The latest patent reassignment cycle recorded the transfer of more than 750 US patents, underscoring a clear acceleration in secondary patent-market activity across multiple high-value technology sectors.

In total, 296 reassignment transactions resulted in 795 unique assets moving to new owners. These included 177 pending applications, 39 design patents and 72 expired patents. This composition suggests that the activity goes well beyond routine portfolio housekeeping. Instead, it reflects an intentional reshaping of intellectual property positions by both operating companies and non-practicing entities. The presence of early-stage filings alongside design-focused assets points to growing interest in technologies that can drive product differentiation today while preserving long-term competitive optionality.

Equally notable is the diversity of technical coverage. The transferred patents span semiconductors, medical devices, wireless and networking technologies, biotechnology, and telecommunications. This broad distribution mirrors the innovation pressure points currently faced by companies operating under compressed development cycles, intensifying competition and evolving regulatory and market dynamics.

Individually, each reassigned patent represents a shift in ownership. Collectively, however, these transfers signal something more consequential. Changes in control directly influence future licensing strategies, monetisation potential, competitive positioning and the likelihood of disputes. Viewed as a whole, December’s reassignment activity offers a directional snapshot of how IP value is being redistributed and where strategic leverage is likely to concentrate next.

Looking for early indicators behind today’s patent realignments?

Revisit our November 2025 patent transaction analysis, where the initial signals of these strategic reallocations first became visible.

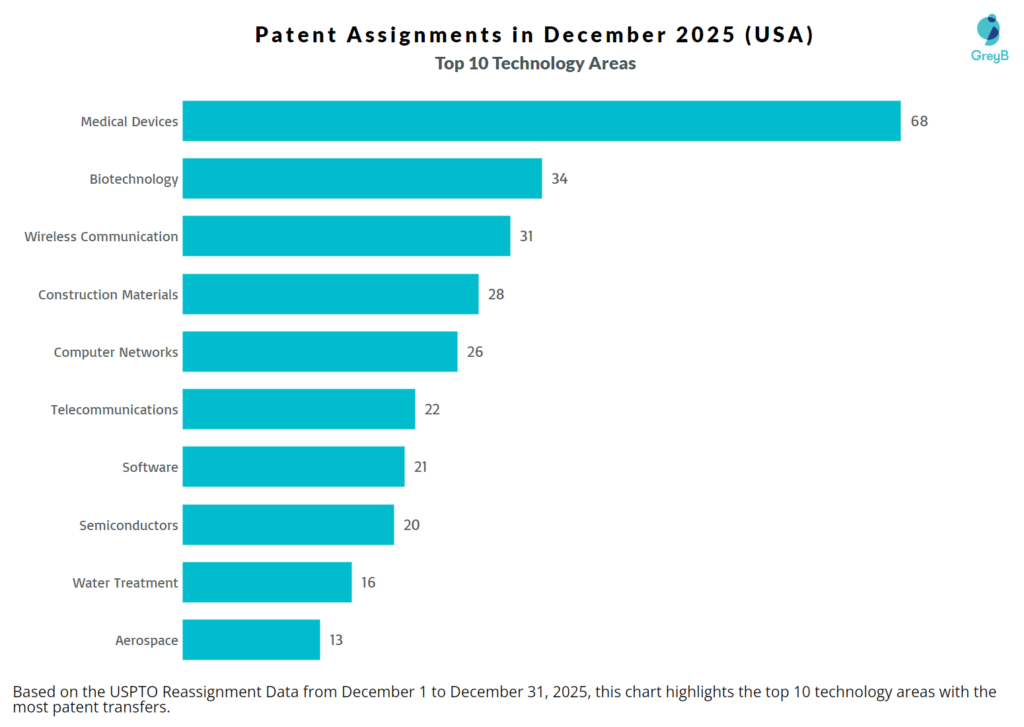

Which Technology Areas Are Leading in the Latest Patent Transfers?

The distribution of patent reassignments in December offers a clear view of where innovation pressure is most pronounced.

Medical device technologies led the month, with 68 patents changing ownership. Much of this activity centers on surgical instruments and implant-tracking solutions, reflecting sustained investment in precision-driven and data-enabled medical procedures.

