Over 800 US patents changed hands in just the first three weeks of October 2025 — a clear signal that the IP landscape is shifting gears.

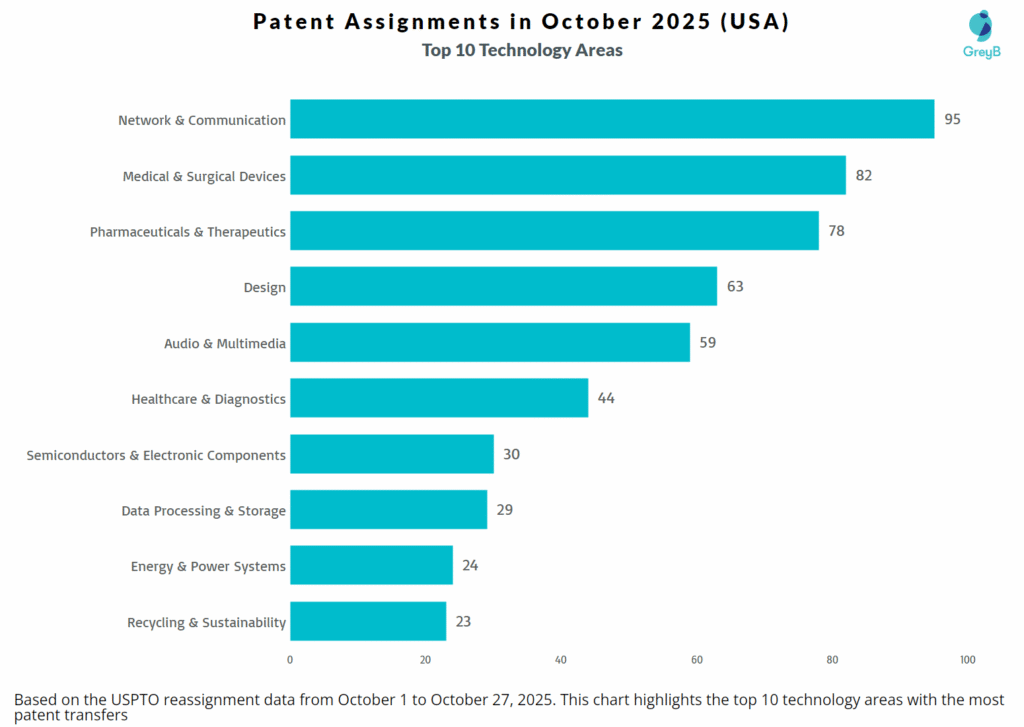

Between October 1 and October 27, a total of 112 reassignment transactions under the United States Patent and Trademark Office (USPTO) encompassed more than 800 unique patents, spanning everything from network & communication (95) and medical & surgical devices (82) to pharmaceuticals (78) semiconductors (30) and recycling/sustainability (23).

This flurry of activity is more than routine housekeeping, it reveals which technologies are emerging as strategic battlegrounds. For example, the wireless‑communications sector is re‑engaging in large‑scale patent movement, underscored by portfolio transactions tied to 4G/5G assets. Meanwhile, the medical‑device industry is seeing a surge of innovation and consolidation in AI‑enabled diagnostics, wearables and surgical robotics.

Why does this matter? Because each transferred patent represents a strategic shift: new ownership, new risk, new opportunity. These aren’t just filings on a ledger; they are levers that influence licensing trajectories, portfolio monetisation, competitive positioning and potential litigation.

As you read on, these transfers will emerge as more than raw data, they are a directional map for where IP value is moving, and where it may be headed next.

Which Technology Areas Are Leading in October 2025 Patent Transfers?

October’s patent transfers offer a clear snapshot of where innovation is surging. The network and communication sector leads the charge with 95 patents moving hands, underscoring the relentless drive towards next-generation networks, from 5G to the early rumblings of 6G. Telecom giants are optimizing their portfolios, divesting older assets and positioning for future advancements in wireless technology.

