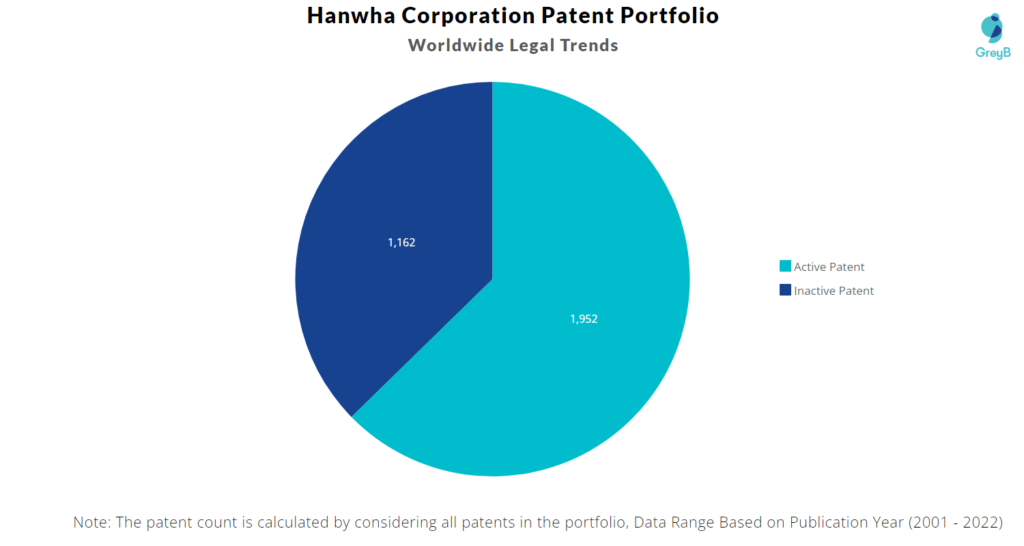

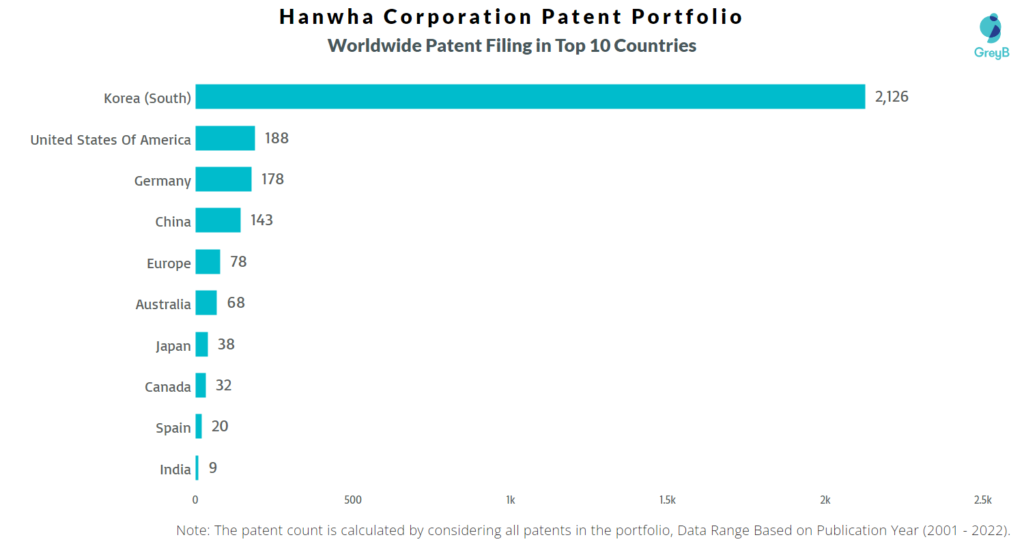

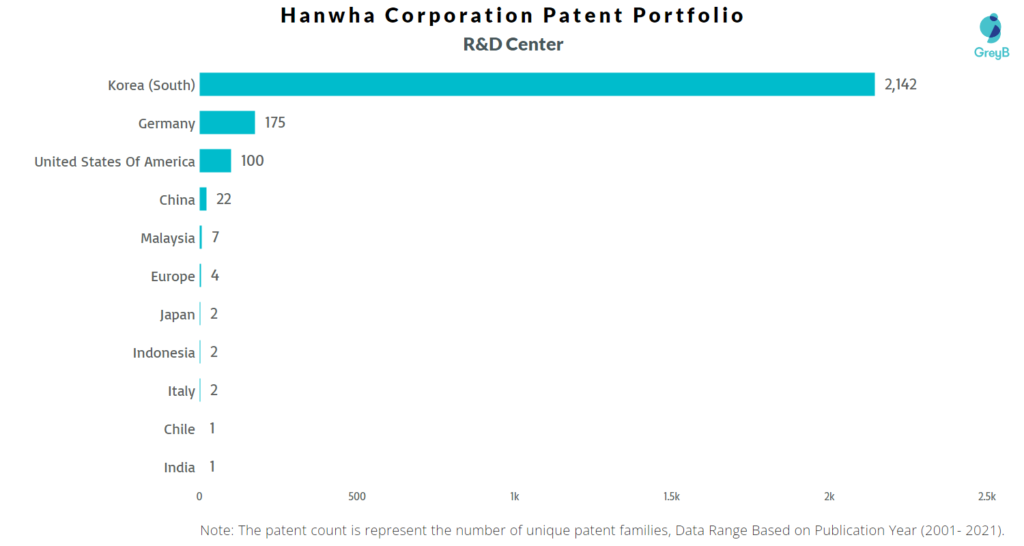

Hanwha Corporation has a total of 3114 patents globally, out of which 2212 have been granted. Of these 3114 patents, more than 63% patents are active. Korea is where Hanwha Corporation has filed the maximum number of patents, followed by the USA and Germany. Parallelly, Korea seems to be the main focused R&D center and is also the origin country of Hanwha Corporation.

Hanwha Corporation was founded in 1952 by Kim Chong-hee. Hanwha Corporation operates as a conglomerate. Hanwha Corporation imports and exports petrochemicals, machinery, automotive, electronics, and steel. The Company also produces explosives for the defense and construction industries. In addition, Hanwha manufactures automotive