Software and computer networking followed with 47 transfers, highlighting continued focus on core digital infrastructure. The assets span cloud-native system design, cybersecurity frameworks, and scalable networking platforms, underscoring the strategic importance of software-led differentiation and control over data-centric architectures.

Biotechnology accounted for 34 patent transfers, signaling ongoing momentum across biologics, genetic engineering, diagnostics, and therapeutic development platforms. This activity aligns with broader trends toward precision medicine, platform-based drug discovery, and tighter integration between research and clinical application.

Wireless communication recorded 31 reassignments, reinforcing its long-term strategic relevance. These patents support advancements across 5G evolution, early-stage 6G research, IoT connectivity, and edge-enabled communication systems. Collectively, they point to sustained positioning around spectrum efficiency, ultra-low latency services, and increasingly intelligent network behavior.

Semiconductor technologies saw 20 transfers, reflecting steady demand for advanced chip architectures, energy-efficient designs, and specialized processors that enable AI workloads, high-performance computing and next-generation networking.

Aerospace technologies contributed 13 patent reassignments, often tied to avionics, propulsion, advanced materials and space-related systems. These transfers are frequently aligned with defense modernization initiatives and the continued expansion of commercial space capabilities.

Artificial intelligence-related patents showed more selective movement, with six transfers recorded during the month. Rather than broad platform consolidation, this pattern suggests targeted acquisition of high-value algorithms, model optimization techniques and applied AI solutions with clear commercial or strategic relevance.

Curious how AI and machine learning are reshaping next-generation wireless networks?

Explore how intelligent RAN, self-optimising systems and AI-driven network control are redefining connectivity and what this means for licensing strategies and competitive positioning in our in-depth analysis: Invest in AI/ML Technologies to Lead Next-Generation Wireless Networks.

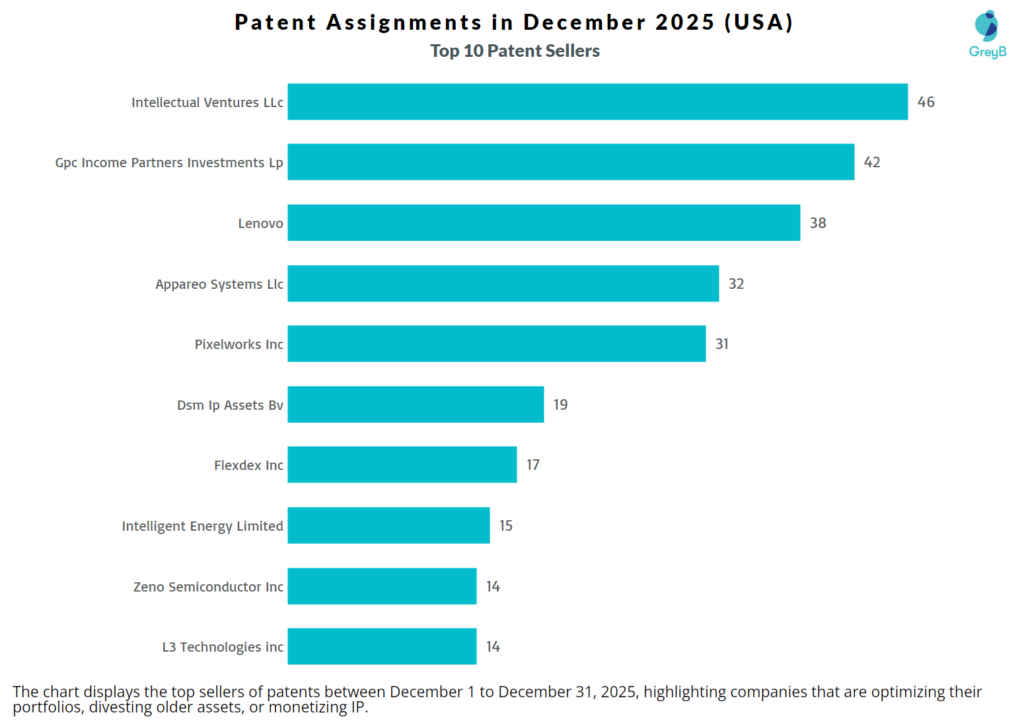

Who Are the Top Sellers and Buyers Shaping the Patent Landscape in December 2025?

