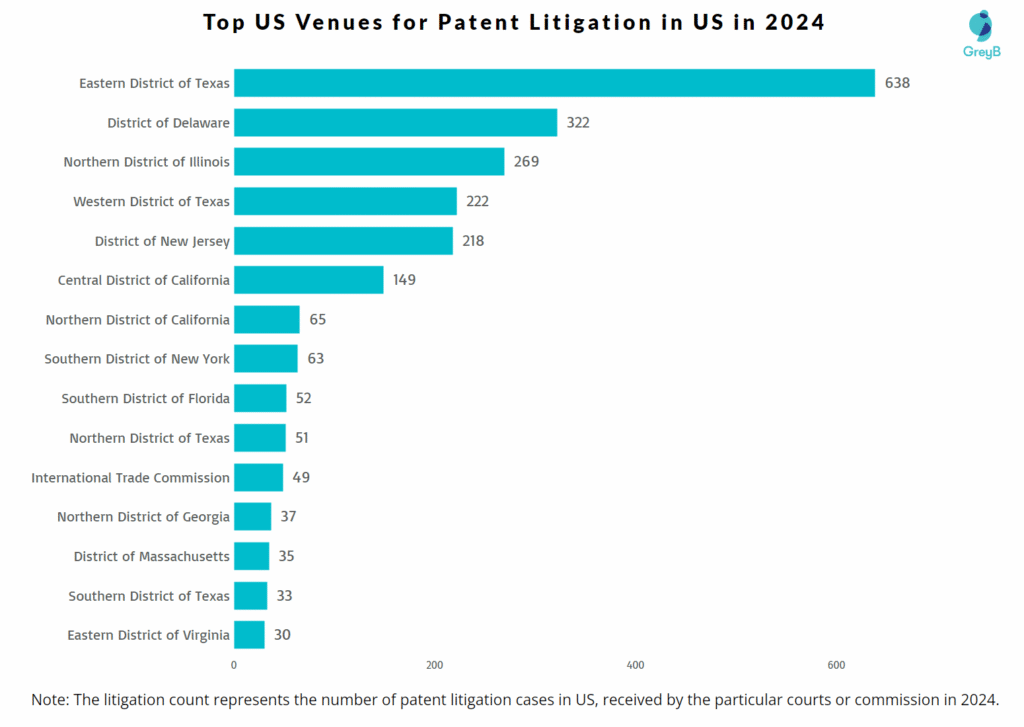

The chart below highlights the top US venues for patent litigation in 2024, showcasing the number of cases received in the most active districts.

Looking at the top venues for patent litigation in 2024, one thing stands out: Texas dominates the list, with four districts, the Eastern, Western, Northern and Southern Districts of Texas, accounting for a total of 944 cases. This geographical dominance points to a few key factors driving the concentration of patent disputes in these areas.

First, the Eastern District of Texas (EDTX) has long been known as a patent litigation hotspot, largely due to its plaintiff-friendly reputation and accelerated trial schedules. The Western District of Texas (WDTX), under the leadership of Judge Alan Albright, has seen an increase in filings, particularly since his appointment, as he is known for fast-tracking patent cases and favoring patent holders.

However, it’s not just Texas that is driving this trend. The District of Delaware, with 322 cases, renowned as patent litigation hotspot, remains a major player due to its strategic location and established history as a go-to venue for patent litigation.

Notably, the International Trade Commission (ITC) also makes an appearance in the top venues, with 49 cases filed. While the ITC is not a federal district court, its inclusion in the list highlights the growing importance of Section 337 investigations. The ITC’s ability to issue exclusion orders against imported goods has made it a powerful tool for patent holders seeking to protect their intellectual property globally.

As we explore the venues driving patent litigation, it’s equally important to understand which the major litigation cases of 2024 are, based on the number of patents involved in these cases.

Which Major US Patent Litigation Cases Involved the Most Patents in 2024?