In parallel, the medical and surgical devices sector saw 82 patents reassigned, reflecting the growing demand for cutting-edge healthcare innovations. From minimally invasive surgeries to wearable health devices, this surge signals the ongoing transformation of the medical landscape, driven by precision technologies and AI-enabled solutions.

Meanwhile, pharmaceuticals and therapeutics saw 78 patents transferred, highlighting the continued investment in drug development, particularly in targeted therapies and biopharmaceuticals. These transfers underscore a vital shift towards personalized medicine and breakthrough treatments aimed at tackling complex health challenges.

Not far behind, design and audio & multimedia technologies also commanded attention, as patents tied to consumer electronics and entertainment media reflected an increasing focus on immersive experiences and advanced product designs.

Additionally, we identified a diverse set of niche technologies spanning textiles, construction, defense and additive manufacturing and others, representing outlier patents that fall outside the broad categories highlighted in the table below.

| Technology Areas | Patent Count | Description |

| Network & Communication | 95 | Wireless, optical and digital communication systems driving connectivity, data transmission and signal efficiency. |

| Medical & Surgical Devices | 82 | Advanced tools and systems supporting surgical precision, patient care and medical procedure optimization. |

| Pharmaceuticals & Therapeutics | 78 | Drug compositions, biologics and therapeutic solutions driving innovation in modern medicine and disease management. |

| Design | 63 | Design-focused innovations enhancing functionality, user experience and product aesthetics across industries. |

| Audio & Multimedia | 59 | Sound, broadcasting and multimedia technologies enriching digital communication and entertainment experiences. |

| Healthcare & Diagnostics | 44 | Technologies for monitoring, diagnostics and treatment that advance personalized and preventive healthcare. |

| Semiconductors & Electronic Components | 30 | Foundational electronic components and circuitry powering next-generation devices and communication systems. |

| Data Processing & Storage | 29 | Computing and data management solutions enabling efficient analytics, processing and secure digital storage. |

| Energy & Power Systems | 24 | Breakthroughs in energy generation, storage and management enabling efficient and sustainable power solutions. |

| Recycling & Sustainability | 23 | Eco-driven technologies promoting waste reduction, material recovery and circular economy practices. |

| Consumer Electonics & Wearables | 20 | Everyday smart devices and connected wearables transforming lifestyle, health and digital convenience. |

| Automotive | 19 | Vehicle systems and innovations advancing automation, safety and the evolution of intelligent mobility. |

| Industrial Manufacturing & Equipment | 18 | Machinery and industrial technologies streamlining production, precision engineering and process automation. |

| Sensors & Imaging Systems | 16 | Vision, radar and sensing technologies improving automation, data perception and digital imaging accuracy. |

| Packaging & Container | 13 | Innovative and sustainable packaging systems enhancing product protection, logistics and consumer appeal. |

| Blockchain & Payment Systems | 13 | Secure and decentralized financial technologies reshaping transactions, authentication and digital commerce. |

| Food & Consumer Goods | 11 | Innovations improving food composition, safety and quality, alongside advancements in personal care formulations. |

| Advanced Materials & Nanotechnology | 11 | High-performance and nanoscale materials enabling stronger, lighter and more adaptive product solutions. |

| Chemical & Material Processing | 10 | Chemical transformation, purification and synthesis technologies enhancing industrial and material performance. |

| 3D Scanning | 9 | High-precision scanning and digital modeling technologies enabling accurate replication and product design. |

| Gaming & Digital Interaction | 6 | Interactive entertainment, gamification and social platforms redefining user engagement and virtual experiences. |

| Software & Internet Services | 5 | Digital software and web-based systems enhancing connectivity, productivity and online experience. |

| Animal Trap | 4 | Mechanical and safety devices designed for humane animal control and environmental management. |

| Medical Imaging | 4 | Advanced imaging systems improving diagnostic precision, visualization and guided medical interventions. |

| Mapping & Navigation | 4 | Geospatial and navigation systems supporting logistics, mobility and autonomous operations. |

| Lighting & Optical Systems | 3 | Light-based and optical technologies driving advancements in visibility, imaging and photonic applications. |

| AR/VR | 2 | Immersive augmented and virtual reality platforms transforming visualization, simulation and digital collaboration. |

In sum, these patent transactions reveal much more than simple ownership changes, they point to the emerging technology hubs of tomorrow. For those tracking IP, the story is clear: technology is converging and the next wave of innovation is already taking shape through strategic patent moves.