The December reassignment cycle reveals pronounced portfolio realignment with several established patent holders accelerating divestments across wireless systems and software-related technologies.

Intellectual Ventures led the sell-side activity, transferring 46 patents and reinforcing its long-standing approach of selectively monetising mature assets. GPC Income Partners Investments LP followed closely with 42 transfers, reflecting continued turnover by financially oriented IP holders.

Lenovo reassigned 38 patents during the month, consistent with its ongoing optimisation of communications and device-related intellectual property. Appareo Systems contributed 32 assets, suggesting a deliberate pullback from embedded and system-level technologies. Taken together, these concentrated sell-side moves point to an industry-wide recalibration, where both operating companies and IP-focused entities are trimming non-core holdings to reduce long-term maintenance costs while sharpening strategic focus.

Intellectual Ventures’ activity carries additional weight given its long-standing role as a high-volume non-practicing entity and active patent litigator. The firm has been involved in more than 450 patent litigation matters, with over 100 cases filed in the past five years alone against operating companies including HP, Ericsson, EMC, Lenovo, TCL and Volvo. This enforcement history provides critical context for its December transactions.

During the month, IV transferred 54 patents to Interstate Patents LLC spanning optics, semiconductors, telecommunications and computer networking. The breadth of these domains suggests a deliberate repositioning of enforcement-ready assets into a specialised holding entity, rather than a passive exit from those technologies.

Why This Matters?

When a prolific NPE reallocates assets to another IP-focused vehicle, it typically signals a recalibration of assertion and licensing strategy rather than a retreat. By moving a multi-domain portfolio to Interstate Patents LLC, IV effectively externalises future licensing and enforcement activity while preserving economic upside through structured transfers or downstream agreements.

For operating companies familiar with IV as a counterparty, such transfers can materially alter risk assessments. Enforcement pressure may re-emerge under a new name with a narrower, more targeted mandate. In this sense, the IV–Interstate transaction reflects a broader market pattern, where litigation-tested patents are repositioned into leaner entities optimised for licensing leverage and long-horizon monetisation rather than direct operating use.

The table below summarises the top ten sellers and buyers in December 2025, along with the primary technology areas involved in each transaction, offering a concise view of where portfolio realignment and acquisition-driven consolidation intersected during the month.

| Seller | Buyer | Count | Tech Area |

| Intellectual Ventures Llc | Interstate Patents Llc | 46 | Computer application & software | Network & Communication | Logistic & Supply Chain | Automotive |

| Gpc Income Partners Investments Lp | Crystal Lagoons Technologies Inc | 42 | Water Treatment & Sustainability | Construction & Architecture |

| Moderno Porcelain Works Llc | Mightyslab Distribution Company Llc | 38 | Construction & Building Materials |

| Lenovo | Edgewood Ip Llc | 38 | Network & Communication |

| Flexdex Inc | Livsmed Inc | 32 | Medical Devices & Robotics |

| Pixelworks Inc | Bitharmony Llc | 31 | Multimedia and Video Processing |

| Dsm Ip Assets Bv | Resolution Medical Llc | 19 | Medical Devices |

| Intelligent Energy Limited | Innovation Asset Collective | 15 | Chemical & Energy |

| L3 Technologies Inc | Vertical Autonomy Llc | 14 | Aerospace Engineering |

| Zeno Semiconductor Inc | Exactojoin Llc | 13 | Semiconductors |

To access the complete patent transaction details and underlying technology coverage, fill out the form below.