airbag inflators and telecommunication equipment, such as wireless phones, and provides financial services through its subsidiaries. As of January 2022, Hanwha Corporation has a market cap of $2.79 Trillion.

Do read about some of the most popular patents of Hanwha Corporation which have been covered by us in this article and also you can find Hanwha Corporation patents information, the worldwide patent filing activity and its patent filing trend over the years, and many other stats over Hanwha Corporation patent portfolio.

How many patents does Hanwha Corporation have?

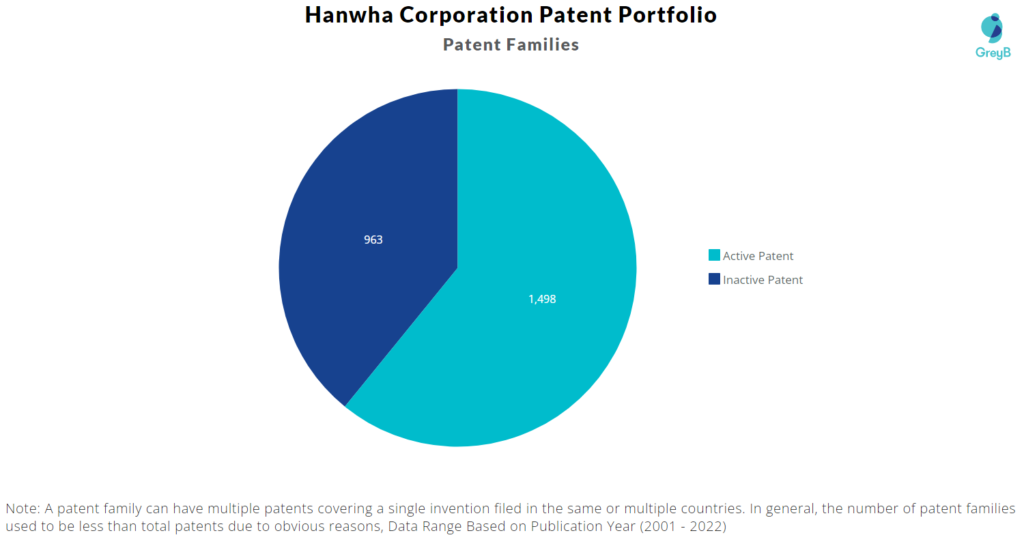

Hanwha Corporation has a total of 3114 patents globally. These patents belong to 2461 unique patent families. Out of 3114 patents, 1952 patents are active.

How many Hanwha Corporation patents are Alive/Dead?