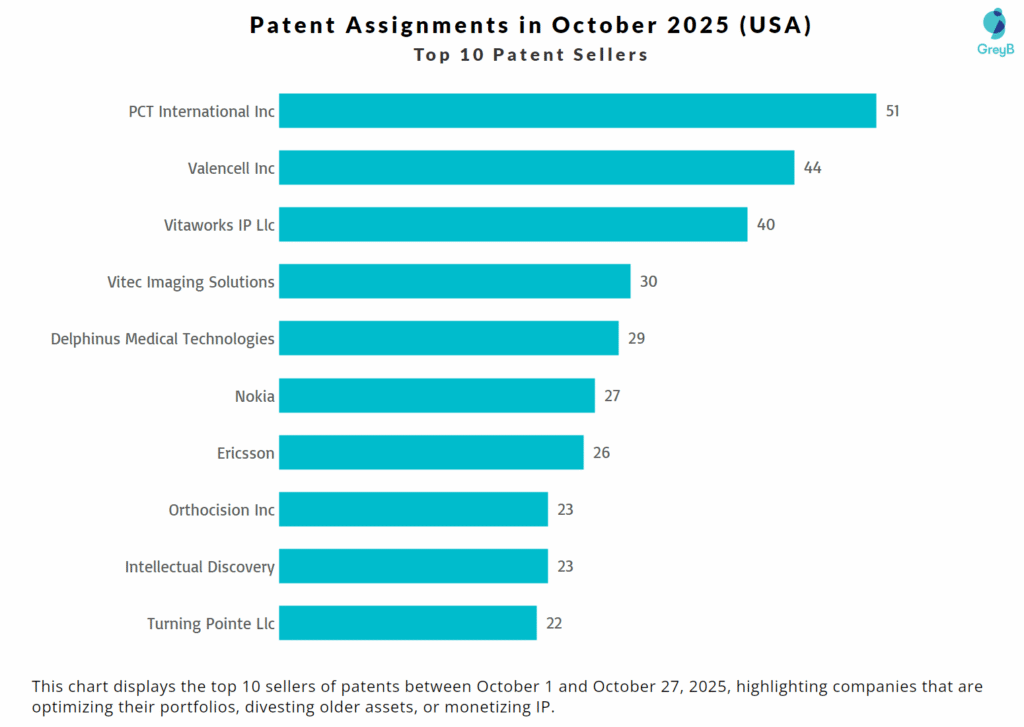

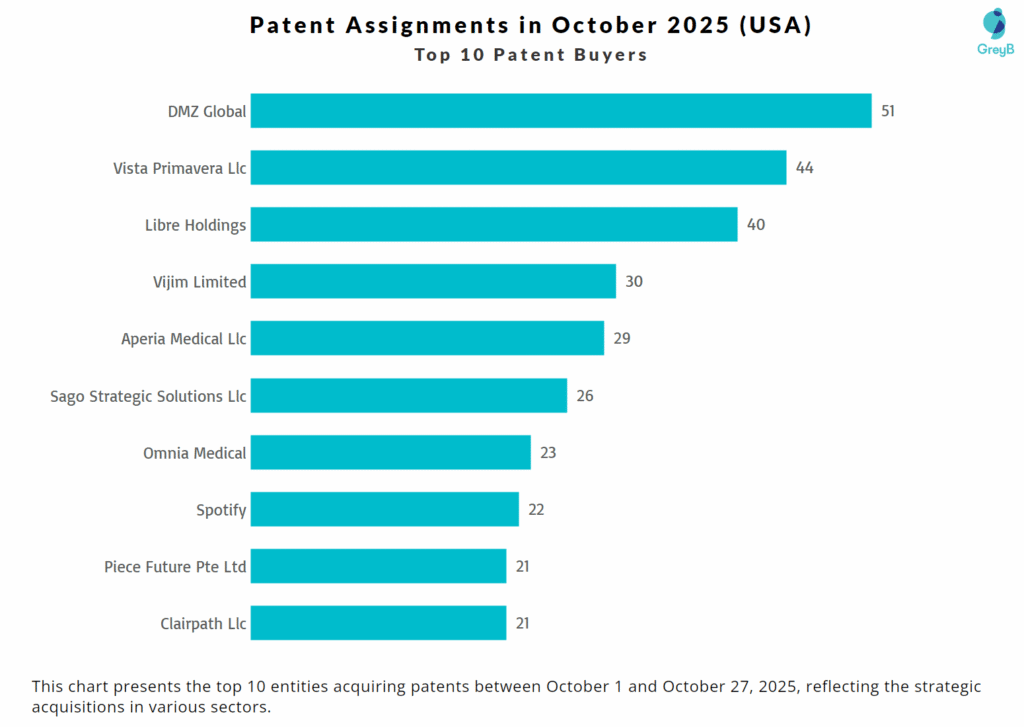

Who Are the Top Sellers and Buyers Shaping the Patent Landscape in October 2025?

The recent patent assignments in October 2025 offer a fascinating glimpse into the strategic moves across key industries, particularly in medical technology and telecommunications, two sectors experiencing significant consolidation and innovation.

In the medical technology sector, around 23% of all recorded patent transfers were focused on medical and surgical instruments, treatment devices and surgical supplies. Valencell Inc led with the transfer of 44 patents to Vista Primavera Llc, a strategic acquisition likely aimed at expanding Vista’s portfolio in wearable health technologies.

As medical technology continues to advance, the demand for innovative healthcare patents is on the rise. For a more in-depth look at patent activity in the healthcare space, including diagnostic and therapeutic innovations, visit our article on the Healthcare Patent Landscape

Omnia Medical also made headlines by acquiring 23 patents from Orthocision, strengthening its position in the growing field of spinal and orthopedic surgery. These transactions underscore the ongoing consolidation trend in the medical device industry, as companies acquire specialized IP to accelerate innovation and stay competitive in an evolving healthcare landscape, particularly in areas like minimally invasive surgery and sacroiliac joint fusion technologies.