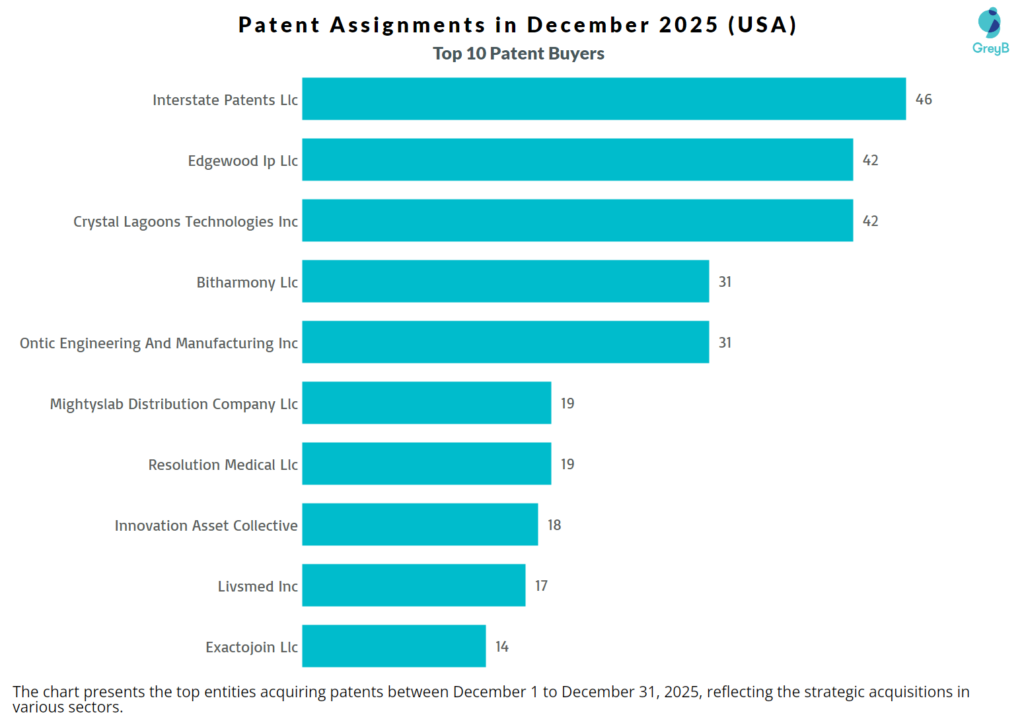

On the acquisition side, activity was equally concentrated and strategically revealing.

Interstate Patents LLC emerged as the top buyer in December, acquiring 46 patents and positioning itself as a major recipient of divested portfolios. Edgewood IP followed with 42 acquisitions, including 38 patents acquired directly from Lenovo.

Notably, all Lenovo-originated assets transferred to Edgewood IP are standards-essential and relate to wireless communication technologies, including VoIP and broader 5G and early 6G developments. This pattern strongly points to a licensing-oriented accumulation strategy, where SEP-heavy portfolios are consolidated to support structured monetisation or future enforcement initiatives.

Crystal Lagoons Technologies also acquired 42 patents, signalling either diversification into adjacent technical domains or deeper consolidation aligned with its core industrial focus. Bitharmony LLC rounded out the top buyers with 31 acquisitions.

The prominence of SEP-driven transfers, particularly those flowing from a major OEM like Lenovo to specialized IP buyers, highlights a broader market dynamic. Operating companies appear increasingly willing to offload surplus or non-core standards assets, while dedicated IP entities quietly consolidate these rights for long-term licensing leverage. Given that wireless SEPs underpin nearly all modern communication products, such portfolios retain relevance across smartphones, network infrastructure and emerging 6G ecosystems.