This table presents the major patent litigation cases of 2024, ranked by the number of patents involved in each case.

| Case Number | Plaintiffs | Defendants | Number of Patents Involved |

| 1-24-cv-01251 | Yeti Coolers Llc | Waterbear Global Llc | 82 |

| 1:24-cv-06497 | Amgen Inc | Celltrion Inc | 29 |

| 1:24-cv-00053 | Regeneron Pharmaceuticals Inc | Celltrion Inc | 25 |

| 3:24-cv-00882 | David Austin Roses Limited | Gcm Ranch Llc | Sproutique Llc | 24 |

| 0-24-cv-04269 | Nokia | Element Television Company | 17 |

| 1:24-cv-00688 | Novo Nordisk | Rio Biopharmaceuticals Inc | 17 |

| 3-24-cv-02014 | Yakima Products Inc | Thule Sweden Ab | 16 |

| 3:24-cv-04314 | Intra-Cellular Therapies Inc | Dr Reddys Laboratories | 16 |

| 3:24-cv-04327 | Intra-Cellular Therapies Inc | Sandoz Inc | 16 |

| 1:24-cv-00432 | Horizon Therapeutics Inc | Teva Pharmaceutical | 14 |

| 2-24-cv-00646 | Light Guide Innovations Llc | Tcl Communication Ltd | Tcl Technology Group Corporation | 14 |

| 1-24-cv-01411 | Harman International Industries Inc | Klipsch Group Inc | Voxx International Corp | 13 |

| 2:24-cv-04608 | Axsome Therapeutics Inc | Alkem Laboratories Limited | Hikma Pharmaceuticals Usa Inc | Sandoz Inc | Unichem Laboratories Limited | 13 |

| 1-24-cv-00756 | Sap | Key Patent Innovations Limited | Patent Platform Services Llc | Valtrus Innovations Limited | 12 |

| 1-24-cv-01390 | Divx Llc | Top Victory Investments Ltd | 12 |

Notably, Yeti Coolers LLC filed an unprecedented 82-patent suit against Waterbear Global LLC, likely a licensing or portfolio defense strategy rather than a conventional infringement claim. Pharma disputes also appear prominently, with Amgen, Regeneron, and Intra-Cellular Therapies engaged in multi-patent battles reflecting the complexity of biologics and generics markets.

Want to see patents involved for every case in the article? We’ve tracked each patent litigation, and the data could drastically shift your IP strategy. Don’t miss out on critical information that could shape your legal moves.

Fill out the form below to get access to exclusive information and stay ahead of the game!

As we’ve seen the major cases and the number of patents at play, it’s equally crucial to understand who is driving these disputes. In the next section, we’ll take a closer look at the top plaintiffs involved in US patent litigation in 2024, revealing the key players behind these high-stakes cases and the sectors they represent.

Who Were the Top Plaintiffs Driving US Patent Litigation in 2024?