Meanwhile, the telecommunications sector saw major portfolio reshuffling as Ericsson transferred 26 patents to Sago Strategic Solutions Llc, a move that highlights Ericsson’s continued focus on streamlining and monetizing its IP portfolio. Sago, known for acquiring telecom-related patents in 4G, 5G and next-gen technologies such as network slicing and RAN optimization, is positioning itself for continued revenue generation through licensing.

The activity in telecom patents is part of a broader movement towards next-generation networks. If you want to dive deeper into the current 5G patent landscape and understand how these shifts are impacting innovation, check out our comprehensive analysis on the 5G Patent Landscape.

Similarly, Nokia reassigned 21 patents to Piece Future Pte Ltd, reflecting its shift towards an IP-led business model focused on licensing and strategic partnerships. These moves suggest that leading telecom companies are divesting older, non-core assets in favor of refining their portfolios around next-generation technologies like 5G, 6G and cloud-native network solutions.

This dynamic activity among both sellers and buyers illustrates the ongoing shift in IP strategies. Sellers are optimizing their portfolios, divesting older or non-core assets, while buyers are making strategic acquisitions to position themselves for future growth, especially in fast-evolving sectors like telecommunications and healthcare. As these patent transfers unfold, they highlight key opportunities for industry players to capitalize on emerging technologies, monetize existing IP and shape the future of their respective fields.

With over 100 buyers and sellers shaping the landscape, the details of these transactions can offer valuable insights. Interested in accessing the full list? Fill out the form below to get exclusive access to the data.