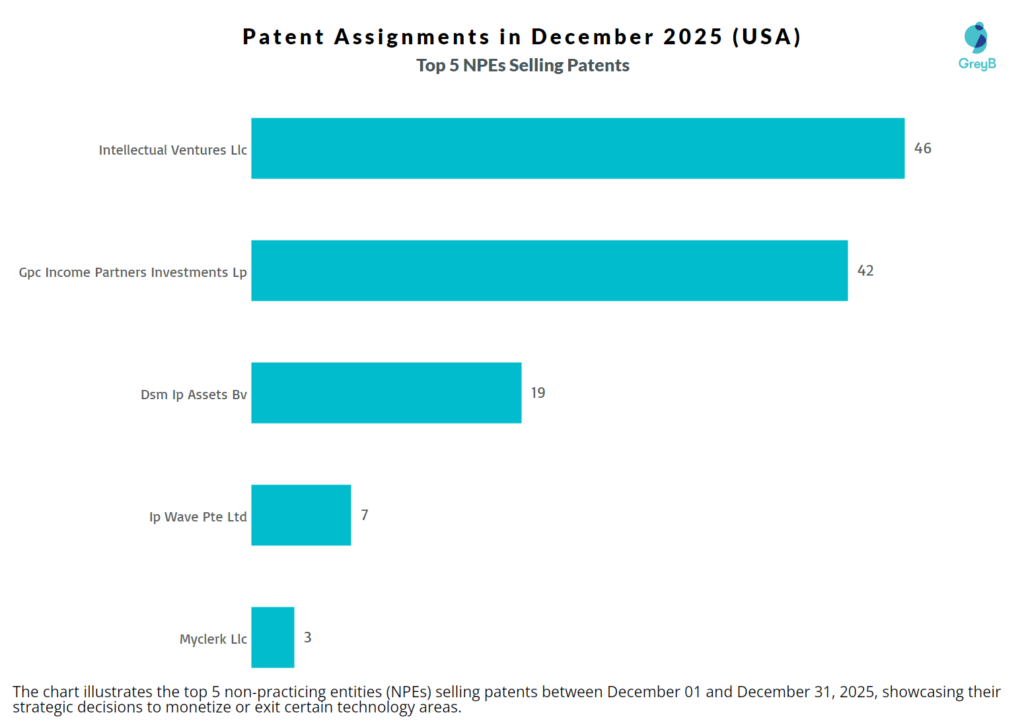

Who Are the Top Non-Practicing Entities (NPEs) Involved in Selling Patents?

Non-practicing entities played a central role in December’s reassignment activity on both sides of the market.

Intellectual Ventures LLC led NPE divestments with 46 transferred patents, followed closely by GPC Income Partners Investments LP with 42 and DSM IP Assets BV with 19. These transactions underscore the continued importance of NPEs as active participants in the trading and monetisation of networking, software and security-related IP.

One particularly notable transaction involved GPC Income Partners Investments LP transferring 42 patents to Crystal Lagoons Technologies. The assets span chemical apparatus, separation and purification systems and fluid handling technologies. Unlike consumer-facing innovations, this portfolio aligns closely with large-scale water treatment, industrial processing and infrastructure-oriented applications.

This move suggests a strategic shift from passive IP holding toward application-driven monetisation, where patent value is realised not only through enforcement but also through integration into real-world systems and long-term industrial projects.