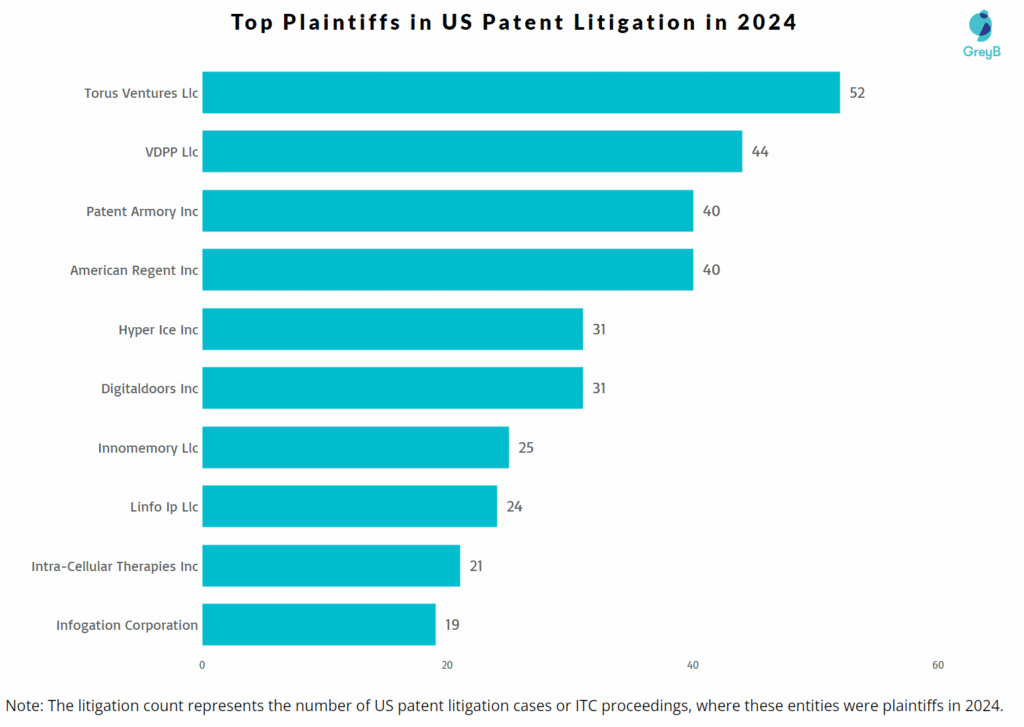

This chart presents the top plaintiffs involved in US patent litigation in 2024, ranked by the number of cases filed.

The list of top plaintiffs in 2024 highlights a dominance of Non-Practicing Entities (NPEs), with companies like Torus Ventures Llc, VDPP Llc and Patent Armory Inc leading the charge. These entities, often referred to as patent trolls, assert patents not as part of manufacturing or service delivery, but purely to extract settlements or damages from other companies.

For a deeper understanding of the specific patents at the center of these litigations, our article on the Most Asserted Patents provides valuable insights into the patents that were most frequently asserted from 2021 to 2024.

On the flip side, companies like Hyper Ice Inc, Digitaldoors Inc and Intra-Cellular Therapies Inc, rooted in wellness tech and biopharmaceuticals respectively, represent operating companies actively defending market share and R&D investments through enforcement.

This distribution of plaintiffs paints a picture of a growing patent assertion economy, where litigation is often driven by entities whose sole purpose is to profit from existing patents, rather than innovate or commercialize products. For companies, this means an increased need for proactive defensive strategies and a rethinking of how patents are protected and enforced.

With the landscape shaped by NPEs and tech-based companies, the next logical step is to turn our attention to the top defendants in patent litigation for 2024, to understand who is on the receiving end of these patent disputes.

Who Were the Top Defendants Driving US Patent Litigation in 2024?