Which Are the Top 10 Start-ups Involved in the Patent Reassignments in October 2025?

The following table presents the top start-ups that bought or sold patents between October 1 and October 27, 2025, reflecting how young companies are building or streamlining their intellectual property portfolios.

| Start-up | Founded Year | Patent Sold | Patent Bought |

| Maxeon Solar Pte Ltd | 2020 | – | 11 |

| Discord Inc | 2015 | – | 4 |

| Twelve Benefit Corporation | 2015 | – | 4 |

| Chemosensoryx Biosciences Sa | 2018 | – | 3 |

| Koloma Inc | 2021 | – | 2 |

| R Plus Japan Limited | 2020 | – | 1 |

| Health Hope Pharma Hk Limited | 2023 | – | 1 |

| Ripple Luxembourg Sa | 2025 | – | 1 |

| Field Engine Wildlife Research And Management Llc | 2020 | 4 | – |

| Alyve Medical Inc | 2018 | 2 | – |

Among emerging companies, a clear bifurcation is visible: start‑ups are either acquiring patents to scale rapidly or selling off assets to monetize early innovation.

Consider the case of Maxeon Solar Pte Ltd, founded in 2020, which bought 11 patents, an aggressive move for a young company in the solar‑tech domain. In contrast, Field Engine Wildlife Research And Management Llc and Alyve Medical Inc sold 4 and 2 patents respectively, suggesting founders are unlocking value early and potentially reinvesting or pivoting.

Notably, several start‑ups that bought patents (e.g., Discord Inc with 4) operate in fast‑moving software or digital ecosystems and appear focused on expanding their IP footprint to strengthen future monetisation or defense.

Meanwhile, sellers are often in more mature niche markets or simply exiting an innovation cycle. This pattern signals a broader trend: start‑ups are no longer just reliant on their own R&D pipeline, they are actively shaping their IP strategy either by buying to build or selling to capitalise.

For stakeholders tracking innovation, these early‑stage moves by start‑ups reveal both where white‑space technology resourcing is happening and where monetisation is already kicking off.

Looking to explore the start-ups actively involved in patent transfers in October? Access the complete list of start-ups by filling out the form below.