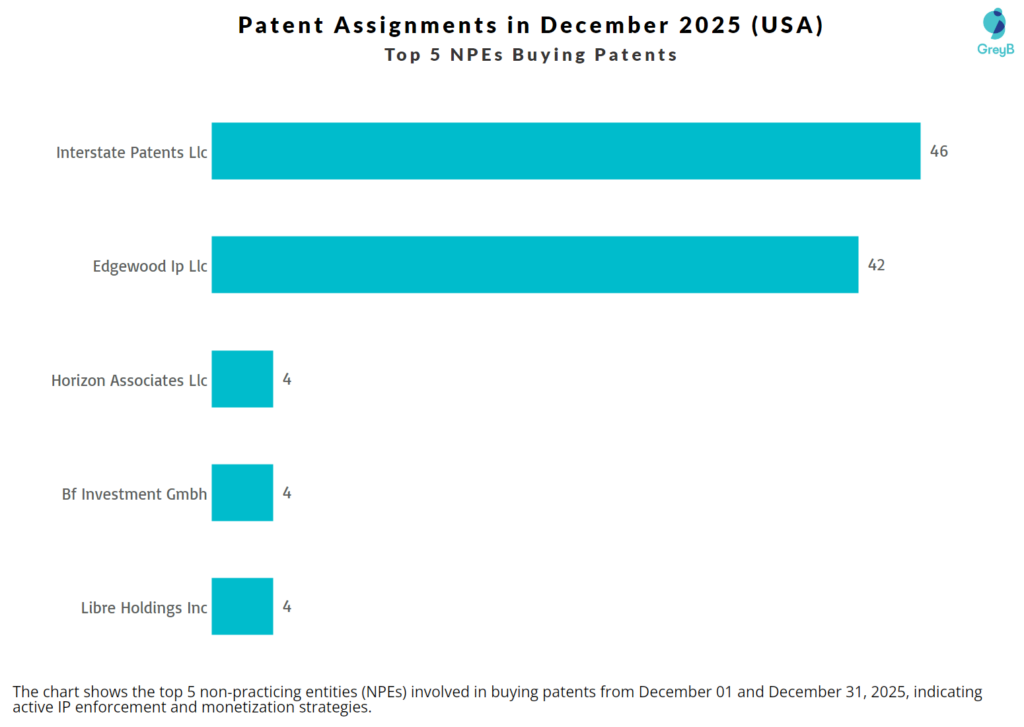

Who Are the Top 5 Non-Practicing Entities (NPEs) Involved in Patent Acquisitions?

Several NPEs also emerged as dominant buyers in December, reinforcing the acceleration of portfolio consolidation across communications, networking and automation technologies.

Interstate Patents LLC and Edgewood IP LLC together accounted for 88 acquisitions, making them two of the most influential buyers of the month.

Edgewood IP LLC appears to operate as a monetisation and assertion-focused entity, acquiring third-party portfolios rather than practising or commercialising products. Entities with similar profiles have historically deployed licensing and enforcement strategies that emphasise early settlement and structured licensing over prolonged litigation.

Edgewood’s acquisition of 38 SEP patents from Lenovo, all related to telecom and computer networking, fits squarely within this pattern. In addition, four further telecom-related SEPs transferred from Motorola reinforce the view that the portfolio is being deliberately constructed around standards-essential connectivity technologies. Such strategies are consistent with broader NPE behaviour, where SEP-centric portfolios are leveraged through licensing programmes and selective enforcement to generate long-horizon monetisation opportunities.

Want visibility into the NPEs shaping today’s patent assignment landscape?

Access the complete list of non-practicing entities involved in recent patent transfers by filling out the form below.

Strategic Patent Assignments: 40+ Telecom SEP Patents Transferred from Lenovo and Motorola to Edgewood IP LLC