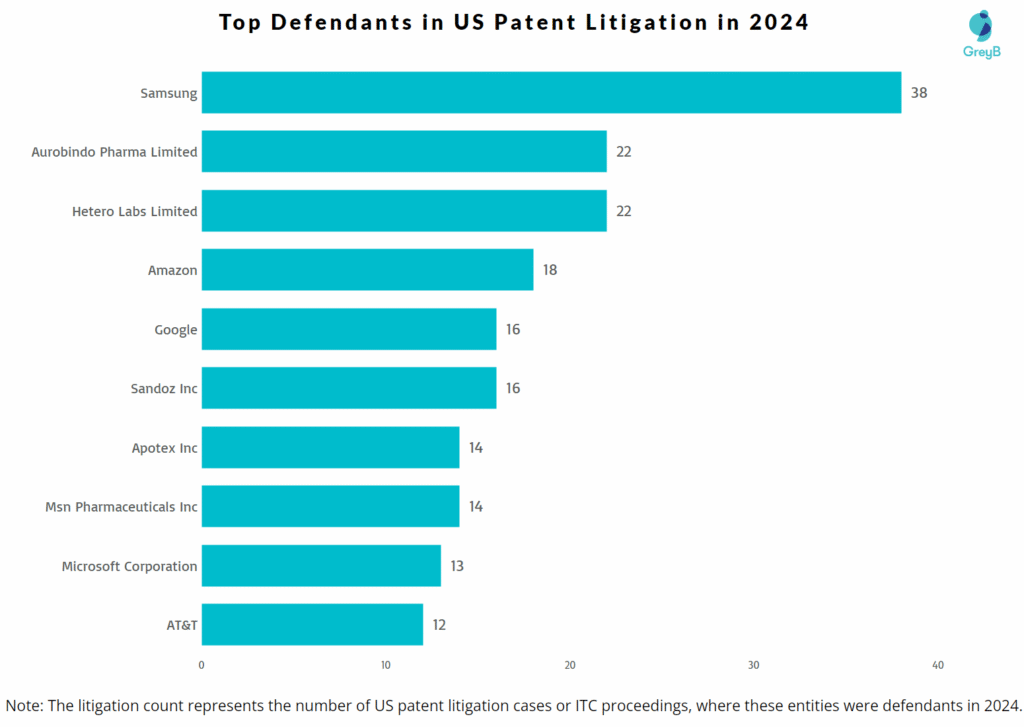

This chart presents the top defendants involved in US patent litigation in 2024, ranked by the number of cases filed.

2024’s most litigated companies reflect a familiar narrative tech and pharma remain prime battlegrounds for patent disputes. At the top is Samsung, which is no surprise given its sprawling patent footprint across consumer electronics, semiconductors and mobile technology. The company’s global scale and deep IP portfolio make it a frequent target for both NPEs and operating companies alike.

Meanwhile, the pharmaceutical sector saw heavy litigation activity, particularly among generic drug makers. Aurobindo Pharma, Hetero Labs, Sandoz, Apotex, and MSN Pharmaceuticals each appeared in over a dozen lawsuits, often tied to ANDA (Abbreviated New Drug Application) litigation, a type of dispute common under the Hatch-Waxman Act.

Big tech wasn’t spared either. Amazon, Google, Microsoft and AT&T were frequently pulled into lawsuits, many of them filed by NPEs asserting software and communication patents. These companies often face broad patent exposure due to the scale of their digital operations and infrastructure.

As NPEs continue to target these prominent defendants, the next step is to explore the key plaintiff law firms that represent these entities in patent disputes, offering a closer look at the legal minds behind these high-profile cases in 2024.