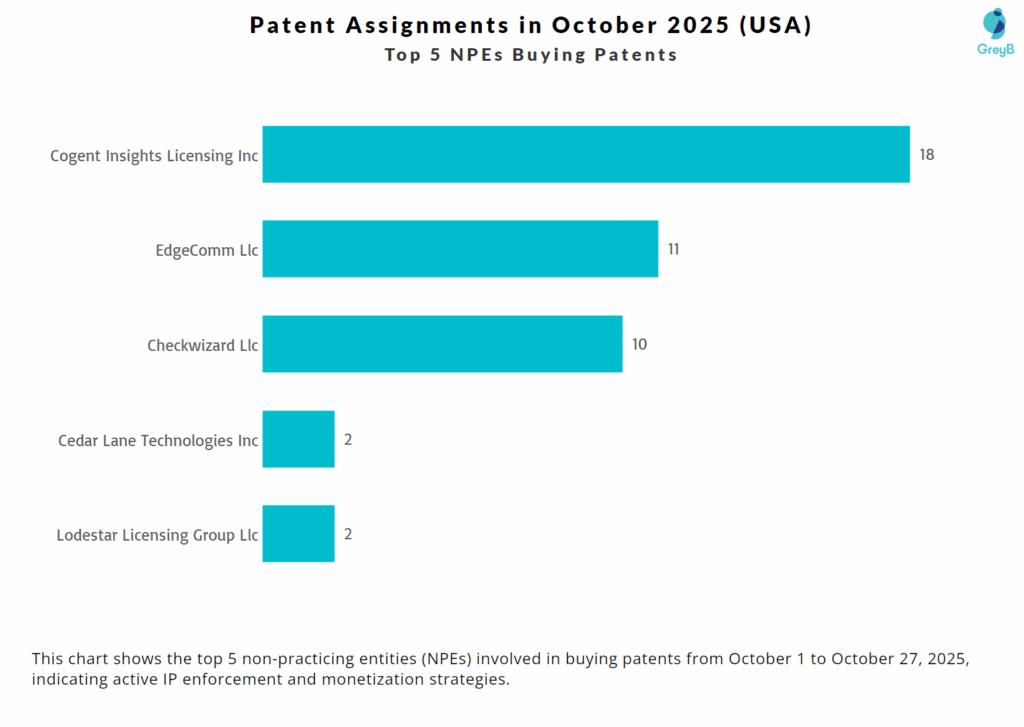

Who Are the Top 5 Non-Practicing Entities (NPEs) Involved in Patent Acquisitions?

In October 2025, Non-Practicing Entities (NPEs) continued to play a pivotal role in shaping the patent market. Cogent Insights Licensing Inc stands out with the acquisition of 18 patents, cementing its position as a key player in the IP monetization space.

These acquisitions underscore the growing influence of NPEs in the patent ecosystem, where patents are being acquired not for product development, but to assert rights and generate revenue through licensing or litigation. This offers a critical view into potential litigation risks and opportunities for monetizing unused patents.

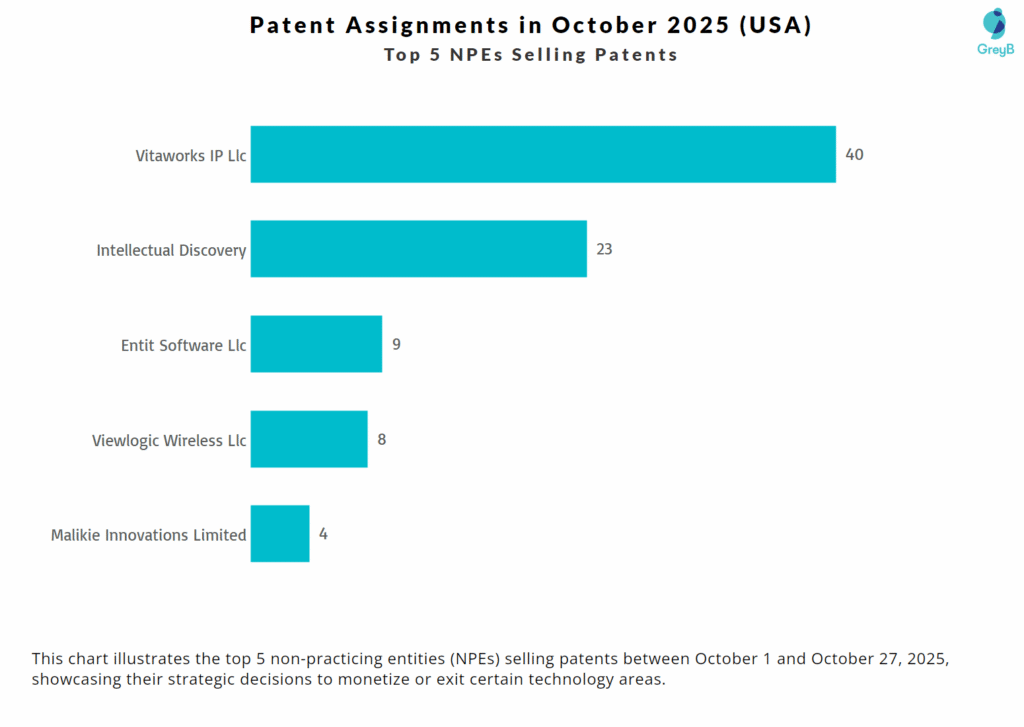

Who Are the Top Non-Practicing Entities (NPEs) Involved in Selling Patents?

In October 2025, several Non-Practicing Entities (NPEs) made significant moves in the patent market by selling key assets. Vitaworks IP Llc led the way, parting with 40 patents, reflecting its strategy of capitalizing on its portfolio, likely for monetization or strategic realignment. Similarly, Intellectual Discovery followed with 23 patents sold, positioning itself as a key player in IP transactions.