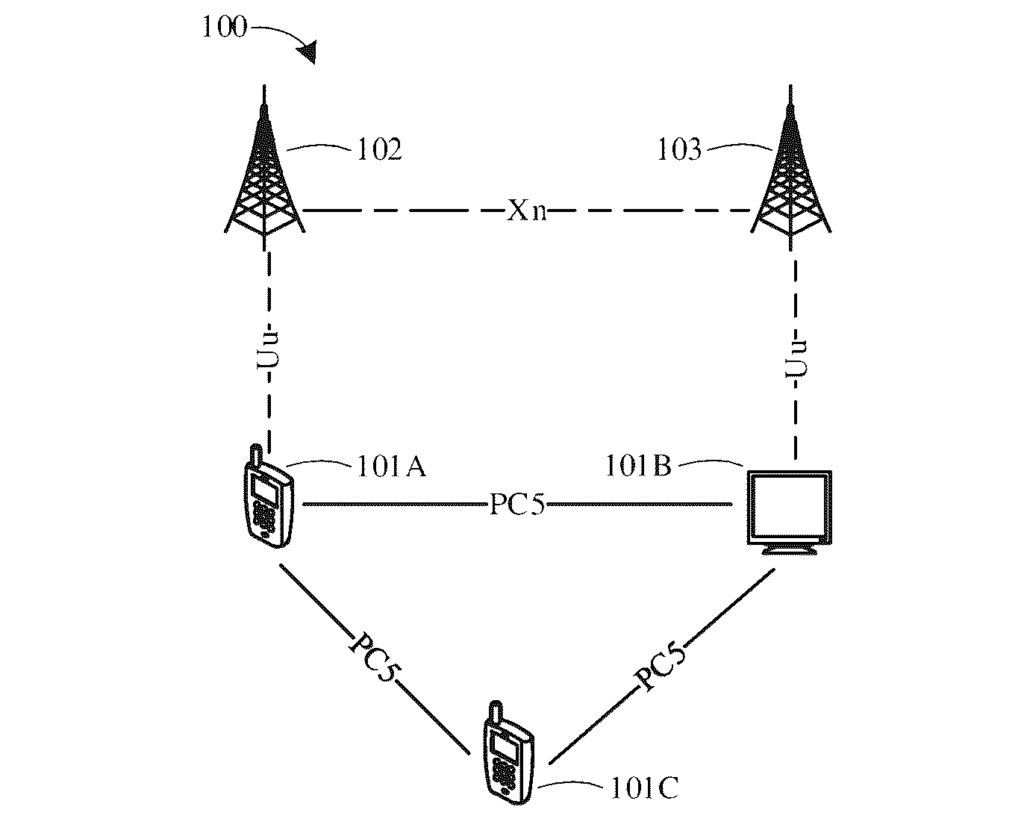

Among December’s patent reassignments, the transfer of more than 40 telecom standards-essential patents from Lenovo and Motorola to Edgewood IP LLC stands out for both its technical depth and strategic implications. Two representative patents, US2025176055A1 and US8254982B2, operate at different layers of the radio access network but address a common challenge: reducing coordination ambiguity caused by indirect inference of network state.

One patent focuses on relay-assisted access in 5G sidelink environments, while the other improves inter-base-station awareness in heterogeneous LTE networks. Despite targeting distinct scenarios, both inventions aim to replace assumption-based behavior with explicit signaling, enabling the network to make faster and more reliable decisions.

Infrastructure-Side Intelligence Over UE Guesswork

Taken together, these patents reflect a design philosophy centered on infrastructure-side intelligence rather than reliance on user-equipment-driven inference. The relay-focused disclosure introduces explicit handling of inactive-state signaling failures when a Remote UE depends on an intermediate relay node. The cell-type signaling disclosure allows base stations to immediately understand the role, scale, and coverage class of neighboring cells without waiting for historical handover data to accumulate.

In both cases, critical state awareness is moved into control-plane signaling. This reduces ambiguity during mobility events, handovers, and failure conditions, scenarios where delayed or inferred information can significantly degrade network performance.

Anticipating Gaps in Evolving Standards

Both filings address areas where standards historically left behavior underspecified. Relay-assisted access during inactive mode and coordination in heterogeneous networks were initially treated as extensions of simpler direct-link models. As cellular networks became denser and more layered, those assumptions began to break down.

These patents anticipate that shift by defining proactive signaling mechanisms that allow the network to adapt in real time. This forward-looking alignment with emerging deployment realities helps explain why such concepts often appear well before standards bodies fully converge on formal solutions.

Patent Deep Dive

US20250176055A1 – Method and apparatus for wireless communication

This application introduces relay-aware inactive-state handling that enables a Remote UE to manage RAN Notification Area updates while accessing the network via a sidelink relay. The UE can interpret relay-originated notifications or PC5 release messages indicating relay handover, radio-link failure, or access rejection. Rather than declaring a connection failure, the UE can defer the update using a pending RNA update flag or restart a periodic update timer.

The invention addresses a clear gap in the current 5G NR framework, where RRC Inactive procedures are largely defined for direct UE-to-base-station links and provide little guidance for relay-dependent access scenarios.

If 3GPP continues to expand sidelink relay support for wearables, automotive systems, and IoT deployments, standardized handling of relay-side interruptions during inactive-mode signaling may become essential for robustness and signaling efficiency.

Why this matters for SEPs?

Once standardized, relay-aware inactive-state behavior is not optional. Any chipset supporting NR sidelink relaying would be required to implement such logic, placing the technology on a clear trajectory toward standard essentiality.