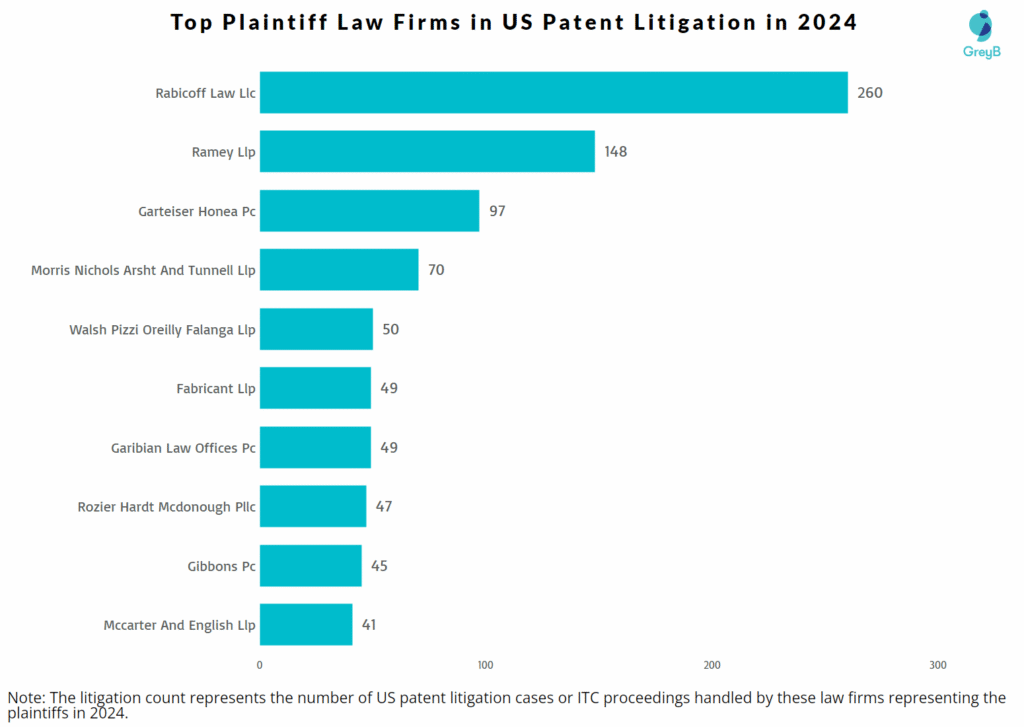

Which Law Firms Were Representing the Plaintiffs in US Patent Litigation in 2024?

This chart presents the top plaintiff law firms involved in US patent litigation in 2024, ranked by the number of patent cases they represented.

Now that we’ve explored the key plaintiff law firms driving patent litigation, it’s time to turn our attention to the other side of the courtroom. In the next section, we’ll examine the top defendant law firms that represented the companies targeted in the 2024 patent disputes.

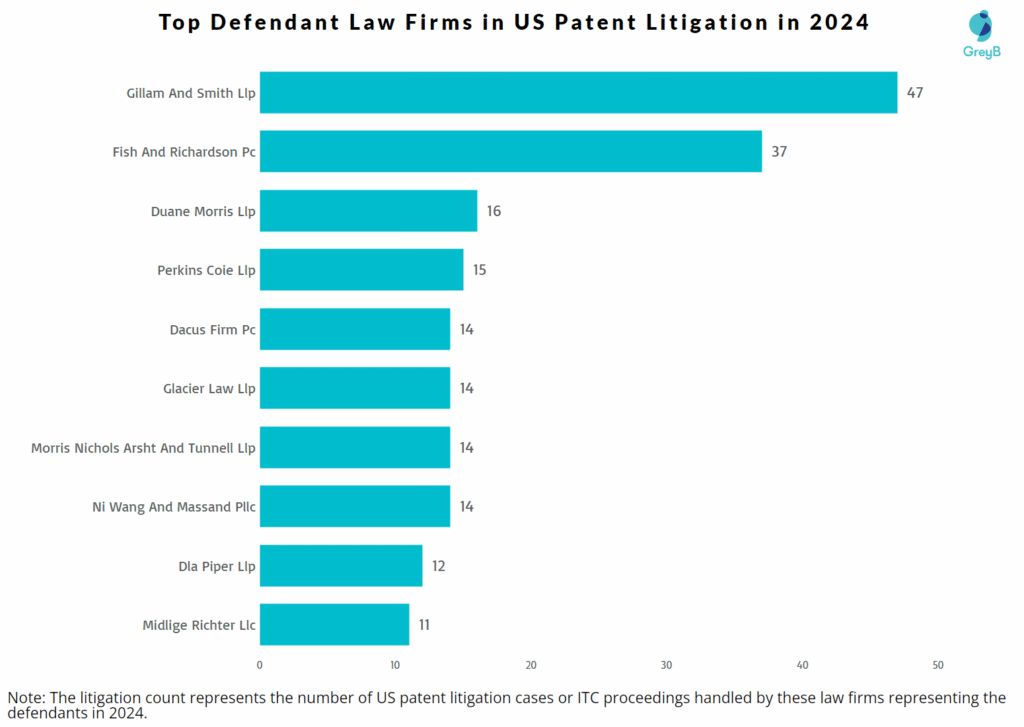

Which Law Firms Were Representing the Defendants in US Patent Litigation in 2024?

