In the last five years, 3,606 new dairy products were launched in the U.S., showing that companies are actively using innovation to stay competitive. Growth is no longer coming just from selling more of the same products, but from offering new benefits, better experiences, and more relevant choices to consumers.

However, this innovation is not spread evenly across all dairy categories. Most new launches are concentrated in a few segments such as cheese, yogurt, creamers, and butter, while several other categories see limited activity. At the same time, dairy products are competing more directly with plant-based alternatives on the same shelves, making differentiation through formulation, claims, and product format more important than ever.

This article looks at how dairy products in the U.S. are evolving, where most innovation is happening, and what this means for companies planning future product development. By analyzing product launches, key categories, regions, and company strategies, the article aims to highlight where the market is crowded, where opportunities still exist, and how dairy innovation teams can make smarter decisions going forward.

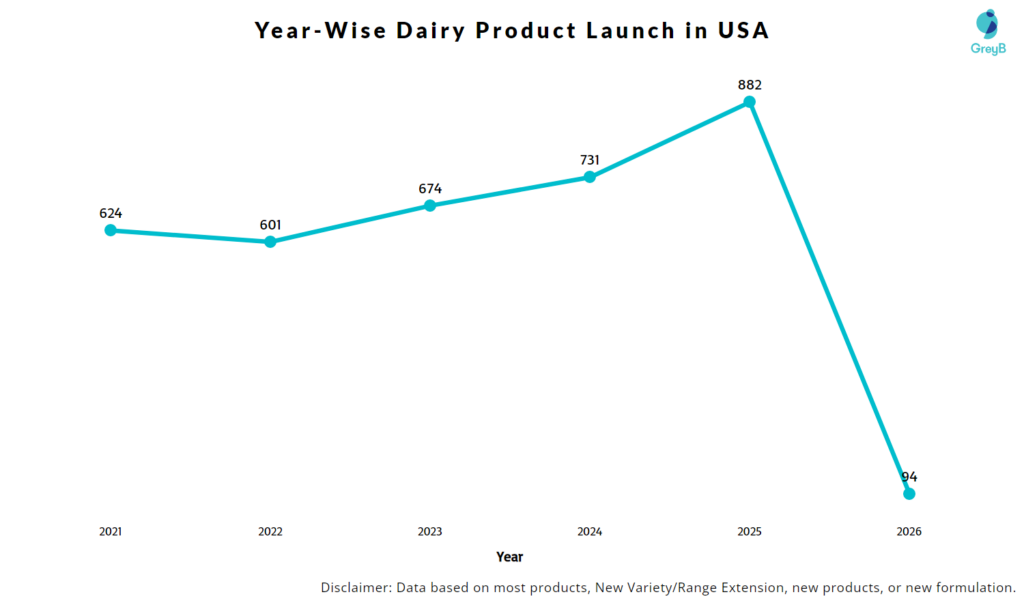

Year-wise Product Launch Trends in the U.S. Dairy Market

Dairy product launches in the U.S. have shown a steady upward trend over the last five years. In 2021, around 624 new dairy products were launched, followed by 601 launches in 2022. While 2022 saw a slight dip, launch activity picked up again in the following years.

Innovation momentum increased in 2023 with 674 launches and continued to grow in 2024 with 731 launches. This upward trend reflects renewed investment in product development as companies responded to changing consumer expectations around nutrition, convenience, and clean-label products.

The strongest growth is seen in 2025, with 882 product launches, making it the most active year in the period analyzed. This suggests that dairy companies are accelerating innovation efforts, particularly within established categories, to remain competitive in a crowded market.

The lower number of launches in 2026 (94 launches) reflects partial-year data and should not be interpreted as a slowdown in innovation. Overall, the year-wise trend indicates sustained and increasing focus on product innovation in the U.S. dairy market.