These patent sales reveal how NPEs are actively engaging in the secondary market, not only acquiring patents for monetization but also selling off portfolios to optimize financial returns or exit certain technology domains.

Such NPE movements provides valuable insight into potential IP acquisition opportunities and emerging trends within specific technology sectors.

To understand the broader implications of how Non-Practicing Entities (NPEs) are shaping patent enforcement strategies, you can explore our detailed article on the NPE Litigation Trend

Curious about the top non-practicing entities (NPEs) shaping patent assignments? Get the full list of NPEs involved in recent transfers by filling out the form below.

How Are Litigation Patterns Shaping Patent Transfers in October 2025?

Out of the 800+ patents reassigned in October 2025, 20 patents have a history of litigation, underscoring the ongoing relevance and high value of these assets. These litigated patents primarily span key technology areas such as telecommunications, cryptography and cybersecurity, speech and audio processing, computer architecture and simulation, and medical instruments and diagnostic devices, sectors where patent strength can significantly influence market positioning and licensing opportunities.

If you’re particularly interested in understanding how US patent litigation cases are shaping the future of patent enforcement, take a closer look at our article on the US Patent Litigation Cases of 2025

A particularly noteworthy transaction involved Kiritin Inc, which transferred three patents to Edgecomm Llc, a known non-practicing entity (NPE) with an active history of IP enforcement. Edgecomm has filed five litigation cases in Texas courts between May and October 2025, suggesting that these newly acquired patents may soon be the subject of further licensing or enforcement actions. This move aligns with Edgecomm’s broader monetization strategy, reinforcing the growing role of NPEs in asserting patents to drive revenue.

In the telecommunications sector, Viewlogic Wireless Llc transferred four patents to Checkwizard Llc, another active NPE known for its aggressive litigation strategy. Checkwizard is currently involved in 11 patent litigation cases against major US banks, including JPMorgan Chase and Bank of America, signaling its intent to use the acquired patents in enforcement actions against high-value sectors like financial services. This move exemplifies the trend where NPEs strategically acquire telecom-related patents to support future litigation or licensing campaigns.

The presence of previously litigated patents in these transactions suggests a more mature IP landscape, where acquisitions are not only about fostering innovation but also about leveraging existing patents that have proven market applicability and legal standing. For patent buyers and NPEs, this is a clear indication that enforcement and licensing strategies are central to how patents are valued and monetized in today’s IP environment.

Want to dive deeper into the patents with litigation history and understand their strategic importance? Reach out to us for more details on these high-value assets.

Navigating the Patent Assignments

October’s patent assignments have shed light on dynamic shifts across industries, with the medical technology sector attracting significant attention. The growing demand for patents in minimally invasive surgery, diagnostic equipment, and wearable health technologies highlights a surge in innovations that integrate sensing, data processing, and therapeutic delivery. These trends open up numerous opportunities for companies holding portfolios in connected healthcare and medical devices.

Simultaneously, telecommunications companies like Ericsson and Nokia are actively streamlining their portfolios, reflecting a shift toward IP monetization and the increasing importance of 5G/6G network solutions. As these technologies continue to evolve, buyers are focusing on acquiring patents that not only enhance their licensing programs but also bolster their positions in next-generation communications.

Moreover, the rising influence of non-practicing entities (NPEs) acquiring patents with prior litigation history underscores the continued focus on enforcement-ready assets. This emphasizes the growing value of patents with proven legal standing and applicability in driving revenue through licensing or litigation.

As the patent landscape evolves, every reassignment marks a strategic shift—whether it’s for innovation, licensing, or monetization. That’s where we come in. We assist clients in maximizing the value of their portfolios through targeted monetization strategies, identifying high-value patents for licensing or sale, preparing litigation-ready claim charts or Licensing Talk Decks, and offering expert advice on portfolio pruning to divest non-core or low-value assets. Let us help you navigate the complexities of the patent market and unlock new opportunities.