This chart presents the top defendant law firms involved in US patent litigation in 2024, ranked by the number of patent cases they represented.

After exploring the defendant law firms shaping patent defense strategies in 2024, it’s essential to understand which technologies were at the center of these legal battles. In the next section, we’ll delve into the top tech areas most targeted in US patent litigation, revealing the sectors that saw the most patent disputes and why these areas are under intense scrutiny.

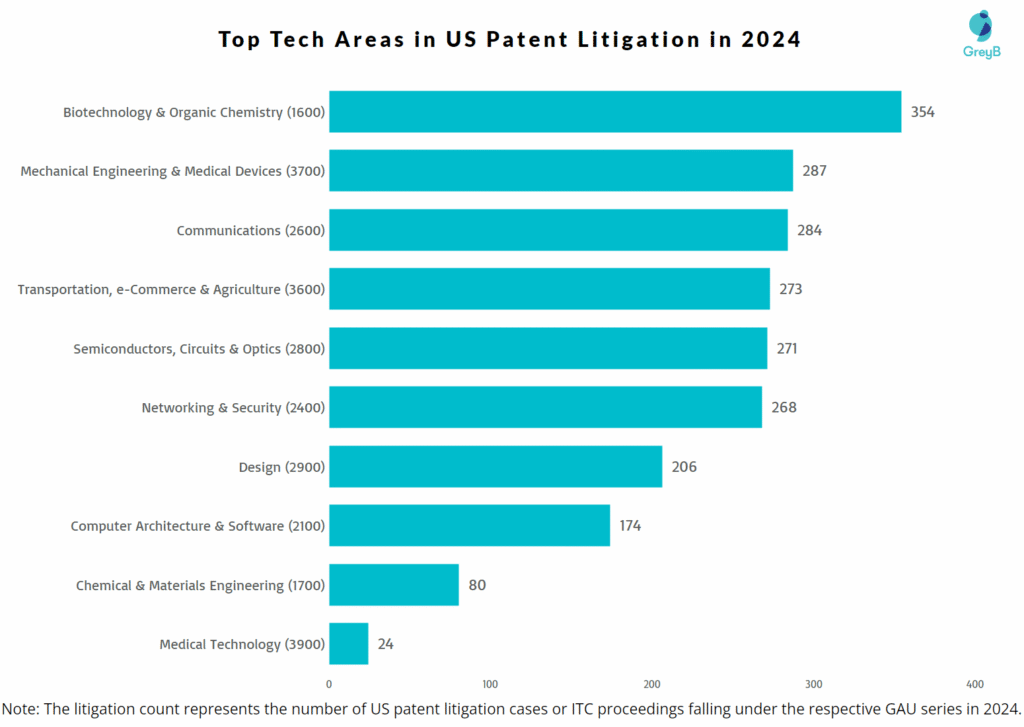

Which Tech Areas Were Most Targeted in US Patent Litigation Cases in 2024?

This chart presents the number of patent litigation cases handled by various GAU (Group Art Units) series in 2024. It reflects the tech domains most involved in disputes, with the understanding that a single case may span multiple tech areas, as each patent may be categorized under several GAUs. This should not be confused with the total count of active patent litigation cases for the year.

This distribution of cases across various tech sectors reveals the increasing complexity of modern patent litigation. Innovation-heavy industries like biotech and networking are leading, but emerging fields like semiconductors and medical technologies are also becoming key battlegrounds.

The fact that a single patent may fall under multiple GAUs highlights the multidimensional nature of modern technologies and the intricate web of interrelated innovations that are often at the core of these disputes.

Want to Explore Patent Litigation in Your Tech Domain?