Worldwide Patents

Patent Families

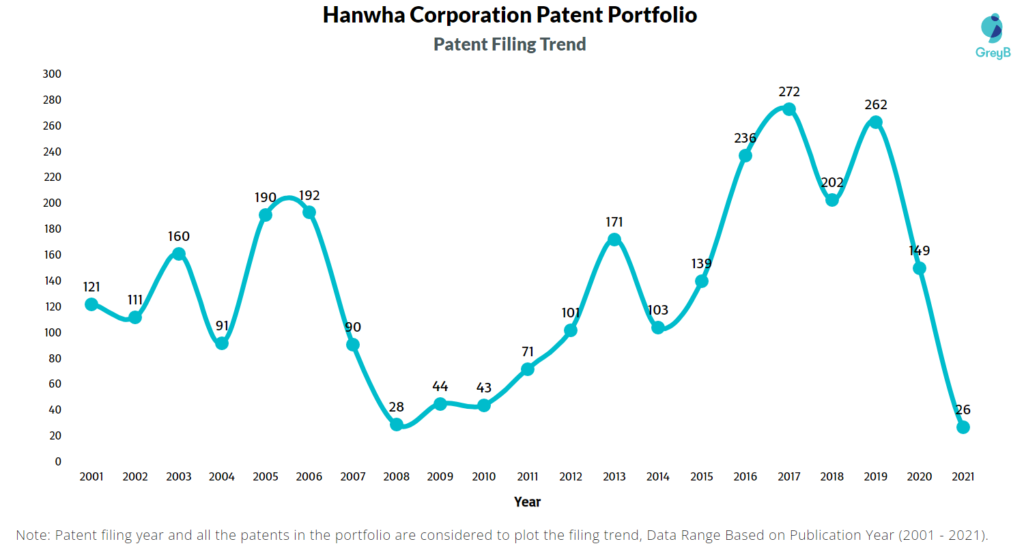

How Many Patents did Hanwha Corporation File Every Year?

Are you wondering why there is a drop in patent filing for the last two years? It is because a patent application can take up to 18 months to get published. Certainly, it doesn’t suggest a decrease in the patent filing.

| Year of Patents Filing or Grant | Hanwha Applications Filed | Hanwha Patents Granted |

| 2011 | 71 | 29 |

| 2012 | 101 | 32 |

| 2013 | 171 | 57 |

| 2014 | 103 | 45 |

| 2015 | 139 | 57 |

| 2016 | 236 | 61 |

| 2017 | 272 | 83 |

| 2018 | 202 | 225 |

| 2019 | 262 | 186 |

| 2020 | 149 | 173 |

| 2021 | 26 | 186 |

| 2022 | – | 4 |

How Many Patents did Hanwha Corporation File in Different Countries?

Countries in which Hanwha Corporation Filed Patents

| Country | Patents |

| Korea (South) | 2126 |

| United States Of America | 188 |

| Germany | 178 |

| China | 143 |

| Europe | 78 |

| Australia | 68 |

| Japan | 38 |

| Canada | 32 |

| Spain | 20 |

| India | 9 |

| Malaysia | 8 |

| Austria | 7 |

| Poland | 6 |

| Indonesia | 6 |

| Brazil | 5 |

| Mexico | 4 |

| Eurasian Patent Organization | 3 |

| Taiwan | 3 |

| Hungary | 3 |

| Czech Republic | 3 |

| United Kingdom | 2 |

| Italy | 2 |

| Chile | 2 |

| Israel | 2 |

| Singapore | 2 |

| Slovakia | 2 |

| Russian Federation | 2 |

| South Africa | 1 |

| Denmark | 1 |

| Lithuania | 1 |

| Philippines | 1 |

| Netherlands | 1 |

| Estonia | 1 |

| Portugal | 1 |

Where are Research Centers of Hanwha Corporation Patents Located?

10 Best Hanwha Corporation Patents

US20100021718A1 is the most popular patent in the Hanwha Corporation portfolio. It has received 97 citations so far from companies like BYD Company, Hyundai Motor and Boeing.