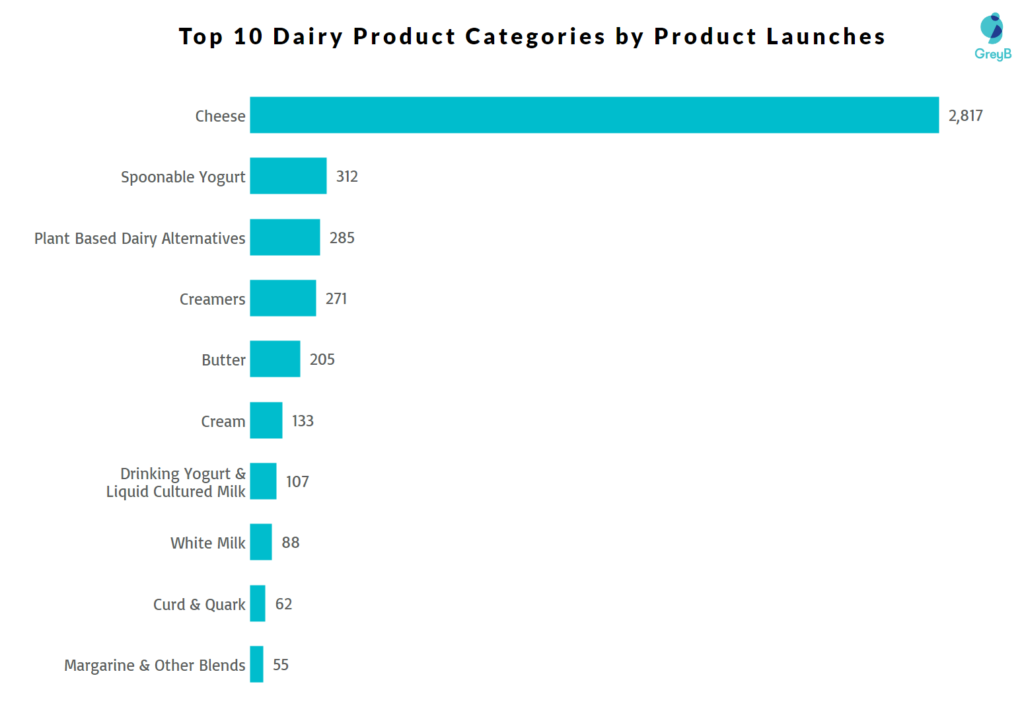

Top Product Categories in the U.S. Dairy Market

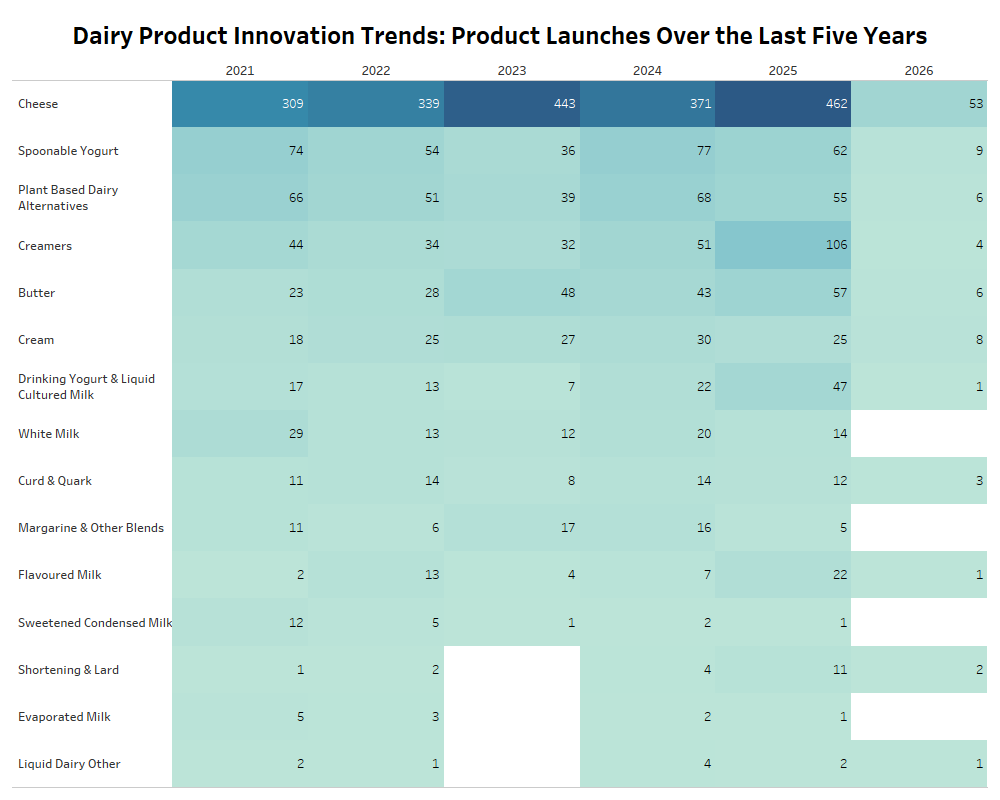

Which Dairy Categories Are Growing, Plateauing, or Declining?

In 2025, dairy product innovation in the U.S. is highly concentrated in a few core categories, with cheese standing out as the dominant innovation engine. Accounting for the majority of launches this year, cheese continues to attract disproportionate innovation investment due to its versatility across formats, strong premiumization potential, and broad consumer relevance. The category remains a preferred platform for differentiation through flavor, texture, aging profiles, and usage-led positioning.