Looking for in-depth insights on US patent litigation cases in your specific area of expertise? Fill out the form to gain access to comprehensive case details that could refine your legal strategy and give you a competitive edge!

With 2024’s litigation trends providing insights into the sectors most under scrutiny, in the next section, we’ll break down the key patent litigation cases with the largest financial outcomes, providing a closer look at how much these disputes are worth.

Which Top 10 US Patent Litigation Cases Yielded The Highest Compensation in 2024?

This section highlights the Top 10 US patent litigation cases in 2024 that resulted in the highest compensation awards. It provides insight into the financial stakes of patent disputes, showcasing the key cases where significant damages were granted.

| Case Number | Plaintiff | Defendant | Court Name | Compensation Awarded |

| 2-22-cv-00394 | General Access Solutions Ltd | Verizon Data Services Llc | Verizon Corporate Services | Group Inc | Verizon Online Llc | Verizon Communications Inc | Cellco Partnership | Verizon Business Global Llc | Verizon Services Corp | Verizon Business Network | Services Inc | Eastern District of Texas | $847.00 million |

| 1-18-cv-08175 | Kove Io Inc | Amazon Technologies Inc | Amazon Com Inc | Northern District of Illinois | $525.00 million |

| 2-22-cv-00294 | Netlist Inc | Micron Technology Inc | Micron Semiconductor Products Inc | Micron Technology Texas Llc | Eastern District of Texas | $425.00 million |

| 8-16-cv-01799 | Spex Technologies Inc | Western Digital Corp | Hgst Inc | Western Digital Technologies Inc | Central District of California | $315.72 million |

| 8-22-cv-01599 | Mr Technologies Gmbh | Western Digital Technologies Inc | Central District of California | $262.39 million |

| 1-18-cv-00001 | Ipa Technologies Inc | Microsoft Corp | District of Delaware | $242.00 million |

| 2-22-cv-00398 | Mojo Mobility Inc | Samsung Electronics America Inc | Samsung Electronics Co Ltd | Eastern District of Texas | $192.14 million |

| 6-21-cv-00898 | Almondnet Inc | Intent Iq Llc | Amazon Web Services Inc | AmazonCom Services Llc | Amazon Com Inc | Western District of Texas | $121.95 million |

| 2-22-cv-00293 | Netlist Inc | Samsung Electronics America Inc | Samsung Electronics Co Ltd | Samsung Semiconductor Inc | Eastern District of Texas | $118.00 million |

| 1-21-cv-01015 | Nippon Shinyaku Co Ltd | Sarepta Therapeutics Inc | District of Delaware | $115.22 million |

2024 has already proven to be a defining year for US patent litigation. With new rulings, explosive settlements and a surge in high-stakes cases, the game has changed. From tech giants battling over semiconductor patents to emerging companies staking their claim in industries like biotech and security, every case is shaping the future of innovation.

Key Strategic Takeaways

- Design patent law and administrative deference underwent foundational shifts.

- Patent litigation volumes increased, driven by NPE resurgence and pharma complexity.

- Texas and Delaware continue to be venue battlegrounds.

- Verdict values soared—a reflection of growing litigation maturity and strategic assertion.

- Stakeholders must proactively align legal strategy with a volatile litigation environment.

These shifts don’t just reflect the evolving legal landscape, they represent opportunities and risks that could determine the success of your IP strategy moving forward. With so much at stake, the question is: Are you prepared to navigate the twists and turns of patent litigation?

The stakes are higher than ever.

The top 10 cases we’ve highlighted here are just the beginning. These cases reflect the largest compensation awards, but in reality, there were 65+ cases in 2024 where substantial compensation was awarded.

As patent litigation continues to evolve, having insight into the full landscape is essential for staying ahead of the curve. Want access to the details of all the high-compensation cases in 2024, or perhaps just the top 10? We’ve got you covered. The patents, technologies and current case statuses are available—ready to reshape your IP strategy.

Fill out the form below to get access to the detailed insights.