Below is the list of 10 most cited patents of Hanwha Corporation:

| Publication Number | Citation Count |

| US20100021718A1 | 97 |

| US20070269645A1 | 93 |

| US6286879B1 | 65 |

| US20070196637A1 | 54 |

| US7318498B2 | 43 |

| US7157034B2 | 43 |

| US20090011210A1 | 42 |

| US7244501B2 | 37 |

| US20080070019A1 | 37 |

| KR101009485B1 | 32 |

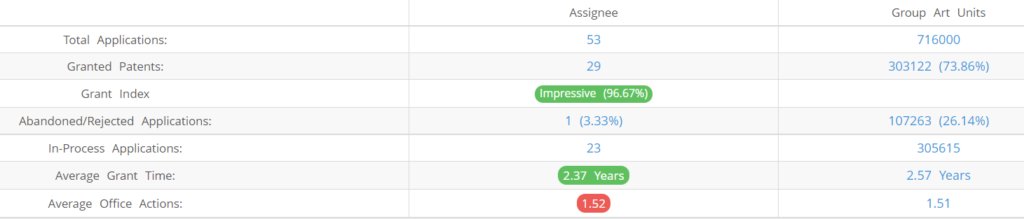

What Percentage of Hanwha Corporation US Patent Applications were Granted?

Hanwha Corporation (Excluding its subsidiaries) has filed 53 patent applications at USPTO so far (Excluding Design and PCT applications). Out of these 29 have been granted leading to a grant rate of 96.67%.

Below are the key stats of Hanwha Corporation patent prosecution at the USPTO.

Which Law Firms Filed Most US Patents for Hanwha Corporation?

| Law Firm | Total Applications | Success Rate |

| Westerman Hattori Daniels & Adrian | 21 | 100.00% |

| Sughrue Mion | 19 | 100.00% |

| Birch Stewart Kolasch & Birch | 4 | 100.00% |

| Hunton Andrews Kurth | 4 | 100.00% |

| Leopold Presser | 1 | 100.00% |

| Morris Manning & Martin | 1 | 0.00% |

| Nsip Law | 1 | 100.00% |

| Rabin & Berdo | 1 | 100.00% |

Hanwha has organized a task force, called “Space Hub,” which will orchestrate research, development and investments across a wide spectrum of business areas. These efforts will play a pivotal role in helping Hanwha take the industry to new heights as a global leader in space.

Hanwha has been involved in the space industry since 1994, when it contributed to the development of mono-propellant thrusters for the Korea Multi-Purpose Satellite-1. Since then, Hanwha’s various aerospace businesses have made crucial contributions to Korea’s journey into space.

Hanwha Aerospace has participated in the development of liquid engines for the Korea Space Launch Vehicle (KSLV-II) series. The upcoming launch of Korea’s first fully indigenous carrier rocket, also known as Nuri, will be a landmark moment for the Korean aerospace industry.

Liquid-fuel rocket engines allow rockets to accurately position themselves, through repeated ignition and combustion, to reach a desired orbit. Controlling a rocket’s thrust after launch is vitally important, and an engine like Nuri’s makes it easy to do so. Designing and refueling a liquid fuel rocket engine is more complex than doing so with solid fuel.

Hanwha Corporation has been involved in a variety of Korean government-led space programs. The company was involved in the development of a kick motor and thrust vector control (TVC) system for KSLV-I, Korea’s first space launch vehicle. Going forward, the company has set its sights on manufacturing rockets for launching satellites.

Beyond providing the thrust to break through the Earth’s gravitational pull, Hanwha is also taking steps to engage in satellite businesses. For instance, in 2021, Hanwha Aerospace acquired a 30 percent stake in Satrec Initiative (SI), a company that develops high-performance small/medium satellite systems for Earth observation (EO) missions and has contributed to the success of over 30 international and domestic space programs over the past 30 years.

Through this acquisition, Hanwha Aerospace has vertically integrated business areas related to EO. Hanwha Aerospace will launch EO satellites manufactured by SI, which will also provide ground stations for monitoring and controlling satellites. SI’s subsidiaries, SI Imaging Services and SI Analytics, focus on providing satellite-based services, such as satellite imagery distribution, as well as artificial intelligence (AI)-based geospatial analytics services.

EXCLUSIVE INSIGHTS COMING SOON!

What are Hanwha Corporation‘s key innovation segments?

What Technologies are Covered by Hanwha Corporation?

The chart below distributes patents filed by Hanwha Corporation in different countries on the basis of the technology protected in patents. It also represents the markets where Hanwha Corporation thinks it’s important to protect particular technology inventions.

R&D Focus: How Hanwha Corporation search focus changed over the years?

EXCLUSIVE INSIGHTS COMING SOON!

Interested in knowing about the areas of innovation that are being protected by Hanwha Corporation?