Beyond cheese, spoonable yogurt, plant-based dairy alternatives, creamers, and butter form the second tier of high-activity categories in 2025. Spoonable yogurt innovation is closely tied to functional claims such as protein, gut health, and sugar reduction, while creamers benefit from flavor-led experimentation linked to at-home coffee consumption.

Plant-based dairy alternatives emerge as a strategically important category in 2025, reflecting sustained interest in lactose-free and sustainability-driven options and intensifying competition between dairy and non-dairy products. Butter’s continued activity is largely premium-led, supported by natural fat narratives and culinary positioning.

In contrast, categories such as cream, drinking yogurt, white milk, and curd & quark show more limited launch activity in 2025, suggesting innovation maturity and a focus on incremental updates rather than new value propositions. Traditional processed segments-including margarine, flavoured milk, condensed milk, shortening, and evaporated milk-see minimal innovation, constrained by weaker health perceptions and declining relevance. Overall, the 2025 category mix highlights a polarized innovation landscape, with most new product activity concentrated in high-value, flexible categories while legacy segments receive limited strategic attention.

Ice Cream Industry Patent Overview Report

Read The ReportHow Are Dairy Categories Evolving Over the Past Five Years?

In 2025, dairy product innovation in the U.S. is highly concentrated in a few core categories, with cheese standing out as the dominant innovation engine. Accounting for the majority of launches this year, cheese continues to attract disproportionate innovation investment due to its versatility across formats, strong premiumization potential, and broad consumer relevance. The category remains a preferred platform for differentiation through flavor, texture, aging profiles, and usage-led positioning.

Beyond cheese, spoonable yogurt, plant-based dairy alternatives, creamers, and butter form the second tier of high-activity categories in 2025. Spoonable yogurt innovation is closely tied to functional claims such as protein, gut health, and sugar reduction, while creamers benefit from flavor-led experimentation linked to at-home coffee consumption.

Plant-based dairy alternatives emerge as a strategically important category in 2025, reflecting sustained interest in lactose-free and sustainability-driven options and intensifying competition between dairy and non-dairy products. Butter’s continued activity is largely premium-led, supported by natural fat narratives and culinary positioning.

In contrast, categories such as cream, drinking yogurt, white milk, and curd & quark show more limited launch activity in 2025, suggesting innovation maturity and a focus on incremental updates rather than new value propositions.Traditional processed segments-including margarine, flavoured milk, condensed milk, shortening, and evaporated milk-see minimal innovation, constrained by weaker health perceptions and declining relevance.

Overall, the 2025 category mix highlights a polarized innovation landscape, with most new product activity concentrated in high-value, flexible categories while legacy segments receive limited strategic attention.

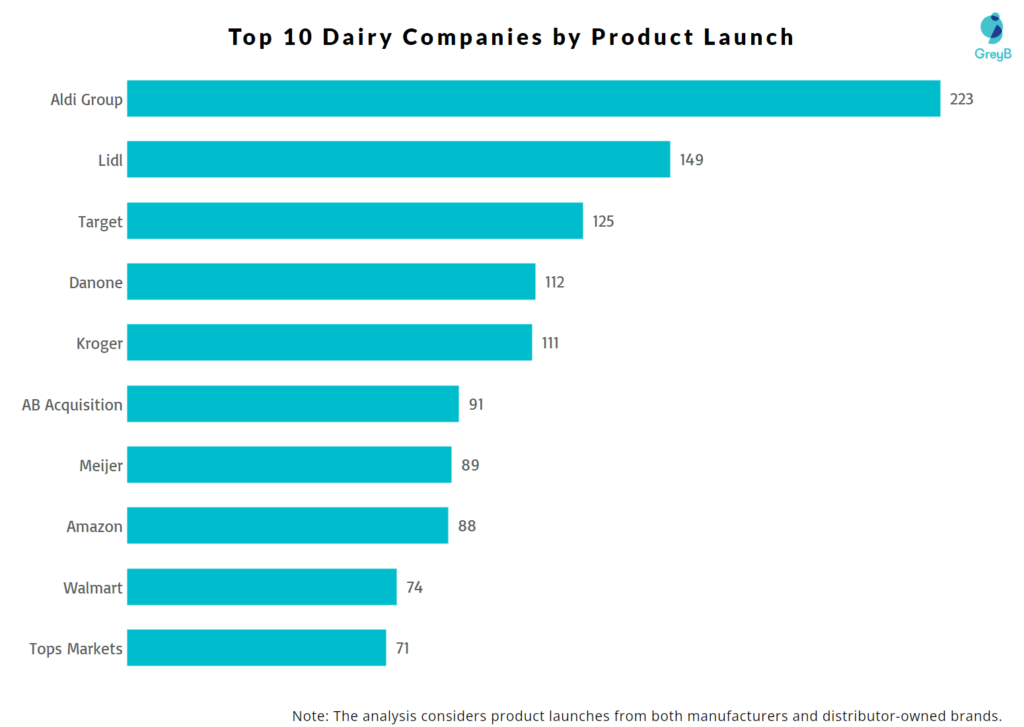

Top 10 Dairy Companies by Product Launches in the U.S.