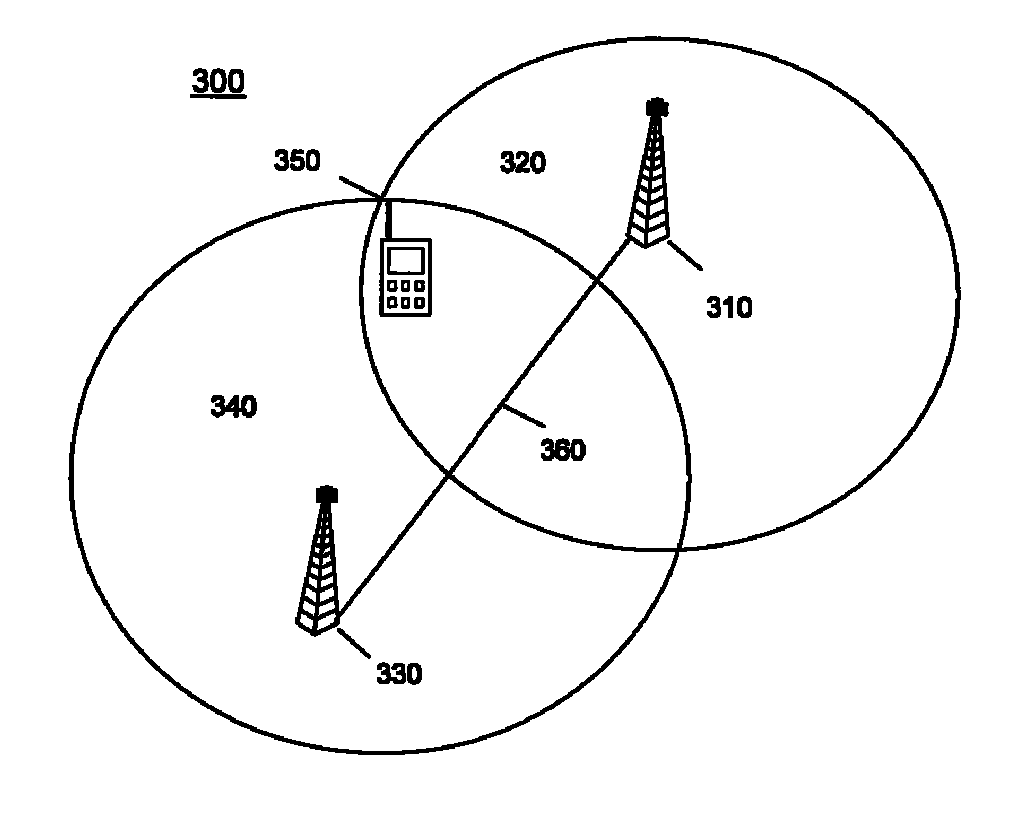

US8254982B2 – Cell-type information sharing between neighboring base stations

This patent introduces explicit cell-type signaling between base stations, enabling each node to advertise its coverage class, such as macro, micro or pico, during standard setup or configuration procedures. By embedding this information into X2 Setup, S1 Setup or eNodeB Configuration Update messages, base stations gain immediate awareness of neighbor capabilities.

The approach eliminates reliance on slow and error-prone statistical inference from user-equipment handover history, addressing a longstanding gap in LTE and early heterogeneous network deployments where base stations lacked real-time insight into neighboring cell roles.

Relevance for OEMs and Network Operators

These technologies are directly relevant to companies that design, deploy, and optimize cellular infrastructure in heterogeneous environments. Infrastructure vendors such as Ericsson, Nokia, Samsung, Huawei and ZTE, all active developers of macro and small-cell RAN solutions, have clear commercial and strategic interest in such capabilities.

Network operators including Verizon, AT&T, T-Mobile, Vodafone and Telefónica would benefit from improved handover stability, faster network optimization and reduced operational overhead, particularly in dense urban macro–small-cell deployments.

Looking to explore high-value telecom SEPs shaping 5G and beyond?

Get in touch to dive deeper into these assets and their strategic relevance across evolving wireless standards by reading this article: Who’s Leading the 5G-Advanced Race? GreyB’s 5G-Advanced Ownership Report

Turning Patent Complexity into Strategic Advantage

As patent-market activity accelerates, reassignment decisions increasingly reflect deliberate strategic intent rather than routine transfers. Some portfolios are being repositioned to support long-term innovation roadmaps, while others are consolidated to enable licensing, monetisation or future enforcement.

We help clients navigate this complexity by identifying high-impact patents with strong licensing and assertion potential, developing litigation-ready claim charts and licensing talk decks and designing monetisation strategies aligned with technical depth, standards relevance and market timing. With the right insight and execution, today’s patent marketplace can become a source of sustained competitive advantage rather than uncertainty.