Danone leads dairy innovation activity in the U.S., reflecting its strong presence in yogurt, functional dairy, and health-focused products. General Mills and Chobani also show high launch activity, driven largely by yogurt and value-added dairy formats.

Global dairy companies such as Groupe Lactalis, Saputo Group, and Bel Group continue to invest heavily in the U.S. market, particularly in cheese-based categories. At the same time, the presence of Califia Farms and CROPP Cooperative highlights growing innovation from plant-based and organic-focused players. Regional and specialty brands like Tillamook County Creamery demonstrate that focused category expertise can still support consistent product innovation.

Overall, the data shows that dairy innovation in the U.S. is led by a mix of multinational companies, category specialists, and emerging challengers, creating a competitive environment where continuous product development is essential.

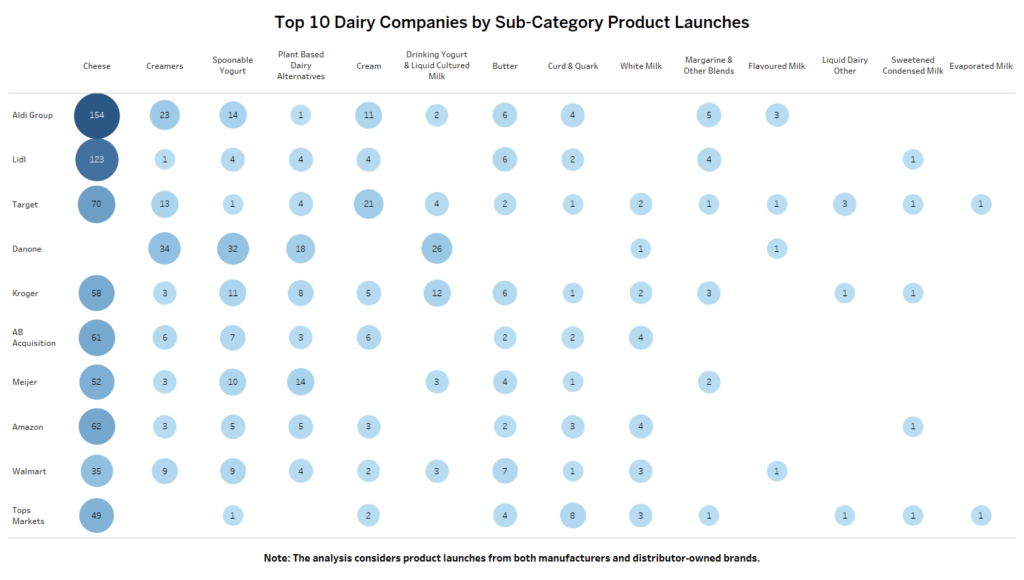

Which Dairy Companies Are Innovating Across the Widest Range of Sub-Categories?

The chart shows a clear divide between private-label–led retailers and branded specialists in dairy innovation. Aldi Group and Lidl are strongest in Cheese, far outpacing other categories, highlighting a scale-driven, value-focused strategy centered on high-volume staples. Their limited presence in plant-based, drinkable yogurt, and functional dairy points to selective innovation rather than broad experimentation.

Target displays a more balanced portfolio, combining strong Cheese and Cream activity with moderate participation in emerging segments, reflecting a curated private-label approach. Danone stands out as the functional dairy leader, dominating Spoonable Yogurt, Plant-Based Dairy Alternatives, and Drinking Yogurt, while intentionally avoiding commodity categories like Cheese.

Kroger and Walmart follow hybrid strategies, anchoring on Cheese and Butter while selectively extending into plant-based and cultured dairy. Gaps in specialty and functional segments among retailers suggest reliance on branded partners. Overall, the distribution underscores volume-led retailer strategies versus differentiation-led branded positioning, with clear white spaces for cross-category expansion

What ingredient or whitespace opportunities exist in the Dairy

How is sustainability driving innovation in the Dairy?

How is the Dairy advancing health-focused or alternative product innovations (low-sugar, low-fat, plant-based, etc.)?

Interested in accessing the complete list of active products in the Dairy Industry or detailed innovation benchmarking? Fill out the form to access it now!